Sulphur 390 Sept-Oct 2020

30 September 2020

Market Outlook

SULPHUR

- The risk of a second Covid-19 wave over the winter period continues to fuel the trend of forward trading of sulphur cargoes. Downward pressure in some sectors for demand is likely as the macro economic forecast remains challenging.

- Two Western European sulphur remelter projects are underway in Germany to ease the tighter balance that is currently forecast for liquid sulphur as gas based supply depletes and the refining sector remains under pressure.

- Indonesia is set to see significant ramp up in sulphur requirements if planned nickel leaching projects progress in the short and medium term. Sulphur imports are forecast to rise to meet demand.

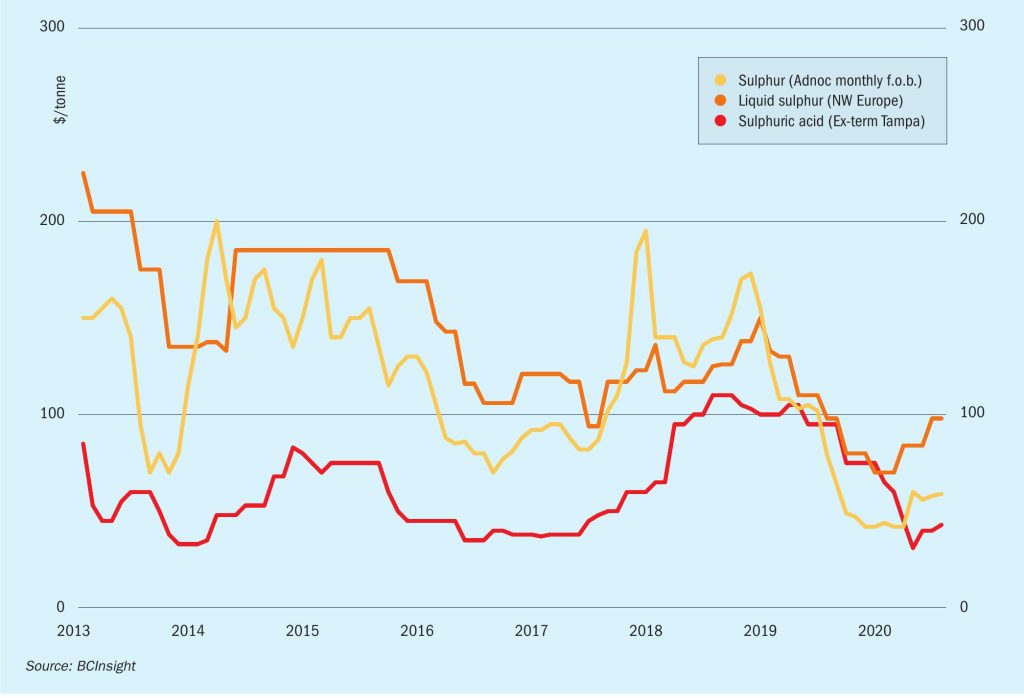

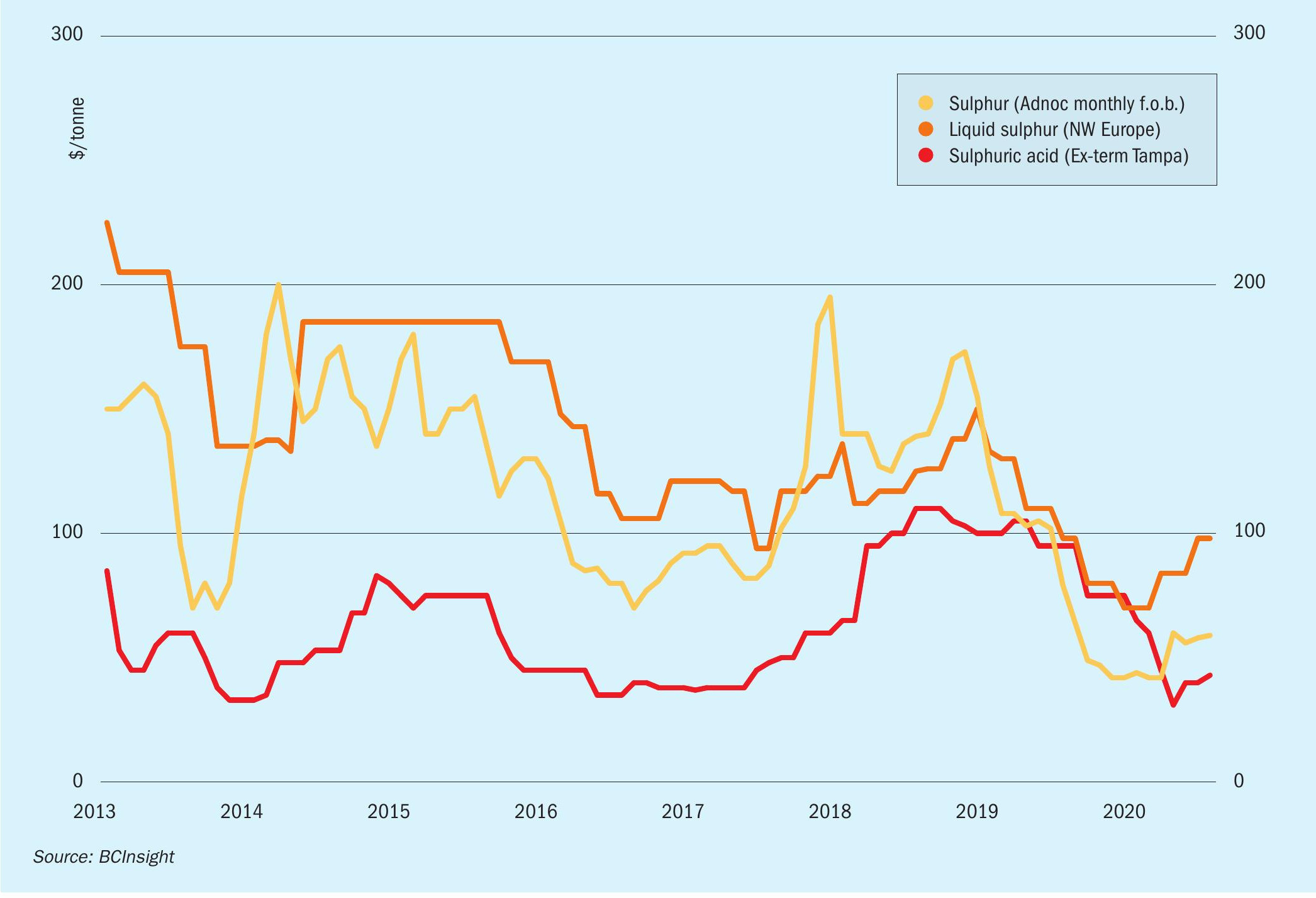

- The development of the refining sector in China remains a major focus for the market as new production is forecast to rise to over 7 million t/a this year with the startup of projects including Sinopec’s Zhanjiang refinery in Guangdong. l Outlook: Project delays are anticipated on the back of disruption from Covid-19, pushing some new sulphur capacity additions into 2021. However, the short and medium term outlook still points to significant supply being added in the Middle East and China. The reduction in Chinese import demand requirements in the forecast would potentially lead to major shifts in trade patterns. Fourth quarter sulphur prices are forecast to see limited movement but some firming is possible within a small range.

SULPHURIC ACID

- DAP prices to remain steady to firm for remainder of 2020 and going into the new year, supporting sulphuric acid demand. DAP market expected to be in surplus from Q2 2021, leading prices to edge down.

- Indian import demand is set to reach record levels in 2020 at 1.9 million t/a. The Sterlite Tuticorin smelter is currently expected to remain closed through 2021, a key driver for sulphuric acid imports in the interim.

- Moroccan import demand is forecast to reach highs in 2020 at 1.9 million t/a, supporting trade through the remainder of the year.

- Planned smelter turnarounds appear to be below levels seen in recent years in 2020. This points to the likelihood of a busier schedule in 2021, potentially providing a floor to pricing during periods of weakness.

- The ongoing global pandemic remains a wildcard for the acid market. There is potential for further supply side disruption and demand losses over the year ahead.

- The sulphur supply forecast is expected to be an influential factor for acid prices. Increased sulphur availability from Middle East projects from 2021 may provide a ceiling on achievable acid prices.

- Industrial and metals markets are forecast to rebound from 2021 with a robust outlook for nickel and copper. The uncertain macroeconomic picture relating to Covid-19 remains a risk to demand growth.

- Outlook: Chile and Northeast Asian acid prices remain under pressure on the back of sustained weakness, limited demand and ample supply. n