Sulphur 407 Jul-Aug 2023

31 July 2023

Market Outlook

Market Outlook

SULPHUR

Indonesian imports have increased in 2023 so far on a year earlier. As new nickel high pressure acid leach projects ramp up, demand for sulphur is expected to increase further. Swing buyers have been importing significant volumes of sulphuric acid, affecting short term sulphur demand in the second quarter. It remains to be seen if this will continue, we expect sulphur demand to ramp up further in the second half of the year, bringing import expectations for the year to around 2 million t.

China sulphur capacity is forecast to rise even further in 2023, with the first quarter reflecting a 5% year on year rise. After reaching a record 9 million t/a in 2022, we expect production to climb to over 10 million t/a. New gas-based capacity and refining projects will ramp up to support this view. l In Canada, a strike by members of the International Longshore and Warehouse Union (ILWU) Canada halted commodity loadings across Canadian-Pacific ports, including sulphur. The standstill of sulphur loadings will likely lead to a build up at Alberta prilling sites and inventory builds at production sites.

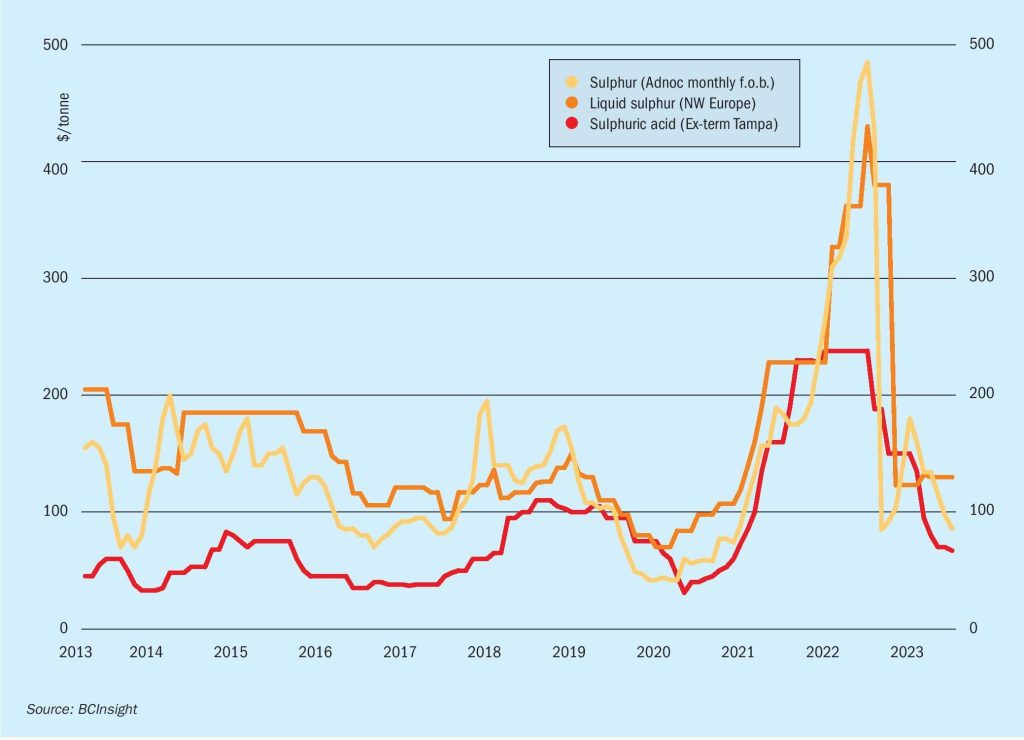

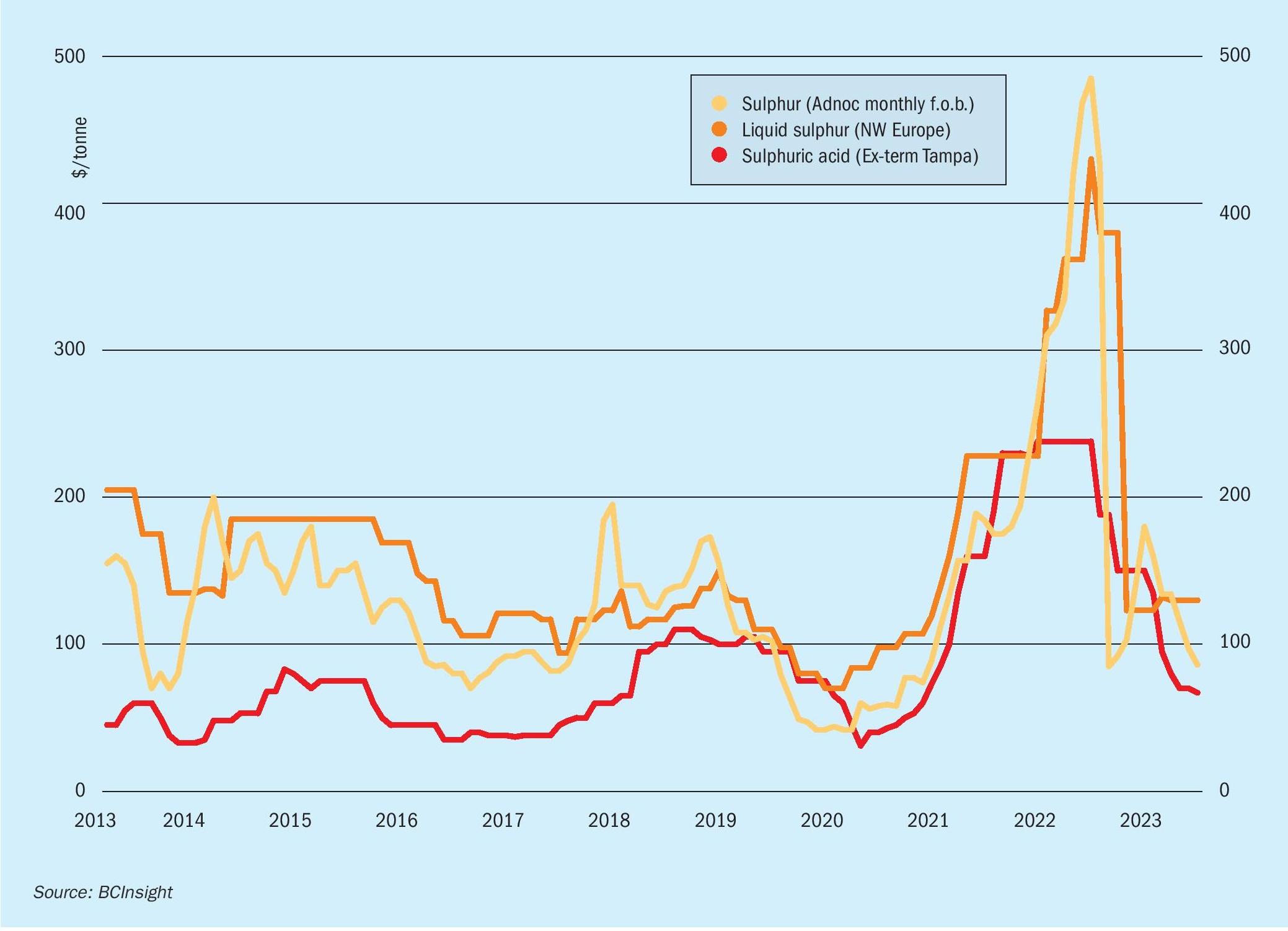

Outlook: Global sulphur prices are expected to stabilize and see slight uplift in July following the recent downturn. Consumption is emerging in key markets such as Indonesia, supporting the view for the downturn to turn to stability. Expected softness in DAP prices in the short term remains a bearish factor but with sulphur currently undervalued against DAP, there is room for increases in sulphur pricing.

SULPHURIC ACID

Morocco remains on the sidelines of the spot market, with no sulphuric acid vessels scheduled in the line up for Jorf Lasfar. OCP is expected to see higher consumption in the second half of the year but attractive sulphur prices are likely to keep interest in acid limited.

Negative pricing in South Korea/Japan has emerged on the back of cargoes for shipment in the August-September period with lower delivered prices in key markets. Smelter maintenance in Japan during the fourth quarter will limit acid availability, with potential for prices to rise on the back of this.

India buyers CIL and Iffco are expected to turn increasingly to the sulphur market with the start of new sulphur burning capacity in the 2023-24 period. Acid imports are expected to be impacted as a result.

Outlook: Further softening is likely before a floor in pricing is reached out of northeast Asia. Market sentiment remains weak from key markets such as Morocco and Chile. There is potential for recovery as demand returns and if sulphur prices start to see uptick, swing buyers may choose to enter the acid market.