Sulphur 392 Jan-Feb 2021

31 January 2021

Price Trends

MARKET INSIGHT

Meena Chauhan, Head of Sulphur and Sulphuric Acid Research, Argus Media, assesses price trends and the market outlook for sulphur.

SULPHUR

The upward trend in global pricing has continued into the new year showing little sign of dissipating in the short term. The holiday season slowed the market temporarily but focus remained on the outcome of first quarter 2021 contract negotiations. The global pandemic has continued to impact broader macroeconomic sentiment although progress in the development and approval of vaccines in some countries led to higher oil prices in December. Rising cases of Covid-19 in some countries despite new vaccine roll outs is also adding uncertainty and concern.

Sulphur supply in the Middle East remained tight through much of the final quarter of 2020, leading to a firm footing in spot prices. Average prices in December 2020 were $93/t f.o.b. in the region, up $30/t on average prices at the end of the third quarter. Expectations are for this trend to continue in the short term, with first quarter contracts setting the tone for a firm short term view. Middle East producer pricing for December 2020 reflected the tighter market and more bullish sentiment. In the UAE, ADNOC set its December monthly price at $80/t f.o.b. Ruwais, $6/t up on November, for shipments to the Indian market. KPC/Kuwait set its price at $83/t f.o.b. Shuaiba, up by $10/t on the previous month. State-owned marketer Muntajat set its December Qatar Sulphur Price (QSP) at $86/t f.o.b. Ras Laffan/Mesaieed. This was $14/t above November. Muntajat has also announced its January 2021 price in the three digits at $101/t f.o.b. The spot tender for December shipment attracted several bids from the high-$90s/t to $102/t f.o.b. A softer tone is likely to emerge from February as major buyers in China exit the market for the lunar new year holiday.

On the supply side, Kuwait’s KNPC completed its long-awaited Clean Fuels Project (CFP). Sulphur capacity in Kuwait is set to rise above 2 million t/a as a result. Additional sulphur volumes have yet to be heard offered for export but the coming months are likely to see progress. Qatar’s Barzan project appears to be seeing further delays, with start up pushed to Q2 2021 from an end 2020 estimate. Once online, this would bring 0.8 million t/a sulphur capacity.

Vancouver sulphur prices have also followed the uptick in international markets with the spot price range rising to an average of $89/t f.o.b in December. Further firming may be supported by tighter availability in the US, the Middle East and Russia and Central Asian regions owing to seasonal restrictions and the impact of the global pandemic. US fourth quarter negotiations were expected to get underway at the end of 2020. Production in the US from the refining sector has seen an impact on the back of the shock to global oil demand, leading to lower refinery run rates. USGS data shows for the January-October 2020 period total US sulphur production dropped by 540,000 tonnes compared with the same period in 2019. Export prices out of the US Gulf averaged $83/t f.o.b. in December.

Prices in China rose at a pace through the fourth quarter of 2020, buoyed by spot demand supported by a healthy finished fertilizer market and as port inventories depleted. Spot prices averaged $100/t c.fr in December and firmed to $119/t on the high end of the range in the latter part of the month for granular product. The entrance of Chinese speculative traders also stepped in, showing interest in picking up supply ahead of the spring application season, boosting demand. Port inventories dropped to 2.3 million t in December, the lowest level since November 2019. This has come on the back of firm ex-works prices, encouraging liquidation of stocks. The heat in the price run is expected to wane going into February 2021, with the lunar new year holiday due to commence on 12 February. End users usually step out of the market prior to the holidays, likely adding some stability for the latter part of the month. Softening is not expected owing to the supply side tightness. On the trade front, China imports totalled 7.9 million tonnes in January-November 2020, down by 25% on the previous year. The leading supplier to China in the first eleven months of 2020 was the UAE, at 1.9 million tonnes, representing an 8% increase year on year and 24% of total imports. Significant declines came from Saudi Arabia, Qatar and Canada, with total supply at just 1.6 million tonnes combined, compared with 3.8 million tonnes a year earlier in the same period. The downturn in Chinese imports is a trend expected to continue as domestic production rises from the oil refining sector in the outlook.

Elsewhere in Asia there are mixed reports regarding the domestic supply situation in India. Some refiners were heard ramping up operating rates at the end of 2020 but the prevalence of sweeter, lighter crudes kept sulphur recovery reduced. Major domestic producer Reliance was understood to be in contract negotiations for supply in 2021 with no outcome heard by the start of the new year. Indian spot prices were assessed at $111-118/t c.fr at the end of 2020, up on an average of $82/t c.fr at the end of the third quarter.

First quarter contracts were in the early stages in December for North African buyers. Broad expectations were for prices to be agreed on an increase on the fourth quarter. North African spot prices have firmed in line with the export price uptick, supporting the view for higher contract prices. Spot prices increase by $27/t on average in December to $97/t c.fr North Africa compared with the end of the third quarter. Prices on the high end were assessed at $105/t c.fr at the end of 2020. Another supporting factor is the seasonal tightness from the Russia/Central Asian region over the winter months.

The ruling by the US Department of Commerce to place preliminary duties on US imports of Moroccan and Russian phosphates is not expected to impact OCP’s sulphur requirements. OCP is expected to change its trade flows over time, focusing on exporting finished fertilizers east of Suez and into Latin America while continuing to cover demand in Africa. Morocco is set to remain a sulphur import hotspot with growth forecast for the year ahead. Trade data shows sulphur imports in January – October 2020 sulphur imports to Morocco totalled 6.1 million tonnes, up by 7% on the same period a year earlier.

Over in Tunisia protests in the second half of 2020 have hampered GCT’s processed phosphate operations at the Gabes facility. A question mark hangs over potential sulphur consumption levels in the year ahead. Attention will remain on the outcome of any first quarter negotiations and whether lower volumes will be agreed.

SULPHURIC ACID

Global sulphuric acid prices continued to rise through December amid tight supply for prompt shipments. This trend is expect to remain firm on the back of the supply squeeze with outages compounding the situation. Sentiment at the end of December 2020 was to see firmer prices through the first half of 2021, assuming the supply balance remained tight. Average NW European export prices for sulphuric acid increased by $37/t between April and December 2020 to $27/t f.o.b. This was indicative of the supply/demand balance with support from downstream markets and elemental sulphur also underpinning this trend. Recovery from negative netbacks earlier in 2020 was initially slow and steady but prices accelerated towards in the fourth quarter as liquidity reduced. First quarter contract negotiations for molten sulphur are expected to yield increases on the fourth quarter. Exact levels were still in question at the end of 2020. An uptick in prices would influence sentiment for the domestic sulphuric acid prices.

South Korean and Japanese export prices firmed through December for the third consecutive month on the back of improved international sentiment, with the price range rising to $10-20/t f.o.b. in December. The gap between East and West export prices has been closing – down to $15/t compared with $32/t earlier in the year. Chinese export prices have also strengthened, up at $1520/t by mid-December through to the end of the year. Japanese acid exports were estimated at 3.0 million t in January-November 2020, up by 17% on a year earlier. The Philippines led trade at 1.2 million t, up 9% year on year. Shipments to India also show a significant increase at 0.6 million tonnes. Meanwhile decreases were to Chile and Taiwan.

Exports from China remained strong despite low pricing and Covid-19 related disruption earlier in 2020. In January-November 2020 exports were 1.6 million tonnes, down slightly on 1.9 million tonnes a year earlier. Morocco is the leading market at 0.7 milion tonnes with volumes increasing by 17% on a year earlier. The post Covid-19 recovery for sulphuric acid production in China is expected to be swift, with development at major copper projects driving the market. Total acid production is estimated to have dropped to 93 million tonnes. In project news, Phase I of the Houman North Copper project in Shanxi started up in November. This will add 0.7 million tonnes/year acid when it reaches capacity. The Yantai Guorun copper project is also set to add 0.7 million t/a of acid capacity from 2021. Trade tensions between Australia and China are being closely watched and may impact acid output at smelters. China has imposed import constraints on Australian copper ore, copper concentrates and other products. The copper concentrate market is expected to be tight in the short term, with falling production in key producing regions. Argus expects China to maintain its net exporter status through the short and medium term outlook.

There are two new speculative smelter projects in India with the potential to add 0.6 million t/a of sulphuric acid capacity. Hindustan Zinc (HZL) has announced plans to commission a new zinc smelter in Doswada, Gujarat and a second project to double capacity at its existing Dariba smelter. In the meantime, Vedanta’s Sterlite Tuticorin smelter in Tamil Nadu remains offline. Uncertainty remains on a potential restart given the length of time the smelter has been out of operation and without maintenance. Indian imports remained strong through 2020, partially to cover the shortfall from Vedanta and also reflecting buyers encouraged by low prices in the first half of the year. Spot prices were assessed at $43-50/t c.fr at the end of 2020 and averaged $39/t c.fr for the month of December. This is considerable above levels as low as -$4/t c.fr in April 2020.

Chile demand for sulphuric acid eroded in 2020 and Argus estimates a 9% fall in the copper sector down to around 8 million tonnes with copper output faltering on the back of Covid-19 related issues. The earlier collapse of finished copper demand as countries across the globe entered lockdowns forced production cuts at mines, furthering the mining activity decline. As producers continue to normalize operating rates, Argus expects demand to recover through 2021. The rise in copper prices and strong demand will likely support market sentiment. Spot prices at the end of December 2020 ranged $73-80/t c.fr, the highest levels on average seen through the year. Chile annual contract settlements for 2021 were heard in a wide range from $55-65/t c.fr depending on size and delivery terms. A greater proportion of volumes were settled at a midpoint closer to $58-59/t c.fr and the annual price has been assessed at $56-62/t c.fr, a decrease of $12/t on the 2020 annual price. It is the smallest year-on-year change in more than five years.

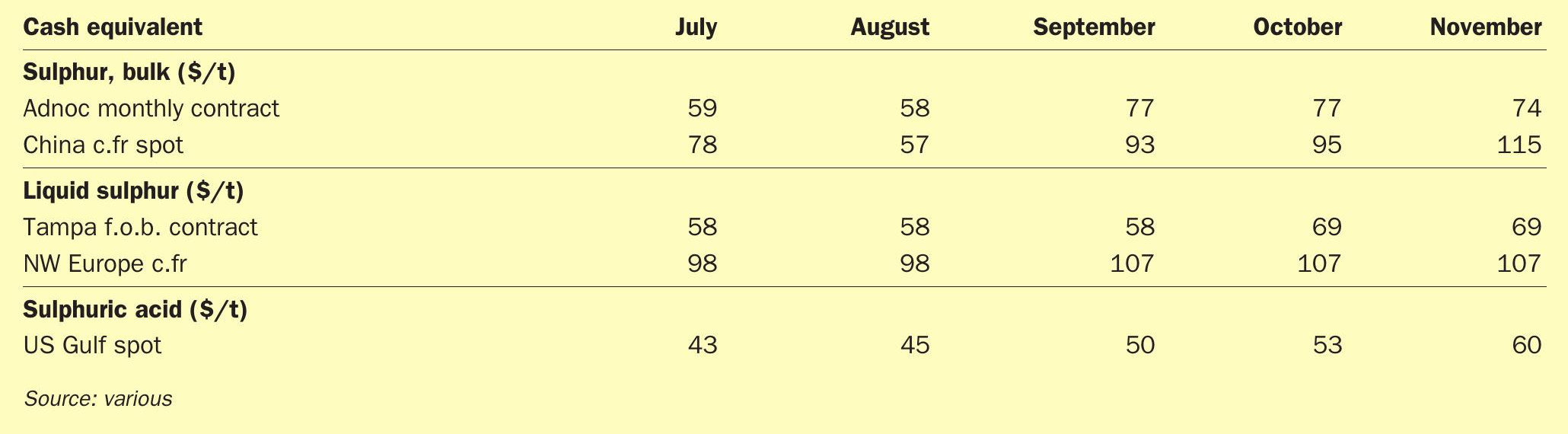

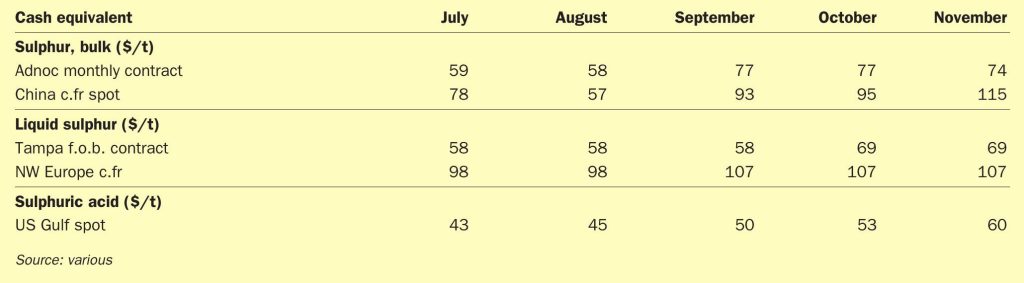

PRICE INDICATIONS