Sulphur 406 May-Jun 2023

31 May 2023

Price Trends

MARKET INSIGHT

Meena Chauhan, Head of Sulphur and Sulphuric Acid Research, Argus Media, assesses price trends and the market outlook for sulphur.

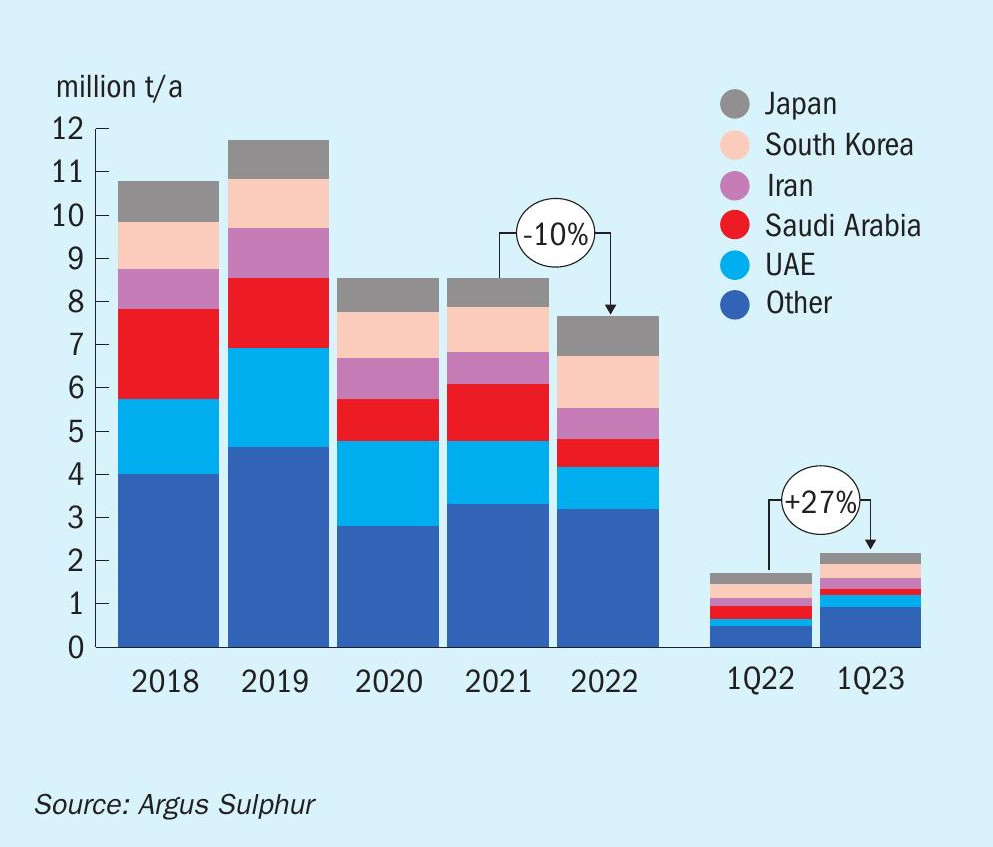

SULPHUR

Global sulphur prices continued to soften between March and April, and this trend is expected to continue in the short term, with the potential for some slight uplift in the month of July before resuming the softer trend. The fourth quarter could also see a slight increase based on expected demand emerging in key import markets, and the trade balance currently reflecting a deficit for the quarter. Spot market interest was sluggish through the month of April, adding continued downward pressure on pricing as new business was concluded for May shipment arrivals at further lows. Looking to the key driver of sulphur market prices, processed phosphates, there is likely to be a ceiling on potential price recovery over the next year. Sulphur demand is forecast to rise in the fertilizer sector as phosphoric acid production rises relative to the slowdown in 2022. On the one hand, this will support sulphur trade over the course of the coming months, but the continued expected downward trend in processed phosphates pricing through until at least the first quarter of 2024 will likely keep sulphur prices subdued.

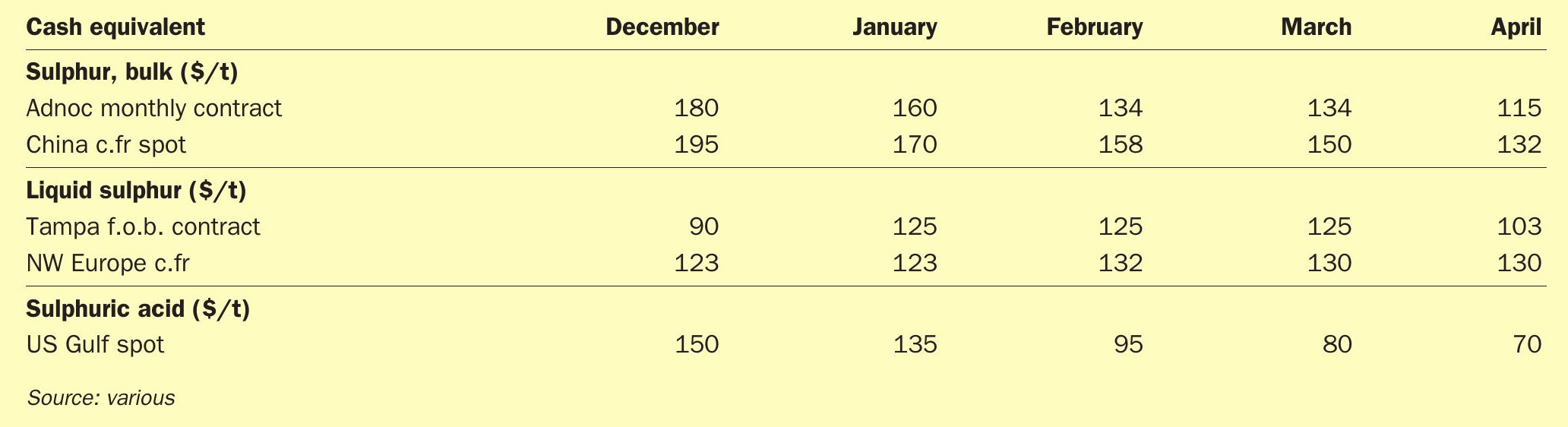

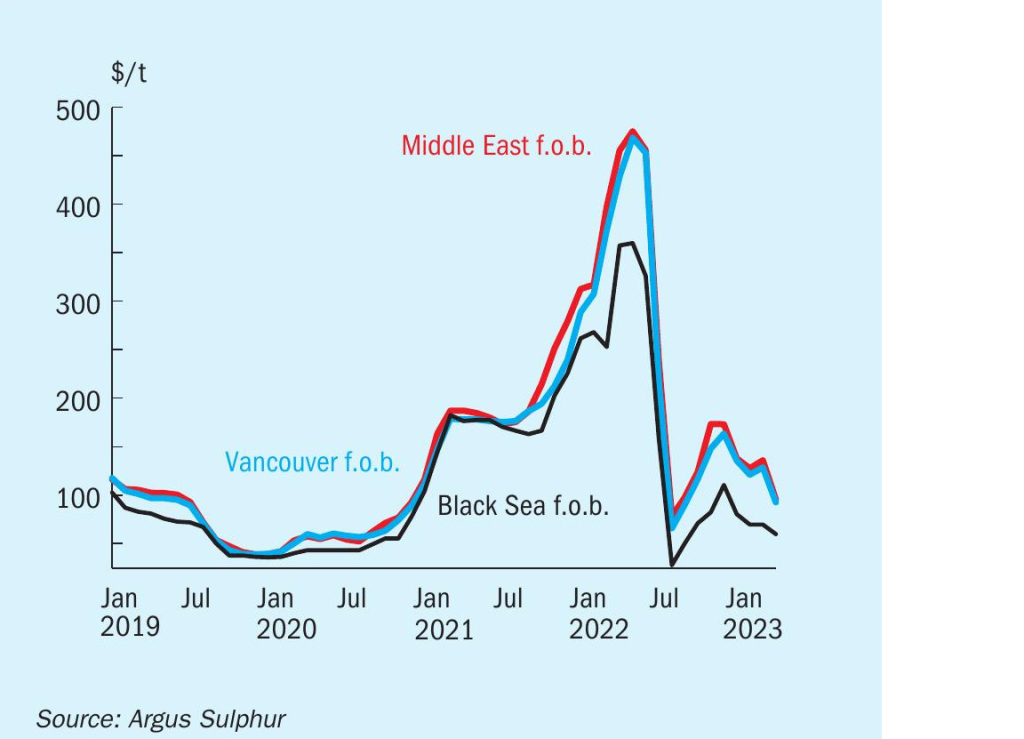

Average monthly Middle East prices decreased by around $33/t between March and April, down to $95/t f.o.b., over $380/t lower on prices a year earlier. Qatar’s state-controlled Muntajat set its May Qatar sulphur price at $86/t f.o.b. Ras Laffan/Mesaieed, down by $24/t from the April QSP of $110/t f.o.b. The May QSP level implies delivered pricing to China of $112-117/t c.fr at freight rates at the end of April. Kuwait’s KPC set its April Kuwait sulphur price (KSP) at $109/t f.o.b. Kuwait, reflecting a decrease of $26/t on the March price. Meanwhile Abu Dhabi’s state owned ADNOC set its April official sulphur price (OSP) for liftings to India at $115/t f.o.b. Ruwais, down by $19/t from the March price.

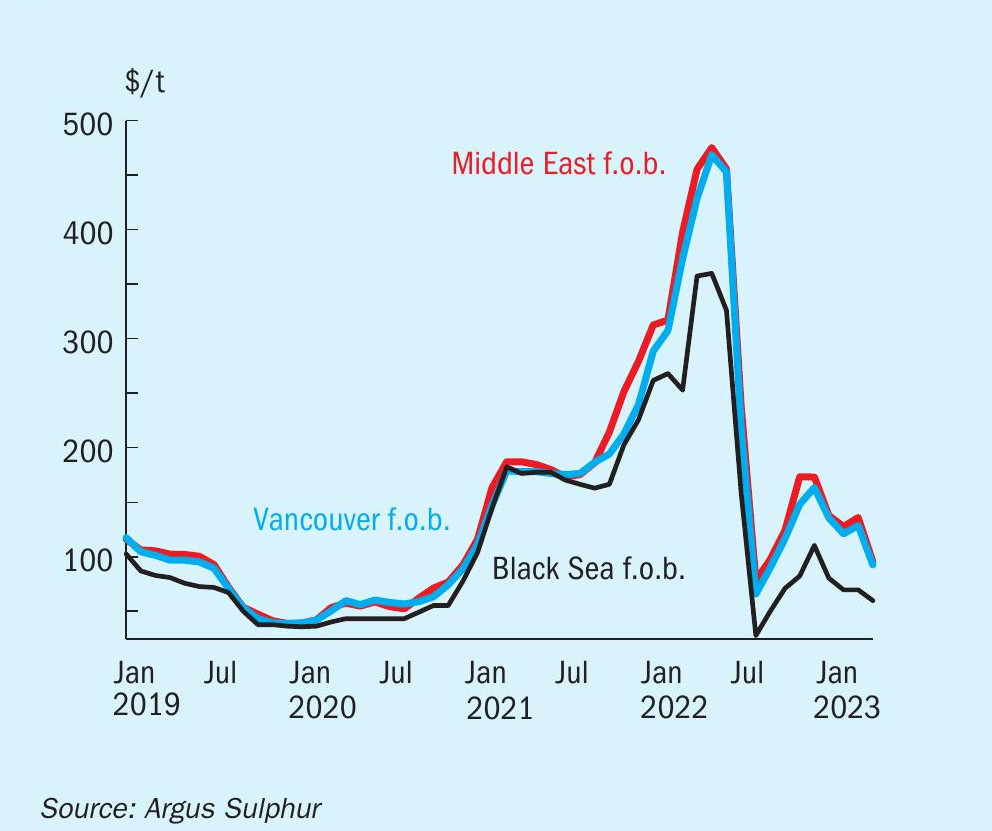

In supply news, Kuwait’s KPC has restarted one of two crude distillation units (CDU) at its 615,000 bbl/d Al-Zour refinery on 21 April after resolving technical issues that led to its closure. The status of the refinery’s No.2 CDU, which also went offline in early April because of technical issues. One March shipment of sulphur has been lifted so far from the new refinery with further sulphur liftings delayed. But Argus expects to see export availability continuing to rise in the region to make up the shortfall from the refinery. The increase in sulphur remains a key influence on short term pricing from the region. Sulphur export availability is forecast to rise by over 1 million t/a in 2023 on a year earlier, driven by an increase in production. Saudi Arabia and Kuwait lead growth with the continued ramp up of new capacity in the refining sector.

The north Africa spot c.fr price was assessed by Argus at $95-115/t c.fr. at the end of April. This compared to the contract range for supply for delivery during the second quarter at $105-130/t c.fr. This was down on the first quarter levels of $156-265/t c.fr. and the decrease reflects the softer tone in the market. This sluggish sentiment is expected to prevail through the rest of the second quarter, based on a weak global sulphur market and downward pressure from processed phosphates prices.

On the demand front in north Africa, one potential supportive factor is the expected increase in consumption in the phosphoric acid sector. Moroccan demand is expected to grow on 2022 levels but the growth expectation is at risk as OCP was operating at below capacity rates in April following a period of slow demand for processed phosphates exports. Short term spot demand from the sulphur buyer was not expected to emerge. The uplift in demand is possible from the third quarter which would support trade and provide a floor to the downturn in pricing.

Sulphur demand in China is expected to rise in 2023 on year ago levels. A key driver is the industrial sector, following only a limited increase last year. While there is still much focus on the developments of export quotas on processed phosphates in 2023, we expect sulphur consumption for phosphoric acid production will only see a minor increase. Some processed phosphates producers plan to cut production in May because of weakening domestic demand and the erosion of end product prices in the export market. Some smaller sized producers have already been operating at lower levels since March. Run rates were estimated at around 50-60% in southern China and around 60-65% in the river area in April. The reduction in output will slow sulphur consumption and adds to the more bearish sentiment for short term pricing in the market.

SULPHURIC ACID

Average global sulphuric acid prices have softened since the start of the year but showed signs of stabilizing or ticking up in April. The uptick is expected to continue in the short term but will be gradual. Concerns and risks remain around the continued downward trend in processed phosphates market prices, and with sulphur price softening, this has added to the potential for a ceiling on the sulphuric acid price recovery.

Latin American markets have been sluggish since the start of the year, with limited spot interest emerging in key market Chile as arrivals have been moving under contracts. End user tanks were reported to be at full capacity in April, supporting the view for limited spot volumes to encourage prices to rise. A closure was planned at the port of Mejillones in late April to 10 May, which will add to congestion, but end users were understood to be planning around the shutdown with a healthy line up through April. The Chilean acid market is expected to remain long in the short term but it remains to be seen how increased potential demand at copper mines could impact the balance. Price ideas for third quarter shipments have dropped down to $90-105/t c.fr owing to the weaker demand view. Over in Brazil terminal operations were suspended at Paranagua port in April while some repairs were underway. Prices in the country were assessed by Argus at $75-85/t c.fr on 27 April.

Base metal prices on the London Metal Exchange (LME) rose at the end of April as China’s Politburo – the foremost economic decision-making body of the country’s ruling Communist Party – reiterated its focus on economic growth, pledging possible fiscal and monetary policy support for the world’s top metals consumer through the second quarter. But price gains were capped by a more bearish outlook for Western demand, where sticky inflation has potentially left the door ajar for longer-lasting policy intervention by the US Federal Reserve and the European Central Bank (ECB).

While China’s economy continues to recover this year – its economy grew at a faster than expected pace in the first quarter – demand headwinds remain for the country and analysts have argued that growth has mostly been uneven so far this year. Recovery in the real estate sector has been choppy with end-sales remaining low, with a persistent debt squeeze and a slowing world economy impacting a complete recovery from Covid-19 and supply shocks of last year. The Politburo has renewed its focus on improving consumption and private investment, creating optimism in base metals markets as a result. An upward trend in metals prices will support operating rates at mines and sulphuric acid consumption.

Major Chinese smelters Jiangxi Copper, Tongling Nonferrous, Yunnan Copper and Zijin Mining have planned maintenance on part of their production lines during April-June, which will result in reduced copper concentrate demand and sulphuric acid production in the second quarter. China’s sulphuric acid output and export availability is a key consideration for the market balance and pricing outlook in the short term following record export levels in 2022. New capacity is expected to come online in the short term, adding to the expectation for strong exports this year.

Meanwhile in Morocco key sulphuric acid importer OCP has been largely on the sidelines so far this year on the back of low operating rates at its processed phosphates operations. Acid imports were close to 63,500t in January-February 2023, well below the 319,000t imported a year earlier. China remains the largest supplier so far this year, followed by South Korea. North Africa acid prices were assessed at $45-105/t c.fr with further softening expected in the short term.

PRICE INDICATIONS