Sulphur 394 May-Jun 2021

31 May 2021

Price Trends

MARKET INSIGHT

Meena Chauhan, Head of Sulphur and Sulphuric Acid Research, Argus Media, assesses price trends and the market outlook for sulphur.

SULPHUR

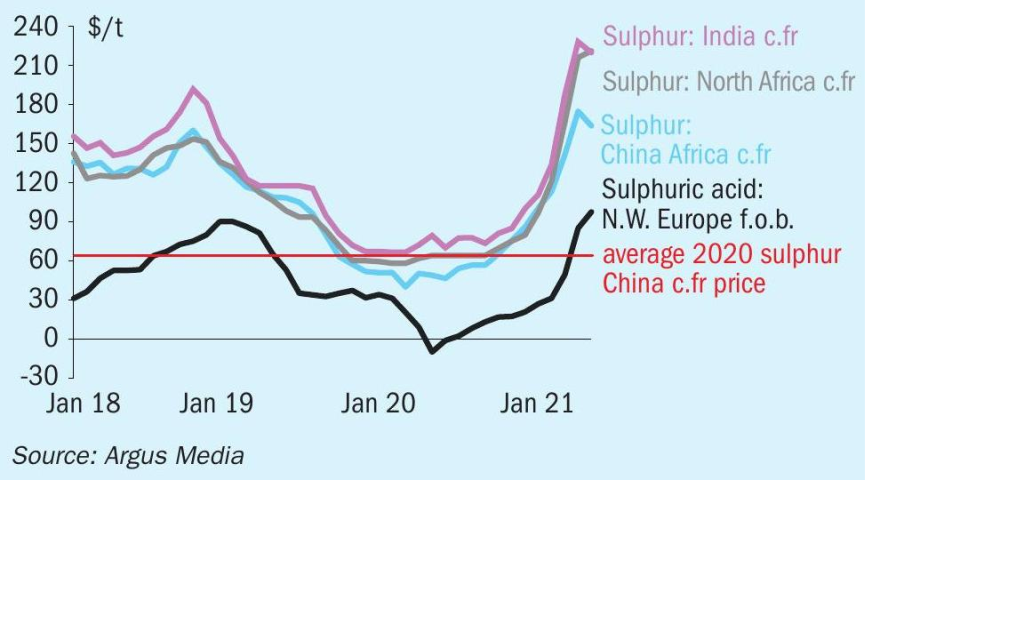

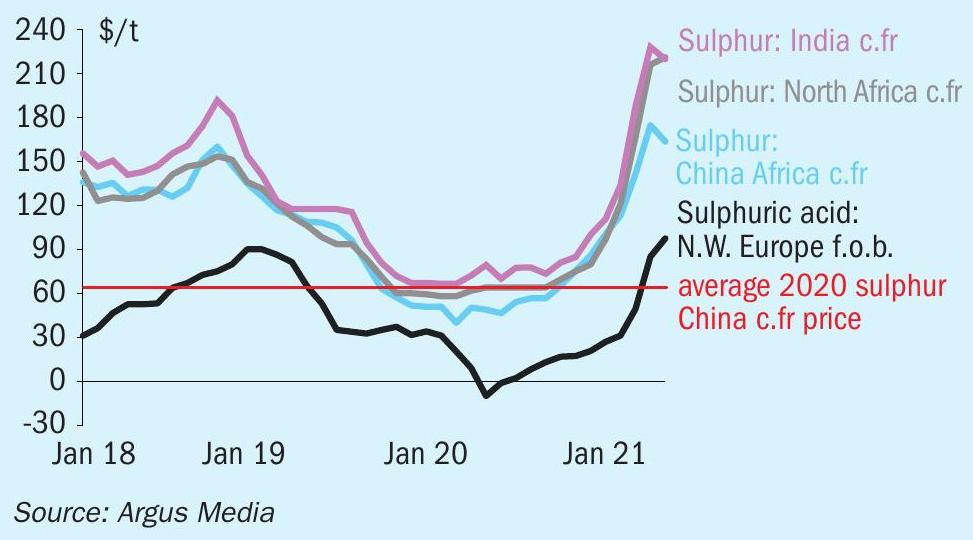

The global sulphur market was focused on second quarter contract negotiations in April, with the final stages progressing by the middle of the month. As expected, confirmed agreements firmed by almost three figures on last quarter as settlements reflect the first-quarter rally in spot prices. But the recent plateauing and slight softening in global spot prices throughout March has raised tensions between the buy and sell sides, as parties struggle to reach agreement on where prices should settle.

The Tampa molten contract was agreed in early April and set the precedent for second quarter contracts, settling at $192/lt c.fr – a rise of $96/lt on the previous quarter. Spot availability out of the US Gulf has been tight in recent months but there were hints of improvement as refinery run rates have been improving. Spot pricing was assessed by Argus at $193-199/t f.o.b. in mid-April although few sales have tested the price recently. The vaccine rollout in the US has been largely successful and traveller numbers were more than 10 times higher than in the first lockdowns a year earlier in April. Rising fuel demand is positive for refining margins and expectations are to see the some easing in market tightness for sulphur as a result through the second quarter onwards.

On the demand side in the US, processed phosphates sector-based consumption remains healthy following duties imposed on Moroccan and Russian imports. Nola DAP prices softened to just under $540/t f.o.b. in mid-April from a high of $562/t f.o.b. at the start of April.

The supply situation in Western Europe remains one of the tightest globally. The pandemic has held refinery run rates at minimal levels and further closures have removed further sulphur supply. Preliminary deals for second quarter molten contracts for Benelux were penned at $190/t c.fr, and others heard potentially settling above $200/t c.fr. The supply situation has become so stretched that one European buyer took delivery of a molten cargo from the Middle East – the first time this is understood to have occurred. Molten product from Tampa, US is also making its way to European customers.

Brazil is expected to take most product for the second quarter from the FSU, and some product had already been secured at $213-214/t c.fr. Middle East suppliers were looking to settle in the mid-$180s/t f.o.b., above the price range targeted by Brazilian buyers when freight is considered.

Contracts for north African delivery were expected to settle in the range of $187-225/t c.fr, with Moroccan processed phosphates producer OCP securing larger cargoes at the low end and Tunisian offtakers settling at the high end.

As contracts finalise, volatility has decreased in the spot market and prices continue to soften slightly across most regions. Demand from China has now softened as the domestic phosphates season is almost at an end. This has left India as the main c.fr market supporting f.o.b. prices in the Middle East. Easing freight rates and the arrival of cheaper Turkmen product from the Black Sea have also helped soften major c.fr benchmarks, but the sustainability of these cargoes has come into question as barge availability remains scarce, slowing transit times.

As spot liquidity wanes, India has been supporting Middle Eastern prices. The Indian processed phosphates market is preparing for the upcoming kharif season and is securing DAP for application. The fundamentals are supportive of strong sulphur demand – high phosphoric acid and sulphuric acid import prices remain unworkable for most phosphate producers, and DAP imports remain priced above India’s DAP maximum retail price, meaning importers will suffer losses on every cargo of DAP purchased.

To add to the expected high sulphur demand, DAP inventories are low, meaning high domestic production rates are expected in order to replenish levels over the second quarter. This means that even if demand from China remains subdued, global prices are expected to remain well into three figures next quarter as demand holds strong and supply remains tight.

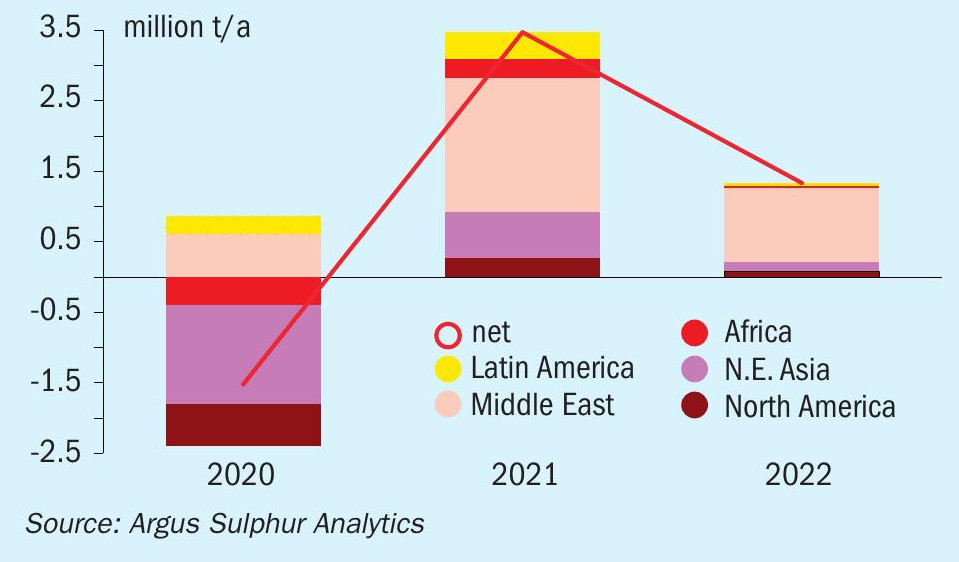

There is little change on the supply side, but there are signs of the tightness potentially easing through the second quarter and going into the latter part of the year. After following a very cautious approach in the first quarter of 2021, OPEC+ agreed to increase crude quotas to full levels in line with the agreement reached in July 2020. Saudi Arabia will also ease its voluntary 1 million bbl/d cut. Meanwhile in the US, refiners continue to steadily increase utilisation rates as travel restrictions are lifted.

But the story is not the same in Europe and the Mediterranean, where countries continue to impose lockdowns and refineries struggle to maintain positive operating margins. A split is now evolving between countries successfully rolling out the vaccines and those which are making slow progress. Hopes of a global recovery in international travel this year increasingly seem optimistic, and ‘normal’ run rates are unlikely to return in most regions by the end of the year, supportive of ongoing tight supply.

SULPHURIC ACID

Tightness in the global sulphuric acid market has supported prices across most major benchmarks over the past month. NW European export prices reached triple digits on the high end at the start of April, ranging $90-100/t f.o.b. through to mid-April. This compares with a range of $3035/t f.o.b. at the start of 2021.

Ineos announced the proposed closure of its sulphur chemicals plant in March at Runcorn and its withdrawal from the UK sulphur chemicals market. According to the company, this decision followed a detailed management review of the business. Back in October 2020 a power supply outage at the site led to the plant being taken offline. The subsequent restart showed a number of components were damaged and the plant was taken back offline. Estimates to safely repair and restart were pegged at a further 18-24 months, leading the company to effect a permanent closure of the plant. This is a blow for the UK sulphuric acid market which has already faced a period of tightness in recent months. Market participants were looking to make new trade connections and we expect to see acid imports to the UK remain healthy as a result. The closure also points to heightened prices for the local sulphuric acid market and adds pressure to an already tight NW European market.

The rollout of the Covid-19 vaccine across Europe is being closely watched, with some countries seeing a faster programme than others. Sulphuric acid demand has been improving in the region despite second waves of the virus and localised lockdowns emerging through the first quarter. Looking ahead, Argus expects to see the tight balance to remain with little downside to pricing in the coming months. Some downward pressure is likely to lead to a price correction or stabilise the upturn as associated markets are starting to see softening. Sulphur and processed phosphates appear to have reached a peak and this may provide a ceiling to the acid market price run.

On the trade front, acid imports to Morocco dropped 16% in January monthon-month and 92% year on year. This was in part because of the tight supply situation in the global spot market. There have been difficulties sourcing supply from traditional trade routes and prices have spiked since the start of the year.

The latest Chinese trade data highlights the different sulphuric acid export routes as the tight supply situation has taken hold. Around 25,000t of Chinese supply went to countries outside regular trade patterns in February 2021. China regularly exports sulphuric acid from either the Jinchuan smelter or sulphur-based acid from Two Lions in Zhangjiagang. Regular contracts are held with Morocco, Chile, India, Australia, Indonesia, Namibia, the Philippines, Malaysia and Vietnam. South Korea, Japan, Taiwan and the Philippines import acid into the country. But in the first two months of the year, as the supply situation has grown increasingly tight, Chinese smelters have been approached by a diverse range of markets. A shipment to Saudi Arabia and small volumes to Singapore reflected the market sentiment. Ma’aden, Saudi Arabia was also reported to be seeking two acid cargoes in the market for July and August delivery.

Export prices for spot out of China were assessed by Argus at $85-95/t f.o.b. in mid-April. This compares with levels around $20/t f.o.b. at the start of 2020. Meanwhile Japan/South Korea export prices have ranged from $70-77/t f.o.b. in April.

Prices for nickel, copper and zinc have plateaued since undergoing a steep recovery over the past year, as macroeconomic momentum and the global demand recovery slow down. Prices have been broadly flat since the beginning of March – albeit with some volatility within narrow ranges – with the LME three month contracts standing at $16,257/t for nickel, $9,002.50/t for copper and $2,811.50/t for zinc in mid-April. Some market participants see potential for prices to rise further in the long term, with longer positions being taken by speculative traders and corporate funds on the LME and several macroeconomic indicators such as purchasing managers’ indexes picking up in March. But others are wary that the global macroeconomic recovery is reaching its limits for the time being and indicate that any significant near-term rise in base metals prices would probably depend on the 2021 demand outlook increasing. The firmer footing in base metals has been a driver supporting the sulphuric acid market at mining operations, keeping demand healthy.

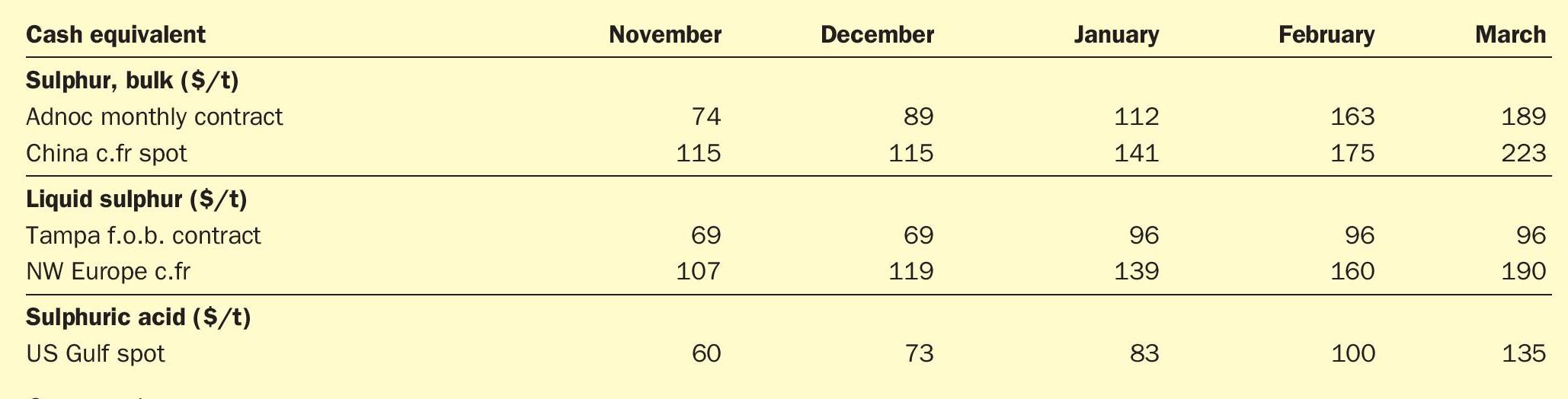

PRICE INDICATIONS