Sulphur 386 Jan-Feb 2020

31 January 2020

Price Trends

Price Trends

MARKET INSIGHT

Meena Chauhan, Head of Sulphur and Sulphuric Acid Research, Argus Media, assesses price trends and the market outlook for sulphur.

SULPHUR

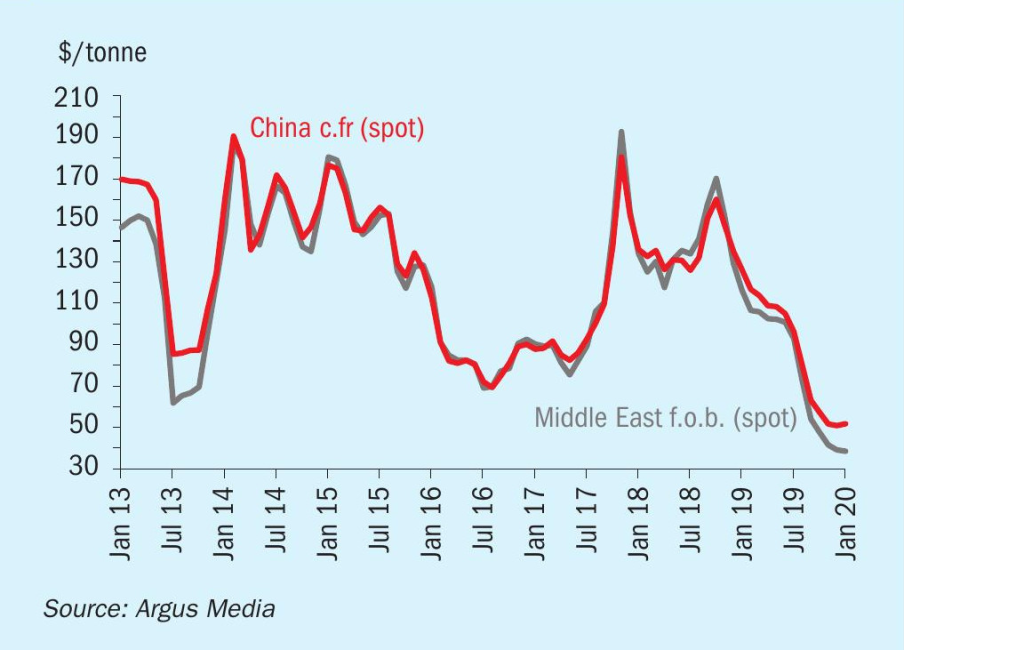

Global sulphur markets were weighed down by the lacklustre processed phosphates market throughout 2019 and this led to a sustained period of price erosion. Toward the end of the year, availability was limited due to forward selling, leading to some stabilisation of spot price ranges. Entering the new year, expectations are for there to be no fundamental shift in pricing in the short term. The second half of the year is forecast to see some recovery in the fertilizer market and any uptick in sulphur consumption would lead to fresh supply being absorbed during this period.

Middle East producers all posted rollovers for January, further supporting short term stability in the market. In Kuwait, KPC set its January price at $39/t f.o.b. Shuaiba. State-owned Muntajat announced its January Qatar Sulphur Price (QSP) at $40/t f.o.b. The marketer will not issue a sulphur spot sales tender for February loading, however, owing to tight availability. The last spot tender held by the company was back in September. Meanwhile in the UAE ADNOC set its January monthly price at $42/t f.o.b. Ruwais for shipments to the Indian market.

First quarter contracts in the Middle East were heard ranging $34-38/t f.o.b, but final conclusions were still awaited from buyers in Tunisia and Brazil at publication time. ADNOC contracts with traders were deemed to reflect the top end of the range while North African prices to date supported the lower end of the range. In 4Q 2019 major buyer OCP in Morocco did not agree a contract price with ADNOC, with no deliveries received during the period. However, an agreement was later reached at under $60/t c.fr. This is expected to contribute to reduced spot activity from OCP through to March as deliveries resume from the UAE, as well as holding high stocks. In addition, the reduction of output by 500,000 t from mid-December to the end of February on the back of weather related problems will curb consumption. The port of Jorf Lasfar was closed, impacting the arrival of raw materials. In the year ahead, we expect to see increases in OCP’s demand for sulphur as processed phosphates production continues to ramp up.

Supply developments in the Middle East are expected to add to the market balance through 2020. KPC will have increased export availability this year with the start-up of its Clean Fuels project. The long delayed Qatar Barzan project is set to start its first phase in 2020 – Argus is forecasting a start-up at low rates of around 250,000 tonnes for the year with the project expected to reach capacity in 2022. Total sulphur production capacity in Qatar is expected to reach just over 2.5 million t/a with the addition of this project.

In mid-January sulphur stocks at Chinese major ports was estimated at 2.7 million tonnes, around 1.4 million tonnes up on a year earlier and understood to be close to capacity of around 2.8 million tonnes. There was a minor rebound in prices for Chinese granular product in December despite unchanged market fundamentals. The spot price range ticked up further in January to $40-64/t on the back of firmer bids, but we expect this trend unlikely to continue in the short term. Healthy stocks are expected to remain for the short term, with reduced DAP production cuts providing a ceiling to offtake. The upcoming Lunar New Year holiday in China at the end of January will also temporarily stall import demand. Domestic sulphur production in China is forecast to rise in 2020 with three projects scheduled to add capacity. The Fujian refinery began construction in 2017 and this is due to complete in mid-2020, adding 500,000 t/a of sulphur.

On the import front, Jan-Nov 2019 trade data reflects an increase of 4% on the 2018 period, despite pedestrian demand through much of the year due to weak downstream fertilizer markets.

Indian spot prices ranged $65-68/t c.fr at the start of January. At the end of 2019 several buyers stepped in with purchase tenders including FACT and CIL. FACT scrapped its render while CIL secured a cargo from Qatar, with its next requirement heard secured at the start of January from a Middle East trader. Shipments in January – October 2019 to India totalled over 1 million t for the first time since 2016, reflecting a 12% increase on the year. The UAE and Qatar are the leading suppliers at 604,000 t and 280,000 t respectively.

Over in Australia, First Quantum Minerals (FQM) has announced its production guidance for 2020-2022, indicating its Ravensthorpe Nickel Operations is estimated to produce 15,000-20,000 t of nickel in 2020, rising to 25,000-28,000 t in 2021. The project was put under care and maintenance back in Q4 2017 on the back of a sustained period of low nickel pricing. The leaching operations utilize a 1,400 t/d sulphur burner when running at full capacity. In the January-November 2019 period Australia imported 566,000 t of sulphur, down 6% on a year earlier.

SULPHURIC ACID

The stable/soft global sulphuric acid price trend has continued in recent months and into the new year. The view for the short term outlook remains stable to soft. Limited demand from Chile and low prices in India in December resulted in downward pressure on the South Korean and Japanese smelter export prices. Average monthly prices dropped from $7/t f.o.b. in November to $5.50/t f.o.b in January, down to $4/t on the low end of the range. Limited spot tonnes were on offer towards the end of the year. Pan Pacific Copper (PPC) in Japan has announced it will restructure the joint venture by April 2020 to allow its partners to better use copper smelting and refining assets independently. PPC has a planned maintenance at its Hibi Tamano smelter in December 2020 for 35 days. The smelter produces around 73,000 t/month acid. On the export front, Japanese acid trade dropped by 10% in January-November 2019 to just under 2.6 million t. South Korean exports were flat at 2.72 million t for the same period.

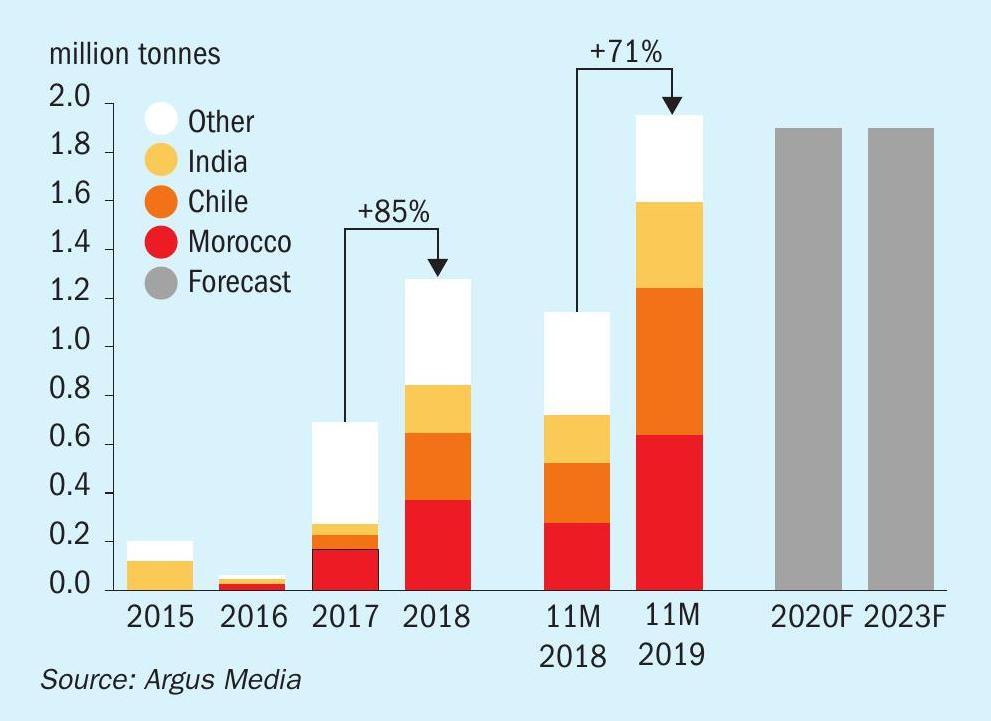

The presence of China in the export market remains a major focus point for the industry on the back of growing acid supply from copper smelters in the country. Exports in the first eleven months of 2019 totalled 1.95 million t – surging by 71% on a year earlier. Morocco was a major outlet at 637,000 t delivered during the period. Alongside the upward trend in exports there has been a dramatic decline in import trade to the country. Imports to November in 2019 drop to 501,000 tonnes, down by 47% on a year earlier. South Korea is the main supplier to the country at 89% of total acid. The weak processed phosphates market has weighed on pricing and demand in China. Argus expects acid imports to remain at low levels through the medium term forecast with exports forecast to remain at around 2 million t/a.

In India FACT issued a tender closing 12 December, understood to have been awarded at $33/t c.fr, with 180 days credit. Buyer MCFL was also expected to enter the market in January. Long term contract negotiations for 2020 continued into the new year with buyers including IFFCO and CIL in discussions over formula based and fixed price terms. On spot pricing, the Indian range has dropped 68% in January 2020 compared with a year earlier in line with international developments. The Sterlite Tuticorin smelter in Tamil Nadu remains offline, coming up to almost two years of closure. India’s Madras High Court has reserved judgement on petitions from the company asking for permission to re-open the plant.

In NW Europe, spot prices moved up slightly in December on the high end of the range to $40/t f.o.b. on the back of firmer prices in Brazil before easing once again in mid-January to $27-38/t f.o.b. Exports out of Germany in January-September 2019 dropped 14% to 701,000 t. The US is the leading export market at 102,000 t. First quarter contracts were heard being discussed at a rollover, but indications were for decreases on long term contracts. No major turnarounds have been announced in Europe for 2020 as yet.

Average monthly Chile spot prices have eased from $72/t c.fr in November to $70/t c.fr in January with import demand tepid going into the new year. A number of tankers were due to arrive in late January at the port of Mejillones, however, to meet demand during planned maintenance at domestic smelters. Chile acid imports increased by 25% in January – November 2019 to 3.26 million t, higher than any full year previously, despite imports easing in the latter part of 2019 as domestic production improved after a period of significant maintenance.

Acid shipments to Morocco were a major focus through 2019 with demand from downstream processed phosphates producer OCP impacting global trade flows. Acid imports to the port of Jorf Lasfar tallied 1.56 million t at the end of 2019, down 7% on a year earlier. China was the leading supplier, with over 700,000 t delivered, up by 91%. Meanwhile European trade dropped 23% on the year. Bulgarian shipments were notably absent and all countries except Belgium and Italy dropped their share in the Moroccan market.

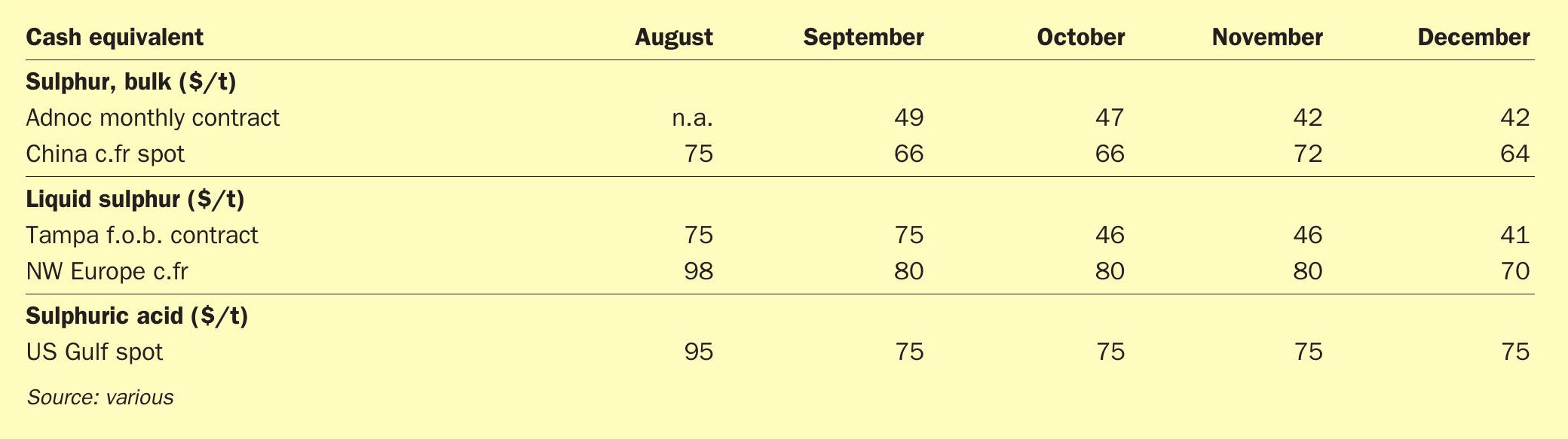

PRICE INDICATIONS