Sulphur 389 Jul-Aug 2020

31 July 2020

Price Trends

MARKET INSIGHT

Meena Chauhan, Head of Sulphur and Sulphuric Acid Research, Argus Media, assesses price trends and the market outlook for sulphur.

SULPHUR

Supply side tightness in the second quarter supported the global sulphur market, leading to reduced liquidity in the spot market. End users were heard holding healthy inventories and the macroeconomic uncertainty weighed on sentiment heading into Q3 contract negotiations. The global pandemic continues to impact the supply demand balance for the year. There are substantial risks of a further Covid-19 flare ups as lockdowns are eased in many countries. The third quarter is usually a period for an upturn in the price cycle with increases still anticipated this year. Limitations on price increases are expected however with a muted market sentiment from downstream markets including processed phosphates and metals.

Uncertainty prevails over how the various containment measures put in place to overcome Covid-19 will impact sulphur end-use markets over the short and long-term. Argus has studied the impact of previous pandemics in order to form a view on possible consequences such an event could have on fertilizer demand. The impact of a pandemic on the agricultural markets and in turn sulphur demand is dependent on the various government responses. Containment measures may be disruptive to the flow of goods and labour or could impact farmers’ costs and revenues. Reduced purchasing power means farmers are less able to bear fertilizers costs. Travel restrictions mean that inputs can be more difficult to access, resulting in lower fertilizer demand, ultimately impacting the consumption of raw materials including sulphur. This was the case during MERS in 2012 and Ebola in 2014. Sulphur consumption for phosphoric acid production decreased in 2012 and in 2014. Argus expects a drop in sulphur demand in the sector in 2020.

In other end use markets, Nickel remains the leading metals demand sector for sulphur. Australian sulphur demand is expected to see a boost from 2020 with the restart of the FQM Ravensthorpe nickel project. Australian sulphur imports have been increasing with January-April trade data showing a 116% rise to 442,000t. Meanwhile the Ambatovy nickel project in Madagascar temporarily halted operations, reducing sulphur consumption. Further downward revisions on demand are possible as fresh waves of Covid-19 emerge.

Sulphur demand losses for copper appear to have been far more muted than for sulphuric acid as elemental sulphur forms a small percentage of demand vs direct acid from smelters at copper mines. The macroeconomic outlook remains uncertain with volatility in copper prices leading to questions around investment and future trends. Some mining companies have announced cuts in capex guidance for 2020, influencing the near-term view. Flaring tensions between the US and China have weighed on copper prices but signs of cautious optimism emerged in June.

Mining company MM Boleo suspended operations at its copper, cobalt, zinc and manganese sites in April, following government coronavirus measures to shutter non-essential activities until 30 April. The company restarted operations on 1 June at its various sites and was back in the market for sulphur. Coronavirus is set to test the Mexican economy this year. The country’s confirmed cumulative coronavirus cases rose to over 203,000 and over 25,000 deaths in June.

On the supply side, production cuts on the back of Opec+ agreements have resulted in a subsequent decline in oil-based sulphur output in recent months. In its Q1 2020 financial results Saudi Aramco reported its Fadhili Gas plant increased processing capacity to 2.0 scf/d from 1.5 scf/d. Operations at Saudi Aramco facilities are a combination of oil and gas. A significant portion is from associated gas, so reductions in sulphur output are possible given the country is the worst hit in the region by Covid-19.

State-owned refiner KNPC remains on track to complete its long delayed $16 billion Clean Fuels Project (CFP) in the fourth quarter after commissioning a water-cooling unit and the main fuel gas line at its 265,000 bbl/d Mina Abdullah refinery. Kuwait’s CFP involves the integration of the Mina Abdullah and Mina al-Ahmadi refineries, raising their combined crude processing capacity to 800,000 bbl/d. The 615,000 bll/d Al-Zour refinery in the south of the country is also expected to come online by the end of the year. The Clean Fuels project and Al Zour combined are set to add 2.3 million t/a of sulphur capacity.

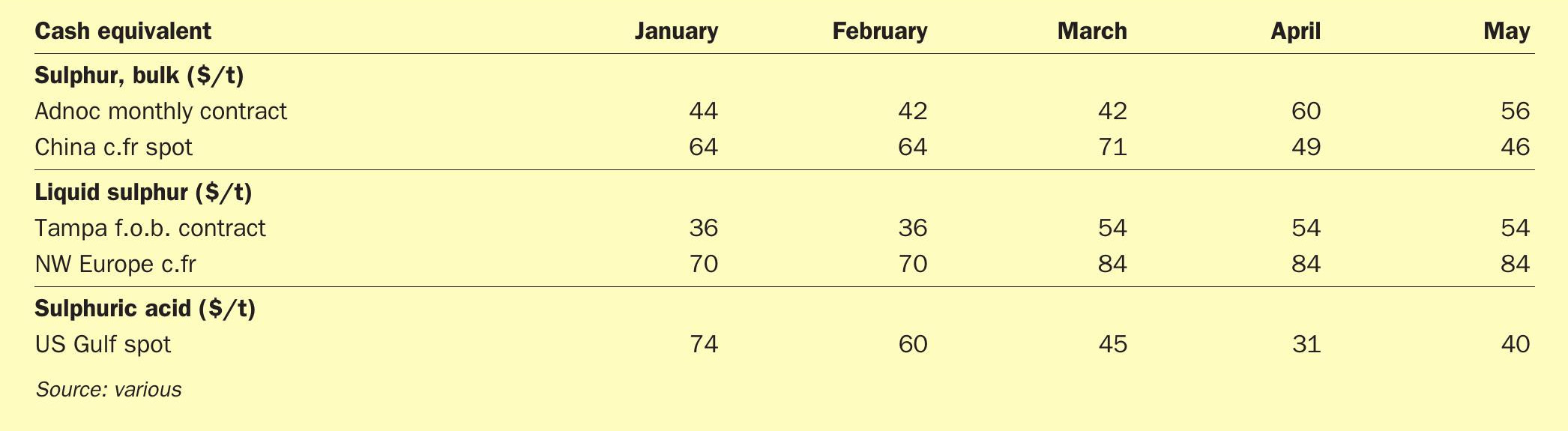

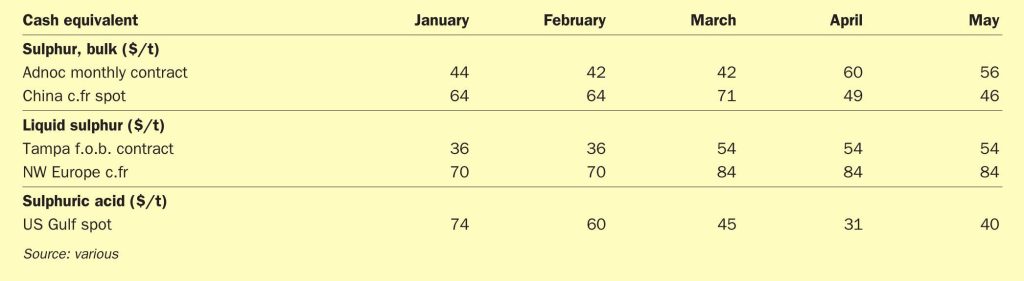

Middle East producer pricing for June reflected increases in line with reduced liquidity in the market. In the UAE, ADNOC set its June monthly price at $58/t f.o.b. Ruwais, up by $2/t on May, for shipments to the Indian market. KPC/Kuwait set its price for June at $57.5/t f.o.b. Shuaiba, up by $4.50/t on the previous month. State-owned marketer Muntajat set its June Qatar Sulphur Price (QSP) at $57/t f.o.b. Ras Laffan/Mesaieed. This was $4/t above the May. Muntajat issued its first spot tender in nine-months in June. It was awarded towards the mid-$60s/t fob.

Chinese supply is not expected to be negatively impacted by the Covid-19 pandemic in 2020. Total production is set to breach the 7 million t/a level in 2020 for the first time, driven by capacity additions in the refining sector. The initial lockdown and strict quarantine measures introduced to contain the spread of the disease in China placed significant uncertainty on sulphur demand. Argus expects a downturn in total demand down for 2020, concentrated in the phosphoric acid and industrial sectors. Whilst many of the country’s industries are back up and running, fears of a second wave of infections have not yet entirely been ruled out as authorities in Beijing reintroduced lockdown measures once again in June. There is potential for further downward revisions for supply and demand with outbreaks remaining a risk to the market. Demand recovery is expected from 2021, across most end uses. The rise in local supply, the slowdown in demand and healthy stocks have been eroding China’s import requirement. China imported 2.6 million tonnes from January-April, down by around 26% on a year earlier. The UAE remained the leading supplier and delivered around 719,000 tonnes, up by around 97%. Deliveries from other Middle East suppliers fell. Iran supplied 15% less, at 408,000 t. Saudi Arabia supplied 59% less, at 232,000 t and Qatar supplied 77% less, at 122,000 t. India supplied 225,000 t, up by 43%, reflecting improved production capacity in the Indian market on the year as well as increased exports because of the impact of the pandemic in India.

SULPHURIC ACID

Global sulphuric acid market prices saw gains over the last few months, with prices ticking up in some regions on the back of spot demand. The pandemic is weighing on major demand sectors including copper, with disruption from Covid-19 containment measures taking its toll on the market. In NW Europe, average prices for export rebounded from $-10/t f.o.b. in April back into positive territory at $4/t f.o.b. at the start of July. Following significant shipments to Morocco, reduced availability supported the tick up in prices out of Europe. Contract negotiations were underway in the region for the third quarter. Some settlements for sulphur-based acid were reported at a rollover on the previous quarter, but negotiations were ongoing at the start of July for others. Softer prices were indicated for smelter acid. Impact from slow industrial demand and squeezed end product margins weighed on price discussions.

Demand for sulphuric acid for the copper sector is forecast to drop significantly in 2020 vs 2019. Some uncertainty remains on the short-term outlook due to ongoing economic disruption as lockdowns continue in many regions. The shifting macroeconomic conditions raise questions on how the remainder of the year will unfold. Some mining companies have announced cuts in capex guidance for 2020, influencing the near-term view. Flaring tensions between the US and China weighed on copper prices in May with cautious optimism returning in June. Mining projects in Arizona and the Central African copper belt add to prospects for consumption growth for leaching in the forecast. The view for Chile in 2020 is to see a drop in demand, recovering in the medium-term before seeing significant drops from 2025 as copper oxide ores erode. Coronavirus cases in Chile were over 282,000 at the start of July and further disruption to the mining sector was expected due to the escalation in cases.

In project news, Freeport McMoRan expects its Lone Star copper leach plant in Arizona to begin copper production during the second half of the year, completing the remaining $100 million investment in the venture in 2020. Sulphuric acid consumption for the project is expected to mostly be sourced from the company’s own production. Copper output is estimated at 91,000 t/a and was close to 90% complete at the end of April 2020.

Excelsior Mining copper mining operations were temporarily suspended at the Gunnison project in Southern Arizona in response to the Covid-19 outbreak. The duration of the suspension is unknown according to the company. The project was under care and maintenance in order to remain flexible for a restart once the issues surrounding the pandemic are resolved.

India has taken most significant Covid-19 related demand hit, with 1.6 million t/a of phosphate based sulphuric acid demand forecast to be lost in 2020. A snap decision in India to stall customs clearances on Chinese product had localised impact on throughput, but a lack of clarity on the nature and duration of the rules added uncertainty. India imported nearly 250,000 tonnes of Chinese acid in the first half of the year. Lower acid prices have supported trade from a range of suppliers so far this year. Prices for spot range $6-19/t c.fr at the start of July, according to Argus assessment of the market.

One of the main bright spots for demand this year is Morocco. Despite all the disruption to phosphoric acid demand in other regions, Morocco is expected to see growth as OCP continues to ramp up at the Jorf Lasfar processed phosphates hub. Imports were expected to remain strong through July with OCP continuing to be active in the spot market in Europe and Asia. Argus analysis shows sulphuric acid June arrivals at Jorf Lasfar reflect the highest ever monthly volume at 271,000 tonnes. Imports are expected to remain strong through the remainder of the year. Supply is led by China – around 361,000 tonnes were shipped in the first half of the year. European trade has seen a significant increase on a year earlier.

Sulphuric acid production is expected to decrease in almost every region in 2020. Significant losses have been noted at captive production sites for the processed phosphates sector and metals leaching projects. A major drop is forecast in India as lockdowns led to temporary closures at several fertilizer plants with associated sulphur burners. Disruption is also noted at the Mopani smelter in Zambia.

Exports from Japan totalled 1.3 million t in January-May 2020, up by 100,000 t on a year earlier. The leading market was the Philippines at 499,000 tonnes, followed by India at 239,000 tonnes. The outlook for trade volumes for the year is stable. Price pressure remained into the start of July, with product available for prompt loading. Markets including southeast Asia have seen offers for Japanese tonnes, but little interested was noted.

PRICE INDICATIONS