Sulphur 403 Nov-Dec 2022

30 November 2022

Price Trends

MARKET INSIGHT

Meena Chauhan, Head of Sulphur and Sulphuric Acid Research, Argus Media, assesses price trends and the market outlook for sulphur.

SULPHUR

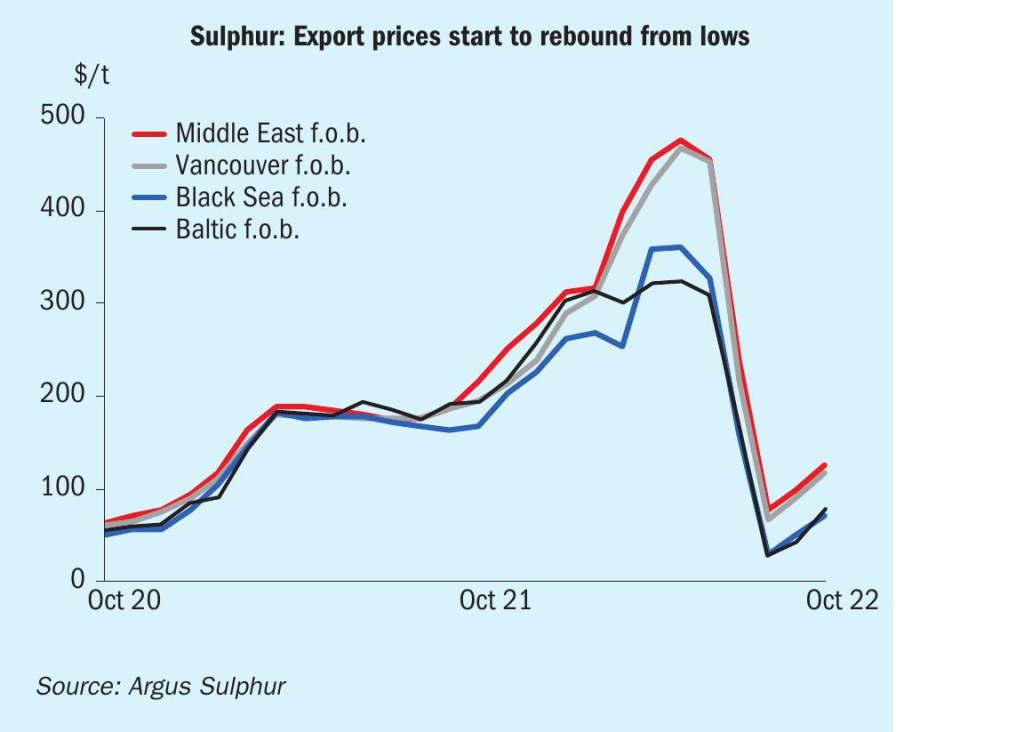

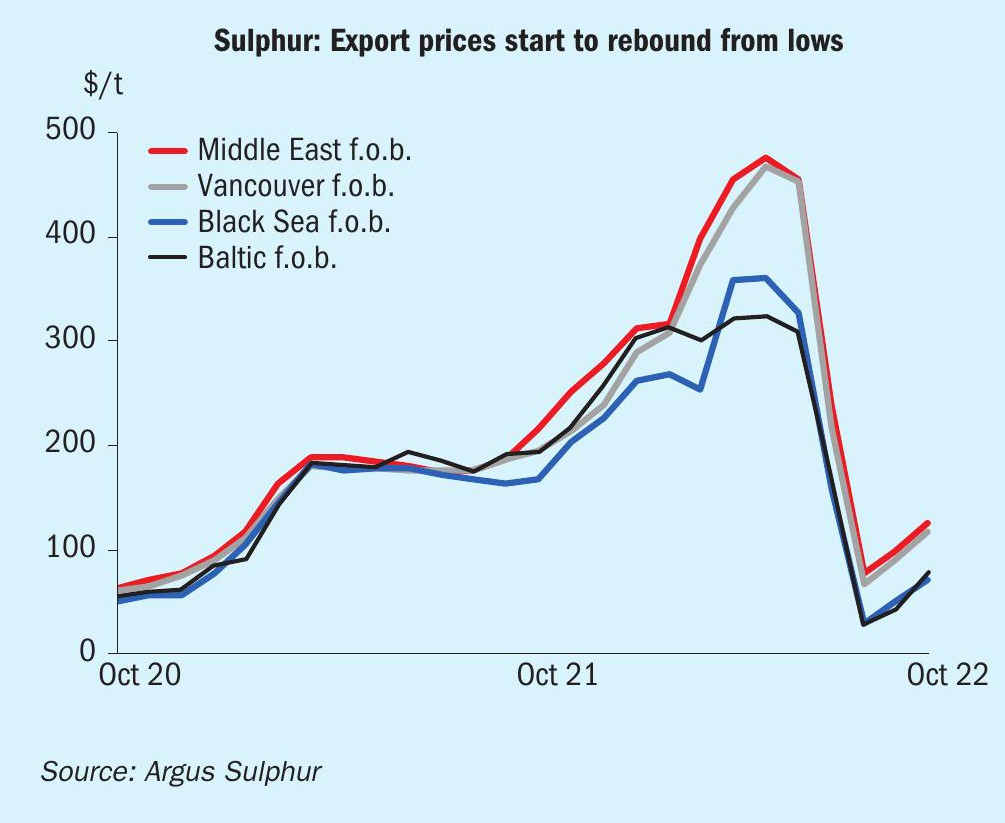

Global sulphur prices have been on the rise following a collapse during the back end of the third quarter. There appears to be further room for prices to firm through November, underpinned by expectations of a slight deficit during the month. Liquidity in the processed phosphates market has been reducing, with prices expected to ease further in some regions going into the new year.

Contract negotiations for fourth quarter delivery to north African buyers were reported ranging $103-130/t c.fr. This includes supply from the Middle East and Central Asia. Reduced volumes of crushed supply are expected to flow from Central Asia through the remainder of the fourth quarter following an explosion on a bridge that links Russia to Crimea on 8 October. OCP Morocco increased sulphur purchases once it secured the full volume in an Ethiopian tender to buy NPS. Tenders to South Asia were also secured. OCP has earmarked 4 million tonnes of fertilizers for Africa in 2023, double the volume in 2021. We currently expect sulphur demand to rise by over 2 million t/a in 2023 on this year, leading Morocco to become the top global sulphur importer.

Strikes in sub-Saharan Africa meanwhile have been disrupting product moving from Zambia to the DRC. The National Union for the Protection of Truckers in the DRC blocked freight trucks from crossing the border into Haut-Katanga and Lualaba over 5-10 October. Drivers in these provinces were protesting against violent crime at roadblocks, against the $50-150/truck tolls imposed by local communities, and against the presence of unregistered foreign workers. Sulphur inventories at ports in Africa have been a topic in the market, with estimates of high inventories at high prices alongside the logistical challenges.

Average Middle East prices have increased by $46/t between August and the beginning of November 2022 at $124/t f.o.b., but are around $188/t lower than prices at the start of the year. Kuwait’s KPC set its October sulphur lifting price at $105/t f.o.b., up by $10/t from the September price. ADNOC set its October official sulphur price (OSP) for liftings to India at $103/t f.o.b. Ruwais, up by $11/t from the September price. Meanwhile Muntajat set its October Qatar sulphur price at $104/t f.o.b. Ras Laffan/ Mesaieed, and announced its November price at $149/t f.o.b., up by $45/t on the October price. This marks a continued uptick with a $72/t increase since the month of August. This is indicative of the market direction, with momentum for this to continue in the short term. The November QSP implies Chinese delivered prices at $178-183/t c.fr based on freight rates at the end of October of around $29-31/t to south China and $33-34/t to Chinese river ports.

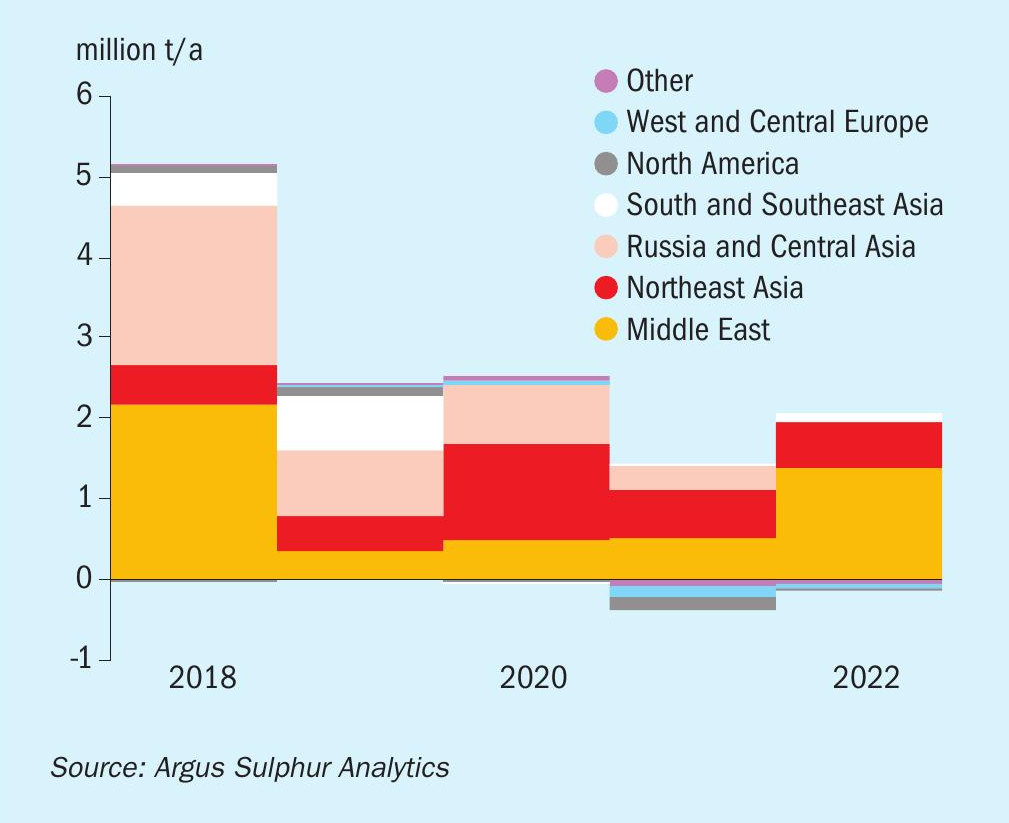

The China c.fr all forms range was assessed by Argus at $60-175/t c.fr at the end of October, with the low end reflecting molten product and the high end granular sulphur. Average prices have increased by around $31/t since August, in line with market demand and fob values trajectory. China imports were broadly stable in January-September 2022 compared with a year earlier at around 6 million tonnes. Shipments from South Korea continue to dominate this year at just under 900,000 t in the period while the UAE was the second largest supplier at close to 700,000 t. Projects expected to impact the short-term view for new sulphur capacity in China include Petro China’s Jieyang refinery and Shenghong Petrochemical’s Lianyungang refinery. The rise of domestic sulphur production continues to impact the forward view for import demand. A decrease in imports is expected in 2023 as further domestic capacity is brought online.

Over in the US, fourth quarter Tampa molten sulphur contracts settled at a drop of $262/long tons to $90/lt delivered. This was the lowest price since the fourth quarter of 2020. The increase in production alongside reduced demand from the processed phosphates sector because of demand destruction and technical issues were factors in the drop. US production in January – August 2022 totalled 5.3 million tonnes, 450,000 t/a higher than the same period a year earlier, according to USGS data. The upward trend has been driven by a recovery and improvement in fuel demand following global pandemic related reductions in 2020-21. Sulphur recovery was also healthy through the rest of the third quarter. Our current expectation is for 2022 production to total 8.2 million t/a, similar to levels last seen in 2019, although we do not expect oil-based production to return to pre-2019 levels in the outlook.

SULPHURIC ACID

Global sulphuric acid prices have continued to deteriorate in recent months, although signs of stability started to emerge in October. Major contract negotiations remain under way at a time when liquidity has been limited, leading to some stability in key prices in the first half of October. Demand remains a concern for the short-term view but with the recent rebound in sulphur prices, acid prices are expected to remain stable to firm. The downstream processed phosphates sector has been the main concern on the demand front. Demand destruction in recent months will impact projected consumption levels for the remainder of the year. In Japan and South Korea, the upturn in sulphur prices led to smelters awaiting firmer acid f.o.b. prices at the end of October before concluding deals, with incoming bids understood to be unworkable.

Average northwest European acid prices have dropped by over $110/t between August and the end of October down to $40/t f.o.b., around $190/t below prices at the start of the year. The energy crisis in Europe continues to affect operating rates at smelters. Nyrstar’s Budel zinc smelter in the Netherlands remains offline operations were halted in mid-August because of high energy costs. Nyrstar is likely to maintain this course of action into the winter with the increasing uncertainty around energy prices. In August Nyrstar said its Auby site in northern France would continue “at the curtailed production levels announced last year”. Shutdowns at Umicore in Belgium and at Zijin Bor in Serbia are contributing to further tightness in smelter acid during the fourth quarter. Meanwhile Glencore was expected to put its zinc smelter at its Nordenham plant in northern Germany under maintenance beginning 1 November, because of high energy costs. Some major European producers finalized fourth quarter smelter acid contracts leading the range to be assessed at e146-176/t c.fr. This reflects rollovers and a drop of e10-15/t in some cases.

A fire at Mejillones port in Chile has caused concerns over port logistics including the unloading and storage of sulphuric acid. The full impact is uncertain with another terminal still operational. The import demand outlook for Chile is unclear with mixed views on when operations will be back to normal. Some industry sources expect a reopening at the end of November, while others consider this timeline to be optimistic and expect a year end resolution. The acid deficit for 2022 is expected to reach 3.2 million t/a, dropping slightly next year based on the supply and demand balance. Contract discussions for 2023 are continuing with freight still a core factor affecting the short term forward view for acid. Freight from South Korea/Japan to Chile was estimated at $150-160/t at the start of November.

Codelco has lowered its copper production guidance for the year after output and profits fell sharply in the first nine months of 2022. Codelco produced 1.06 million tonnes of copper in January-September, down by 10.4% on the year, according to the company’s most recent filing. Falling production was driven by lower grades and recovery rates in Ministro Hales, and lower ore grades and a drop in recovery rates at copper concentrator plants in Chuquicamata and El Teniente. Problems at Chuquicamata smelter also impacted output. Codelco will carry out major maintenance at the smelter in November.

Chinese sulphuric acid exports are still expected to reach record levels in 2022 with trade data showing a 74% increase in the January-September period on a year earlier at 3.1 million tonnes. Chile, Morocco and India were the top three markets so far this year, absorbing 2.2 million tonnes of Chinese exports combined. A slower fourth quarter is expected but total exports are forecast at close to 4 million t/a. In the year ahead, we would expect exports to rise, but domestic demand will play a role in availability. Uncertainty remains around export restrictions on processed phosphates for 2023, a return to more regular trade would increase sulphur and sulphuric acid consumption in the country, potentially absorbing some of the surplus in the market.

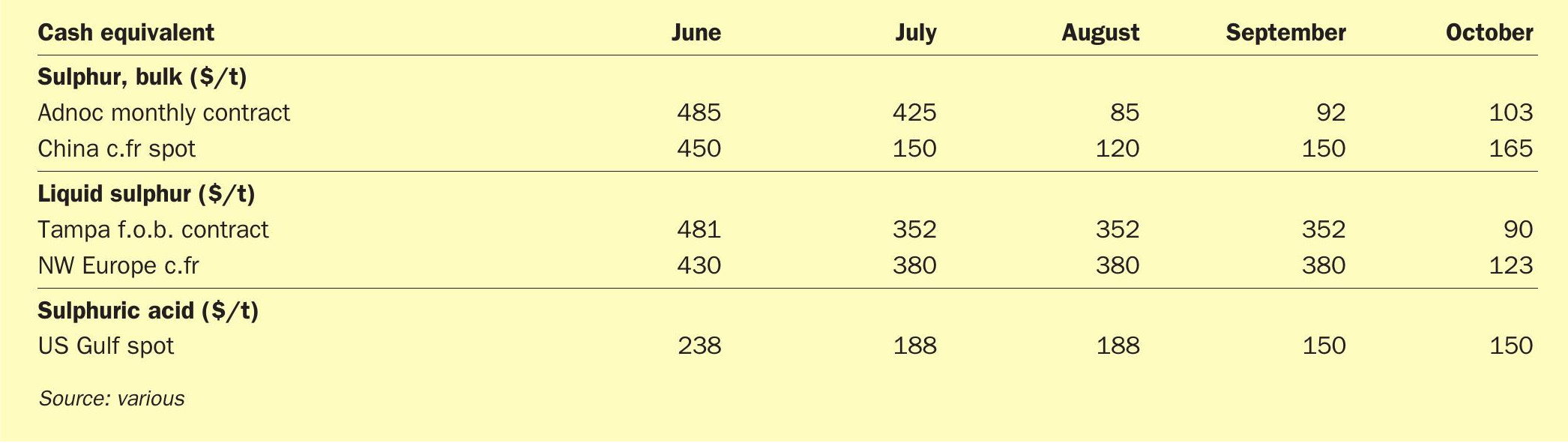

Price Indications