Sulphur 392 Jan-Feb 2021

31 January 2021

Market Outlook

SULPHUR

- The global pandemic and new wave of lockdowns in some regions continue to pose a level of uncertainty to oil demand and in turn sulphur recovery. There are positive signs in the macro economic picture on the back of the vaccine rollout but significant question marks remain.

- Nickel based demand for sulphur at new leaching projects remains a highlight of the market outlook. Indonesia is driving this in the forecast, with several new projects expected to ramp up. Slight delays on the back of Covid-19 disruption may see a more significant ramp up in 2021/2022 for sulphur imports.

- China’s burgeoning sulphur production from new refining projects and expansions is at the forefront of the shift in the market balance. The year ahead is expected to see further pressure on the import requirement.

- Growing demand from the processed phosphates sector in North Africa will offset some of the losses from Chinese trade.

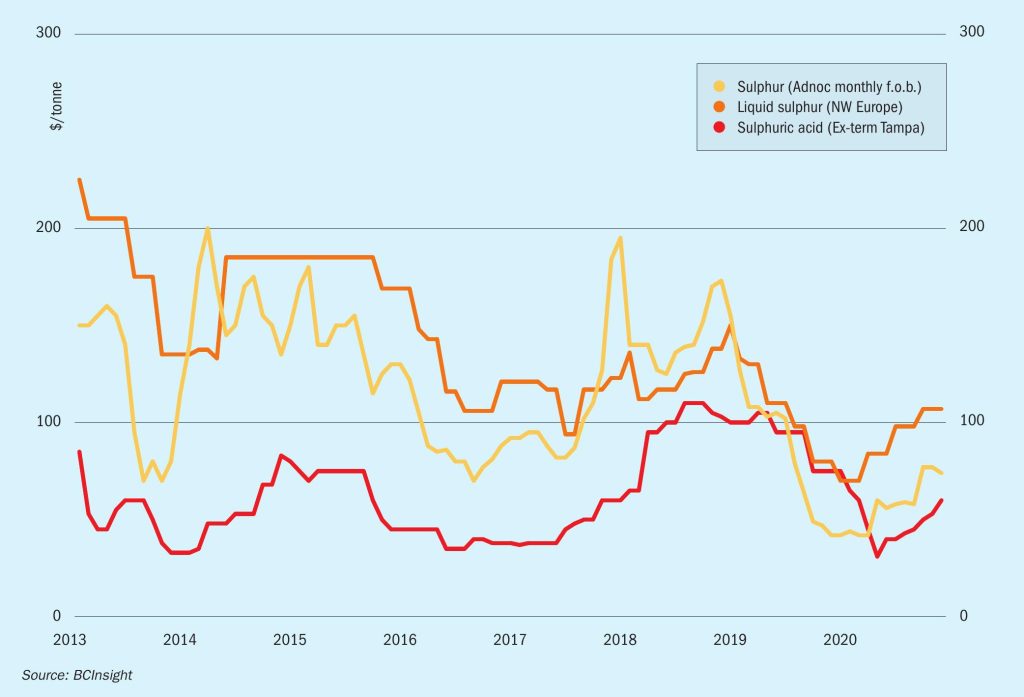

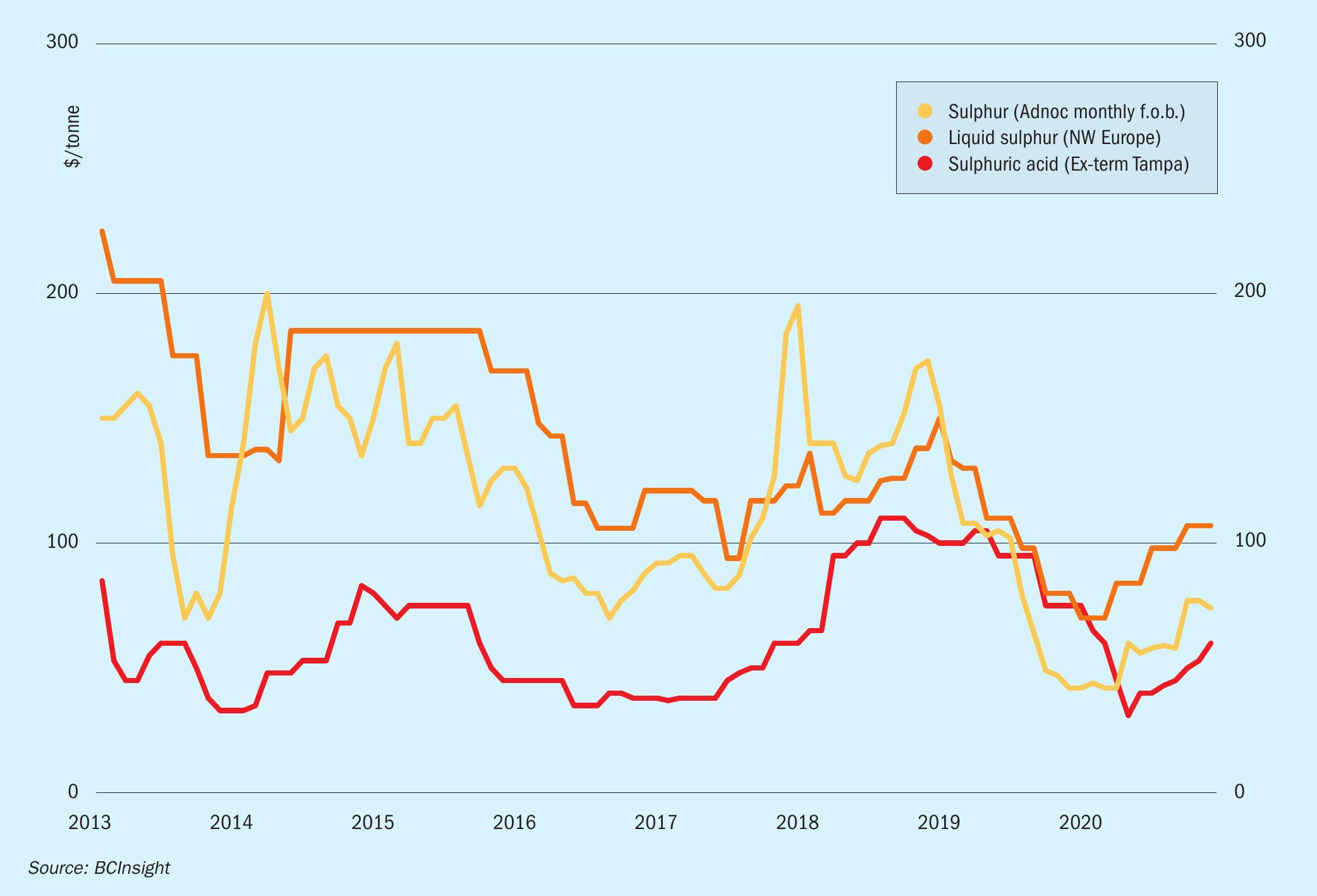

- Outlook: Short term tightness is expected to prevail and prices to remain stable to firm ahead of the Chinese lunar new year holidays. As trades stall in February the heat in the price run is expected to dissipate. The latter part of 2021 is likely to see increased volumes, based on the assumption of new projects adding export availability in markets including the Middle East. Recent positive developments around the rollout of Covid-19 vaccines in many countries have spurred optimism about an oil demand recovery. But the emergence of more infectious strains of the virus in Europe and elsewhere have triggered new travel restrictions and lockdowns.

SULPHURIC ACID

- Seasonal tightness in the elemental sulphur market continues to support the sulphuric acid market price outlook going into the first quarter of 2021.

- Indian imports of acid are estimated to have breached the 2 million tonne mark in 2020 with trade data to October totalling 1.8 million t. This is in line with the low price trend earlier in the year. Strong imports are expected in the year ahead with Sterlite/Tuticorin expected to remain offline through 2021.

- OCP/Morocco is expected to remain a major acid importer in 2021, expected to remain well above one million tonnes based on the outlook for demand.

- Smelter turnarounds are expected to ramp up in 2021 following the delays and reduced levels in 2020. Pockets of tightness are expected to emerge, lending support to pricing.

- Outlook: Prices continue to be buoyed going into the new year, with tight supply compounding the uptick. Support from the DAP and sulphur markets is also influencing sentiment. Average prices in Chile for 2020 were $40/t c.fr following the price run up in the latter part of the year. Developments in the mining sector remain crucial for the short term outlook for supply and demand in Chile with buoyant copper prices remaining supportive. New variants of the Covid-19 virus continue to remain a wild card for the macro economic outlook.