Sulphur 396 Sept-Oct 2021

30 September 2021

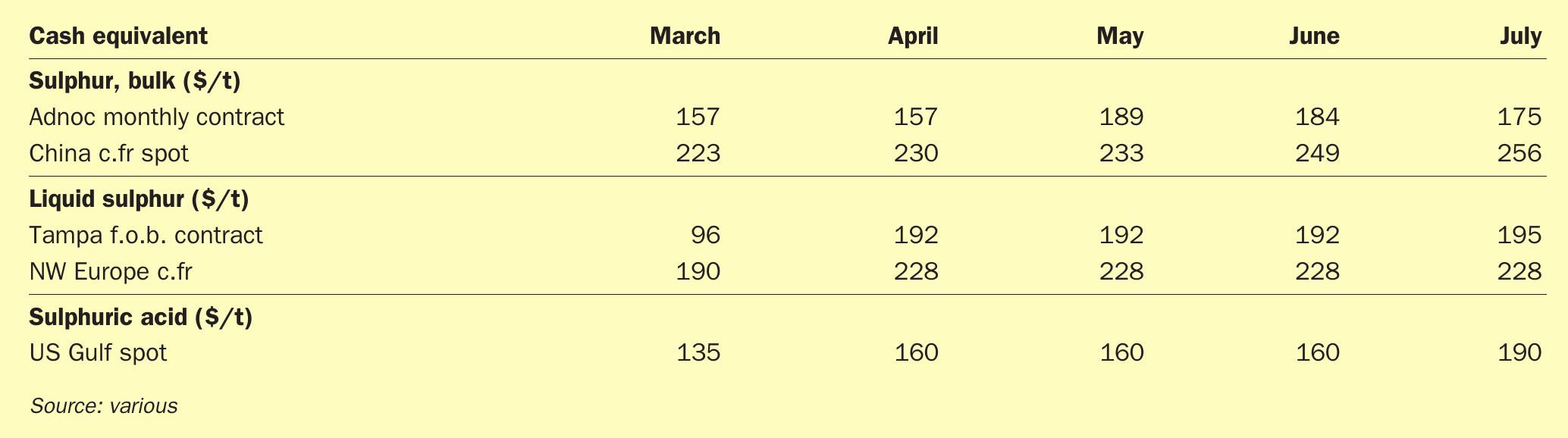

Price Trends

MARKET INSIGHT

Meena Chauhan, Head of Sulphur and Sulphuric Acid Research, Argus Media, assesses price trends and the market outlook for sulphur.

SULPHUR

Following third quarter contract settlements, liquidity in the global sulphur market has been limited, with prices in the spot market stabilising. The impact of the global pandemic appears to have waned in recent months as most regions are progressing with vaccine rollouts. Escalating case rates in India earlier in the year had been a cause for concern, but this has diminished with regular business resuming. Demand for DAP for the Indian market is expected to be a supportive factor for the coming months with remaining tonnes required for the karif season. The country has yet to secure around 3 million tonnes of DAP required to fill demand for the fertilizer year to March 2022. Firm DAP prices have deterred purchases, with sulphur imports expected to produce phosphoric acid to help meet demand. The price premium for sulphuric acid remains unworkable for the majority of processed phosphates producers in the country. Indian sulphuric acid prices have firmed by 260% since the start of the year to end August at $168/t c.fr at the time of writing. In comparison, sulphur prices were at $213/t c.fr at end August, an increase of 86% over the same period.

Over in China, buying activity has been slow, with the domestic fertilizer season resuming in the fourth quarter. Molten sulphur prices firmed through July/August at the low end, closing the gap with the solid prices. Demand from the domestic market is expected to remain healthy through the remainder of the year. Export demand for DAP/MAP is also supporting the sulphur outlook, with strong demand from South Asia. Port inventories of sulphur at the major ports fell to below 2 million tonnes to 1.64 million t in mid-August, leading to an uptick in domestic prices. The drop in inventories and higher local prices may lead to an uplift in import prices, but with rising domestic capacity and supply, low inventories may become a more regular occurrence. Across 2021 and 2022 Argus forecasts over 2 million tonnes of additional capacity will be brought online. While several projects are expected to ramp up in the short term, there is some uncertainty emerging in the Chinese refining sector. The government has cut refiners’ export quotas for the second half of the year. Just 7.5 million t of oil products will be warranted for export, a drop of 75% from the last announcement in December 2020. State and independent refiners have been impacted, leading to uncertainty around how quickly new supply will grow.

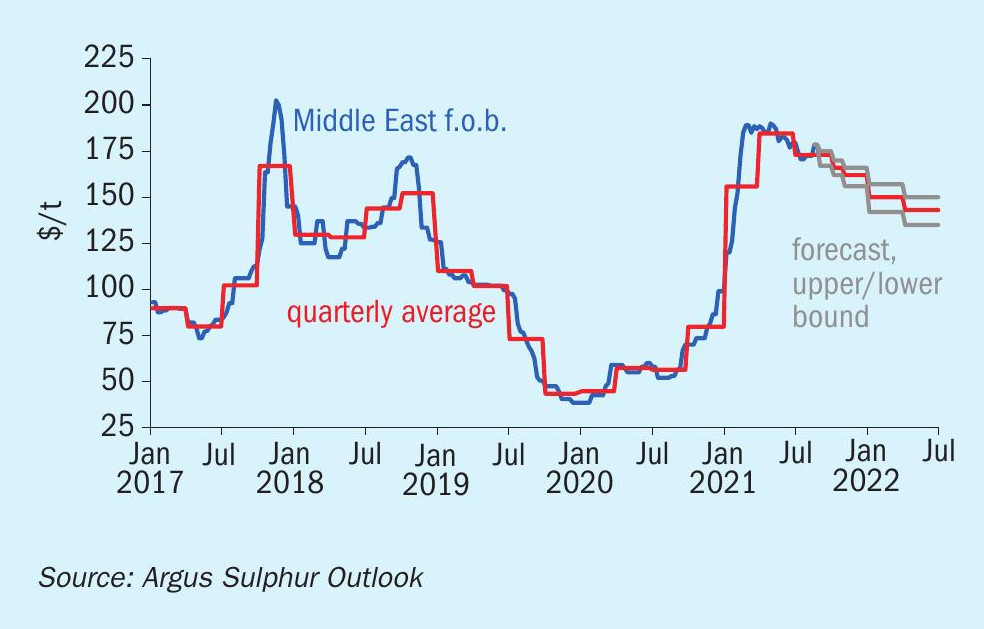

Sulphur supply out of the Middle East has been improving as operating rates continue to tick up on the back of rising fuel demand, leading to softening in pricing. Muntajat/ Qatar and KPC/Kuwait dropped prices for August to $166-166/t f.o.b. from the mid$170s/t f.o.b. in July. Meanwhile in the UAE Adnoc rolled over its July price for August at $175/t f.o.b., for shipments to the Indian market. This led to some uncertainty in the market on price direction. Average prices in August 2021 for spot were $175/t f.o.b. in the region, up $76/t on prices at the start of the year. But the benchmark has dropped by around $12/t on average since the peak in the second quarter. The firmer domestic Chinese market was also reflected in the bid levels under the Qatari sales tender for 35,000 t for September loading, with an award believed to have been made at just above $180/t f.o.b. Expectations are for prices to remain stable in the short term, but there are mixed views on the outlook. Renewed interest from the Chinese market could push up pricing, but increased availability of supply may put some downward pressure on achievable prices.

OPEC+ has provided clarity on extra supply expected in the market following a period of tightness. An additional 400,000 bbl/d per month will be reintroduced through to April 2022 and a further 432,000 bbl/d through to September 2022. This supports the view for softer sulphur prices in 2022, with a price correction expected after firming this year.

On the projects side in the Middle East, formal start up of Kuwait’s KNPC Clean Fuels Project (CFP) is still awaited following the commissioning of various units at the project earlier in the year. Sulphur capacity in the country will increase to above 2.0 million t/a once the refineries reach capacity.

In Indonesia, new nickel high-pressure acid leaching (HPAL) projects continue to support sulphur imports from the Middle East. HPAL Lygend is the first nickel project using this technology in the country with sulphur consumption estimated at over 300,000 t/a at capacity in the medium term. Other nickel projects are in development are forecast to further ramp up demand for sulphur in the country, supporting trade and pricing. One of the questions in the market has been how and if the development of several smelters with associated sulphuric acid supply would impact sulphur imports in the outlook but we do not expect the sulphur burner projects to be impacted.

SULPHURIC ACID

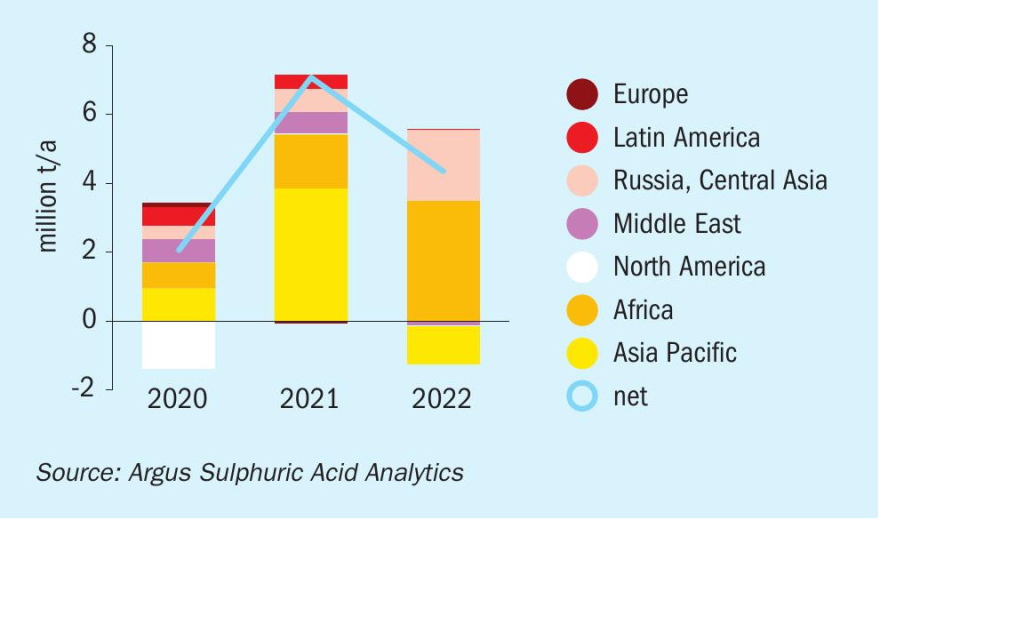

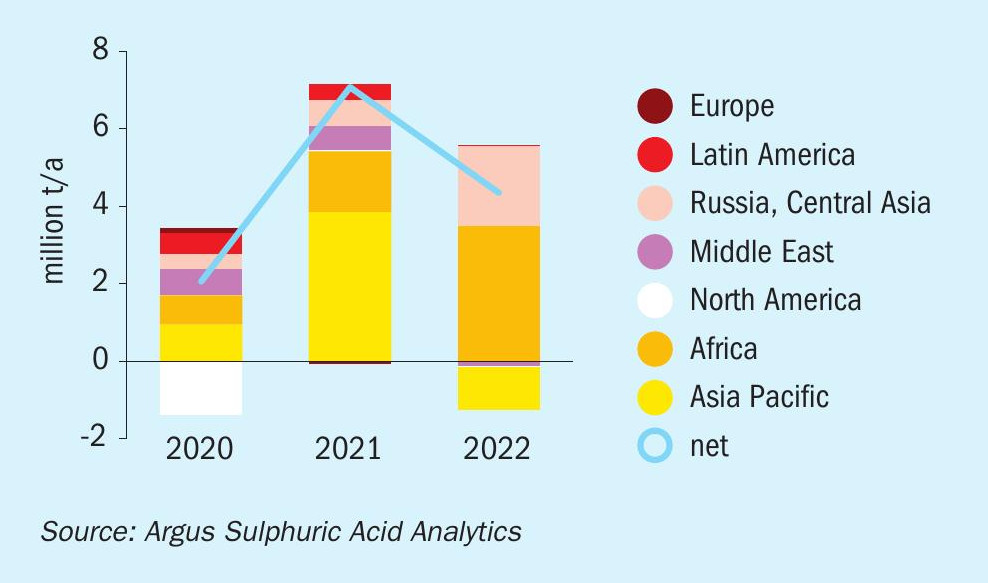

Global sulphuric acid prices have yet to reach a ceiling in August, with major benchmarks gaining ground over the past quarter. The contrast with sulphur has been stark – during a period where prices eased for several weeks in July-August. This is a reflection of the continued tightness in the smelter acid market balance, with numerous outages – both planned and unplanned – leading to disruption to supply. Argus estimates over 2 million t/a of acid losses in 2021 from turnarounds. The market bulls outweigh the bears in the view for the remainder of the year. The year ahead is more opaque, with the potential for a downward correction – led by an expected downturn in sulphur and processed phosphates prices. But the tightness in smelter acid is not expected to ease significantly early in 2022, pointing to the potential for further disconnect between sulphur and sulphuric acid market pricing.

Average monthly acid prices for NW European export volumes have firmed by over 400% since the start of the year, compounded by heightened demand from the domestic market, including the UK and strong demand from major markets in external regions. The average price for the month in mid-August was assessed at $172/t f.o.b. for spot. As Europe accelerates its energy transition plans to a low-carbon economy, demand for battery metals is expected to rise, and this has drawn investment to develop assets in the continent. In Finland, ramp up at Terrafame’s new battery chemicals plant started in June 2021 and will increase the end user’s sulphuric acid requirement. Consumption is also expected to rise in the UK and Germany in the outlook, with the water treatment and other industrial end uses driving the market. This will lead to an increase in the import requirement in the UK following the closure of the Inovyn sulphuric acid plant earlier this year. For Germany, we would expect to see exports dropping as domestic demand grows.

The outlook for Latin American acid consumption in the copper sector is in question with recent political developments. In Peru, Pedro Castillo won a 6 June run-off election and has veered left with his first cabinet. On paper, the Peru Libre party espouses nationalization of extractive industries. Increased sulphuric acid consumption is expected from the ramp up of the Mina Justa mine and, further in the forecast, the long-delayed Tia Maria copper project.

In the US, there are several copper projects in development in Arizona. Excelsior Mining’s Gunnison project continues to progress. Merchant acid is currently being procured for the project but a sulphur burner is planned in the long term. Freeport McMoRan’s Lone Star project has been exceeding the initial design capacity following start up in 2020. EPC activities have been advancing at Taseko Mines’ Florence project, which was 60% complete in the second quarter. Initial deposits were being prepared for major processing equipment for the SX-EW plant in July. A key permit is expected by the end of the third quarter which will be followed by a public comment period. Meanwhile, acid demand for the lithium sector in Nevada has the potential to rise substantially in the long term outlook. While projects are at early stages, at least one is likely to progress to a construction phase in the short term. Acid demand would be met by sulphur burners, expected to be constructed at each of the projects in development and would impact sulphur trade.

Average acid prices at SE US were assessed at $225/t c.fr in August, an increase of around $152/t on the start of the year, or a 208% increase. The benchmark firmed on the back of fundamentals driving global markets, with domestic supply constrained on the back of maintenance turnarounds and outages while demand has stayed strong.

PVS Chemical Solutions announced it will construct a new ultra-pure sulphuric acid plant in addition to its existing plants in Buffalo, New York and Houston, Texas, to meet increased demand for high-purity acid from the computer chip industry. Preliminary engineering has begun and the expectation is for production to commence in 2023.

Members of the United Steelworkers (USW) at Vale’s Sudbury, Canada, nickel operations approved a new five-year collective bargaining agreement at the start of August, ending a two month strike. This will lead to a return of sulphuric acid production to regular levels. The strike squeezed the domestic acid balance, in an already tight market, contributing to a firmer footing in prices. While the resolution of the labour dispute is positive for acid supply, strong demand is expected to keep the market tight and prices are expected to remain elevated in the short term.

PRICE INDICATIONS