Sulphur 387 Mar-Apr 2020

31 March 2020

Market Outlook

Market Outlook

SULPHUR

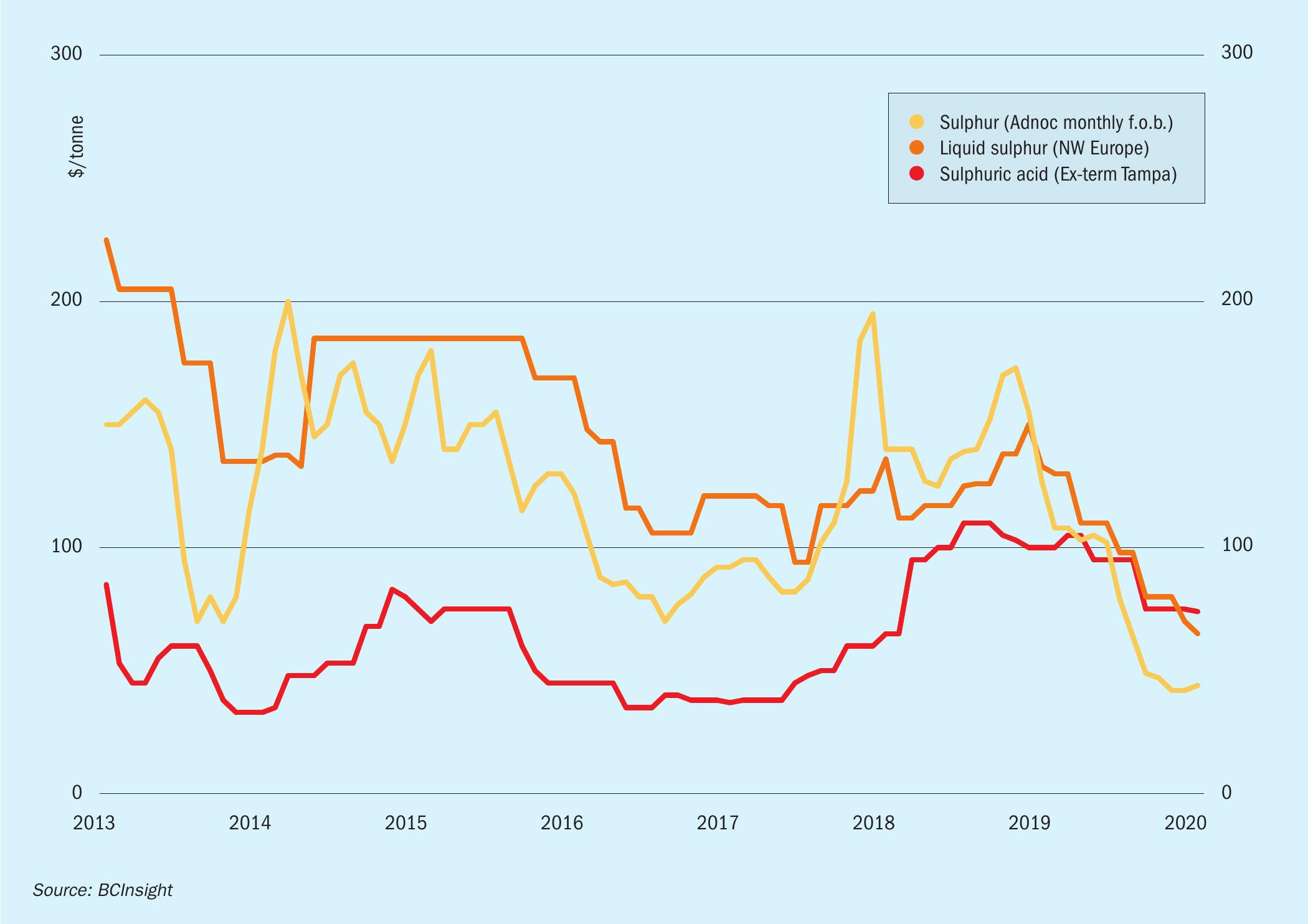

- Middle East supply will return to normal at the start of the second quarter with bottlenecks in the UAE and maintenance in Saudi Arabia at an end. But this is unlikely to result in lower Middle East f.o.b. prices until the second half of April, if not early May. This is because buyers who found it hard to find March loading cargoes will snap up any April product as soon as it’s made available.

- Russian tonnes will return to the market in the second quarter with the opening of the Volga Don river system for the transportation season. But, all of this product will be directed to the North African and Latin American contract markets as supplier GazpromExport does not expect to have any sulphur for spot sale in 2Q. This will limit spot activity in the Black and Baltic Seas to small parcels of Russian sulphur from other suppliers and sulphur of Kazakh origin.

- The evolution and fallout of the coronavirus is still being monitored closely by the market and is the biggest market variable. The impact of the virus has had an influence on freight so far, pushing rates up on routes to China with ship owners less than enthusiastic to send vessels there because of quarantine policies. But, as the virus moves across the globe, rates on other key market routes will likely increase for the same reason, impacting both fob netbacks as well as c.fr prices.

SULPHURIC ACID

- There are mixed expectations as to if the floor has been met in Asian markets on both an f.o.b. and c.fr level. All eyes are on the Chinese market as any improvement in regional prices are only likely to come when logistics and the general supply chain in the country normalises. But a pause in price softening is expected in Asia in the very near term as significant volumes have recently been picked up on the spot market.

- Smelter acid has also been displacing burner production in some areas of the country where logistics have permitted it, but not to a great enough extent to reduce pressure on base metal producers completely. There are still further declines expected in the North American markets, especially considering the arbitrage opportunities which are currently open from Asia. But, if the region continues to look towards its more traditional supply markets, increasing freight rates between Europe and the US could slow c.fr price softening.

- The phosphates sector is of course still one of the biggest influencers no the market and in the long run, until there is a significant recovery, no real recovery will be felt in the sulphuric acid market. But stable to firm demand from the mining sector of the demand-side will mean that some regional prices will find intermittent support.