Sulphur 399 Mar-Apr 2022

31 March 2022

Market Outlook

SULPHUR

- Developments in the Russia-Ukraine conflict is going to be a key influence for the sulphur market through the year. The potential loss of Russian sulphur to key import markets such as North Africa and Latin America is likely to lead to trade flows increasing to these regions from the Middle East and North America.

- The extent to which Kazakhstan exports will be limited will also be a critical factor for the outlook for pricing. There is potential for some supply to move to China but another likely outcome is for sulphur to be blocked temporarily, pending any policy or legal restrictions.

- Rising Chinese sulphur supply is likely to be a focus point for the market as this will provide a limit to how much sulphur is required to be imported. Any reductions in imports to the country could provide supply to other markets impacted by the shortfall from Russia and Central Asia.

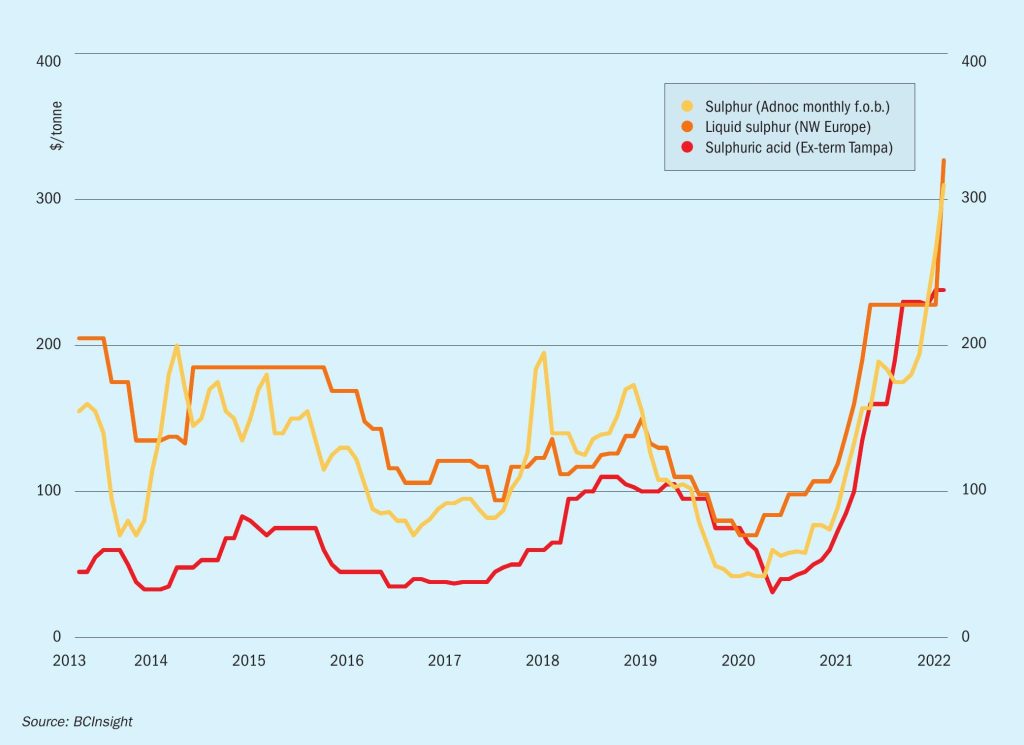

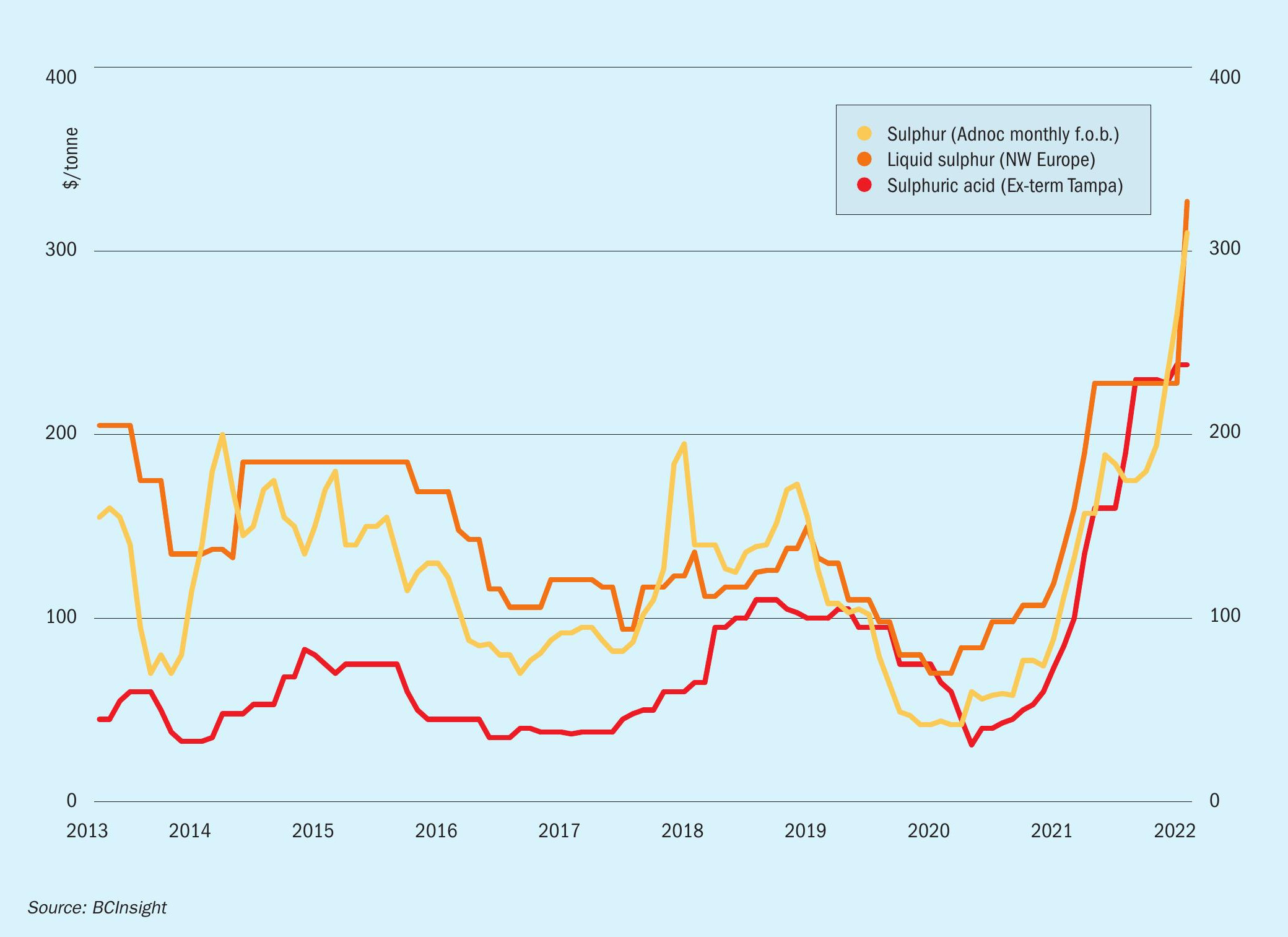

- utlook: Global sulphur prices are likely to see further increases in the short term through the month of April. Concern is mounting in the market that the swift upward spike in pricing may be followed by a downward correction of equal scale. The supply side capacity additions in the Middle East may help to ease the shortfall from Russia but uncertainties still remain around Kazakhstan supply which would also have a significant impact to trade flows and pricing.

SULPHURIC ACID

- Canadian Pacific (CP) railway workers were threatening to strike in March amid trucker protests on the Canada-US border. The strike had the potential to impact the CP railway from 16 March, potentially impacting the flow of acid.

- The spike in sulphur prices may lend support to sulphuric acid market merchant trade in the short term, but regional supply/demand balances will determine whether spot availability can cover demand.

- In China, new supply is expected from the Yantai Guorun Copper smelter in Shandong, expected to start up this year with 720,000 t/a acid capacity. The Xinjiang Zijin Mining smelter is also expected to ramp up to full capacity this year following a start-up back in 2020.

- Acid demand is in question because of the uncertainty in the fertilizer market. The disruption to ammonia supply and trade is likely to lead to potential cutbacks in processed phosphates production during the second quarter, impacting the outlook for sulphuric acid consumption.

- Outlook: Sulphuric acid prices are likely to remain stable to firm in the short term but as with all commodities, volatility is likely to be a part of the market in the months ahead. Availability from Europe may be hampered further by the high energy prices but reductions in operating rates by end users may partially balance supply side losses.