Sulphur 404 Jan-Feb 2023

31 January 2023

Market Outlook

SULPHUR

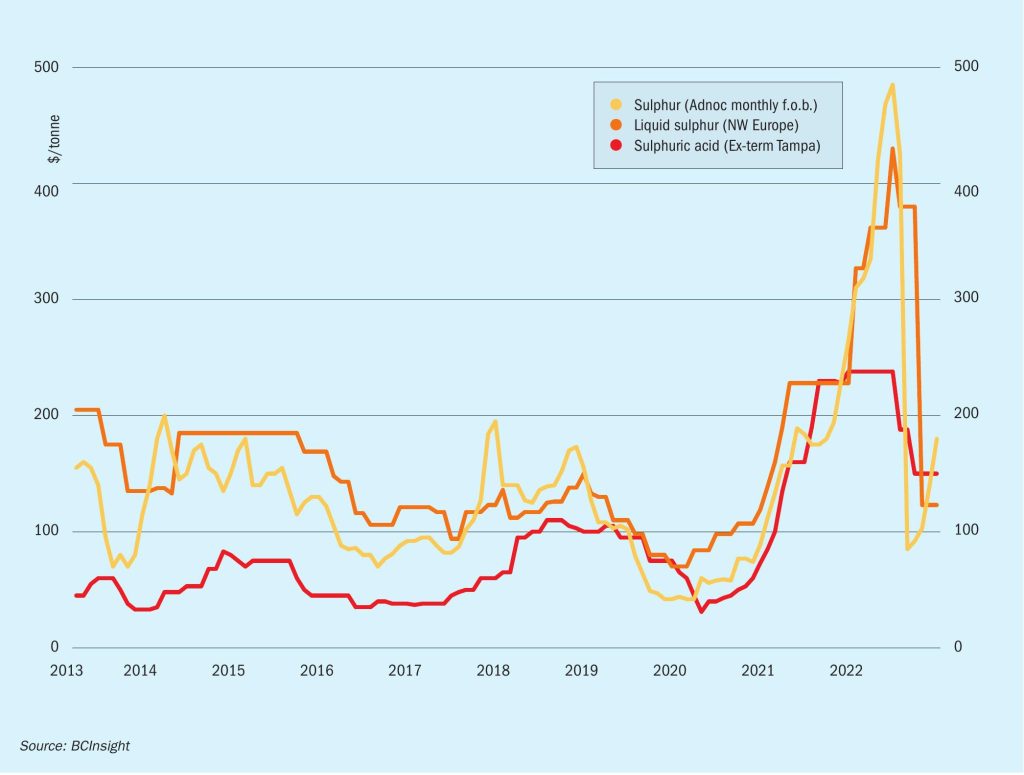

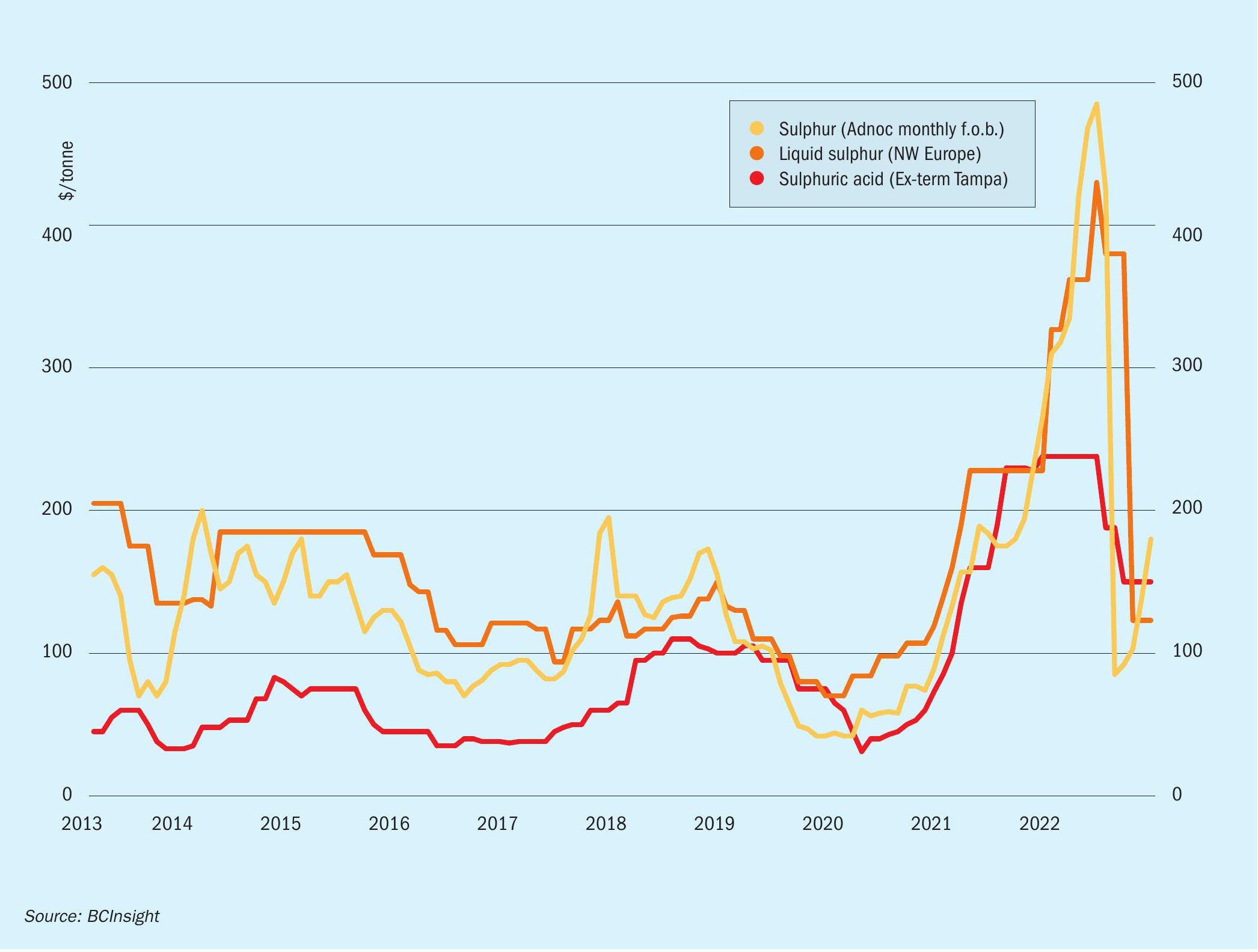

- Processed phosphates pricing will be a major influence in the coming months. A gap remains between historical levels of sulphur and DAP pricing that points to the potential for sulphur prices to recover to higher levels during 2023.

- Whether China returns to the processed phosphate market and at what pace will be key to sulphur consumption levels for sulphur from the second quarter onwards. Sulphur imports in China are forecast to drop to 7.8 million t/a in 2023, but this could drop lower if phosphoric acid-based demand does not reach expected levels.

- Developments in the Russia/Ukraine conflict still pose many questions for the sulphur market. Exports of Russian sulphur are estimated to have totalled around 1 million t/a in 2022, with a similar level forecast for 2023. This will be subject to revision as policy and sanctions continue to restrict the movement of supply from the country.

- Outlook: Prices are expected to continue to soften in the short term on the back of weak sentiment before potentially stabilizing and rebounding. Following the demand decline in 2022, a return to growth is expected this year, but the macro-economic picture remains a risk to this. New capacity additions will add to the balance but this is expected to be exceeded by an increase in demand, leading the market to an overall deficit in 2023.

SULPHURIC ACID

- Chile contract negotiations have concluded for 2023 supply. The majority of contracts settled in a range of $143-148/t c.fr. Meanwhile spot prices were below this level at the start of January, at $135-140/t c.fr. Little spot demand is expected to emerge in the short term. The deficit for Chile this year is forecast to drop on 2022 levels, adding to the expectation for lower prices.

- Copper projects in Western US continue to progress and demand in the country for the sector is forecast to rise by around 200,000 t/a in 2023 on a year earlier.

- Japanese and South Korea acid export availability is expected to drop this year because of scheduled turnarounds. Combined supply is forecast at 5.3 million t/a in 2023.

- Outlook: The price correction in the global acid market is expected to persist in 2023 following the upward trend in the past year. Stability is expected in the short term with the potential for prices to increase later in the year as demand improves, supporting acid trade. The expected rise in sulphur prices in the second half of 2023 will also support acid markets.