Sulphur 405 Mar-Apr 2023

31 March 2023

Price Trends

Meena Chauhan, Head of Sulphur and Sulphuric Acid Research, Argus Media, assesses price trends and the market outlook for sulphur.

SULPHUR

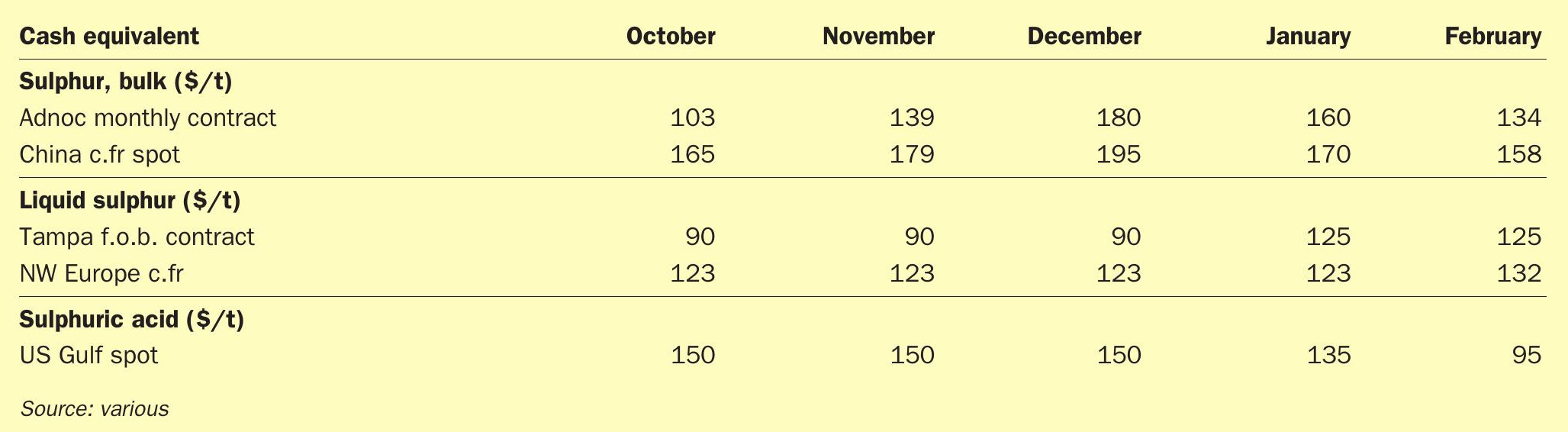

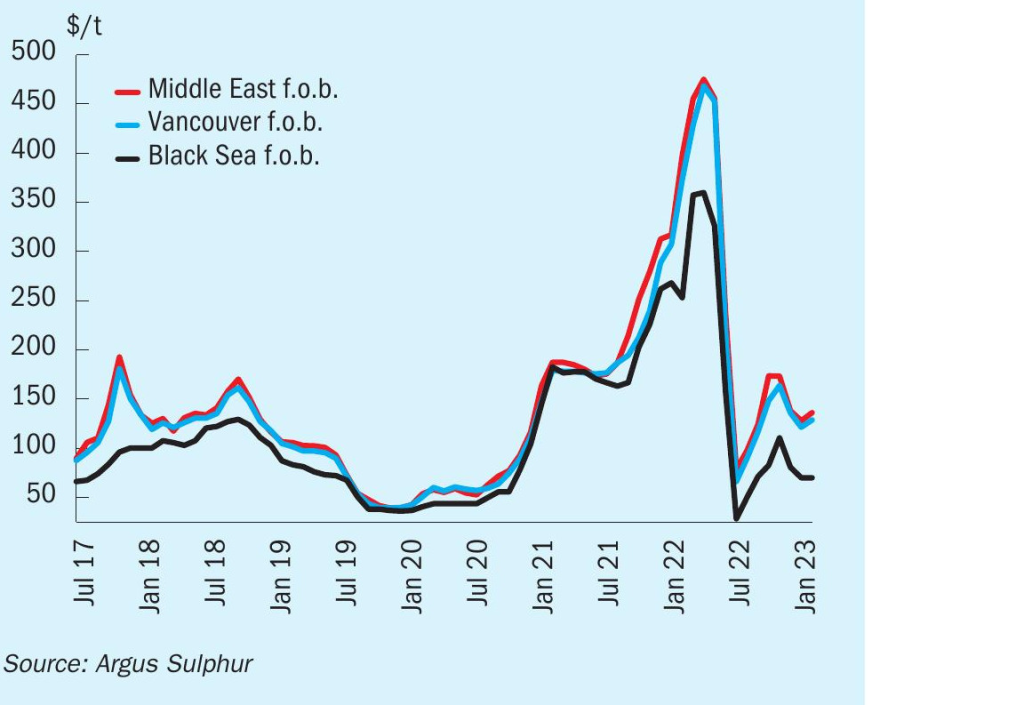

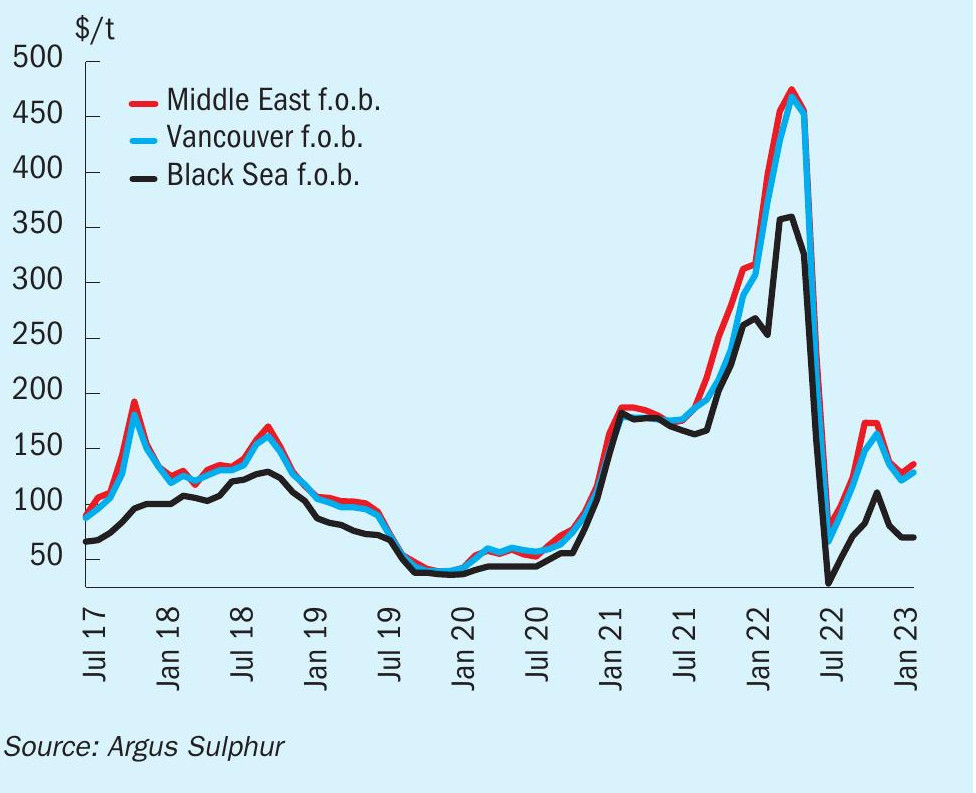

Global sulphur prices softened between February and March following a small uptick as buyers entered the market. Sluggish activity in the processed phosphates market has underpinned this trend. While demand emerged in some markets, including China, buyers have had limited appetite to accept higher prices. This slowdown in purchasing has added downward pressure to major benchmarks in March. Price recovery is not expected until June, with further softening expected as second quarter contract negotiations gear up, with initial indications pointing to bearish factors underlying price direction in major regions.

Average monthly Middle East prices decreased by around $3/t over the first quarter, down to $135/t f.o.b. by mid-March, over $270/t lower on prices a year earlier. Qatar’s state-controlled Muntajat set its March Qatar sulphur price at $33/t f.o.b. Ras Laffan/Mesaieed, up by $9/t from the February QSP of $124/t f.o.b. The March QSP level implies delivered pricing to China of $155-161/t c.fr at freight rates, which estimated at $22-24/t to south China and at $26-28/t to Chinese river ports for a shipment of 30,000-35,000t. Kuwait’s KPC set its March Kuwait sulphur price (KSP) at $136/t f.o.b. Kuwait, reflecting an increase of $12/t on the February price. Meanwhile Abu Dhabi’s state owned ADNOC set its March official sulphur price (OSP) for liftings to India at $134/t f.o.b. Ruwais, up by $7/t from the February price.

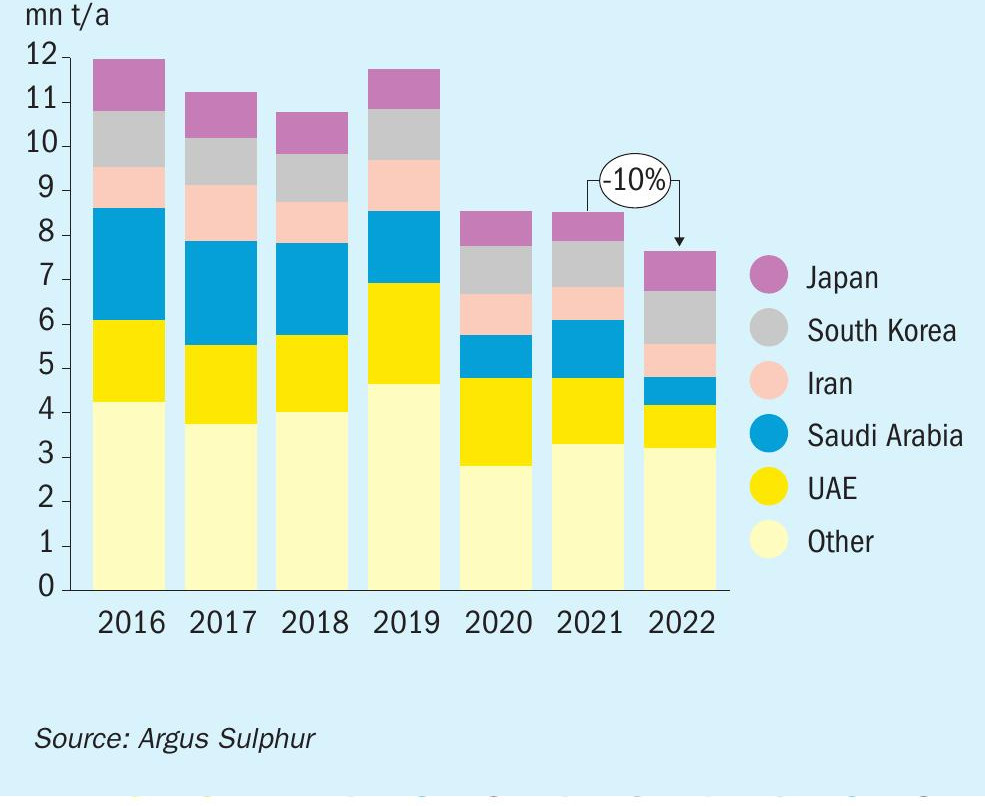

In supply news, KPC loaded the first sulphur export shipment of 40,000t from its new Al-Zour refinery in March. Going forward, sulphur is likely to be offered under spot tenders, but as operations increase and supply becomes more predictable fixed contract arrangements are likely. Higher output from the refiner is expected to increase Kuwait’s sulphur exports alongside the recent ramp up of its Clean Fuels Project. Total sulphur capacity in Kuwait is expected to reach 2.8 million t/a in the medium term because of the new refining projects.

Indonesian nickel producers led the recent upward price momentum but now appear to be well covered for the short term. Buyers re-entered the market in early March to secure around 30,000t of sulphur for delivery in the April-May period. Prices ranged between $163-167/t c.fr, levels not expected to be achieved again until late in the second quarter. The short term sulphur requirement for nickel high pressure acid leaching projects is a key driver for trade in 2023-2024 as new burner capacity is brought online. Indonesian sulphur imports totalled 2 million t/a in 2022 for the first time, a significant rise on just over 1 million t/a imported a year earlier.

The drive for battery materials to meet growing demand in the electric vehicle sector is a key focus for the sulphur and sulphuric acid markets. Outside of Indonesia, further developments are expected to impact the longer term view for sulphur consumption. Canada-based mining firm Lithium America has started construction at its Thacker Pass lithium project. First lithium carbonate production is targeted to start in the first half of 2026.

Russian sulphur has continued to trade at a discount to other exporting regions and is moving to markets such as Egypt and Turkey, a trend Argus expects will continue in the short term. Market potential for Russian tonnes remains limited owing to the ongoing conflict in Ukraine and associated financial and economic sanctions. Constrained Russian exports are not expected to have significant impact on the market however as capacity is growing in the Middle East and Asia, offsetting this loss. We assume there is considerable stock build going on in Russia as production levels grew in 2022 on 2021 levels while exports were estimated at around 1 million t/a for the year.

Demand from Moroccan processed phosphates producer OCP was largely muted through the first quarter of the year. Argus data shows sulphur arrivals will be lower than a year earlier. An increase in Moroccan demand is expected this year compared with 2022 following demand destruction in the phosphate fertilizer market. There is a risk to the potential for this rebound because of continued downward pressure on DAP prices. Sulphur import demand in Morocco is expected to increase from the second quarter onwards to meet expected levels of phosphoric acid production.

Over in China, spot market activity is expected to be limited throughout April as rising domestic supply limits the need for short term requirements from international suppliers. Port inventories as of 10 March were at 1.6 million tonnes. Further price softening may encourage buyers to the market, but demand will likely hinge on the widely anticipated lifting of export restrictions on processed phosphates exports. The subsequent expected downturn in Chinese DAP prices will limit price potential for sulphur. The recent erosion of sulphuric acid export prices to negative values in parts of northeast Asia may temporarily slow acid exports from China, with the potential to supply domestic buyers. This would further pressurise sulphur import demand and pricing potential.

SULPHURIC ACID

Global sulphuric acid prices have softened so far in 2023 because of ample supply in the market, as many regional buyers moved to the sidelines of the spot market. Asian fob prices dropped into negative territory, at $-10/t f.o.b. on the low end on 9 March, according to Argus assessments. There is potential for further price erosion in the short term before a floor is reached. Global acid demand will see a strong rebound this year, providing support for a recovery in pricing from the second quarter onwards. Phosphoric acid-based demand will see a boost this year following demand destruction in 2022.

Average prices out of Northwest Europe decreased by $25/t between January and March, assessed by Argus at $9/t f.o.b. at the midpoint. Supply is a key focus in the region with smelter operating rates expected to be higher this year. The Ecobat lead smelter in Stolberg, Germany, was due to resume operations in March.

In supply news, Chile’s senate has passed a law allowing state copper miner Codelco to close its aging Ventanas smelter in the Valparaiso region. The law passed on 7 March enables national mining company Enami, which supports small- and medium-sized miners, to process copper concentrates at other smelters run by Codelco. Within 90 days of the law’s publication, the mining ministry will have to present a report to congress containing proposals to increase Chile’s state copper smelting capacity. Codelco’s board announced on 7 June 2022 it would advance closure of the smelter, which has capacity to treat approximately 400,000 t/a of concentrates, rather than invest to improve its environmental performance. Acid capacity at the smelter is estimated at 650,000 t/a.

Spot demand in Chile was muted in March with ample supply. Some acid tanks were reported to be at capacity and price ideas in mid-March were $100/t c.fr, down around $27/t on average prices in January. The Ventanas port in Chile started resuming operations from the second half of February after a major fire on 22 December, with copper concentrate exports from the world’s largest copper producer gradually increasing, according to market participants. Blockades at a key mining highway in the world’s second-largest copper producer Peru were temporarily lifted. The highway is a key transport route for Swiss resources firm Glencore’s Antapaccay and Chinese firm MMG’s Las Bambas mines. It has been blocked by protests against newly-elected Peruvian president Dina Boluarte since January.

Demand from Latin American buyers should emerge for the second quarter, with lower pricing expected to encourage buyers to the spot market. The continued downturn in processed phosphates pricing will likely put a ceiling for acid. Average acid prices in the Brazilian spot market were assessed at $112/t c.fr in mid-March, down by $27/t on the start of the year. Acid imports to the country are expected to be stable in 2023 on last year at around 850,000t.

Global acid demand growth in 2023 and 2024 combined is expected to boost consumption by over 18 million t/a. Phosphoric acid is expected to lead demand growth in 2023, adding over 4 million t/a on 2022 levels. This marks a recovery following demand erosion in the sector last year. Meanwhile, demand from the metals sectors is expected to add about 1.6 million t/a in 2023 from 2022 levels. On the supply side we expect capacity across all sources to total over just over 13 million t/a between 2022 and 2023. Smelter-based capacity is expected to see a boost at 2 million t/a. China remains the main driver of smelter capacity additions in the short term but project developments in India and Indonesia will also impact the balance going forward.

PRICE INDICATIONS