Sulphur 389 Jul-Aug 2020

31 July 2020

Market Outlook

SULPHUR

- Sulphur demand losses for production of phosphoric acid are forecast at 2.2 million t/a in 2020. Factoring in demand gains in markets such as Morocco, the sector is expected to see a drop of 800,000 t/a in 2020. Recovery is forecast from 2021 with a 2 million t/a increase forecast.

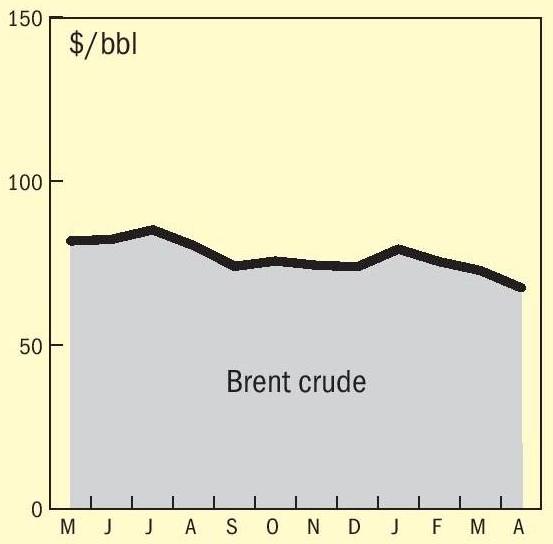

- Oil price erosion and numerous lockdowns have led to a major downturn for fuel demand. Sulphur supply has seen significant erosion, reducing availability in markets including the US.

- Indian import demand will see a drop in consumption for phosphoric acid. The initial lockdown led to fertilizer operations being disrupted. We forecast imports at below 600,000 t/a.

- Morocco remains a bright spot for sulphur and sulphuric acid trade and one of the few exceptions for demand growth this year. Import demand is expected to rise 300,000 t/a to 7 million t/a in 2020.

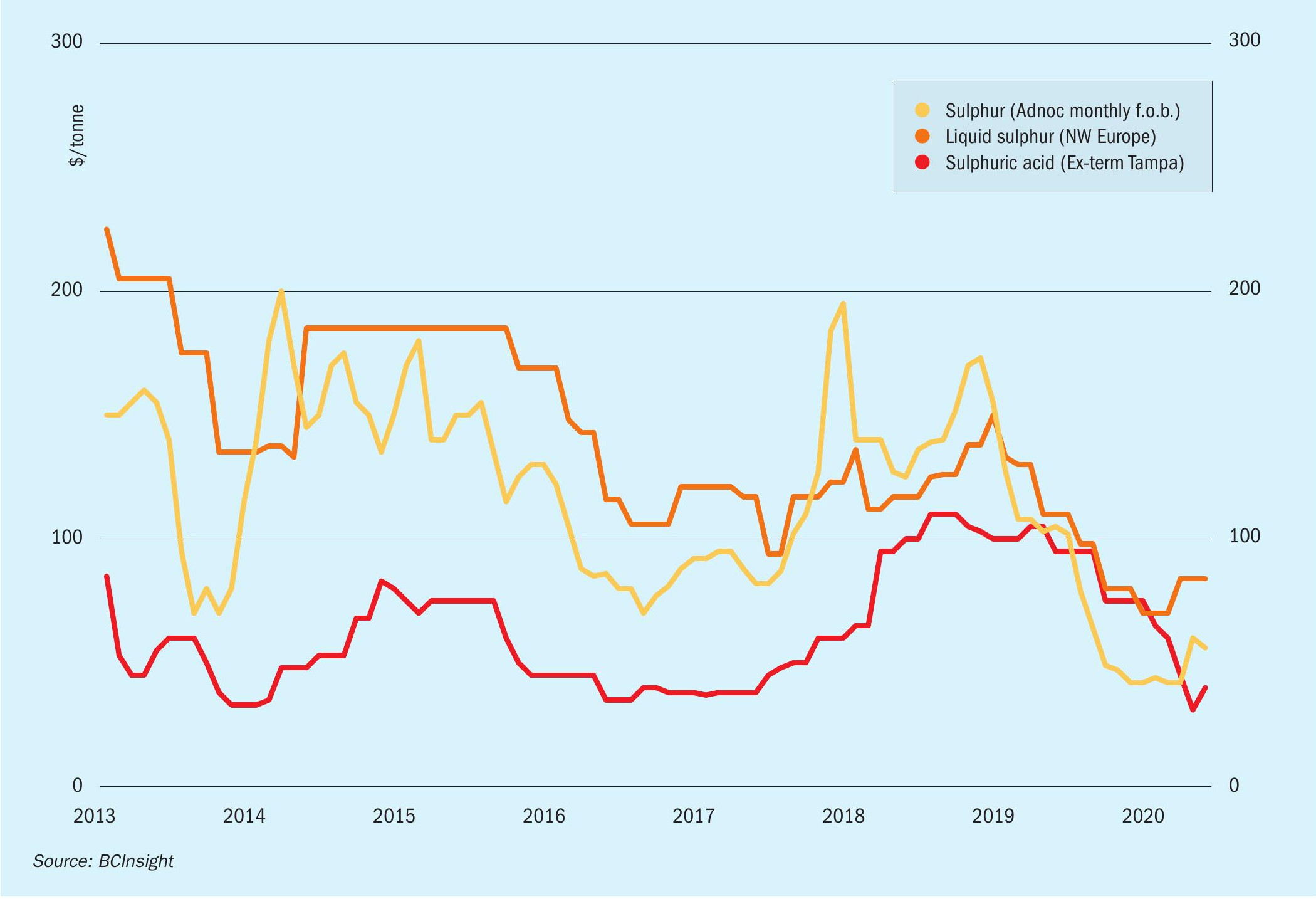

- Outlook: Covid-19 demand losses will tally over 1 million t/a in 2020 with further revisions likely as investment is cut in light of economic uncertainty. This has led to a revision of project timelines but the short term outlook remains robust. Chinese stocks at over 2.6 million t have left buyers on the sidelines to a degree. High stocks appear to be the new norm, reverting back to historical behaviour, having reduced impact on price direction. Prices in the second half of the year are expected to be stable to firm. Third quarter prices are forecast to tick up – with contracts expected to yield increases on the second quarter.

SULPHURIC ACID

- Copper leaching projects in the US including Excelsior Mining’s Gunnison project and Freeport McMoRan’s Lone Star project, are set to add around 850,000 t/a of sulphuric acid demand by 2024.

- Uranium prices surged 24% between March and June due to tightening supply from Covid-19 disruption and the suspension of operations at Cameco. Demand from the power sector remained strong over the period.

- A drop in sulphur-based acid production and reduced netbacks for Chinese acid exports will likely see producers more focussed on the domestic market − resulting in drop in 2020 exports. Exports to May fell by 16% on a year earlier to 834,000 tonnes.

- A weak economic outlook has led to the cancellation or suspension of several large smelter based sulphuric acid capacity projects in China. Despite this, the Argus forecast remains robust for China smelter projects in the short term.

- Acid consumption for the industrial sector for 2020 will see a decrease on 2019 levels but has been stable in most regions in recent weeks. Further disruption is a possibility, but a major medium-term growth area remains acidification of slurry in Europe.

- Outlook: The price outlook is stable to soft with limited upside anticipated in the short term. Reduced consumption at some mine sites is impacting demand. The broader macroeconomic sentiment also points to challenges in consumption of sulphuric acid.