Fertilizer International 507 Mar-Apr 2022

31 March 2022

Exposure to the Russia-Ukraine conflict

Editorial

Exposure to the Russia-Ukraine conflict

Argus Media’s Alistair Wallace assesses how exposed fertilizer and fertilizer raw material markets are to the conflict in Ukraine.

Exposure and disruption

We have assessed the potential impact of the military conflict between Russia and Ukraine on the eight major fertilizers, using six measures to quantify each commodity’s exposure to sanctions:

- Russian share of global capacity

- Russian share of global production

- Russian share of global trade

- OECD share of Russian export business

- Share of Russian trade via Ukrainian or EU f.o.b. ports

- Russian share of forecast growth in capacity.

Sanctions, the story so far…

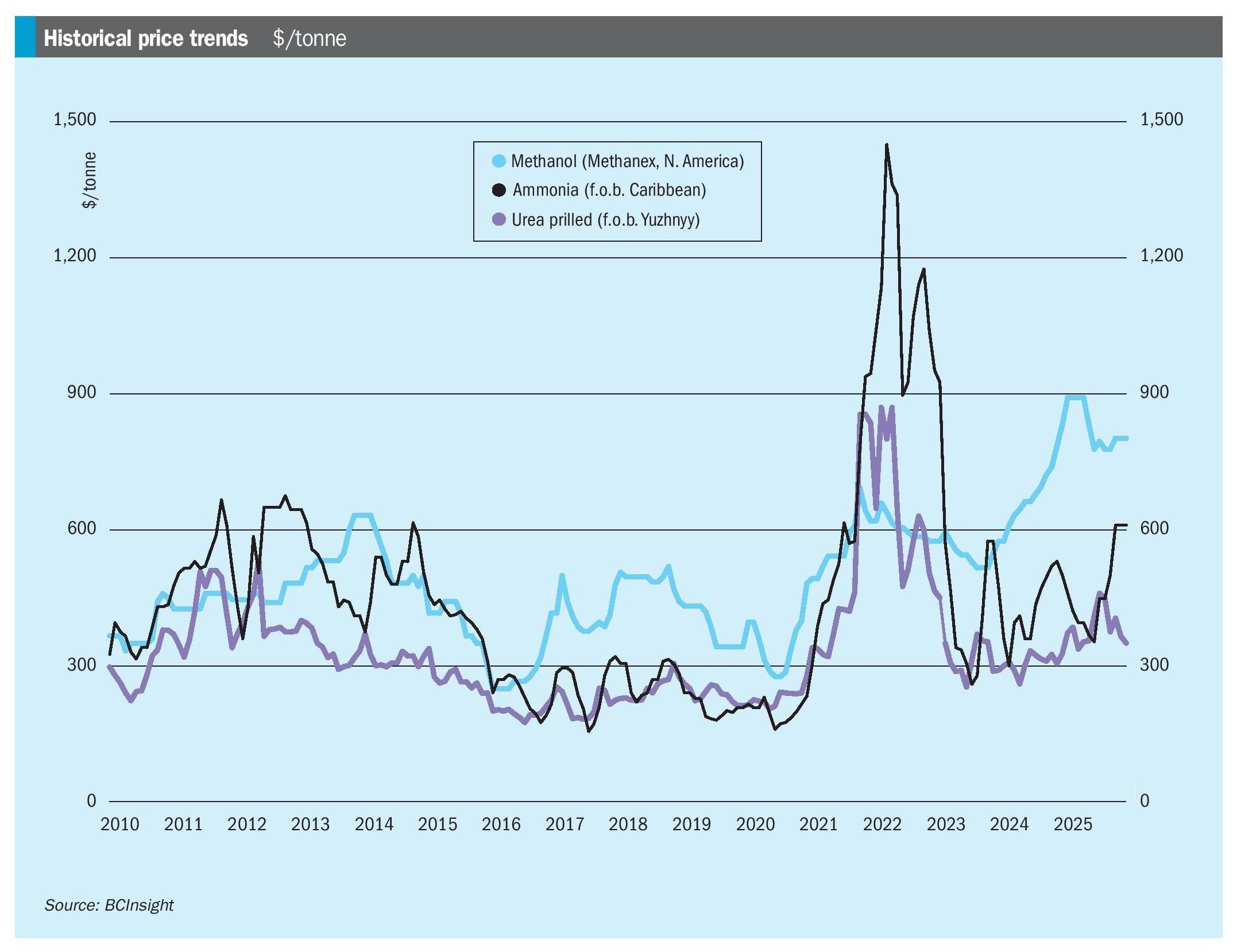

Based on this analysis, the ammonia industry is going to be the most exposed, followed by the potash and urea industries, while the sulphuric acid industry looks like it will be the least affected. The other major fertilizers fall along a spectrum between those two extremes.

The initial impact has been limited in terms of physical supply disruptions but huge in terms of psychological shock, greatly increasing the risk profile of fertilizer trading. Booking freight from Russian ports is looking to be an early and growing problem.

Ammonia most affected

Ammonia has been the most affected in the early days of the conflict. Around 2.4 million tonnes of ammonia shipped from Pivdenny port (Odessa) in 2021, of which only 150,000 tonnes were Ukrainian. The balance is Russian ammonia shipped through the pipeline from TogliattiAzot and Rossosh. Typically, these Russian exporters move 1.8 million t/a and 0.5 million t/a, respectively, through Pivdenny.

The conflict in Ukraine has forced the closure of the Togliatti-Pivdenny ammonia pipeline and all ammonia has ceased shipping from Ukraine. This will have huge implications for supply and prices west of Suez. The largest offtakers from Pivdenny last year were Morocco (800,000 tonnes), Turkey (600,000 tonnes), India (360,000 tonnes) and Tunisia (190,000 tonnes). This means that non-integrated (with ammonia) DAP and MAP producers in north Africa will be the most disrupted in the near term.

Potash is also in a uniquely difficult position given the disruption to trade already being experienced from the sanctions against Belarus’ potash sector. Direct sanctions on Russian potash would cause a combined 40 percent of global exports to become unviable for Europe and the US.

The impact of the removal of Russia from the Swift financial transaction system and the sanctioning of Russian banks on Russian fertilizer sales is uncertain. Many Russian producers process fertilizer transactions through Swiss trading subsidiaries and we are unsure how these will be affected in the short run.

Despite no direct sanctioning of Russian fertilizer trade, and EU ports remaining open to Russian cargoes, we are already seeing impacts on fertilizer shipping. While nominated vessels are loading as normal, the fixing of future fertilizer cargoes appears increasingly problematic for Russia. We are also hearing reports of ‘self-sanctioning’ with some western companies that would normally import Russian fertilizers pre-empting tighter sanctions.

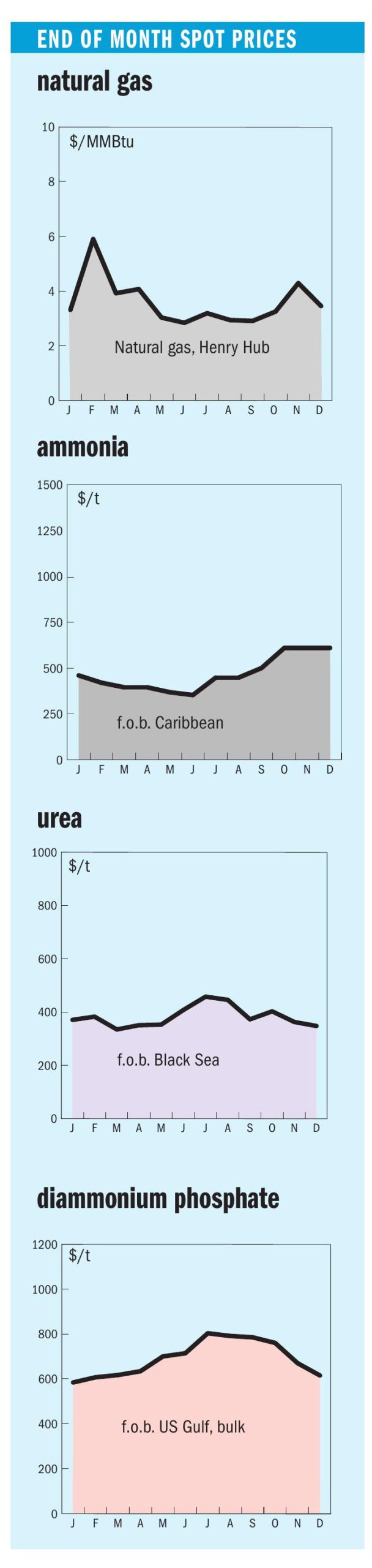

Gas markets price-in risk

So far, we have only considered the impacts of direct sanctions on Russian fertilizer trade and indirect effects from the sanctioning of Russian financial institutions. Yet gas markets are also pricing in risk premiums – with implications for nitrogen producers.

The European gas market has pre-emptively priced in a risk premium of around $10/mn Btu, moving from the mid-$20/mn Btu range to the mid-$30/mn Btu level. This will disproportionally affect EU nitrogen producers given the industry’s gas-based cost structure.

Initial conclusions

As US and EU sanctions on Russia ratchet up, all fertilizer products will face upwards price pressure – should sanctions directly target fertilizer HS codes, fertilizer producers, or their owners.

Any limits on Russian exports will make global fertilizer markets less efficient. This means that buyers within affected jurisdictions – primarily the EU, US, UK and Japan – will lose bargaining power as the pool of available sellers decreases with the enforced absence of Russia and Belarus.

In addition to any trade disruption, ammonia and other nitrogen fertilizer prices will undergo a substantial cost-push as the risk premiums on gas increase the industry’s marginal cost of supply. Actual disruption to Russian gas flows has the potential to push gas prices and nitrogen costs higher still.

Ammonia is already facing both outcomes, with the loss of almost 2.4 million tonnes of supply from Ukraine – and Russia through Ukraine – and the substantial increase in EU gas prices as European markets attempt to price in Russian risk.

Potash buyers in the west, having started to adapt to the sanctioning of Belarusian exports, now face the prospect of losing access to Russian supply as well, should the conflict continue and western sanctions begin targeting the Russian potash trade as well.