Sulphur 403 Nov-Dec 2022

30 November 2022

Market Outlook

SULPHUR

- New supply-side capacity additions in 2023 will increase export availability from the Middle East. Projects have already been ramping up in Qatar, Saudi Arabia and Kuwait.

- Phosphates-based sulphur demand is expected to see some recovery in 2023 following demand destruction this year. This should mean increased sulphur import demand in key markets.

- The ongoing Ukraine crisis is a significant uncertainty for the outlook, particularly because of Russian sulphur trade being hampered by economic and financial sanctions. Two tier pricing is expected to remain in place for product moving from the region.

- Strength in the nickel market as demand for battery materials continues to rise will impact sulphur trade flows. Indonesia nickel-based demand will see further increases with supply needed for the fourth quarter. The year ahead also looks robust for trade to the country as HPAL projects continue to ramp up.

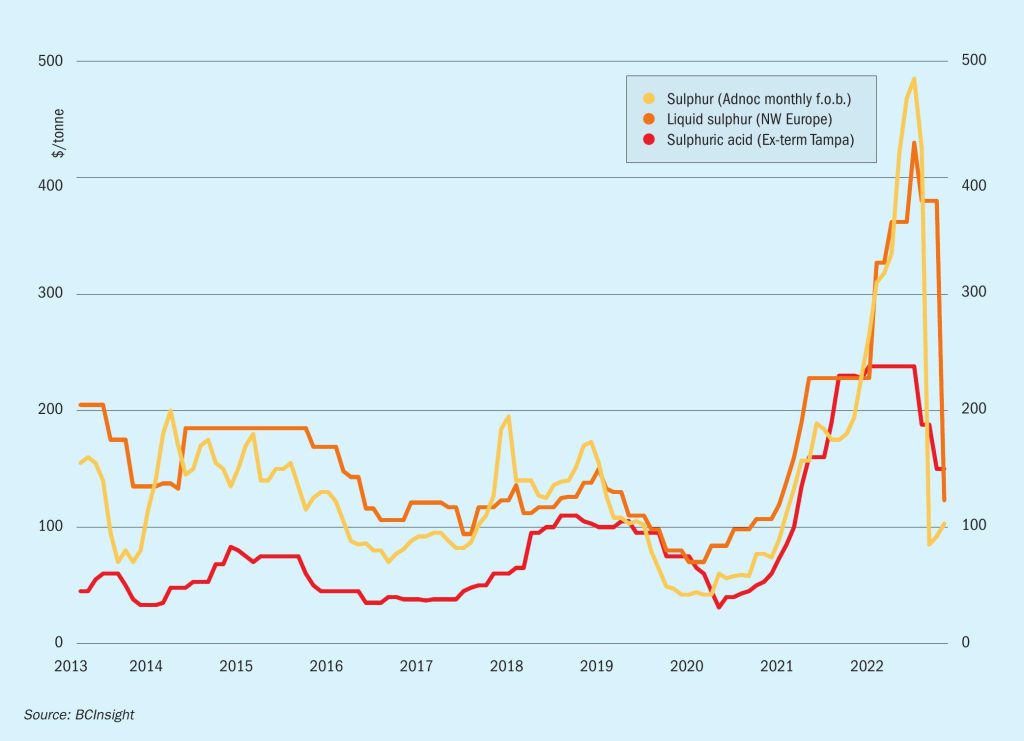

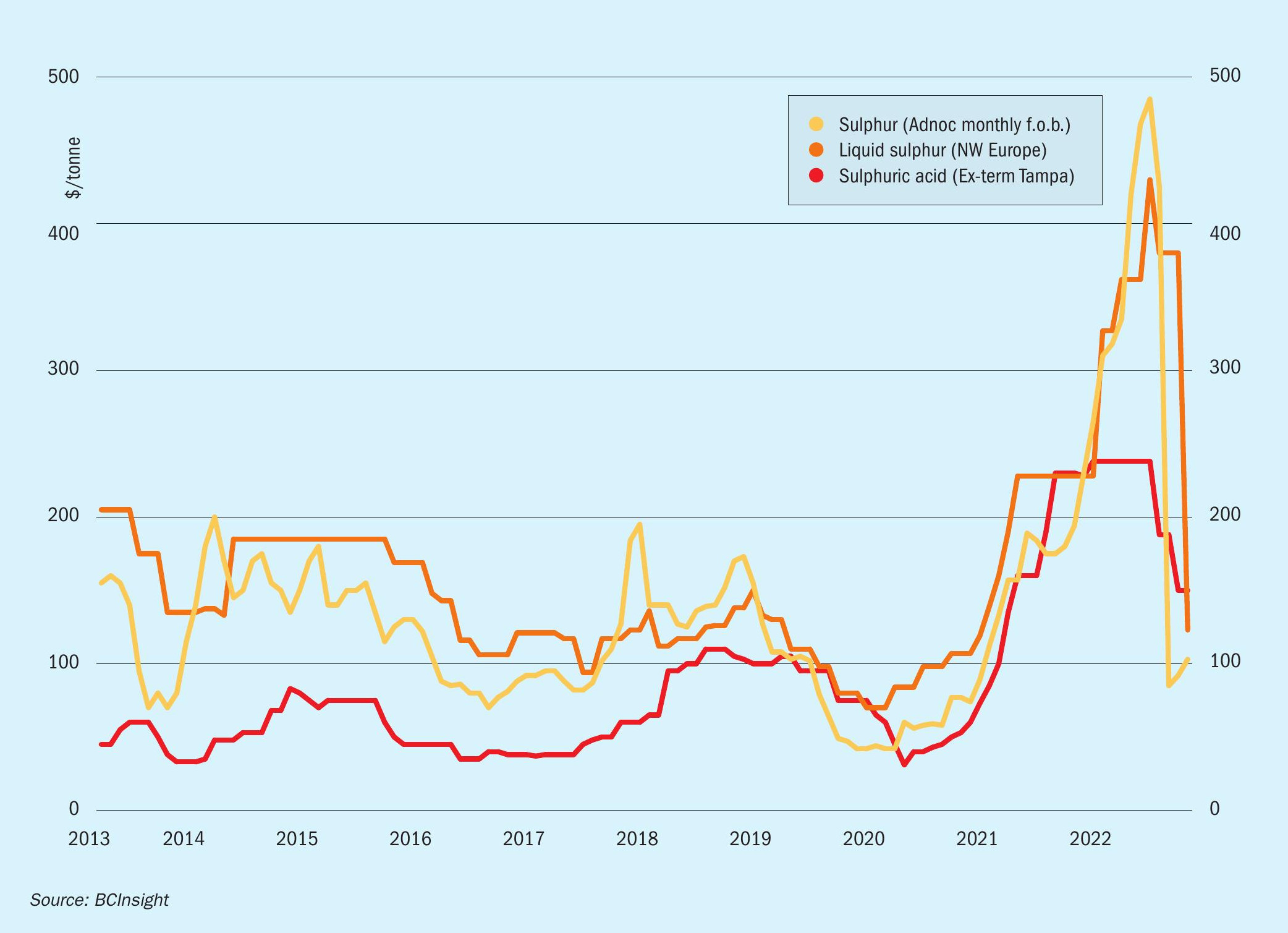

- Outlook: Global sulphur prices will continue to rise with the potential to stabilise towards the end of the year, another rebound is likely at the start of 2023 but much will hinge on Chinese buying activity in January. The year ahead should see less dramatic increases and decreases in prices based on the current view for supply/ demand. The second half of 2023 is expected to be a deficit market, likely supporting another price uptick.

SULPHURIC ACID

- Energy costs will continue to impact operating rates at both suppliers and end users in Europe. Tighter availability of smelter acid has been a feature of the market this year and is likely to persist into the new year.

- Downstream operations in Europe with associated sulphur burners are at risk because of a looming threat of recession and slowing demand in some sectors. Reductions in operating rates will impact acid consumption. In some cases, burners are operating at higher levels for energy generation.

- Availability of acid from China is expected to drop on 2022 levels next year but is forecast to remain over 3 million t/a. Projects adding new acid capacity in the short term in China include Nanguo Copper and Daye Non-Ferrous Copper.

- Outlook: Developments in the freight market will be key to price direction for sulphuric acid in the short term. Expectations are for prices to rebound in the short term but a ceiling is likely from the more bearish view for processed phosphates. Uncertainty prevails around Chilean import demand for the remainder of the year but a decrease in demand in 2023 points to lower average prices compared with the levels achieved this year.