Sulphur 388 May-Jun 2020

31 May 2020

Price Trends

Price Trends

MARKET INSIGHT

Meena Chauhan, Head of Sulphur and Sulphuric Acid Research, Argus Media, assesses price trends and the market outlook for sulphur.

SULPHUR

Uncertainty continues to confound the global sulphur market due to the Covid19 pandemic, with the potential for further downward pressure during this unprecedented and challenging time. The macroeconomic picture is bleak with the exogeneous shock of the global pandemic causing unprecedented shifts in the global commodity markets.

Middle East producers all increased monthly prices for April, on the back of tighter availability and the firmer footing seen in the market since February. The trend is not expected to continue however, with the wider market fundamentals expected to weigh on the short term outlook. In Kuwait, KPC set its April price at $61/t f.o.b. Shuaiba, a $14/t increase on a month earlier. State owned Muntajat announced its April Qatar Sulphur Price (QSP) at $64/t f.o.b., representing a $21/t increase. The marketer is not expected to have any spot availability for the month of May due to ongoing tightness, following several months of tight supply, with the last offer of spot from Muntajat not since September 2019. Over in the UAE, ADNOC does not expect to have spot volumes for the remainder of the quarter, with volumes allocated to contractual customers.

Projects in the Middle East are expected to increase capacity and availability in 2020-2021, although the global pandemic does raise significant questions around new project start up timelines. Some of the most imminent and significant projects in the short term include KNPC’s Clean Fuels Project (CFP), the Barzan project in Qatar and Saudi Arabia’s Al Fadhili gas project. Combined these three projects will add 4.5 million tonnes of sulphur capacity but uncertainty remains around whether there will be any potential delays to planned start dates. However, KNPC’s CFP has seen progress, with three sulphur related units starting up at the Al-Ahmadi refinery. No delays to start up have been announced thus far with estimates of a Q4 2020 start up.

Before the coronavirus situation unfolded, total global capacity was expected to rise by close to 4 million t/a in 2020, but how much of this volume will materialise remains unclear. The recent crash in oil prices has led to downward revisions in expected oil production, with the potential to lead to drops in sulphur supply in those regions dominated by sulphur recovery from this sector. Projects further out in the timeline that are considered speculative are expected to remain delayed – with several projects at just under 1 million t/a of capacity in this category.

Over in Jordan, JPMC completed a maintenance which had been extended through to the middle of April on the back of the coronavirus outbreak. The end user was in the spot market but is now expected to return to the market when it requires volumes for the second half of 2020. The buyer’s demand for the first half of the year was covered via a long term tender at the end of 2019. A 45,000 tonne cargo is due to arrive at the start of May from Qatar.

Canadian oil operations are vulnerable however due to the some of the highest breakeven prices. There has yet to be any major impact reported at Canadian sulphur operations on the back of the low oil prices, with Vancouver sulphur exports continuing. The five major Canadian oil producers announced cuts to 2020 capex budgets. Suncor is to reduce output at its 194,000 bbl/day Fort Hills bitumen venture. In total, Canadian production is estimated to drop by 500,000 bbl/day in 2020. Sulphur production in Canada is forecast to drop in the outlook regardless of any short term changes at oil sands and the refining sector. Production was estimated at over 6 million tonnes in 2010 and is estimated to have dropped below 5 million tonnes in 2019 due to the overwhelming decline of gas-based supply. This trend is set to continue, with the potential to influence export potential in the outlook.

The US market is expected to remain tight during this period on the back of falling refinery run cuts as demand for refined products is low. Some unconfirmed estimates put sulphur losses at 15-20% but this remains to be seen. Sulphur output was already low throughout 2019 versus 2018 as the crude slate changed, on the back of Venezuelan sanctions and the IMO 2020 specifications. Planned turnarounds at refineries in the US that were to take place over the second quarter have been cancelled, potentially aiding in tempering the tightness.Any shortages in supply in the local market may be met by increased imports – assuming demand remains stable. Another factor may be sulphuric acid pricing, with attractive prices versus sulphur leading to interest in acid procurement.

The Chinese market has become increasingly bearish following the lifting of lockdowns in the country. Sulphur prices have dropped down from the mid-$80s/t c.fr at the end of March by around $10/t to the mid-$70s/c.fr at the start of April. High sulphur inventories at the major ports in China had started to see some erosion but levels have climbed once again, edging up back towards the 3 million tonne mark. Many buyers remain covered for the short term with stocks at plants also healthy, potentially stemming short term demand for additional volumes. Prices in the local market have been softening, driven by ample inventories and weak domestic demand. In January-February 2020 Chinese sulphur imports totalled 1.58 million tonnes, down 22% on a year earlier. This decrease had been expected due to high inventories, reduced demand from processed phosphates operations and plant closures during the coronavirus outbreak.

Indian market sentiment has also suffered against the backdrop of its lockdown, with an extension until 3rd May at the time of writing adding to the pressure. At the start of the initial lockdown, fertilizer producers shut down, considerably reducing sulphur demand. Subsequently the government announced some restriction relaxations from 20th April including for the agricultural sector, adding a glimmer of hope for the market. End user IFFCO made enquiries for a first half May shipment. In the month of January, sulphur imports totalled 144,000 tonnes, around 8% up on the same month a year earlier.

SULPHURIC ACID

Global sulphuric acid export prices have dropped into negative territory – NW European f.o.b. levels have tracked below zero following several weeks of negative net-backs from Asia. Delivered prices for spot volumes in Asia dropped below zero in mid-April, a level not previously breached on a c.fr basis – reflecting the unprecedented shock of the global Covid-19 pandemic. Uncertainty prevails throughout the market over how long price weakness will remain, with little clarity on how and when lockdowns across the globe will be lifted. Contract business appears to be continuing as normal for the most part, despite the current situation. The attractive sulphuric acid pricing in relation to much higher relative sulphur prices has led to increased interest in merchant acid purchases. However, ongoing question marks over end user demand rates are expected to weigh on the potential for price stability or recovery.

In key market Chile, spot prices softened in mid-April down to $20-30/t c.fr, from the mid-$30s-low-$40s/t c.fr. High tank inventories were deemed the pressure point for the reductions. Miner BHP anticipates its Chilean copper facilities to see a 30% reduction in its workforce during the quarter to June. Copper output guidance for Escondida and Pampa Norte remained unchanged. Chile imported around 450,000 tonnes of acid from sources outside of Peru in the first quarter of the year. This is dramatically below the 860,000 tonnes imported a year earlier. However 2019 saw a spate of domestic smelter maintenances in the country leading to exceptionally high import demand. Peruvian supply to Chile is estimated at around 100,000 tonnes/month on average.

Brazilian spot prices for acid have also deteriorated down to $23-29/t c.fr in mid-April with demand remaining slow. Planned fertilizer plant turnarounds put further downward pressure on import demand with reduced consumption estimated from the chemicals sector. The leading domestic producer in Brazil was heard operating smelters at regular rates in mid/end April.

In NW Europe, export prices fell down to minus $18/t f.o.b. in mid-April on the back of sales to the Americas. There has been a divide between West and East pricing in the market with European levels maintaining higher levels versus Northeast Asian trade from China, Japan and South Korea. However the extreme level of the negative netbacks in Asia led to opportunities for end users typically supplied by European sources. Muted demand also led to the reductions in European export prices. On the contract front, second quarter European business settled down on the first quarter, with e2-3/t reductions confirmed by suppliers. Italian producer Nuova Solmine pushed back its planned maintenance at its Scar-lino facility by a month to early June, due to run for around a month. The producer was heard operating at reduced rates, with some industrial users under lockdown orders in the country, impacting end user demand.

South Korean and Japanese export price levels dropped down as low as minus $45/t f.o.b. in mid-April on the back of market weakness. Some slight easing was heard towards the end of April, with some confidence as May shipments had been booked, and cargoes for the June-July period under consideration. Some demand from Indian buyers also aided in the sentiment. Chinese spot prices have faced significant pressure and producers started to show less acceptance of the dramatic negative netbacks at the end of April. Some improvement was seen in the domestic market, providing hope at the end of the lockdowns in the country, with prices within the country ticking up in Hunan, Guaangxi and Guizhou. Chinese output from smelters is forecast to rise in the outlook with significant investment in the smelting sector. However the recent turn of events does put some project timelines in question or at risk.

Japanese sulphuric acid exports totalled 536,000 tonnes in Jan-Feb 2020, up from 484,000 tonnes a year earlier. The leading market was the Philippines at 192,000 tonnes. South Korean trade during the period totalled 533,000 tonnes, up from 469,000 tonnes the year below. Chile was the leading market followed by India, with China ranking third.

North African sulphuric acid prices were assessed at $5-8/t c.fr in mid/end April. Major importer OCP in Morocco is due to receive several Asian cargoes in May-June comprising both sulphur-based and smelter acid. Lockdown measures in India led to a reduction in OCP’s phosphoric acid shipments to the country as a result of reduced operations at processed phosphates plants.

While there is expected to be some delays to new projects in the sulphuric acid sector as a result of the shock to markets of the coronavirus with its impact still unfolding, there has been some project news in the US. Miner Freeport-McMoRan (FCX) is to complete its remaining $100 million investment in its Lone Star, Arizona copper leaching project with the status of progress at 90% completion. Initial production is expected during the second half of the year, which would support sulphuric acid demand, due to largely be sourced from the company’s own output.

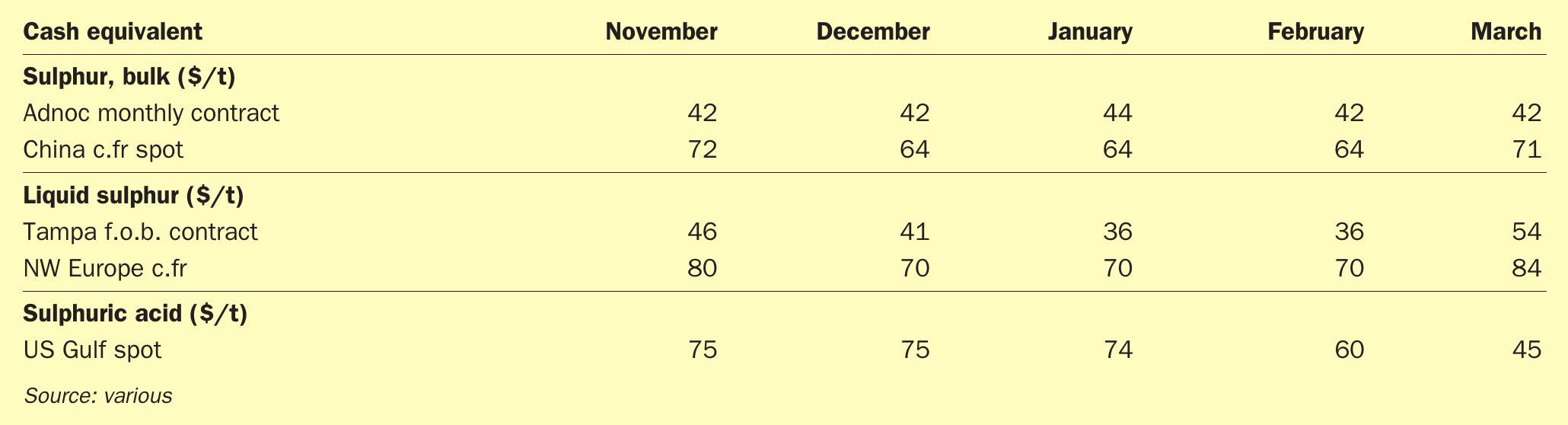

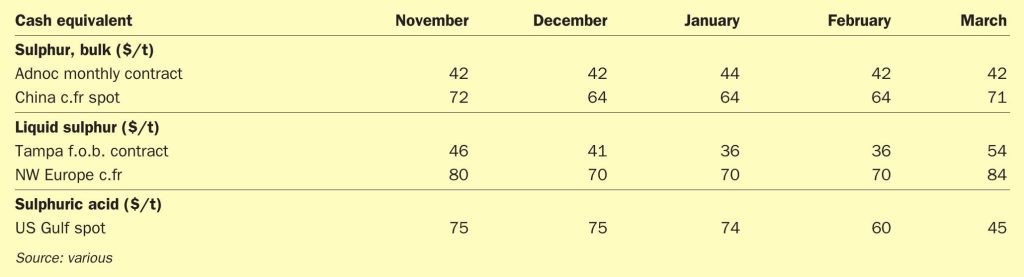

Price Indications