Sulphur 387 Mar-Apr 2020

31 March 2020

Price Trends

Price Trends

Claira Lloyd, Sulphur Editor and Sulphur Fertilizers Team Leader, Argus Media, assesses price trends and the market outlook for sulphur.

SULPHUR

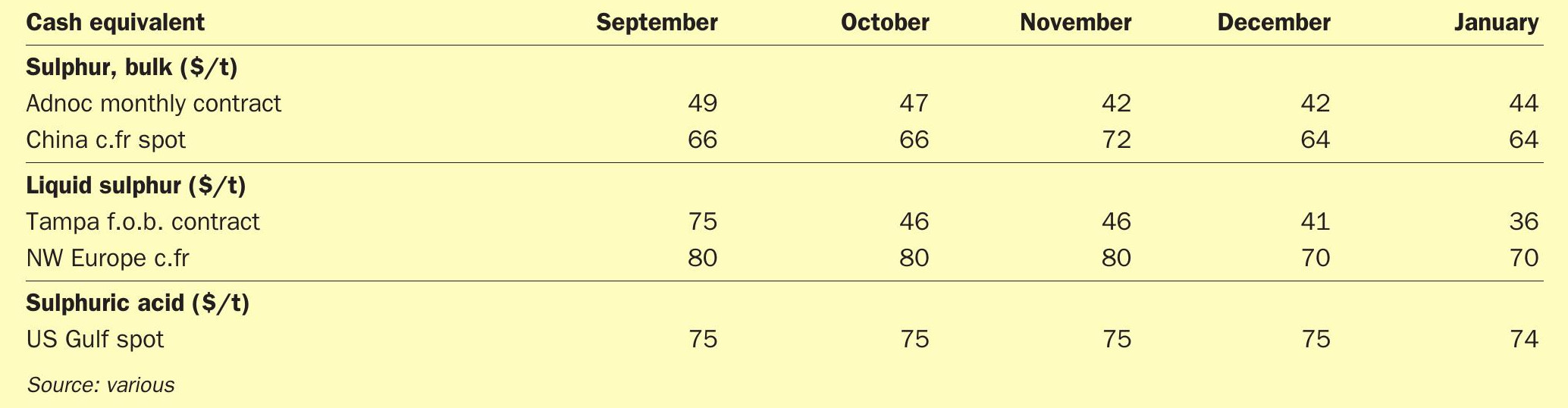

In the first two months of 2020 prices held flat-to-firm, much to the contrary of global market expectation. At the end of last year, the market was in almost total agreement that prices would be flat to soft for at least the first 3-4 months of 2020 on the back of poor demand from the phosphates sector, with key consumers reducing operating rates. But that just hasn’t happened, with a perfect storm of tight spot availability, easing freight rates and continuous pockets of demand providing support to f.o.b. prices in particular.

In the Middle East, supply-side maintenance and bottleneck issues limiting loading at the UAE port of Ruwais together with continued growth in demand for product to be delivered on a quarterly contract basis have curbed availability in the region, and these factors have provided the foundation for Middle East f.o.b. price support. But prices in the Middle East have also found support from softening freight rates on key routes as there has been wider bulk vessel availability because of ship owners being disinterested in sending their vessels to China because of quarantine rules. Also, when it comes to Arab Gulf producers, it is worth noting that monthly lifting prices for February were all announced at an increase on January prices, noting the first month-on-month increase in 21 months. And it is also worth remarking that Iran’s f.o.b. price increased in late-February to $32-42/t f.o.b., the first upwards movement in Iranian fob prices in a year. The price managed to find support because of limited supply for Arab Gulf loading cargoes and a pickup in demand from China, the biggest export market for Iranian product.

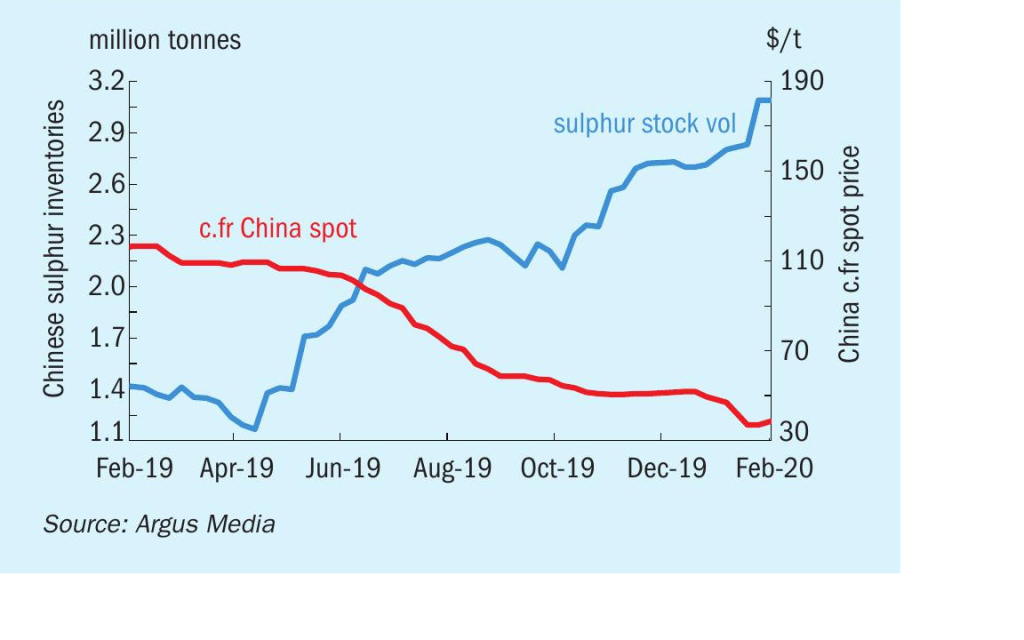

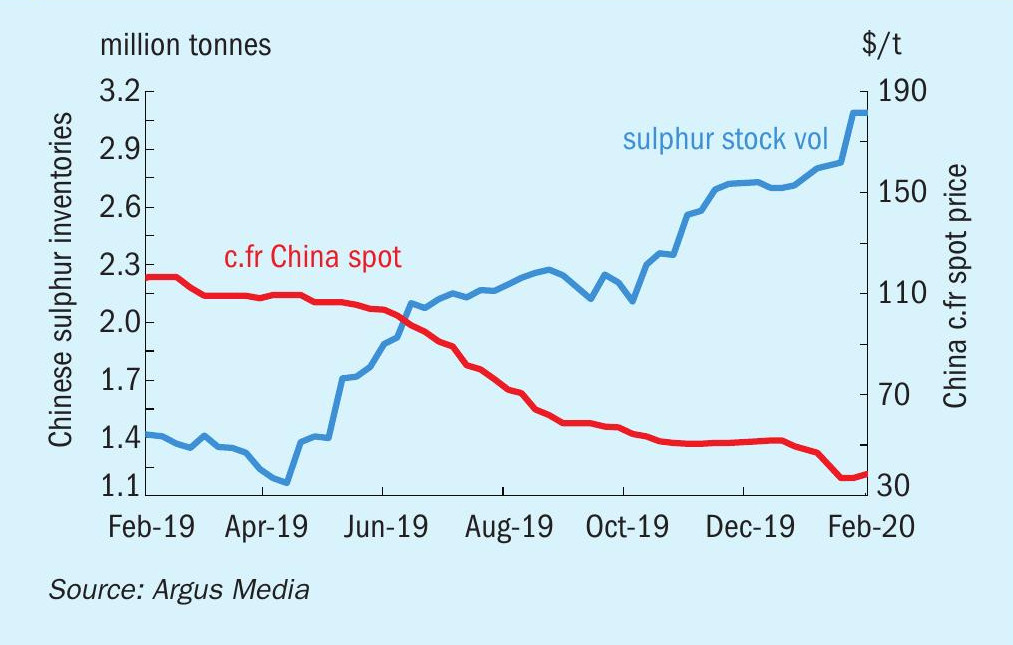

The Chinese market has done nothing but surprise so far this year. As was anticipated, with the Lunar New year holidays taking place at the end of January, buyers exited the market in the middle of the month as internal logistics moved away from commodity transportation to people transportation, port inventories maintained healthy levels of 2.7 million tonnes, and consuming plants started to wind down operations. Traditionally, buyers would return to the market 2-3 weeks after the end of the holiday, and during this 4-5 week absence prices would usually hold flat-to-soft, but not this year, as holidays were extended across the country with the outbreak of the coronavirus and the implementation of measures to curb the virus spreading. End-user buying on a c.fr basis remained largely absent until mid-February with fertilizer plants either closed or operating at very low rates and port inventories climbing to 3.1 million tonnes, the highest ever recorded level. Yet, despite this lack of end-user enthusiasm, prices for granular product on a domestic ex-works and c.fr basis have increased. Ex-works prices started increasing in mid-February and had gained Yn 80/t on a mid-point basis by the end of the month, to achieve the highest price since September. And when it comes to the import market, granular prices started rising in the last 10 days of the month to move over the mid-$60s/t c.fr for the first time since November. The price increase has been attributed to port inventories, though high, largely being in trader hands along with minimal new deliveries because of a tight supply side and a reluctance from vessel owners to deliver product to the country, in partnership with slowly improving end-user demand causing concern that port inventories are finite and will not easily be replenished in the near term.

But it’s not just been in China where c.fr prices have increased. The first price increases on a c.fr basis came from Brazil in early February as the country’s three key consumers all returned to the spot market at once. The buyers were, to an extent, forced to the market because of extended maintenance works at Santos port which will see the Termag terminal halting vessel operations from 28 February-29 March to perform its annual shore equipment maintenance followed by work at the Tiplam terminal. The lack of discharge flexibility pushed the buyers to step in to cover their demand in to early 2Q, at a time when spot availability for March loading cargoes was coming to an end. Prices increased to the mid-to-high-$60s/t c.fr.

In North Africa and India, c.fr prices have been static since the start of the year. When it comes to North Africa the stable pricing has been attributed to key end-users being covered by quarterly contract volumes and because Moroccan fertilizer producer OCP carried out maintenance in February on two granulation facilities at the same time as the company was consciously cutting its phosphate output because of weather-related problems at Jorf Lasfar port, causing problems with raw material arrivals and finished product loading. In India, whilst imports have been continuous, they have almost all been on a contract formula basis and, the increase in domestic sulphur production has also aided some buyers in avoiding the import spot market. Indian refiners will switch to producing Euro 6 fuels from Euro 4 on 1 April and this is of course increasing sulphur availability which is so far largely being directed to domestic consumers across all markets.

Finally, a look at the North American market where supply has also been tight. In the US, the commencement of the annual refinery maintenance season is limiting supply in hand with domestic refiners approaches to complying with IMO 2020 regulations having resulted in lower sulphur production rates. But the solid sulphur loading arm at the US Gulf port of Beaumont is now back in action. This is likely to increase exports and spot availability from the US Gulf in the future, but across February exports have been dedicated to fulfilling contract obligations. In Canada, logistical limitations because of strikes and demonstration action has hindered operations on the CN rail network across much of 2020 so far, lowering deliveries of sulphur to the port of Vancouver. Also, with prices still hovering at a maximum of mid-$40s/t f.o.b. Vancouver, plant-to-port delivery costs are still not feasible for all regional producers, keeping storage plans in action.

SULPHURIC ACID

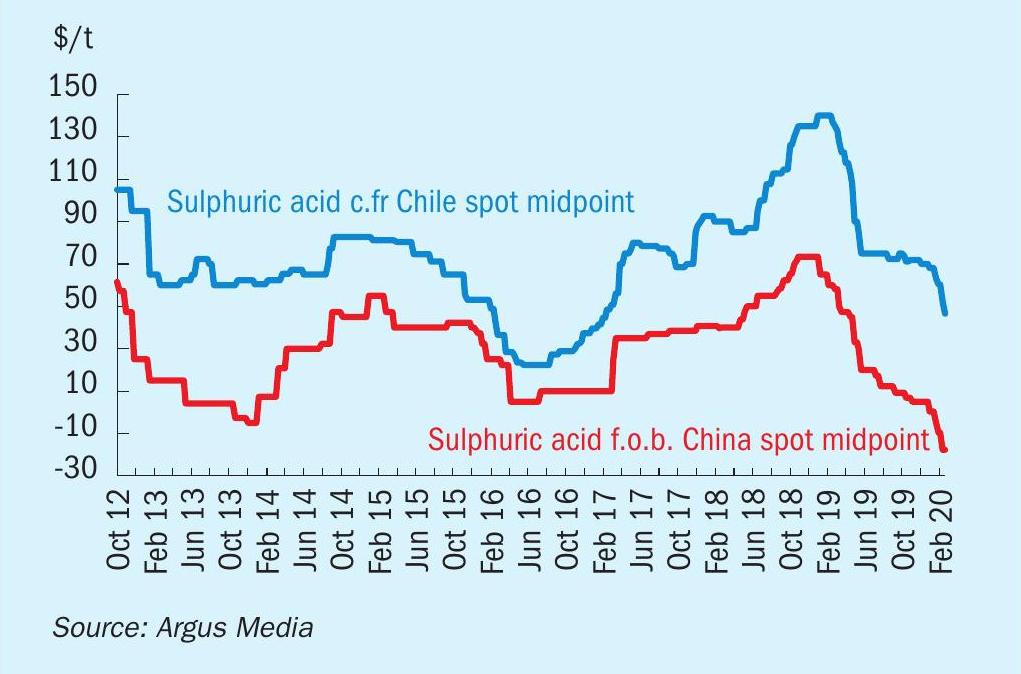

Sulphuric acid prices declined sharply across January-February on a c.fr and f.o.b. basis as sellers struggled to secure outlets for larger-than-expected prompt supply. The pressure came mostly from China, owing to the coronavirus outbreak, but sellers have also had fewer outlets than usual available as a result of a recent uptick in availability from non-traditional suppliers such as Indonesia and Australia. China’s f.o.b. price dropped to negatives in early February for the first time since 4Q 2013, when at its lowest level it was assessed at -$10/t. As of 27 February, the f.o.b. price was already at -$20/t with little domestic end-user demand noted, and no clear time frame for many restarting operations despite encouragement by the Chinese government for industry to start returning to normal operations with easing coronavirus spread prevention measures.

South Korean and Japanese f.o.b. prices have followed that of China and slipped in to negative pricing in the first week of February before dropping by the end of the month to -$20/t. Whilst the price has fallen, unlike China’s f.o.b. price, it has not yet dropped below the last record low of -$35/t f.o.b., which was encountered in the second quarter of 2016. Pressure has mounted in these two markets because of inventory increases in China in hand with swells at Japanese ports preventing some loading operations, forcing a build up in inventories there as well. But, as February came to an end, scheduling disruptions at ports lessened and spot sales to Chile helped ease inventory pressure.

In Chile, buyers of sulphuric acid have taken full advantage of softening f.o.b. prices and this has resulted in the country’s c.fr price dropping by $17.5/t on a midpoint basis across January-February. Consumers have also been favouring vessels of greater than 30,000t because of attractive freight rates, even though such vessels usually require two port loadings. But demand has not been high from the country, which became the world’s biggest sulphuric acid importer in 2019, with inventory levels high.

Turning to the US, of course prices here have also softened following the global trend. But, demand from the country has been firm across most of January and February, particularly with some supply disruptions in January in the west as strikes at the Asarco Hayden smelter kept the facility offline. Regular shipments from Europe and Asia have been satisfying US demand largely. Also, deliveries of Canadian sulphuric acid to the US has indeed been disrupted across the first few months of this year because of strikes followed by protests which blocked railroads. This led Chemtrade to announce in mid-February that the blockades could well have a material impact on the company’s operations. But, given the complexity of the rail networks and the nature of the blockades it has been difficult to predict the extent of the disruption on the company’s sites and third-party suppliers.

To conclude with Northwest Europe, contracts for the first quarter and first half settled mostly at a rollover with a slight reduction on the high end. Any increases in the first quarter contracts were achieved only on a freight basis, with higher rates seen on most routes and on the continent trucking costs had also increased.

PRICE INDICATIONS