Sulphur 401 Jul-Aug 2022

31 July 2022

Market Outlook

SULPHUR

- The ongoing recovery from Covid-19 has led to an uptick of sulphur from refineries in regions including the US compared with a year ago. As travel around the global improves, increasing fuel demand points to higher operating rates and improved sulphur recovery.

- Demand growth is expected to slow in 2022 on 2021 but the year ahead appears to have more potential because of new phosphoric acid capacity and strong growth in the metals sector. This will provide a floor to the correction in prices in 2023 as the market moves towards to a tighter balance.

- Major market import demand in Morocco, China, Brazil and India remain key to future pricing and trade. Domestic production increases in China and India will squeeze requirements but the demand boost in Morocco will mark a major shift in imports in the medium term.

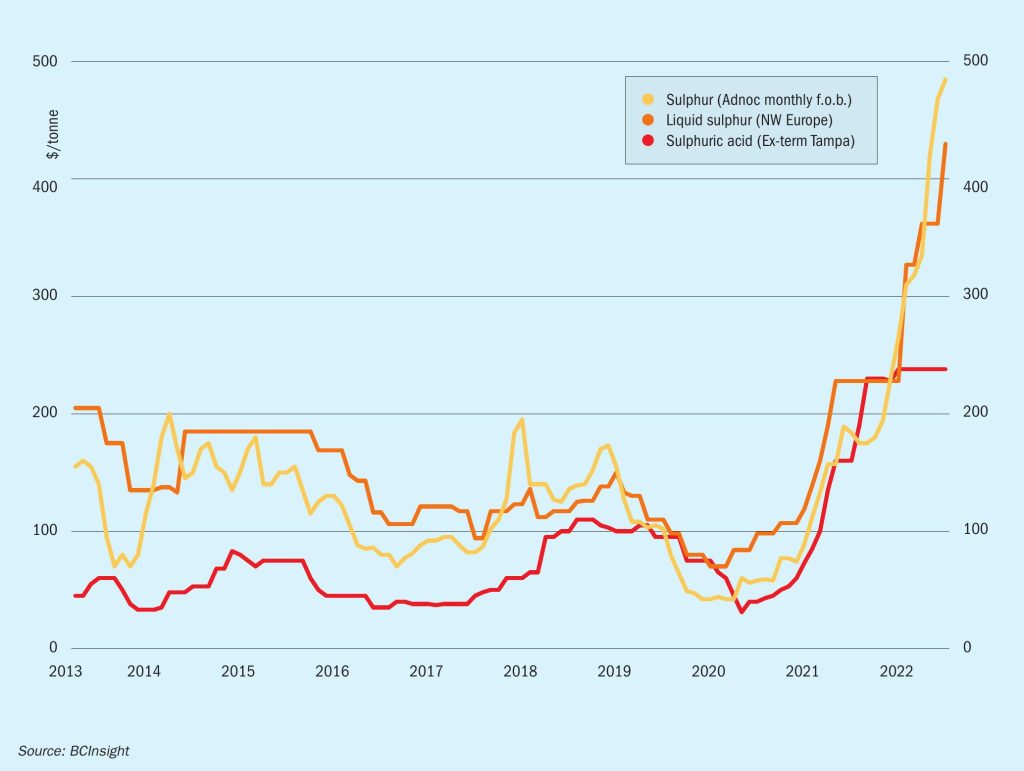

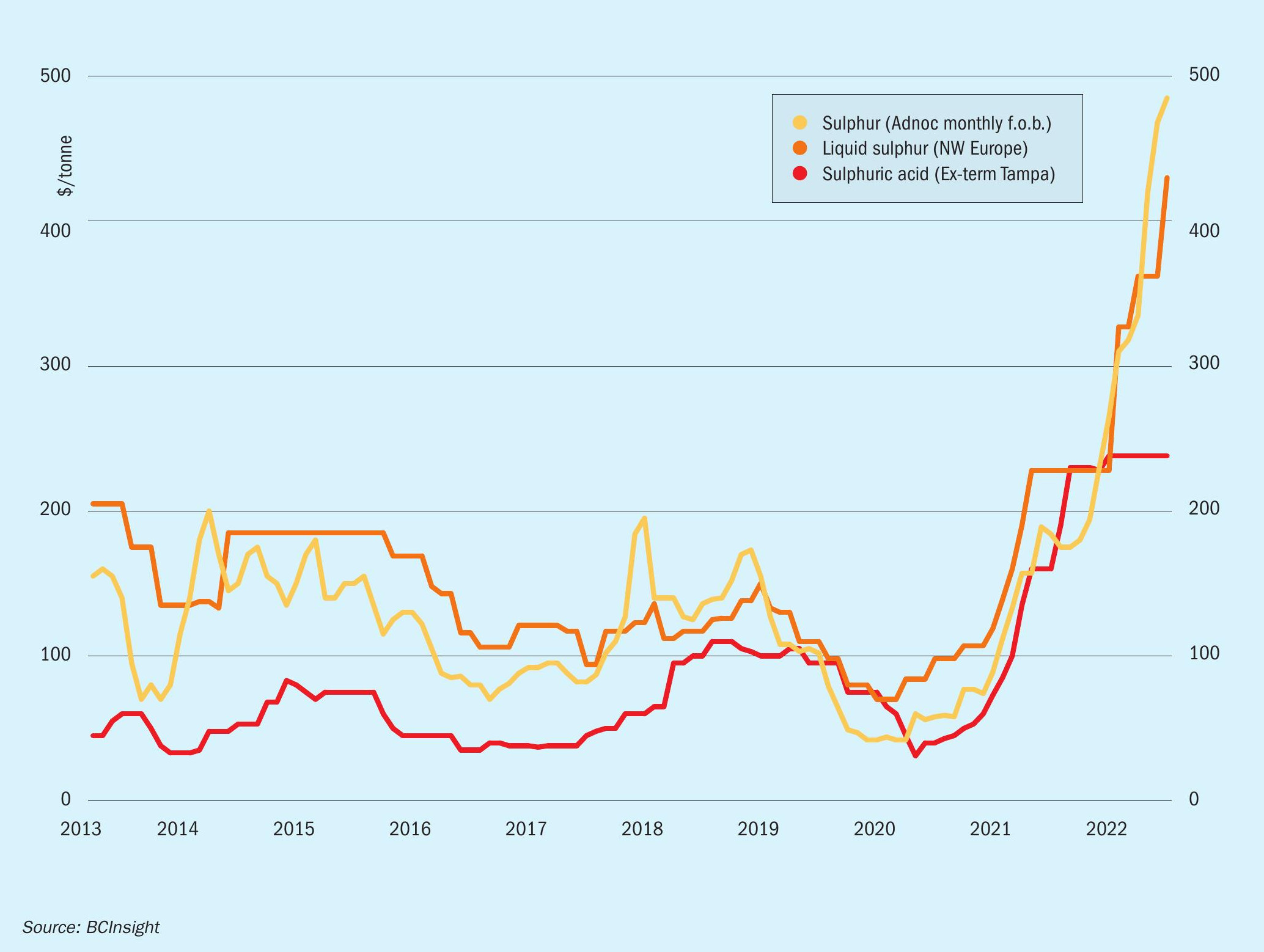

- Outlook: The price correction is expected to continue through the remainder of 2022 with further decreases in 2023 on the back of a softening processed phosphates market and a move away from recent peak prices. While the outlook for sulphur supply from Russia remains a concern, rising capacity in other regions over the next year will more than compensate for the potential loss of tonnage to the export market.

SULPHURIC ACID

- Acid prices are not expected to correct to the extent that sulphur is in the short term. Acid prices have b een more stable through the second quarter, with less direct impact from the conflict in Russia-Ukraine. But, a correction is expected to persist going into 2023.

- Increased elemental sulphur availability in 2023 will lead to higher sulphur-based acid production, putting downward pressure on smelter acid prices.

- The rise in Chinese acid smelter capacity and production, alongside a slowing demand picture for the fertilizer sector domestically will maintain the country’s position as a major acid exporter in the medium term outlook.

- The balance between sulphur and acid imports in Morocco will be changing in the outlook as OCP adds new sulphur burning capacity. Acid imports are expected to drop in the medium term as demand shifts towards sulphur instead.

- Outlook: Expectations are for some softening, with downward pressure from easing copper prices, sulphur and processed phosphates. But the rise in freight rates and turnaround schedule is likely to provide a floor to the correction. Strong metals output is expected according to guidance announced by producers in the year ahead, supporting the view for healthy smelter-acid production.