Sulphur 395 Jul-Aug 2021

31 July 2021

Market Outlook

SULPHUR

- Significant capacity additions in the Middle East are still awaited. The more positive outlook for fuel demand is providing support to seeing these projects ramp up in the coming months. New supply is expected from Saudi Arabia following the commissioning of a gas project in 2020, sulphur availability is likely to improve from the country through the second half of 2021 and into 2022 as a result.

- News is awaited on the potential for a Chinese export tax with fears over potential measures providing a bullish sentiment to the DAP market.

- China’s January-May sulphur imports rose by 10% from a year earlier to 3.61 million t. The outlook for China imports for the year and in the forecast will be a key factor in determining global trade patterns. Total imports for this year are forecast at 9 million t and a similar level for 2022, but it is the lowest level of imports since 2008.

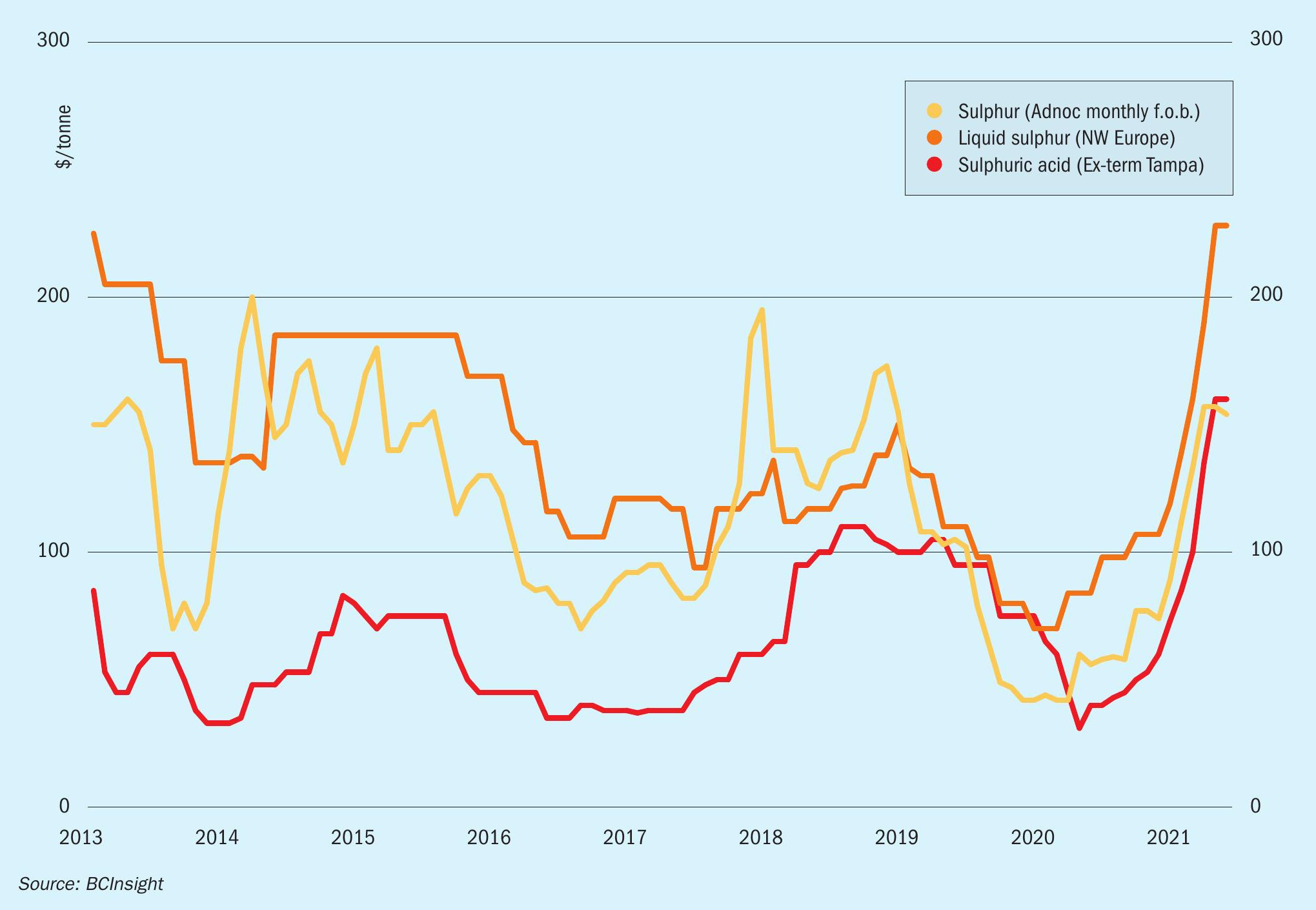

- Outlook: The prospect of supply tightness easing out of the Middle East is expected to provide some softening to export prices but firm freight rates and demand will continue to prop up delivered benchmarks. The downside will be limited by potential DAP price gains and demand, with strong demand from downstream sectors keeping consumption of sulphur healthy. Increased trade for nickel projects is a market bull, following the restart of Ambatovy in Madagascar and the start-up of metals projects in Indonesia, supporting the view that the market will remain balanced in the short term.

SULPHURIC ACID

- The expected improvement in sulphur supply in the second half of the year will provide some relief to sulphur burner operators that have struggled with the tight market in recent months. But the tightness from the smelter sector is not expected to improve in the short term.

- Nickel producer Meta Nikel is understood to be assessing whether to embark on a sulphur burner project in Turkey to meet its demand for sulphuric acid. This is currently met by imports of smelter acid, largely from Bulgaria.

- Japanese suppliers report limited potential for spot cargo availability in the short term because of lower sulphur content in copper concentrates and disruptions to operations during the first half of the year. Acid capacity in Japan is expected to remain stable at 8.6 million t/a in the outlook with production at around 6.0 million t in 2021. Exports are forecast to be down to 2.9 million t this year, below 2020 levels because of turnarounds and reduced supply.

- Outlook: Prices are not expected to ease in the short term, despite appearing to have reached a ceiling. The tight supply situation is not expected to ease in the coming months, with turnarounds and industrial action impacting availability. Strong demand from key industries as well as low inventories at smelter acid suppliers is keeping the price outlook firm. Indications for November spot cargoes are at higher prices to levels in early July – suggesting there may be room for further price increases before a peak is reached for the year.