Nitrogen+Syngas 364 Mar-Apr 2020

31 March 2020

A turn for the worse

“Some difficult weeks and perhaps months clearly lie ahead”

What a difference two months can make. When I came to write the editorial for the January/February issue, the talk was all about climate change and sustainable production in the wake of Australia’s bushfire crisis, but these days there appears to be only one story that it is obsessing the world, and that of course is the Covid19 pandemic. The focus of concern has pivoted in recent days and weeks away from China and east Asia, which seem – hopefully – to have weathered the worst of the storm so far, and across to Europe and North America, where some difficult weeks and perhaps months clearly lie ahead.

The shutdown in China’s Hubei Province, home to a significant portion of the nation’s fertilizer production, especially phosphates, including mono- and diammonium phosphate, has weighed heavily on the ammonia market, slashing Chinese imports for the first quarter and depressing prices more widely. Conversely, the shutdown has also disrupted urea production in China, as well as in Iran, reducing output and exports at the same time that US buyers were looking to cover a shortfall, and raising prices. Methanol has been badly hit by the decline in Chinese industrial production (just reported to be down 13.5% for January and February), as China accounts for half of all methanol demand and an even greater share of the merchant market. Methanol prices had been riding high compared to other syngas derivatives, but have seen a major slump in the past few months.

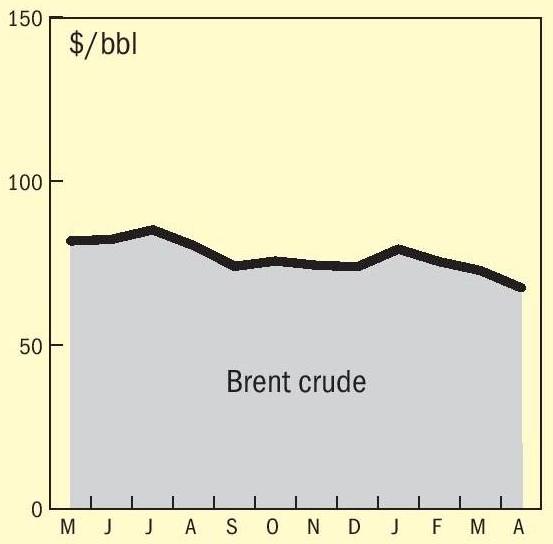

Yet as difficult and devastating as Covid-19 may be, ironically there has been just as great an effect on world markets caused by Russia’s decision to break ranks on OPEC oil quotas, prompting a similar response from Saudi Arabia, which has sent oil prices tumbling below $30/tonne for West Texas Intermediate for the first time in over 20 years. Both producers presumably hope that they can drive highly geared US shale gas producers out of business, but will also take a great deal of pain themselves in the meantime. The forecast decline in demand caused by reductions in mobility caused by quarantines, including the virtual complete shutdown of the world’s air travel, are also playing on oil demand predictions.

Gas prices too are languishing at levels not seen for over a decade, with a glut of supply in the LNG market and Russia and the US both competing for European business, and again a reduction in demand likely from the Covid-19 epidemic. While OPEC discipline may have broken down for the time being, natural gas markets do not even have a body capable of stabilising prices in the same way. Oxford Energy has recently predicted that we may see $2.00/MMBtu natural gas prices in Europe this summer – something that I can’t recall even from the halcyon days of the 1990s, and good news for European chemical producers, assuming that they can stay open.

And that remains the great imponderable – with most of the US and Europe on lockdown, certainly for weeks, possibly for months, and possibly to a greater extent than China was, the economic effects of Covid-19 may turn out to be just as if not more far reaching as the immediate health worries, and a global recession may already be a foregone conclusion, with both supply and demand sides of the economy affected. Governments will want to minimise the impact upon agriculture, so demand on the nitrogen side may be more robust than for industrial sectors, but 2020 is shaping up to be a bad year for everyone. For now we must all hope that the quarantines work, and that the northern hemisphere’s summer brings better news for us all.