Sulphur 393 Mar-Apr 2021

31 March 2021

Price Trends

MARKET INSIGHT

Meena Chauhan, Head of Sulphur and Sulphuric Acid Research, Argus Media, assesses price trends and the market outlook for sulphur.

SULPHUR

Global sulphur prices have continued to escalate through the first quarter, accelerating at a rapid pace through to March. Delivered prices breached the $200/t c.fr mark in India at the time of writing while Middle East prices were set at over $50/t higher for March on the February level. The bullish tone towards the $200/t c.fr level left some buyers hesitant and retreating to the sidelines, but with expectations for firm demand and continued tight supply, prices are likely to rise higher before reaching a ceiling. Commodity markets are supporting demand from metals leaching projects with copper and nickel prices seeing a strong boost on the back of demand from key regions including China.

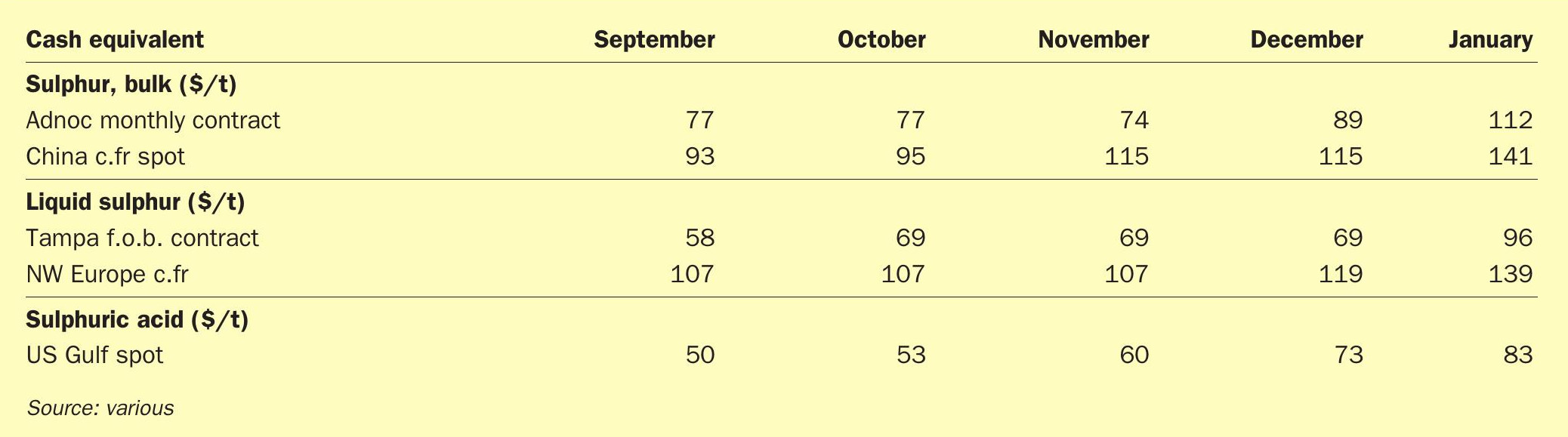

The lack of liquidity is expected to further propel prices in the near term and Middle East prices are edging closer to the $200/t f.o.b. mark. Middle East producer pricing for March 2021 was set at $183/t f.o.b. across the board. In the UAE, this reflected an increase of $55/t on February for ADNOC liftings to the Indian market. KPC/Kuwait raised the price by $58/t f.o.b. while the Qatar Sulphur Price was raised by $58/t.

The Chinese Lunar New Year period failed to bring a break to sulphur purchasing or the price run. The holiday period typically sees Chinese buyers step back from the market for several weeks, but a combination of factors limited the usual seasonal industry slowdown. Travel restrictions remained in place across many regions in China, understood to have led to some industries incentivising employees to continue working through February. High phosphate prices also contributed to the fertilizer sector maintaining higher than expected output levels. DAP operating rates sat at around 65-70% in February in Yunnan, 70% in Guizhou and 65-70% in Hubei. Demand for cargoes remained elevated, driving prices higher than expected.

Rising freight rates have also added to the price rally since the start of the year, widening the spread between Middle East f.o.b. rates and China c.fr through January and February. Average China spot prices in February were $141/t cfr and $183/t c.fr on the high end, representing an monthon-month increase of $28/t and $43/t respectively. Prices at the start of March edged up further, at around $200/t c.fr for granular product, with further increases anticipated, on the assumption freight rates remain firm.

With the short term market balance so tight, a big question mark is around when and if new supply will emerge to ease availability issues. The two key projects in the short term that are awaited are the Clean Fuels Project (CFP) in Kuwait and Barzan in Qatar. Combined, these would add around 3.0 million t/a sulphur capacity to the market. The CFP has progressed with units being commissioned at the end of 2020. Sources have suggested all remaining units at Mina Abdullah should be commissioned by the end of the first quarter. In terms of sulphur volumes, Argus expects to see a gradual start up, owing to the disruption from Covid-19. Barzan meanwhile is still pegged for startup during 2021, but volumes are also likely to be added gradually.

Average Indian market prices have been assessed ahead of China during this price rally and the first market to hit $200/t c.fr in February. Domestic refiners in India have been operating at reduced rates, limited domestic sulphur availability, keeping import demand firm. At the start of March PPL purchased a cargo for March arrival to Paradip priced at $230/t c.fr with credit. The buyer has a scheduled turnaround planned for April lasting a month at its Paradip NPK/DAP plant. Meanwhile CIL bought a 40,000 tonne sulphur cargo priced at $230-$232/t c.fr for a two port discharge for March arrival. On the supply front, increased output is expected in the country. Hindustan Petroleum plans to add a new refinery at Barmer in Rajasthan by 2023 adding over 60kt/y sulphur capacity.

The restart of nickel operations at First Quantum’s Ravensthorpe mine in Western Australia at the start of 2020 has boosted sulphur trade. Australian imports rose by 82% in 2020 on 2019 levels to just over 1 million tonnes, supported by increased demand from the ramp up of the project. Canadian sulphur made up 68% of deliveries and Qatar delivered 335,000 tonnes after an absence on this trade route in 2019. In 2020, First Quantum produced 13,000 t of nickel but expects the mine to produce 23-27,000 t in 2021 as operations complete ramping up. Favourable nickel prices continue to support leaching operations. LME nickel prices reached levels not seen since 2014 trading at $19,722/t in February before retreating back down to below $18,000/t. The medium term outlook for nickel based demand remains robust owing to the spate of leaching projects expected to come online in Indonesia, with several speculative projects in Australia. The projects are expected to include sulphur burners increasing sulphur import demand further.

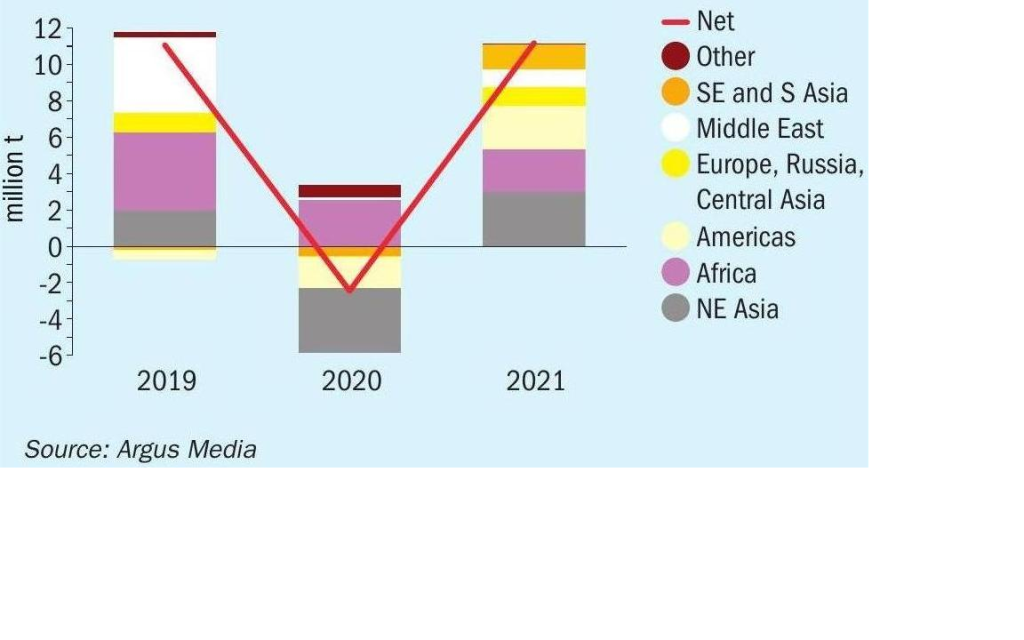

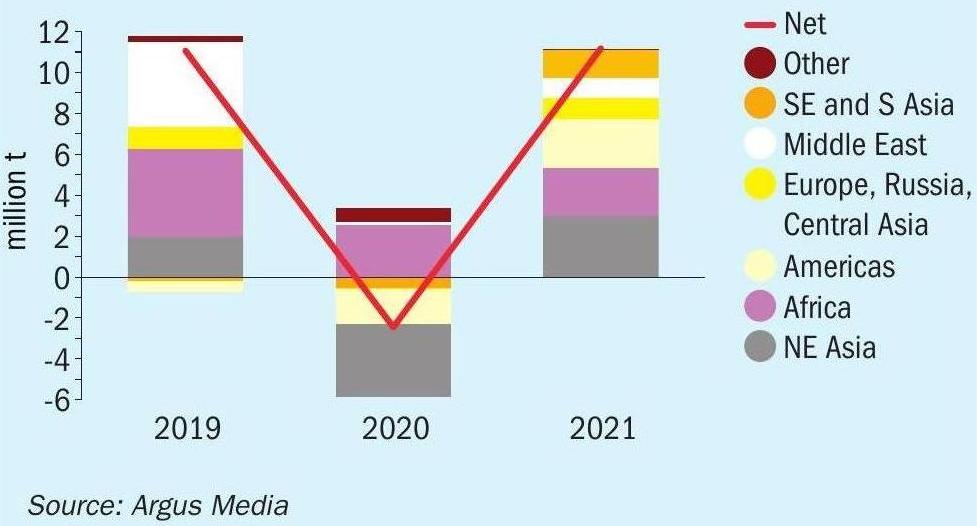

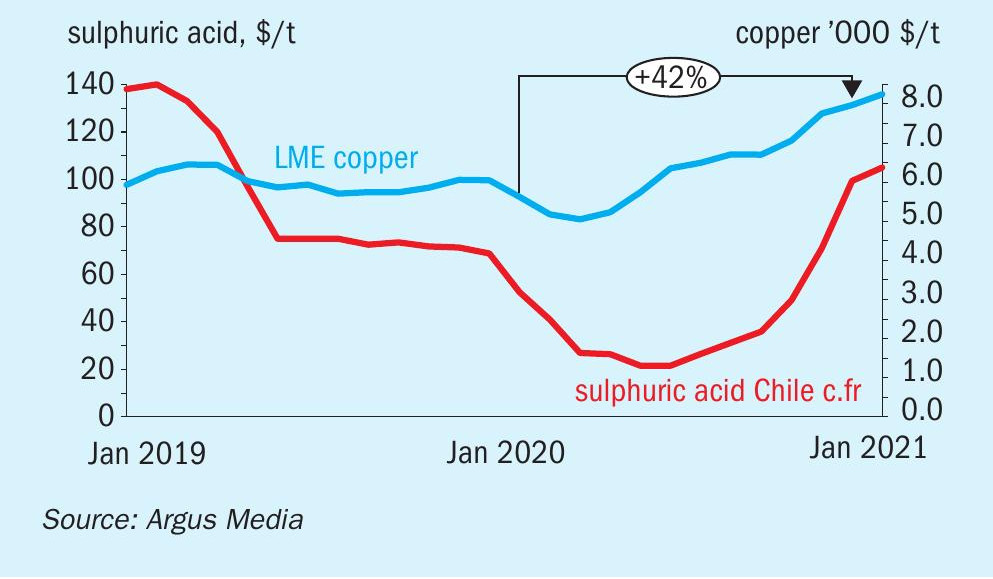

SULPHURIC ACID

Global sulphuric acid prices have seen sharp increases, supported by strong market fundamentals. Continued tight supply, buoyant sulphur prices and strong copper prices have contributed to the run up in achievable prices. The bullish market sentiment is expected to continue in the short term, with no sign of a ceiling being reached. Further price rises were anticipated through March across the major benchmarks. Global demand is forecast to recover with rising commodity market prices and vaccine rollouts in some regions supporting acid consuming sectors. Following the net decline in growth in 2020 on the back of Covid-19 related disruption, Argus is forecasting a strong recovery of over 11.0 million t/a in 2021. On the supply side, smelter acid production was disrupted in 2020 by the Covid19 fallout. A recovery is forecast in the short term as operating rates improve with 0.9mn t of acid supply growth currently anticipated. At the same time, turnarounds for 2021 are expected to lead to a loss of over 1.0 million tonnes acid. Increases on this are expected as further schedules emerge in the coming months. Delays to maintenances in 2020 came as a result of Covid-19 disrupting operations with lower than usual outages over the year.

Northwest European fob spot prices rose to $50-60/t f.o.b. in mid-February from $27-35/t f.o.b. a month earlier. Producers in the region have had little to no spot available in recent weeks but were receiving regular enquiries as consumer operating rates were strong. Sulphur burner acid availability is expected to remain tight in the short term with three sulphur burners expected to come offline in the coming months, tightening supply further. European smelter acid contracts for the first half of 2021 were assessed at e61-72/t c.fr. The top end of the range is up by e7/t on the previous contract price.

Negative prices ex-Northeast Asia were a market talking point in 2020 but in recent months prices have risen sharply. Tight availability and healthy spot interest has lifted major Asian prices. Japan/South Korean acid prices were assessed the same level as in Europe at $50-60/t f.o.b at the end of February. Meanwhile China spot prices were assessed at $70-80/t f.o.b., with the average price up by $60/t on the end of 2020. Domestic demand in China has been strong, with limited supply reported at sulphur burners.

Global demand for sulphuric acid for phosphoric acid production is expected to see growth in 2021 following the disruption in 2020. The pandemic slowed down economic activity and resulted in a downside to phosphate application during key planting schedules. For 2021, Argus expects demand from the phosphoric acid sector to see increases across almost every region, adding 4.5 million t/a of sulphuric acid consumption. Agricultural sectors showed the most resilience in comparison to other commodity markets in 2020. Most crop prices dropped in March/April but quickly recovered. The limited disruption stemmed from most governments declaring the food and agricultural sectors as essential. Agricultural trade has also been less affected than other goods as bulk shipping saw less disruption than other modes of transport.

On 24 November 2020, the US Department of Commerce issued a preliminary ruling on import duties for Russian and Moroccan phosphate shipments to the US. This followed US producer Mosaic’s petition to introduce the duties. The duties have since been changed. For OCP duties increased slightly to 19.97% while tariffs on Russian product fell to 9.19% for Phosagro and 47.05% for Eurochem. The duties had deterred shipments to the US and led US phosphate prices to rise sharply relative to other global benchmarks with spreads reaching 5+ year highs. Domestic DAP/MAP production levels in the US were expected to shift in response and increased domestic phosphates production would have seen US sulphuric acid consumption rise. The US International Trade Commission’s final ruling is scheduled for 25 March when the commission will decide whether to levy the revised duties.

On the copper front, Freeport McMo-Ran’s Lone Star copper leach project in Arizona will continue to ramp up production through 2021 following a 2020 start up. The site will produce 91,000 t/a of copper at capacity. Based close to Freeport’s Safford operations, the new copper mine and SX-EW plant will benefit from existing infrastructure, including the Safford sulphur burner. A plan is also in place to advance studies for a potential expansion and long term development options.

PRICE INDICATIONS