Sulphur 398 Jan-Feb 2022

31 January 2022

The impact of US duties on phosphate markets

PHOSPHATE MARKETS

The impact of US duties on phosphate markets

Import duties on phosphates from Morocco and Russia imposed by the US government in 2021 have compounded a lack of availability of phosphate fertilizer caused by Chinese export restrictions and led to higher prices for US farmers. Are there knock-on effects possible for sulphuric acid demand?

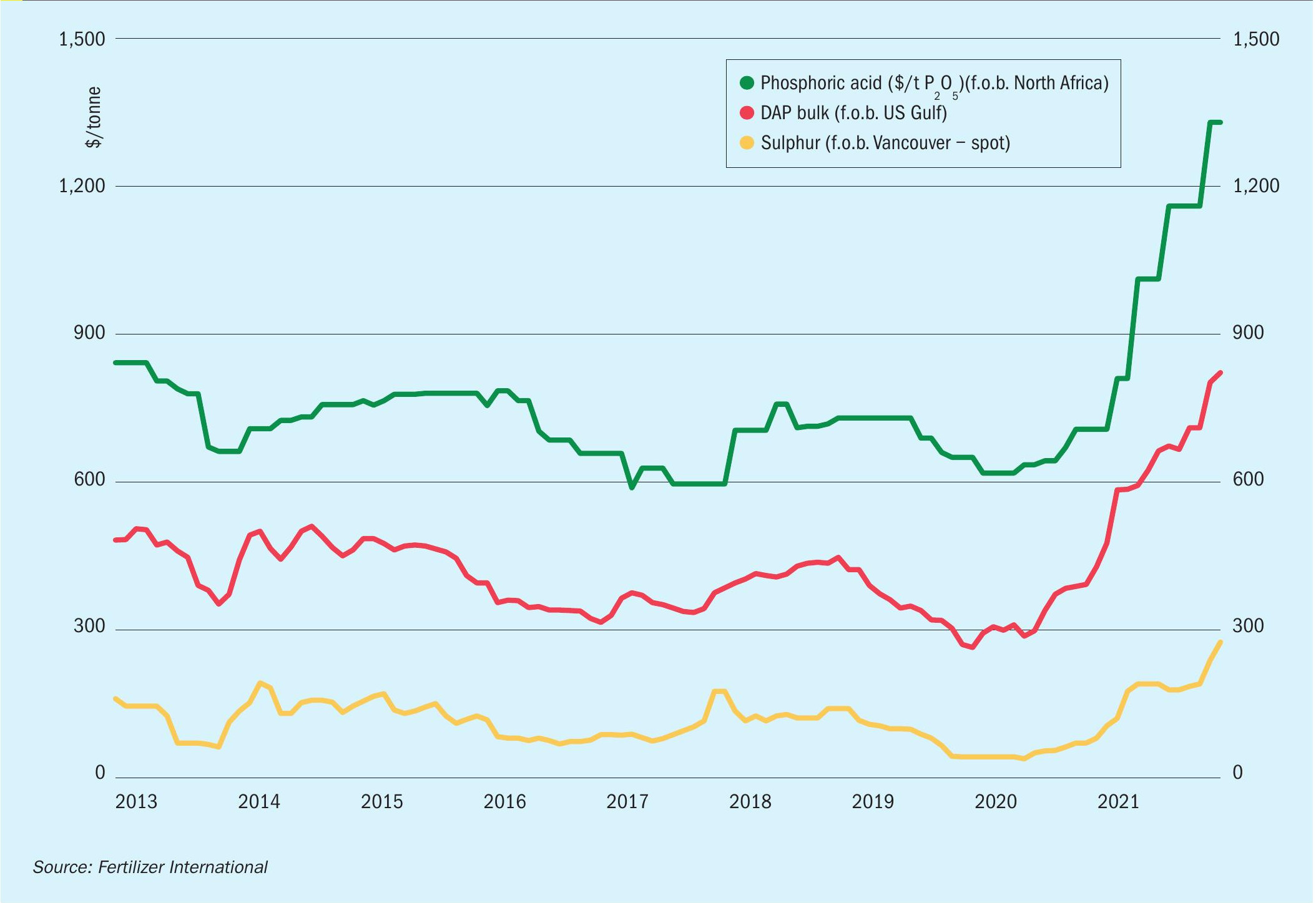

Phosphate prices soared during 2021 after being in a relatively settled range for most of the previous few years. For example, Tampa f.o.b. DAP prices swung between around $300/t and $500/t between 2013 and 2020 (see Figure 1), before climbing to levels above $800/t by the end of 2021. One of the main factors in this, at least in the US, has been the decision by the country’s International Trade Commission (ITC) to impose tariffs on imports of phosphates from Morocco and Russia, the second and fourth largest exporters of processed phosphates, respectively.

The decision stems from a case which was brought in June 2020 by US fertilizer producer Mosaic which alleged that phosphate producers in Morocco (i.e. OCP – Office Cherefien des Phosphates – the state phosphate monopoly) and Russia – essentially EuroChem and PhosAgro – were competing unfairly because of a series of hidden subsidies on their product. Investigations and a hearing were conducted during 2020 and completed in February 2021, and a final determination made in March 2021.

ITC investigation

The evidence presented by Mosaic included an increase in phosphate fertilizer imports into the US from Morocco and Russia from 2.0 million st/a in 2017 to 3.0 million st/a in 2018, before decreasing to 2.7 million st/a in 2019, for an overall increase of 37% between 2017 and 2019. This happened in spite of an overall decline in demand for phosphate in the US in 2018-19 due to flooding of fields caused by exceptionally heavy rains and prolonged river closures along the Mississippi River system in 2019 that stranded fertilizer barges and resulted in delayed, destroyed, or abandoned plantings, especially in the Midwest and Great Plains regions. Mosaic further argued that the reason for the supply increase was that phosphate from overseas was sold at prices below cost due to subsidies in both Morocco and Russia.

Counter-arguments were presented, including the decrease in North American phosphate supply caused by Mosaic’s decision to idle its Plant City facility in December 2017, and Nutrien’s announcement in February 2018 of the conversion of its Redwater facility in Canada from phosphate to ammonium sulphate production. In March 2019, Mosaic also announced a 300,000 st curtailment in production, and in September 2019, it temporarily idled operations at its facilities at Saint James (Faustina) and Uncle Sam, Louisiana, reducing production by 500,000 st until they were restarted in December 2019.

The overseas producers also argued that their production costs were lower than US producers, but the Commission said that in its opinion, soft government loans to OCP, as well as various tax and duty exemptions, counted as subsidies, likewise it also regarded tax incentives and regional government subsidy programmes in Russia as subsidies to production cost.

However, while the action was launched to protect the US phosphate industry, it was not welcomed by end-use consumers in America. In a letter sent to the ITC on February 17th, 2021, the American Soybean Association, National Corn Growers Association, and National Cotton Council said: “While many row crop farmers have observed recent increases in fertilizer prices with concern, the greater problem caused by Mosaic’s petition is that these duties are adversely impacting availability of phosphate fertilizer in the United States. Additionally, these duties reduce competition and choice available to farmers in the US marketplace.” On March 1st, 11 US senators from corn belt states wrote a similar letter to the ITC.

Notwithstanding these pleas, on March 11th, 2021, the US ITC Commissioners ruled 4-1 in favour of Mosaic, and determined that imports had affected the US market, and proceeded to impose countervailing duties on imports of phosphate fertilizer. The duties imposed were 19.97% for Morocco’s OCP, 9.19% for PhosAgro, 47.05% for Euro-Chem, and 17.2% for all other Russian phosphate producers. The duties will be reviewed in five years. The US already operates tariffs on Chinese phosphate producers, leaving only an estimated 15% of the global phosphate market open to US farmers without some form of import tariffs, according to the National Corn Growers Association.

Price impact

Prices of phosphates have certainly spiked since then, and the temptation in the US has been to blame the new import duties. However, phosphate markets have also faced a number of other factors which make untangling the effect more difficult, including increasing grain prices and demand for phosphate fertilizer globally, sharply increased costs for ammonia due to high gas prices, which impacts MAP and DAP costs, and restrictions on phosphate exports from China. In September 2021 China, which accounts for about 30% of the world’s trade in phosphates, said it would not export phosphate until at least June 2022 in order to assure domestic supplies. Fertilizer prices hit record levels in China in 2021 because of strong demand, high energy costs and reduced domestic production, including flooding in Henan province, where the phosphate industry is concentrated. Although the US does not buy much phosphate from China, countries such as India and Australia do, and in the absence of Chinese supply they have been buying from other sources which has reduced availability for US imports. US phosphate production in 2020 was 24 million t/a, with imports running at about 2-2.5 million t/a. Chinese exports total around 5 million t/a.

The situation was exacerbated in November 2021 by Russia’s decision to impose quotas on exports of fertilizer. Prime Minister Mikhail Mishustin said that the Russian government would introduce quotas to run from December 1st 2021 to May 31st 2022 on the exports of nitrogen and complex fertilizers. The former, mainly urea and ammonium nitrate, would be limited to 5.9 million tonnes, and for MAP, DAP and NPKs the limit would be 5.35 million tonnes. According to Mishustin, from December 2020 to May 2021, Russia exported 6.8 million tonnes of nitrogen fertilizers and 5.7 million tonnes of NP and NPK fertilizers.

Blame game

All of these factors have combined in something of a perfect storm for the phosphate market, with, as noted, US Gulf DAP prices now over $800/t f.o.b., a level not seen since 2009. However, angry farmers in the US continue to point the finger of blame at Mosaic for the price rises, due to the ITC duty increases. In December, Iowa Senator Chuck Grassley sent a letter to Attorney General Garland calling on the Department of Justice (DOJ) to investigate possible anticompetitive activity and market manipulation in the fertilizer industry. He was backed by the National Corn Growers Association, whose president, Chris Edgington, said: “There is no reason that corporations like Mosaic Co. and CF Industries should be using the government to expand their monopolies at the expense of farmers.”

In response, Mosaic has pointed to rises in raw material costs, noting that 2021 has seen the cost of ammonia increased 288% year-on-year, and sulphur prices rising by 165%, as well as the export restrictions from China and Russia as the main drivers of rising phosphate prices in the US and worldwide. It also argues that phosphate prices in the US are currently $20-100 per ton lower than in other major agricultural markets such as Brazil, India, and Europe.

Effect on demand

According to the International Fertilizer Industry Association (IFA), global phosphate demand increased by 7.0% in 2020 to 49.6 million t/a P2 O5 . Phosphate rock production reached 207 million t/a, down slightly on the previous year, while phosphoric acid production was slightly up at 87 million t/a. CRU says that phosphate demand rose by 1.2% in 2021, and had been forecasting a rise of 2.9% for 2022. However, the current run of high prices seems bound to cause demand destruction, especially in the United States, the third largest consumer of phosphate after China and India. Rabobank has forecast a 10% fall in US phosphate application in 2022. While nitrogen must be applied on an annual basis, phosphate fertilizer can be left for a year in extremis with only a relatively small immediate impact on crop yields. The 2008-9 price spike saw a 32% fall in US phosphate application, for example, although higher crop prices may mitigate against that this year.

The effect could be more pronounced in other major consumers, such as India. According to the Indian Ministry of Chemicals and Fertilisers, only 910,000 tonnes of DAP was sold in the country in October 2021, against a projected requirement of 1.8 million tonnes. The figure for November was slightly better, but availability was still down 21% on projected requirements.

Of course, a major drop in phosphate demand could have a significant impact on sulphuric acid demand; a 10% fall in phosphate fertilizer demand could reduce acid demand by 5%. At the moment it’s a good time to be a phosphate fertilizer producer, with record earnings likely for 2021 in spite of higher input costs. However, current price levels are not sustainable over the longer term without some level of demand destruction.