Sulphur 402 Sept-Oct 2022

30 September 2022

Market Outlook

SULPHUR

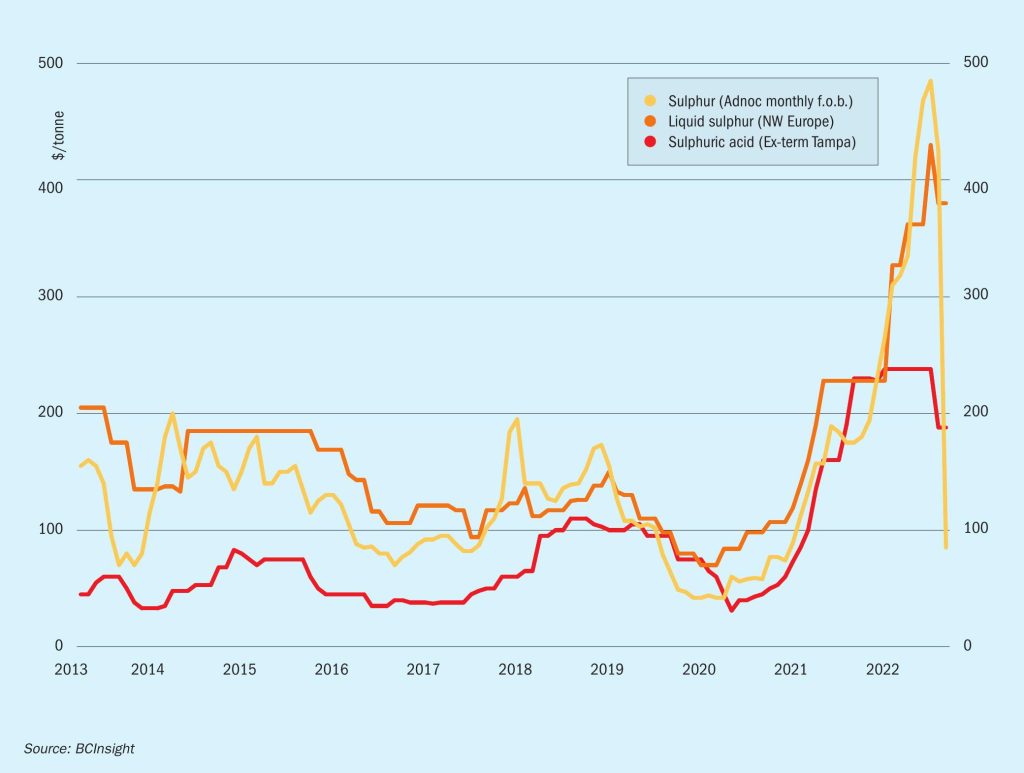

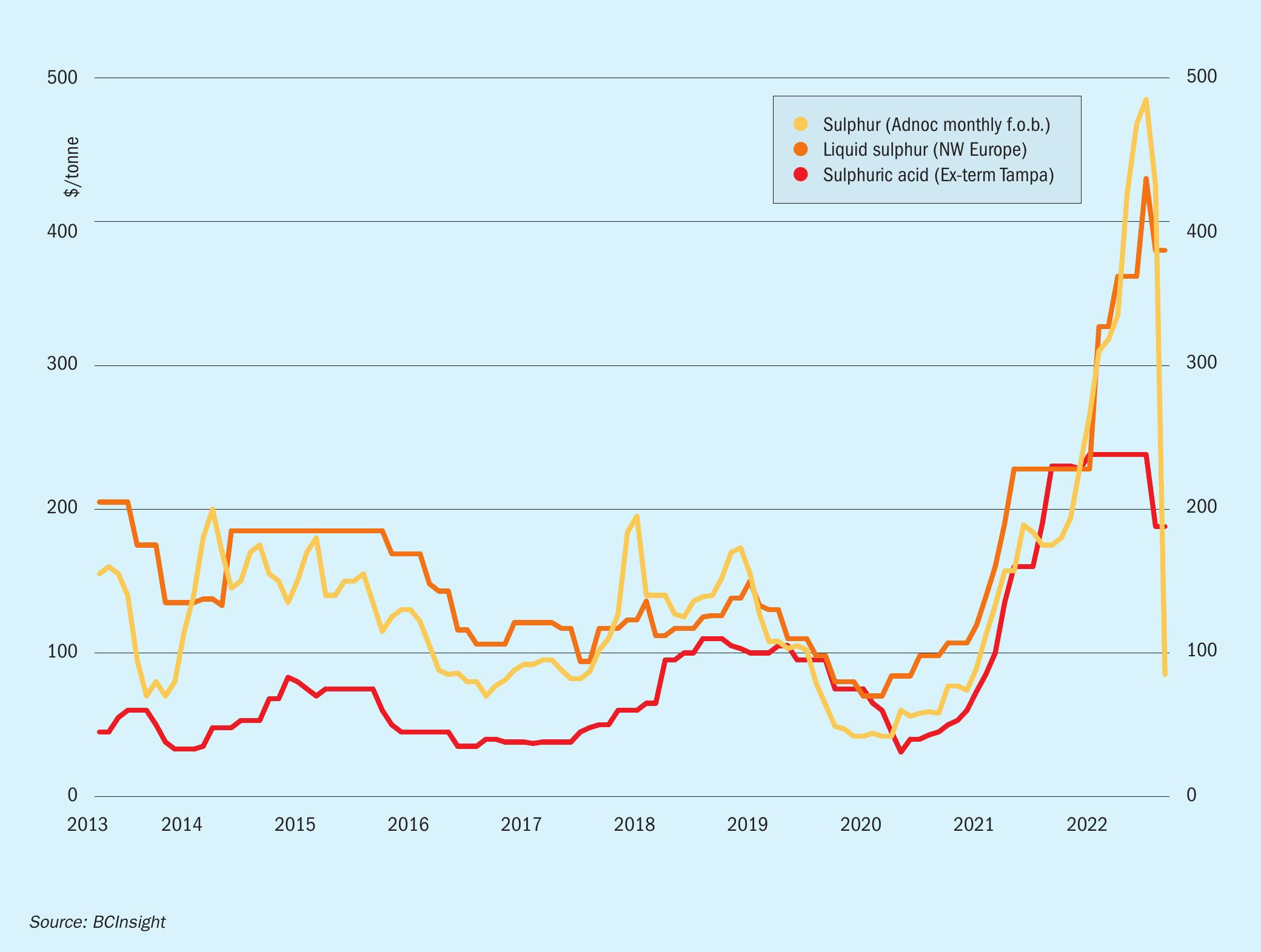

- Reduced appetite for sulphur from processed phosphates producers in China will continue to place downwards pressure on pricing in the near term.

- Phosphates-based demand is likely to remain low in the second half of 2022 as issues surrounding affordability persist, slowing import requirements.

- Refinery run rates are to remain elevated through the second half as global supply chains respond to sanctions on Russian oil and gas. This will bolster the production of sulphur, adding to the potential for prices to ease once again.

- Indonesian sulphur imports are expected to reach a record high of close to 2 million tonnes this year. This is in response to the ramp-up of nickel HPAL projects, a bright spot in the market outlook.

- Outlook: Prices are expected to continue to rebound in the short term following the market collapse but this is likely to be short-lived. Key market fundamentals point to slow demand, impacting import requirements, at a time when supply is improving. A more bearish tone is expected to persist through the first quarter of 2023.

SULPHURIC ACID

- Supply side factors could provide some support to the extent of the downturn but these are likely to be limited because of the continued demand destruction. High energy prices are a continued risk to the market on both the supply and demand side. The European market seems particularly exposed to this with end users struggling to pass on raw material costs.

- On the supply side Nyrstar announced its Budel smelter would be placed on care and maintenance from 1 September 2022 until further notice, reducing acid availability.

- The risk of a global recession remains with the potential for a protracted downturn through 2023. Supportive economic measures in China have yet to positively impact base metals prices.

- Annualised, Chinese exports total 4.5 million t/a for 2022. We expect a slowdown in the second half of the year, but exports are still expected to reach close to 4 million t/a this year with the potential to exceed this level.

- Outlook: The global sulphuric acid market is facing a period of softening, with the bearish sentiment expected to persist through the rest of the third quarter. There is potential for some stability to emerge at lower prices during the final quarter of the year and going into 2023 but the outlook for processed phosphates remains weak and is likely to keep downward pressure on acid demand and prices for the short term.