Nitrogen+Syngas 366 Jul-Aug 2020

31 July 2020

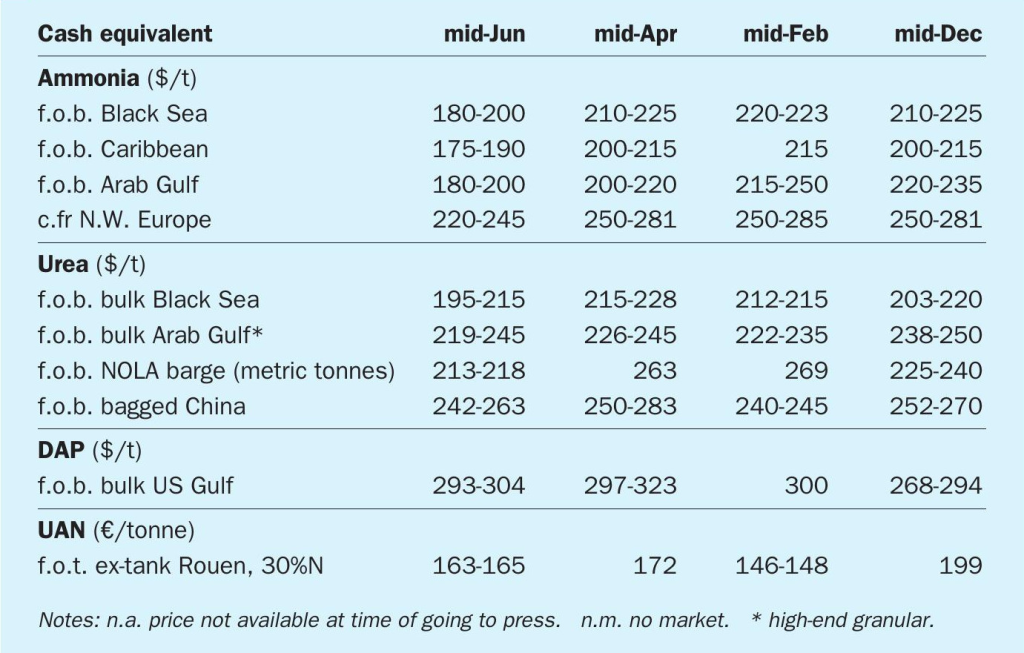

Price trends

Price trends

MARKET INSIGHT

Alistair Wallace, Head of Fertilizer Research, Argus Media, assesses price trends and the market outlook for nitrogen.

NITROGEN

The ammonia market remains oversupplied, and prices are forecast to remain bearish into the third quarter. In Europe, low gas prices are further exacerbating the existing supply length in the region, and the arrival of more Ukrainian exports through the port of Pivdenny (Yuzhnyy) have pulled f.o.b. prices in the region to lows not seen since late 2016.

Spot prices for ammonia loading from Pivdenny fell into the $180s/t f.o.b. in late May, as supply options continue to accumulate for trading companies and buyers in markets west of Suez. Production has been taken offline in Trinidad, Egypt and Indonesia in May and June because of poor demand. Other producers are redirecting ammonia to urea or nitrates production where possible, or operating at lower rates. Industrial demand, which has been the key driver behind the falling price trend, is beginning to improve east of Suez but is still absent in the west, while most economies struggle to recover from the Covid-19 pandemic.

F.o.b. prices have fallen by $40-80/t across key supply regions seen since the Covid-19 outbreak, and while theoretically there is further room to fall, any losses in the month ahead are not likely to be as steep as those seen in recent months. The weak demand outlook for July was confirmed by the settlement of next month’s Tampa price at $13/t lower on the month, at $205/t c.fr.

Urea prices bottomed out in mid-May following the purchase of over 600,000 tonnes of urea in an Indian tender. India bought the spot urea available from Ukraine, Egypt and the Middle East at $227-231/t c.fr. Chinese suppliers were unwilling to sell at that level.

These purchases tightened the market and, after a stand-off, prices began to firm in early June when traders had to cover short sales made for June and first half July shipment. The second week of June was particularly active, with more than 500,000 tonnes of granular urea trading and prices jumping by $20/t in some areas. But the recovery in prices has brought Chinese urea back into play. F.o.b. levels rose to $230-240/t in the Middle East and Egypt. Coinciding with falling prices inside China as summer season demand waned and production remained high, this means that Chinese urea is competitive at current offer prices close to $230/t f.o.b.

Another Indian tender is taking place at the time of writing and Chinese urea is expected to figure prominently in the origins for offers supplying India from July onwards. The ability of Chinese suppliers to provide 400-500,000t/month for export in the second half of the year is expected to cap prices in the short term.

END OF MONTH SPOT PRICES

natural gas

ammonia

urea

diammonium phosphate