Sulphur 397 Nov-Dec 2021

30 November 2021

Market Outlook

SULPHUR

- A seasonal decline in weather conditions in the eastern Atlantic will hinder operations at Jorf Lasfar in Morocco through the end of 2021 and into 2022. In South Africa, port congestion problems were challenging at Richard’s Bay with vessels subjected to 15 day wait times, increasing demurrage costs.

- Indian state refiners increased refinery run rates in October following an anticipated increase in fuel demand. IOC is expected to increase run rates to 90% in October from 85% in September, before upping rates to 95% in November. Indian sulphur capacity is forecast to rise by over 100,000 t/a by 2023, raising domestic output.

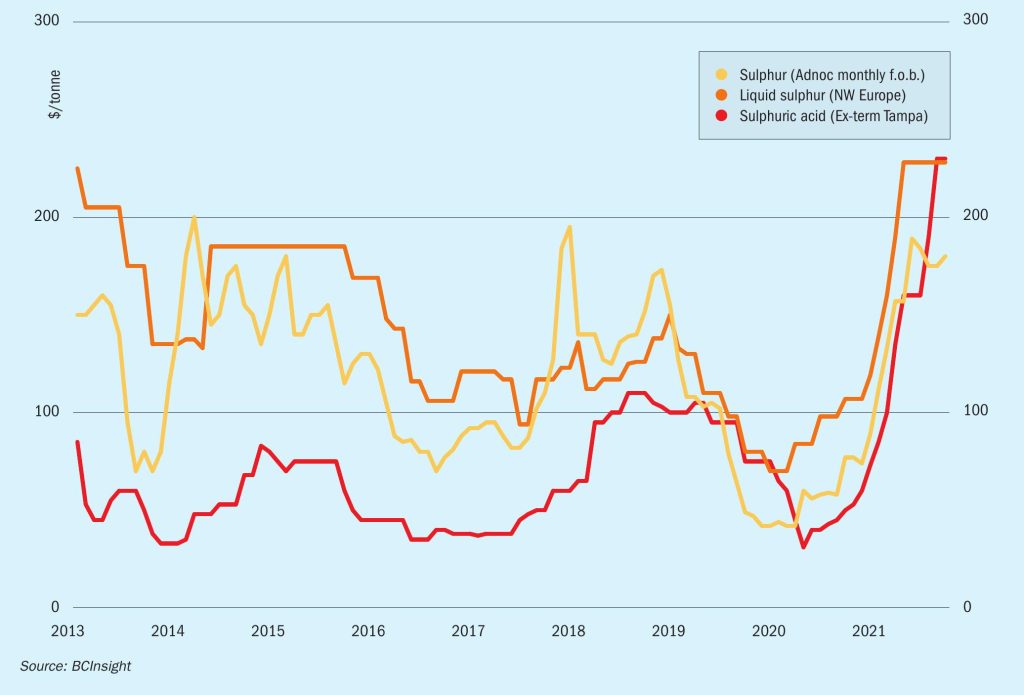

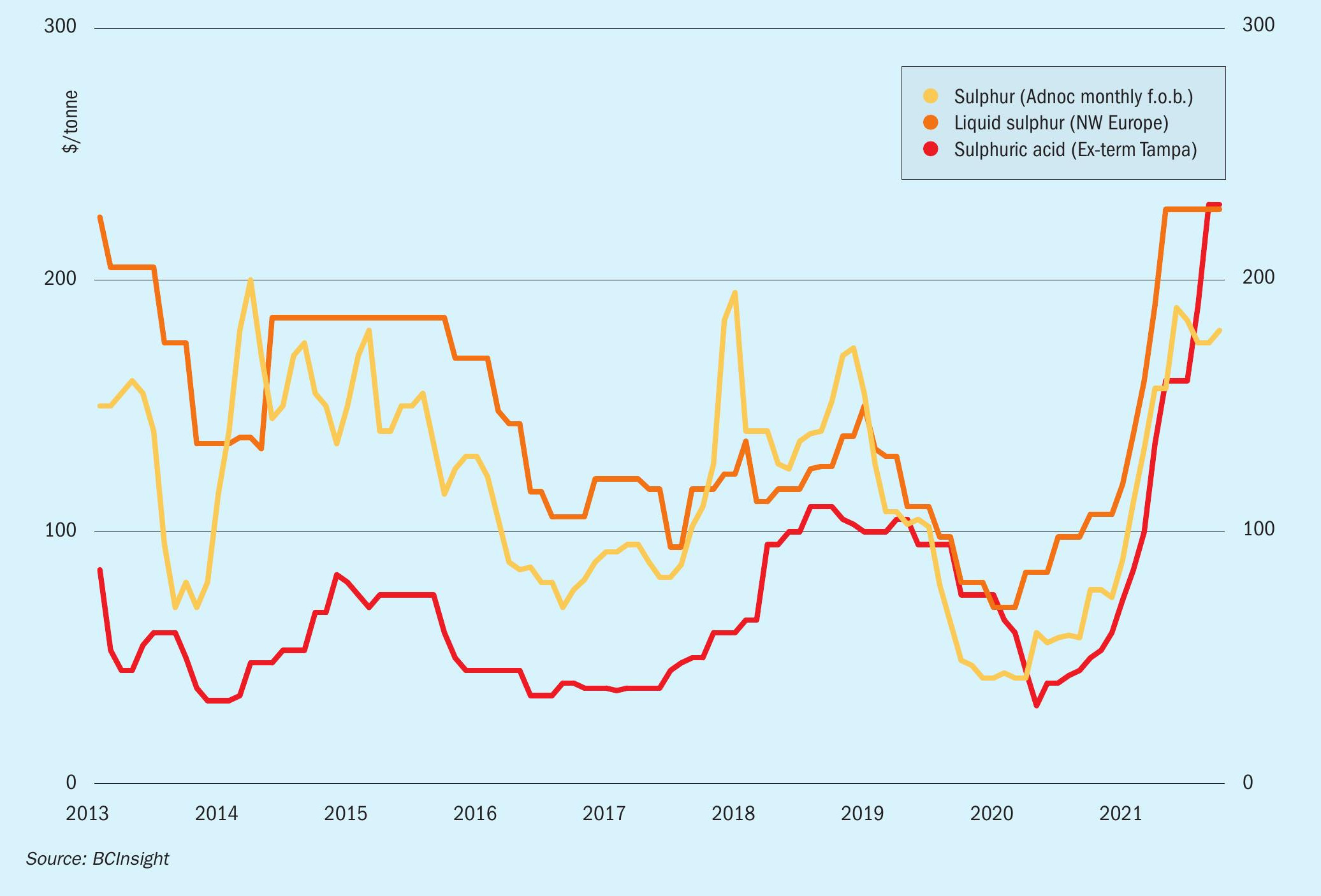

- Outlook: Global sulphur prices are likely to firm further, driven by demand side fundamentals and supported by the short term rally in the DAP market. The outlook for new supply in the 2022-2023 period is healthy, based on projects in the pipeline, the key assumption behind the potential downside to the market view. Strength from non-fertilizer sector demand such as nickel is expected to provide considerable growth in trade volumes to markets including southeast Asia.

SULPHURIC ACID

- Maintenance turnarounds – both planned and unplanned – have supported the tight balance over the course of the year so far and will continue to squeeze availability in the spot market into 2022. Rio Tinto’s Kennecott smelter in Utah was still offline at the end of October following an accident while Vale production at Sudbury was down by 27% for nickel and 6% for copper due to the strike there.

- Nationwide power rationing in China and slowing demand for sulphuric acid is understood to have led to copper smelter Tongling Nonferrous Metals reducing its output. Its Jinlong and Jinguan smelters started to cut operating rates by around 20% from 22 October 2021 with high sulphuric acid stocks also being a factor. Power curbs in China hit chemical and steel sectors and affected operations at several copper smelters, temporarily disrupting acid output.

- In the wider economy, inflation in the eurozone grew to 4.1% in October, jumping from 3.4% in September, a flash estimate from Eurostat shows. Inflation is at its highest since July 2008, driven by significantly higher energy prices and supply-chain price pressures.

- Outlook: Sulphuric acid is expected to remain at a premium to sulphur through the fourth quarter and into 2022. The tight smelter-acid sector is supporting the view for firmer in the coming months. The potential for a price correction remains, potentially in 2022, particularly if DAP and sulphur prices both see substantial decreases. However, with demand expected to remain robust across most sectors including metals, the disconnect with sulphur may prevent acid prices from following the same trends.