Nitrogen+Syngas 368 Nov-Dec 2020

30 November 2020

Price trends

Price trends

MARKET INSIGHT

Alistair Wallace, Head of Fertilizer Research, Argus Media, assesses price trends and the market outlook for nitrogen.

NITROGEN

Prices are static in the ammonia market, with minimal activity reported at the end of October, but negotiations are ongoing for spot cargoes in November and December. In Europe, rising gas prices are firming feedstock costs and supporting current price levels despite relatively slow demand from key consumption regions. In China, firmer prices are reported from caprolactam, acrylonitrile and fertilizer markets, making exports a more attractive prospect for the remaining months of the year. Chinese exports continue to run about 5% ahead of last year In the Middle East, Saudi producer Sabic has positioned its turnaround at the Ibn Baytar plant from early November to 27 November, and will lose 60,000 tonnes of production from the turnaround. In Trinidad, Nutrien is scheduled to idle its smallest plant and the timing of the restart of its largest plant is still unknown.

Argus expects supply availability to improve through December, based on producers coming back on line, as prices towards the end of the year provide enough incentive to ramp plants back up towards full production. Outages in Trinidad and Algeria have given the market some balance, but if production does ramp back up, prices could come under pressure again.

Urea prices came under pressure in the second half of September from a number of factors – India’s tender was announced later than expected, Chinese export supply proved larger than anticipated, and a lack of trade west of Suez continued to depress f.o.b. values. Some European buying started in late September when prices fell to more acceptable levels. More recently, India’s RCF set a new record, awarding 2.18 million tonnes – the first time purchases have exceeded 2 million tonnes in a single tender. Chinese prices rose at the end of October, driven by a spiralling domestic market. Egyptian prices were reconfirmed in the mid $250s/t f.o.b. by a fresh spot sale. Brazil remained a weak point, however, with prices drifting below $265/t c.fr amid minimal liquidity. Europe was equally quiet with buyers mostly awaiting lower values. The void in liquidity outside of India means the direction of the market over the medium term will be decided by its timing. India still needs substantial imports for the rabi application season. However, if it takes a lengthy pause before tendering again, there is little to sustain prices in the interim, based on current evidence.

Strong demand from India will provide an outlet for Middle East and Chinese suppliers. In the west, fourth-quarter demand from Europe and Brazil will be key to granular prices. Suppliers are comfortable for now, but prices will likely come under pressure in between Indian tenders.

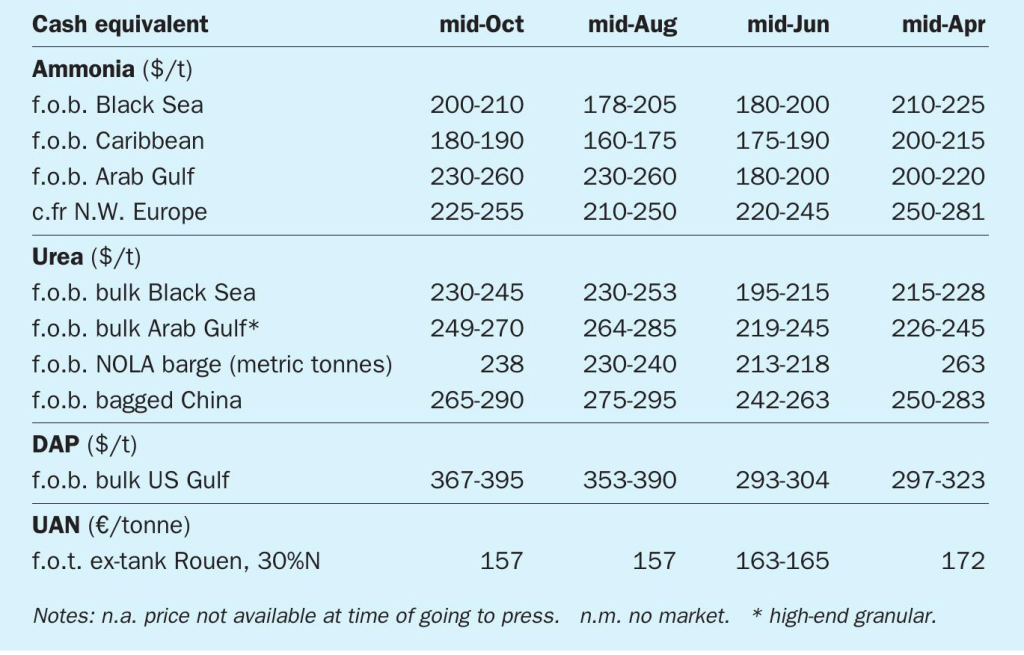

END OF MONTH SPOT PRICES

natural gas

ammonia

urea

diammonium phosphate