Sulphur 388 May-Jun 2020

31 May 2020

Market Outlook

Market Outlook

SULPHUR

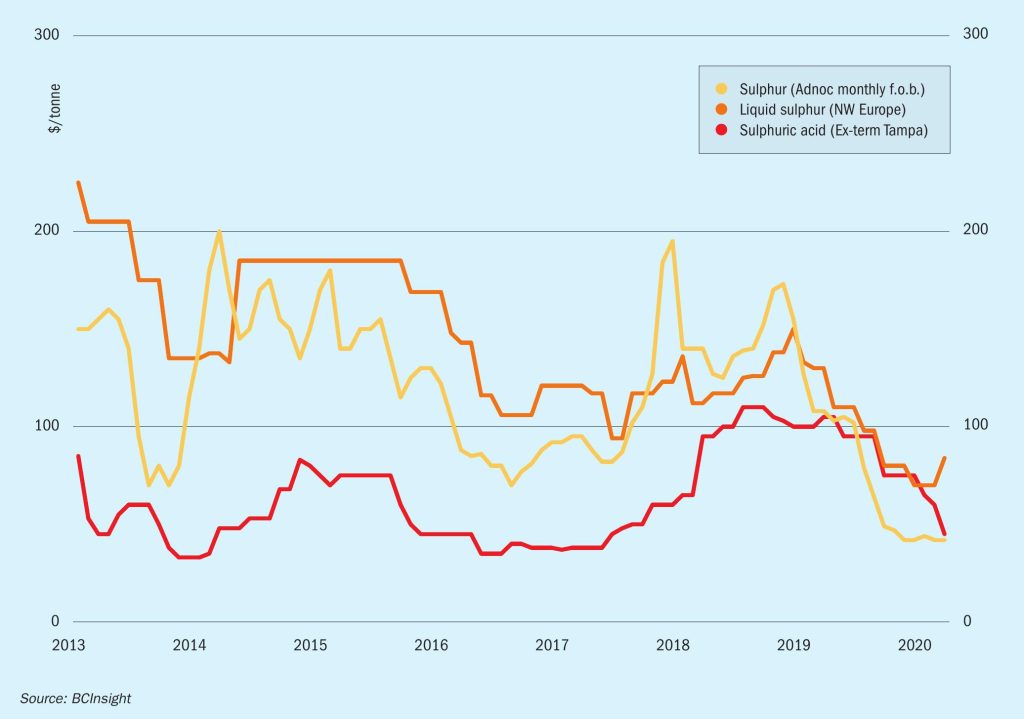

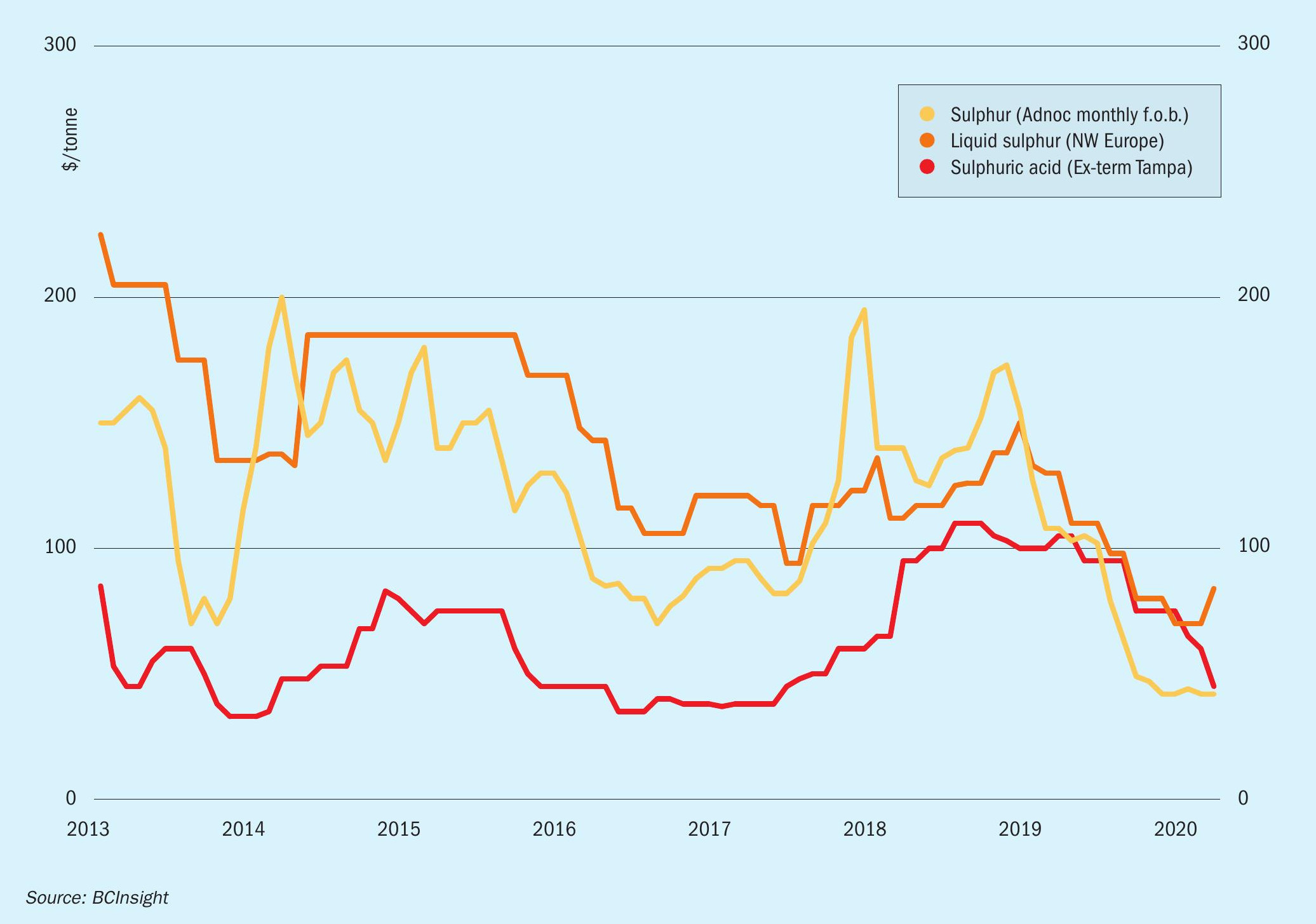

- How the macro market responds to the coronavirus pandemic over the months ahead and governmental response in different parts of the globe will likely have a lasting impact on the outlook for the sulphur market.

- The start-up of any new projects in the refining or gas sector may prove critical during a potentially tight period in the market. All eyes will be on developments in the Middle East as large scale projects may start up towards the end of the year in Kuwait and Qatar.

- Freight rates has provided some limited relief to the market due to the flat to soft trend – bunker fuel prices and length in availability for dry bulk vessels has contributed to this shift. The view is for delivered sulphur prices to ease and soften in the short term – but the falling freight rates are slowing the equivalent drops in f.o.b. ranges.

- Second quarter prices in North Africa settled at increases, covering significant portions of end user requirements. Tunisian consumer GCT has reduced operating rates owing to reduced workforce.

- Outlook: Weaker prices are expected in the short term following the recent uptick on the back of regional tightness. Sentiment is bearish due to coronavirus and the uncertainty surrounding end user markets. The oil price will give producers pause as we enter unchartered territory in many commodity markets. Potential tightness from the refining sector hit by the price collapse and high oil inventories may be partly neutralized by increased supply from new projects and reduced sulphur demand from end users. The weakness in the sulphuric acid market means continued opportunities for some buyers to substitute higher priced sulphur for merchant acid.

SULPHURIC ACID

- Indian fertilizer production has restarted, supporting demand. Meanwhile the industrial sector is experiencing disruption due to the ongoing shutdowns of plants in industries including detergents and surfactants.

- Australian mining operations are facing disruption as a result of the current situation. BHP has reported lower volumes from its Olympic Dam facility in the nine month period to March due to unplanned downtime at its smelter.

- Rio Tinto has cut its 2020 production guidance for mined and refined copper on the back of expected reduced output from its Escondida mine in Chile and repairs to its Kennecott mine in the US in the aftermath of an earthquake.

- Outlook: While uncertainty prevails market sentiment remains overwhelmingly bearish, despite the slight uplift in prices towards the end of April. Support has come as end users are increasingly seeking merchant acid cargoes during a time when elemental sulphur prices have been rising. However, the bleak macroeconomic picture is weighing on various end user operations and the outlook for acid, at least in the short term, is to potentially see the downward, softer trend remain.