Sulphur 394 May-Jun 2021

31 May 2021

Sulphur in India

Although 2020 saw a contraction in GDP by 10% due to the impact of the coronavirus pandemic, the country had been one of the fastest growing of the world’s top 10 economies, with growth of 8.3% in 2016, although this had slowed to 4.1% in 2019. Its population is growing, and it is due to become the most populous country in the world by 2027 according to UN figures, with total population reaching 1.64 billion by 2050. The country thus continues to require more food, leading to rising sulphur/sulphuric acid consumption for the phosphate industry on the one hand, although increasing vehicle use and growth in domestic refining is also leading to some additional sulphur production.

Refining

India is a major importer of crude oil. India’s oil demand is expected to rise to 8.7 million barrels per day in 2040 from about 5 million bbl/d in 2019, according to the International Energy Agency (IEA), while its refining capacity will reach 6.4 million bbl/d by 2030 and 7.7 million bbl/d by 2040, from its present 5 million bbl/d. The government has authorised several brownfield projects which are expected to add 1 million bbl/d of additional capacity at existing refineries by 2025, and there are also two major new greenfield refineries under development to add a further 1.2 million bbl/d of capacity.

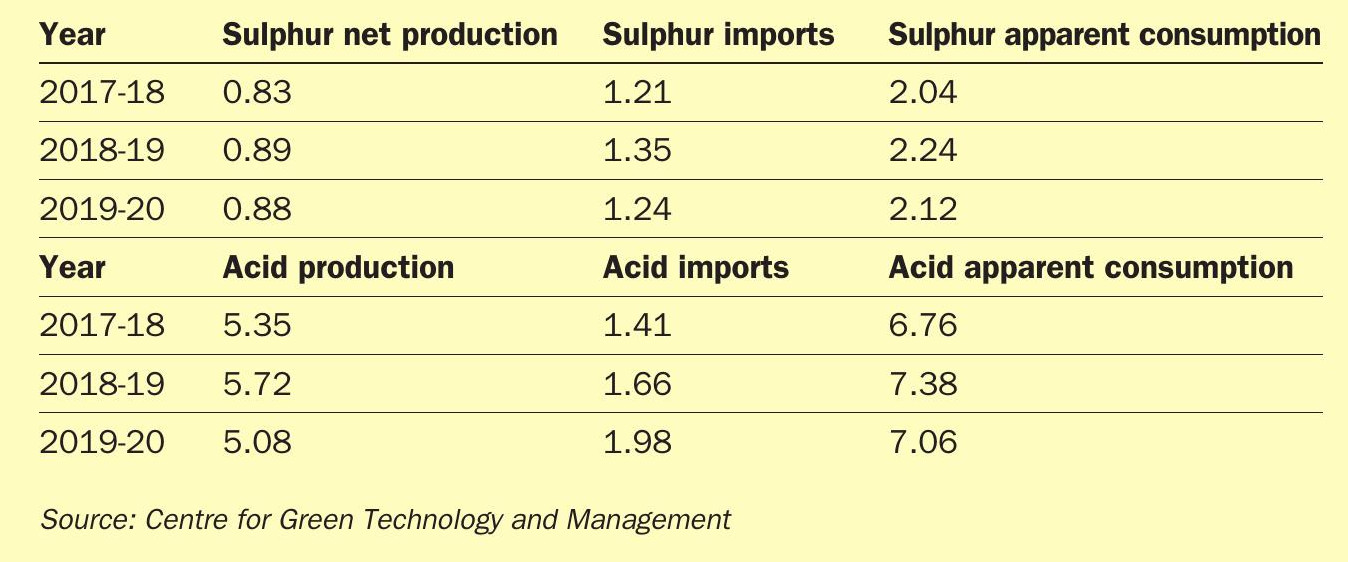

At the same time, Indian fuel standards continue to tighten, moving to a national Bharat/Euro-VI standard of 10 ppm maximum sulphur content in April 2020 (some cities, such as heavily polluted Delhi, have already moved to a Euro-VI standard). This is likely to lead to a slow increase in sulphur production over the next two decades. Overall sulphur production stands at just over 1.5 million t/a, but this is slightly complicated by the fact that refineries on the east coast tend to export sulphur to Asia, whereas west coast phosphate producers tend to import sulphur from the Middle East. This means that India is both an exporter and importer of elemental sulphur. The figures in Table 1 show net sulphur production and imports to produce an apparent consumption figure. Demand for sulphur fell 40% to 0.7 million t/a in 2020 due to the impact of the pandemic, which led to a lockdown which closed a number of phosphate fertilizer plants. However, since September demand has begun to pick up again.

Sulphuric acid

India has 71 sulphuric acid plants, although many of them are extremely small and associated with small scale chemical production. India’s sulphuric acid production is split between sulphur burning acid plants which run on the domestically generated and imported sulphur, and several metallurgical acid plants associated with base metal smelting; copper, zinc and lead. On the metallurgical acid side, Hindustan Zinc Ltd (HZL) is the largest producer, with production from its lead smelter at Chanderiya, and zinc smelters at Debari and Dariba. Hindustan Copper operates two more acid plants at Khetri and Ghatsila, and Hindalco has three sulphuric acid plants at its Dahej copper smelter at Birla. The Sterlite copper smelter at Tuticorin used to add another large scale acid plant to this, but has been closed down since March 2018 because of alleged environmental breaches.

On the sulphur-burning acid side, most of the plants are associated with downstream phosphate fertilizer production. The Indian Farmers Fertilizer Cooperative (IFFCO) at Paradeep in Orissa is the largest. Other major producers include Paradeep Phosphates Ltd (PPL), Gujarat State Fertilizers & Chemicals Ltd (GSFC), Fertilizers and Chemicals Travancore (FACT) and Coromandel Fertilizers. There is also acid capacity at Mangalore Chemicals and Fertilizers (MCFL) and Khaitan Chemicals and Fertilizers. Outside of fertilizer production, there are some smaller sulphuric acid plants associated with the chemical industry.

Most Indian acid producers import sulphur from the Arabian Gulf region. The major exporters of sulphur into India are Abu Dhabi, Qatar, Oman, Japan, Singapore, Saudi Arabia, Kuwait and Bahrain. Some also import sulphuric acid directly; major acid importers include Coromandel, IFFCO, Greenstar, PPL, FACT and MCFL.

Demand for sulphuric acid in India is projected to increase significantly due to greater production and consumption of phosphate fertilizers in the country, but also increased manufacture of other speciality chemicals such as hydrofluoric acid, titanium dioxide and other pigments and dyes, rayon, as well as lead-acid battery manufacture, use in the pulp and paper industry for chlorine dioxide generation, and several other chemical processes and wastewater treatment and pH control. India’s growing population and requirements for food crops, and base metals for infrastructure investment are expected to increase consumption. Average annual growth to 2025 is projected to average 3.35% year on year.

Fertilizers

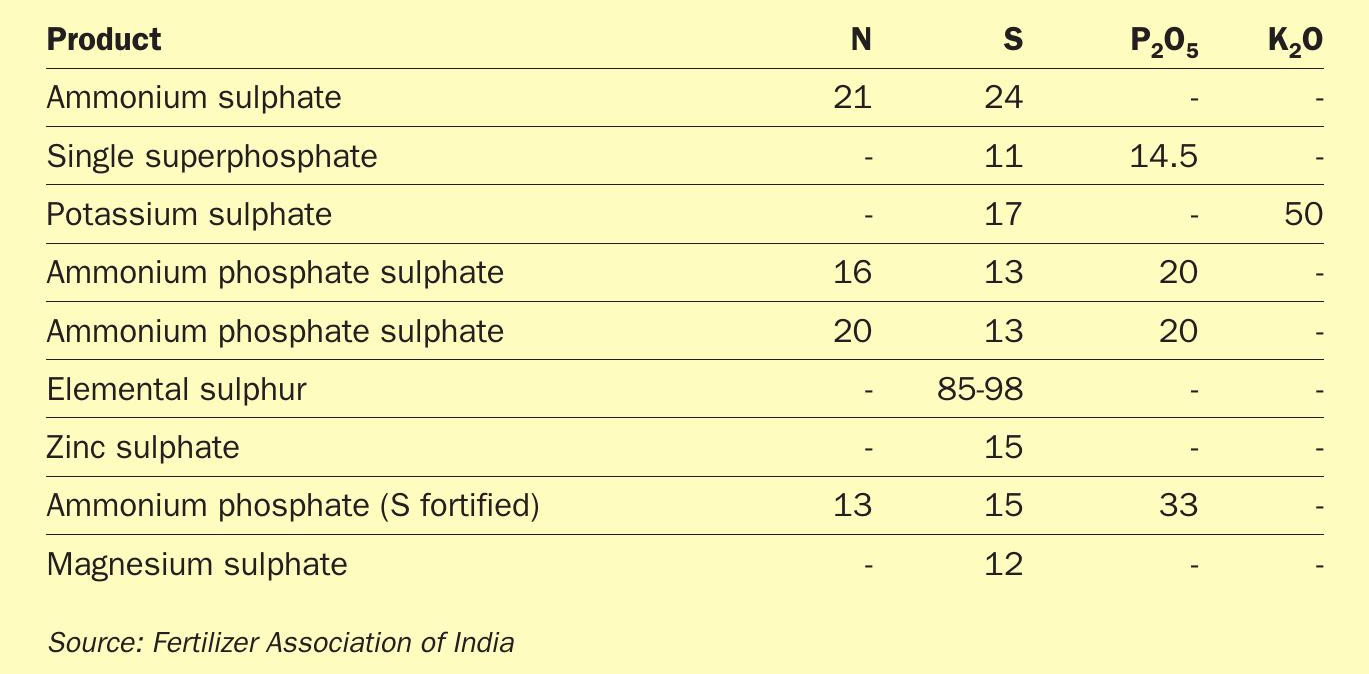

India’s sulphur consumption is dominated by its use of fertilizers, especially phosphate fertilizers. Table 2 shows the sulphur-containing fertilizers commonly used in India, and most of those are phosphate-based. India is the world’s second largest consumer of fertilizers after China; in the 2019-20 application season it used 29.0 million tonnes of nutrient (nitrogen, phosphorus and potassium combined). At the same time, while it is the world’s third largest producer of fertilizers, mainly urea and phosphates, it only made 18.5 million tonnes of nutrient (NPK basis) in 2019-20, and had to import 9.9 million tonnes to make up the shortfall, making it the world’s largest importer of fertilizer on a nutrient basis. Consumption has been steadily increasing. Overall domestic production of fertilizers rose 11% in 201920 compared to the previous year. The increase was especially marked for DAP, production of which rose 16.7%.

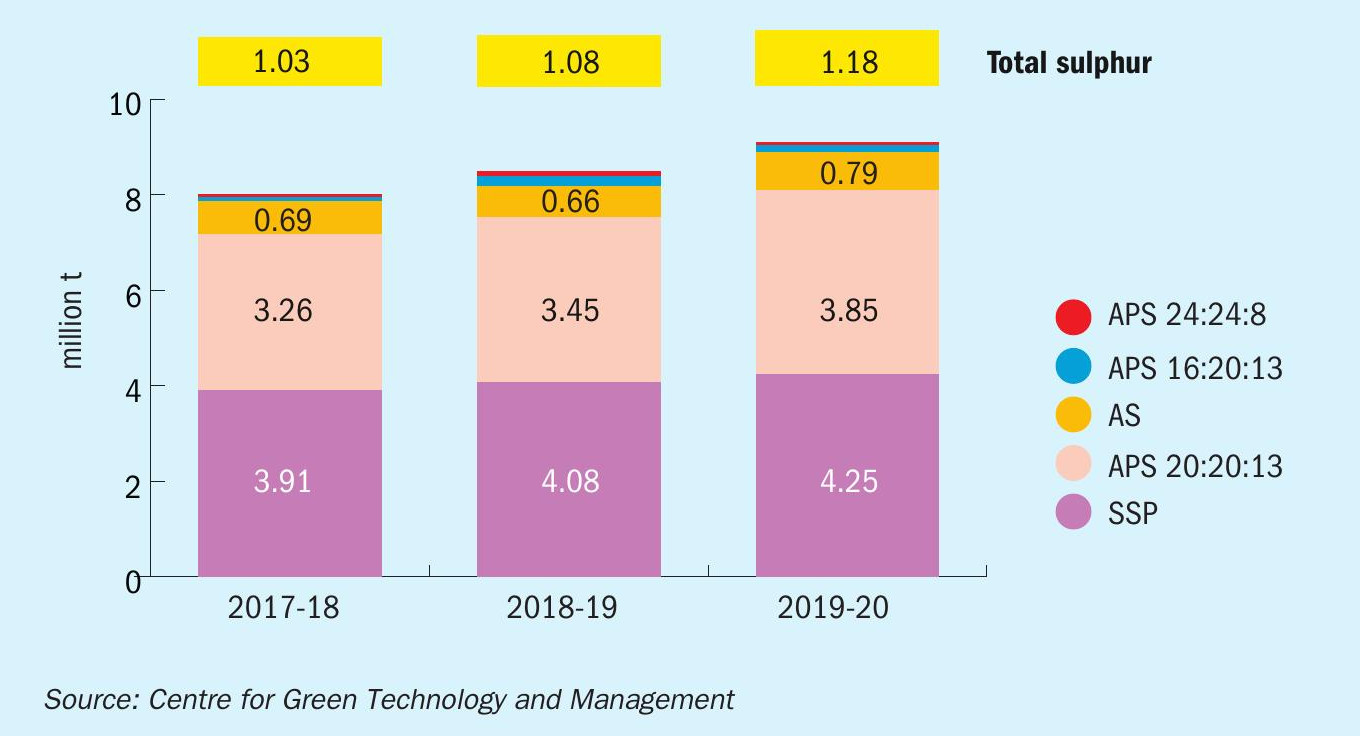

DAP and NP/NPK are the preferred sources of phosphate for Indian farmers. Combined demand for these two product types (19.7 million t/a in 2019/20) equates to around one third of total fertilizer consumption. Currently, India’s domestic industry operates 19 diammonium phosphate (DAP) and NP/NPK plants as well as two plants that produce ammonium sulphate (AS) as an industrial by-product. However, almost 50% of DAP and 7-8% of NP/NPK requirements needed to be imported in 2019/20. India also produces large volumes of single superphosphate (SSP) (4.2 million tonnes in 2019/20) for domestic consumption.

Figure 1 shows domestic production of sulphur-containing fertilizers in India over the past three years. As can be seen, while the total volume of sulphur used/incorporated is relatively low, at just over 1 million t/a, this figure continues to rise as India moves towards more balanced application of nutrients, and is likely to continue to do so in future. Prime Minister Modi’s government has sought to boost India’s self reliance in terms of industrial production. On the urea front that has led to the development of several new plants which could eliminate India’s imports of urea – previously the largest import volume in the world – in just a few years. There have been similar moves on the phosphate side, where India also remains a large net importer. New capacity under construction or development includes 400,000 t/a of DAP and other nitrophosphate fertilizers at PPL Paradip, 850,000 t/a of DAP and NP/NPK fertilizers for Green Star Fertilizers at Tuticorin, and 400,000 t/a of DAP at PPL, Odisha. There is also 130,000 t/a of ammonium sulphate capacity due for completion in 2022 at GSFC Vadodara. All of this is likely to boost Indian demand for sulphur and sulphuric acid over the next few years.

Acknowledgements

Sulphur would like to acknowledge the assistance of Dr Sukumaran Nair of Cybene Consultants Ltd and the Centre for Green Technology and Management, Cochin, India, for his kind help in the preparation of this article.