Sulphur 394 May-Jun 2021

31 May 2021

Market Outlook

SULPHUR

- Major projects to consider in the short term outlook are Barzan in Qatar and the Clean Fuels Project in Kuwait. Combined these would add over 3 million t/a of sulphur capacity.

- China’s import requirement for 2021 and in the outlook remain a major market focus following the drop in 2020 down to 8.5 million tonnes compared with 11.7 million tonnes in 2019. The rise of domestic sulphur production from oil refining remains a risk for imports, with a 10% in domestic production forecast this year. This is likely to put a ceiling on any potential recovery on import demand.

- Demand for sulphur from nickel leaching operations is expected to rise in the outlook as the demand for battery materials for the electric vehicle sector continues to rise. Projects in Indonesia are expected to ramp up demand in the coming months and this will lead to an increase in sulphur trade to the country.

- The Ambatovy nickel site in Madagascar started up at the end of March following a year in care and maintenance, raising sulphur consumption and imports in the year ahead.

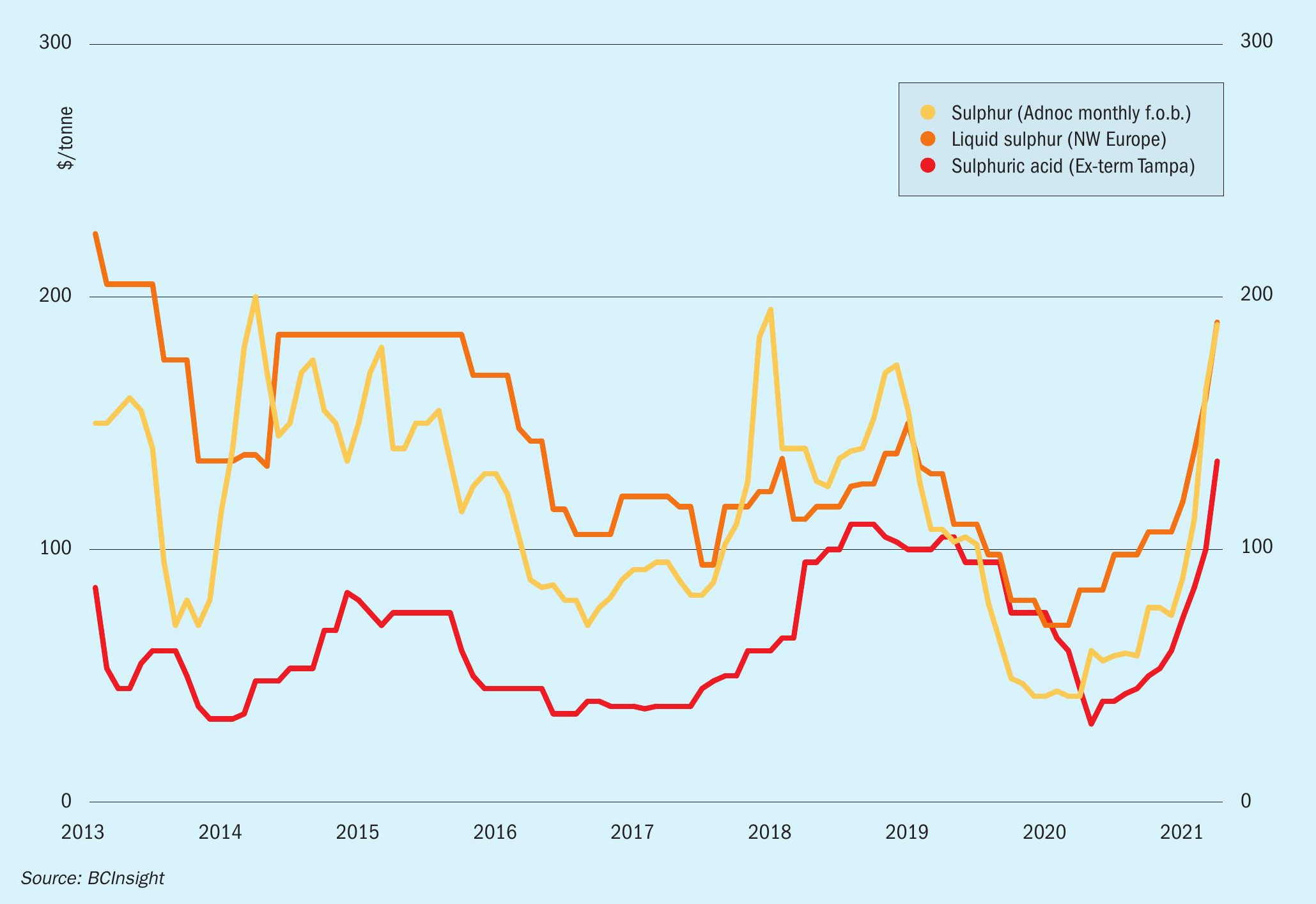

- Outlook: Sulphur prices are expected to soften slightly as price volatility eases as second quarter contract settlements are concluded. The reintroduction of regional supply where refining operating rates improve will provide support for a price correction. This is expected to be gradual rather than a steep decline, owing to pockets of tightness, uncertainty around Covid-19 and healthy demand from the processed phosphates sector and metals and industrial markets.

SULPHURIC ACID

- The tightness in the NW European market is a major market bull with the question mark over how the UK market will manage supply in the aftermath of the Runcorn plant closure.

- Positive signs from the copper sector support the outlook for acid consumption in the Americas. Projects in Arizona, US are progressing and are increasing acid requirements in the domestic market. There is scope for further demand with a range of lithium projects in the country also advancing. While these are currently assessed as speculative there appears to be significant support to come from the US administration with increased focus on reducing emissions and policies around electric vehicles.

- Outlook: Acid prices are at a premium to elemental sulphur prices with the decoupling of the two price ranges continuing so far in 2021. There appears to be little downside potential for acid prices in the short term with smelters holding low inventories in many regions, constrained copper concentrates supply in China and healthy demand from most sectors. Smelter based production is expected to improve this year following disruption in 2020 from the global pandemic but delayed turnarounds either into this year or the next paint a picture of tight supply in the coming months. There appears to be little reprieve expected but the downward pressure from key markets such as processed phosphates may provide a ceiling to any further price gains.