Sulphur 391 Nov-Dec 2020

30 November 2020

Market Outlook

SULPHUR

- Production cuts globally at refineries have left supply tight heading into the fourth quarter, firming prices. This has been compounded by major exporters in the Middle East prioritising sulphur tonnes to contracts before spot sales.

- Chinese sulphur imports are expected to decrease as domestic capacity increases in the mid to long-term. Morocco is expected to become the leading global importer of sulphur by 2022 as OCP’s phosphates industry continues to grow.

- Uncertainty surrounding the recovery of utilisation rates at refineries remains as countries globally re-enter lockdowns and a second wave of coronavirus infections spread.

- New Canadian forming capacity will increase the country’s export flexibility and we may see increased exports from Vancouver in the mid to long-term.

- New capacity growth will come primarily from the Middle East. The region is expected to add 5.1 million t/a of sulphur capacity by 2025 on 2019 figures.

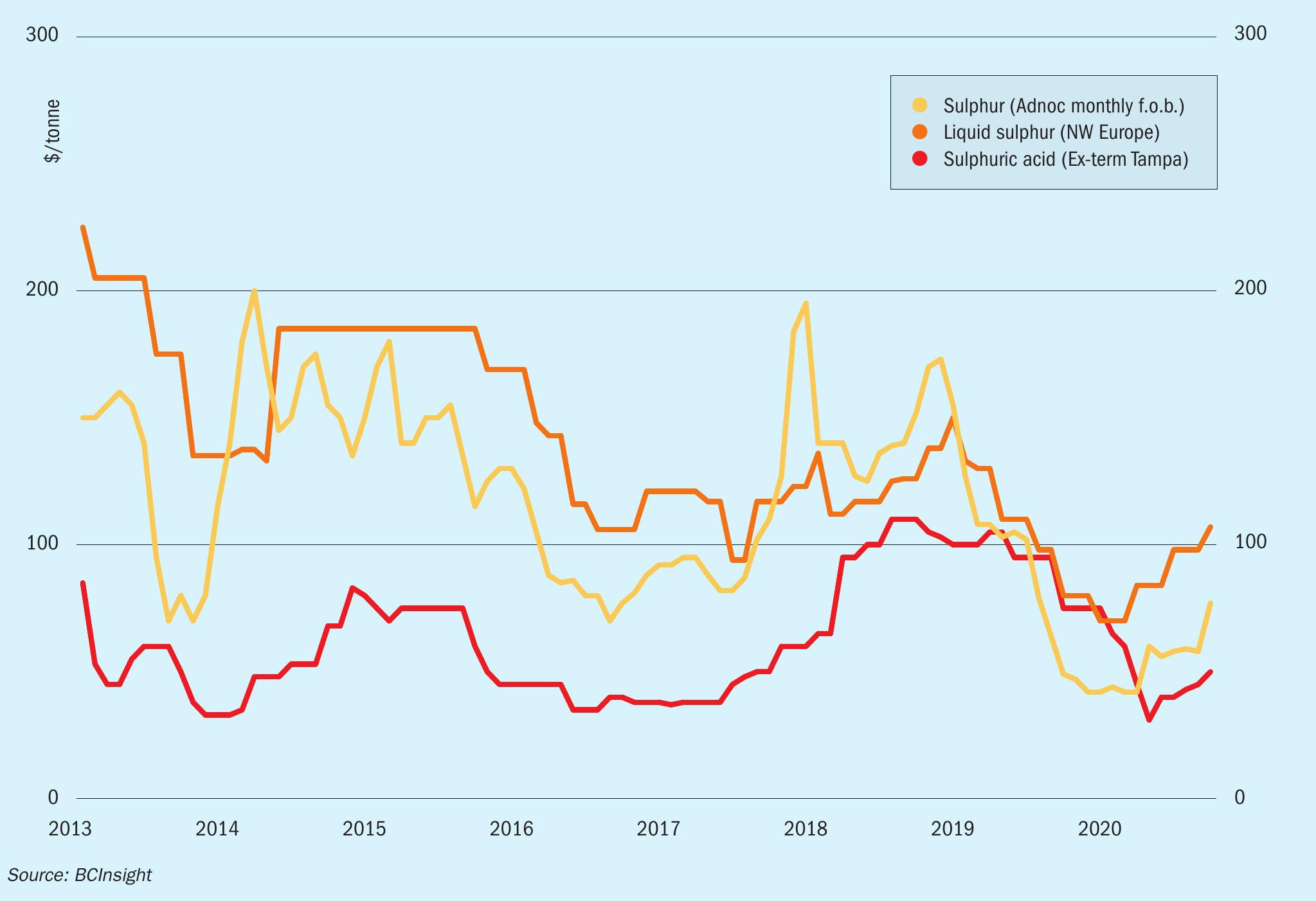

- Outlook: Limited supply and strong demand from the phosphate market have seen buyers accept higher contract prices on the last quarter. Prices will likely peak this month before softening slightly into December and prices will remain stable heading into 2021 whilst supply remains tight.

SULPHURIC ACID

- India’s de mand from fertilizer-based production remains firm with buyers on both coasts opening demand for November-December shipments.

- Firm sulphur prices and limited availability on the spot market heading into the fourth quarter, combined with historically low acid prices has led to fertilizer producers with flexible production lines shifting to acid imports over onsite acid production. Indian acid imports are expected to reach record-breaking levels by the end of the year.

- Uncertainty remains over India’s longterm sulphuric acid supply as Vedanta’s Tuticorin smelter remains shut.

- The copper industry in Chile is continuing to recover, increasing acid demand from the region as we move towards the end of the year. Annual contract discussions continue with bid/offer levels narrowing.

- Looking into the long-term, new nickel demand from the battery sector is expected to be a main driver for acid demand in Asia.

- Outlook: Pricing is expected to hold firm as demand sectors continue to recover from the coronavirus pandemic. Uncertainty surrounding logistics is growing in Europe as countries enter second lockdowns, however it seems restrictions will be less damaging than earlier in the year as governments attempt to minimise economic damage. The expected continuation of high sulphur prices and a strong phosphates market will support acid trade and prices. Looking further ahead, new smelter capacity in 2021 will limit price increases into next year. But a tightening of the market balance from 2022 out supports the view for price gains.