Sulphur 407 Jul-Aug 2023

31 July 2023

New phosphate demand – India and Brazil

PHOSPHATES

New phosphate demand – India and Brazil

The centre of gravity of the phosphate industry continues to shift, with Chinese exports less important, and fresh demand coming from India and Brazil.

The phosphate market, which remains the mainstay of industrial sulphuric acid demand, has continued to seesaw over the past few years, hit first by covid and the attendant shutdowns, and then, when the global economy was beginning to recover, by Russia’s invasion of Ukraine and the attendant sanctions which restricted availability from key suppliers like Russia and Belarus.

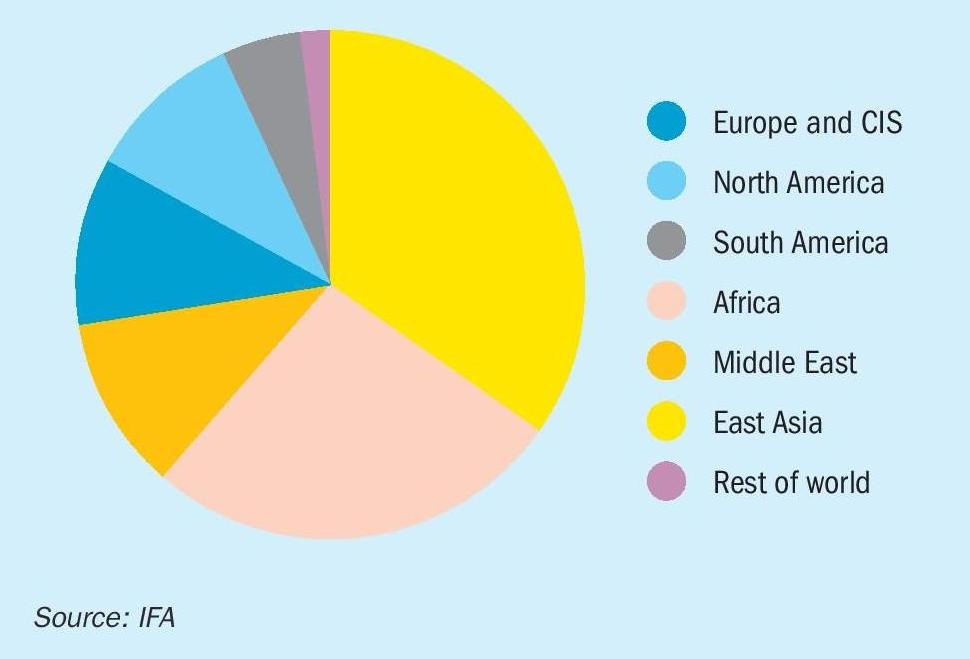

Global phosphate rock production stood at 62.9 million t/a P2 O5 in 2021, with production split as shown in Figure 1. The world’s largest producer remains China, which represents the vast bulk of East Asian production and which produced 21.3 million t/a P2 O5 of phosphate rock, 34% of the world’s supply, mostly for domestic consumption. Next comes Morocco, at 11.6 million t/a P2 O5 (18%), and the United States, with 6.3 million t/a P2 O5 (10%) of production. Russia was the fourth largest producer, followed by Jordan and Saudi Arabia.

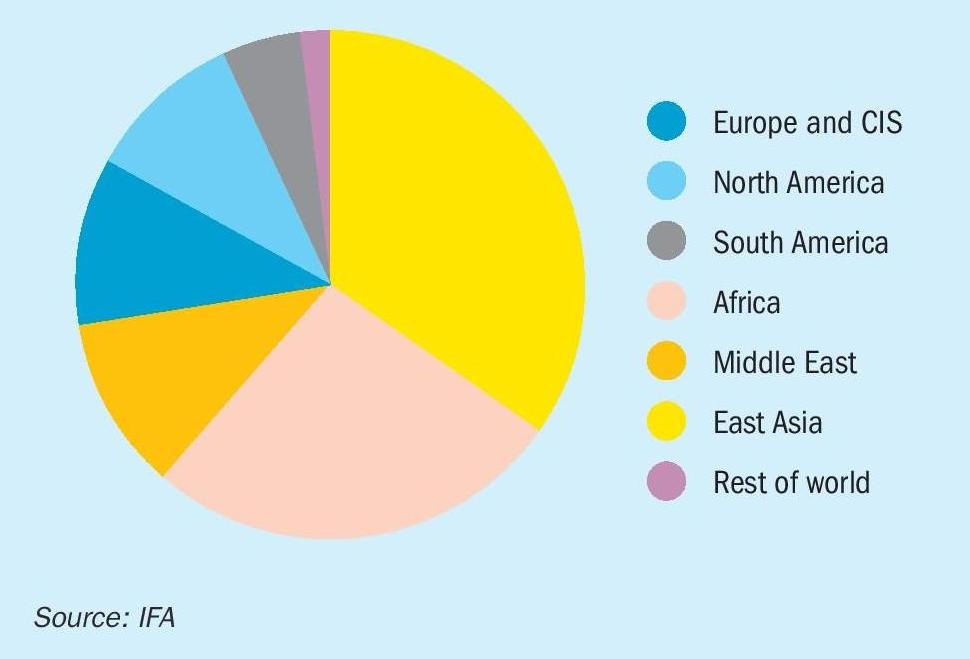

On the processed phosphate side, global phosphoric acid production was 44.9 million t/a P2 O5 , with production split as per Figure 2. On the whole the split is similar to Figure 1, but as Figure 2 shows, Africa produces less finished phosphates a share of world production, and exports phosphate rock to India, China and other places to produce finished phosphates. This is changing quickly however as Morocco expands its downstream phosphate industry.

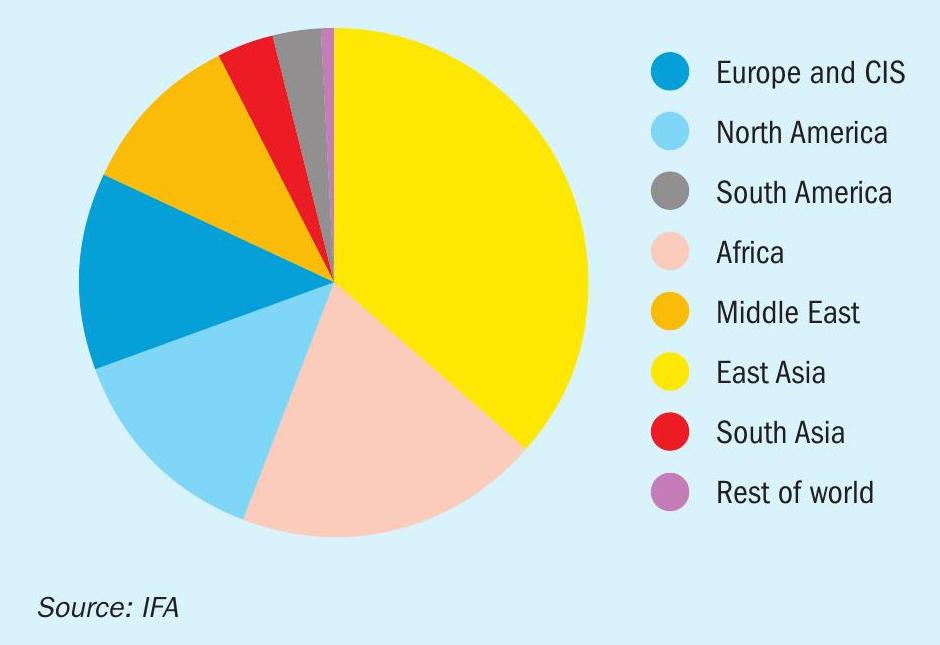

Overall, the regions that have the greatest influence on phosphate production and trade, and hence consumption of sulphuric acid, are China, North America, India, South America and North Africa. China, India, Brazil and the USA between them account for 60% of all phosphate demand globally.

Global picture

The US Department of Agriculture (USDA) indicates that previously steadily increasing global grain yields per hectare have levelled off in the past few years, and this has contributed to declining global grain stocks since 2018, now down to historic lows as a percentage of demand/use. This has helped support higher crop prices for corn and oilseed, exacerbated by a prolonged drought in North America and Argentina/ southern Brazil due to several successive La Nina years. Demand for phosphate tends to be more affected by crop prices than fertilizer cost. Better affordability for phosphate fertilizers bodes well for demand recovery this year. There was a major dip in demand last year due to high prices caused by lack of availability from Russia and Chinese export controls. Combined mono- and di-ammonium phosphate demand (MAP/DAP) fell from 64.6 million tonnes product to 58.7 million t/a in 2022. CRU forecasts a bounce back to 63 million t/a this year, though still down on 2021’s figure.

China

China remains the world’s largest producer and consumer of phosphates. Phosphate fertilizer production capacity stood at 21.4 million t/a P2 O5 in 2021 according to the China Phosphate and Compound Fertilizer Industry Association (CPFIA), though this was down by 3.3 million t/a from 2016. Production of finished phosphate fertilizers was 16.8 million t/a P2 O5 in 2021, and consumption 11.3 million t/a, with 5.7 million t/a P2 O5 of phosphate fertilizers exported. Most of China’s phosphate industry produces mono- and di-ammonium phosphate (MAP/DAP); around 86% of all phosphate is produced in these two forms, as compared to 46% of global finished phosphate production. This preponderance of MAP and DAP means that in the past China has dominated the export markets for these products, representing 35-40% of global trade in DAP and 19-24% in MAP in 2021. Production fell sharply in 2022, however, to 15 million t/a P2 O5 , a decline of 12% year on year, as high global phosphate prices due to the Ukraine war and sanctions on Russian phosphate led to consumption cutbacks. Phosphate prices peaked around June-July 2022 and fell back thereafter, with another uptick at the end of the year. High prices for phosphate rock (inland Chinese prices almost doubled) also affected production margins. At the same time, China has maintained export restrictions on phosphates in order to prioritise its domestic market, where demand remained strong in spite of the higher prices. These began in late 2021 and were maintained throughout most of 2022. The amount of phosphate licensed for export was only a fraction of what it had been for the previous year. Chinese MAP/ DAP exports were 3.3 million t/a P2 O5 in 2022, down 43%. The restrictions have continued into 2023, though were eased a little from April, meaning that Chinese exports for this year are likely to be higher than last.

China’s phosphate industry is concentrated (85%) in four southern/central provinces. The phosphate industry has been shrinking for most of the past decade, suffering as it does from declining consumption as China tries to rein in overapplication of some fertilizers; over-building of capacity; and environmental pressures on plant operators, especially those in the Yangtse River region. The government continues to strive for greater nutrient use efficiency, targeting an increase from 40% to 43% from 2020-2025, and is promoting new fertilizer technologies such as water-soluble fertigation and new products with greater use of micronutrients, as well as substitution with more organic fertilizer. Domestic demand is thus likely to continue a slow decline. Meanwhile development of new MAP/DAP production plants is very restricted and the structural change in China’s phosphate industry continues. China is increasingly viewing phosphate as a strategic resource, and CRU recently reported that there could be cuts to downstream capacity in order to manage China’s phosphate rock reserves over the longer term.

North America

The US was the largest producer of phosphate rock in the world throughout the 20th century, but its dominant position has declined over the past two decades as competition has evolved elsewhere. US production of phosphate rock peaked in 1980 at 54.4 million metric tons, and has more than halved since then. As phosphate rock mining and processing has shrunk in North America, the North American industry has consolidated, leaving just four major producers; Mosaic, Nutrien, Simplot and Itafos, at nine sites. Production of phosphoric acid in 2021 was 6.1 million tonnes P2 O5 .

A larger planted area for corn, soybean and wheat is forecast for 2023; roughly a 3.5% increase year on year due to higher crop prices and better spring weather. Itafos says it expects phosphate demand from June 2022-June 2023 to be 3.85 million t/a P2 O5 , a 9% increase on the previous year, though still significantly down from 2019-2021. Imports and exports are expected to be relatively flat year on year.

Looking out to 2026, however, Canada is set to return to large scale phosphate production with the start-up of Arianne Resources’ Lac a Paul mine.

India

India has a significant domestic finished phosphate industry but little domestic phosphate rock mining. Consequently the country is one of the most important importers of phosphate rock and phosphoric acid, and the largest importer of processed phosphates like DAP. India’s phosphate consumption was 7.83 million t/a P2 O5 for the fertilizer year 2021-22, according to the Fertilizer Association of India, part of a steady increase over the past few years. This included 9.27 million t/a of DAP (tonnes product), 5.68 million t/a of single superphosphate (SSP), and 11.68 million t/a of nitrophosphates and NPK fertilizer. Domestic phosphate fertilizer production was 4.7 million t/a P2 O5 , including 4.2 million t/a (product) DAP and 5.35 million t/a SSP. Imports of DAP ran at 5.46 million t/a.

India has suffered from systematic overapplication of urea at the expense of other fertilizers. In an effort to improve crop yield and provide more balanced nutrition the government is attempting to push greater application of phosphate and potash fertilizers. As a result, Indian phosphate demand is projected to increase by around 2.2% year on year, including a 3.2% increase in 2023.

South America

Latin America continues to be a hotspot for new phosphate demand is South America, with Brazil far and away the largest consumer. Brazil’s fertilizer requirements have more than doubled in the past two decades, and phosphate applications have climbed from just over 3.5 million t/a P2 O5 in 2010 to 7.5 million t/a in 2021. The rest of Latin America adds another 2.5 million t/a P2 O5 of consumption, more than half of this represented by Argentina and Mexico. Phosphate consumption has risen equally rapidly in these countries; around a 4% increase year on year in Argentina, 5% year on year in Mexico, and a remarkable 16% in Peru, now the fourth largest consumer in South America. Phosphate demand is continuing to increase, to counter phosphate deficiencies in topsoil in e.g. Argentina’s grain-growing Pampas region, as well as to serve new areas being brought into cultivation. Growth is predicted to average 5-6% year on year for the region over the next few years.

As far as domestic fertilizer production goes, phosphate rock in the region is mined mainly in Brazil and Peru. But downstream capacity remains limited. Total phosphoric acid production in 2021 was 2.6 million t/a P2 O5 , 1.5 million t/a of that in Brazil, and most of the rest in Mexico, and the region has to import to cover the gap.

North Africa/Middle East

On the production side, North Africa and the Middle East are hugely important to the global phosphate industry in terms of phosphate rock production, but also increasingly in terms of finished phosphates (and hence sulphuric acid demand). Morocco is the world’s largest holder of phosphate reserves and the second largest producer. But with little domestic phosphate demand, it is by far the world’s largest exporter of phosphate rock and, increasingly, processed phosphates. State producer OCP is continuing a major expansion programme that it began in 2007 to not only boost phosphate rock production but also to develop more downstream phosphate production and export capacity in an attempt to capture more value from its phosphate resources. As the lowest cost producer of phosphates, OCP’s increase has come at the expense of edging out exports from China and the United States. Last year, Morocco was the largest exporter of MAP and DAP with a total of 6.3 million tonnes product, placing it ahead of China, previously the world’s largest exporter.

So far, OCP’s expansion has seen rock mining capacity increase by 50% to 44 million t/a, the construction of a gravity driven slurry pipeline to take rock from mines to Jorf Lasfar, and a huge expansion of phosphate processing and phosphate fertilizer manufacture at the Jorf Lasfar Hub. Four large integrated facilities have been built at Jorf Lasfar, each with a capacity of just over 1.0 million t/a of MAP and DAP, and each consuming 500,000 t/a of sulphur each to feed sulphuric acid and phosphoric acid capacity. Jorf Lasfar has grown to become the largest fertilizer facility in the world, with a capacity of 6 million t/a of phosphoric acid and 10.5 million t/a of fertilizers and with a production of 5.65 million t/a of phosphoric acid and 10.18 million t/a of fertilizers. This year, the start-up of Jorf Lasfar Line F will add another 450,000 t/a (P2 O5 ) of MAP and DAP capacity. OCP has been increasing its sulphur melter capacity at Jorf Lasfar to feed acid production at these plants, with capacity now at 12,000 t/d (4 million t/a).

Other new developments include upgrading of the existing Euro Maroc Phosphore (EMAPHOS) lines 3 and 4 at Jorf Lasfar (originally part of a joint venture with Brazil’s Bunge but brought back into full OCP ownership several years ago) by 10% each, as well as the addition of a new 500,000 t/a phosphoric acid plant, and the commissioning of a new 450,000 t/a phosphoric acid line at Laayoune, taking OCP’s phosphoric acid capacity to 8.4 million t/a.

Algeria is also a major phosphate rock reserve holder, mainly exporting phosphate rock (ca 1 million t/a). Last year, following a reorganization of state industries to create fertilizer group Asmidal, a $7 billion deal was signed with Chinese firms Wuhuan Engineering and Tian’An Chemical, a nitrogen and phosphate fertilisers production company, to create the Algerian Chinese Fertilizers Company (ACFC). ACFC aims to develop a world-scale integrated phosphates project. Asmidal will own 56% of the new company while the Chinese companies will own the remaining 44% stake. The plan is to develop phosphate deposits at Bled El Hadba, Djebel Onk, and Tebessa, with downstream conversion into MAP and DAP using Algeria’s domestic ammonia production. It will also include the construction of port facilities at the port of Annaba. Overall the project is expected to have 5.4 million t/a (product) of phosphate fertiliser production capacity.

Tunisia is attempting to rebuild its phosphate industry after years of stagnation due to industrial and political unrest. Phosphate rock production stood at 8 million t/a prior to the Arab Spring, but declined to less than half that in 2011 and has recovered only patchily since then. More recently, however, efforts at improving production seem to be bearing fruit, with the Gafsa Phosphates Company projecting that output will rise to 5.6 million t/a this year.

In Egypt, another phosphate rock exporter (ca 3 million t/a), there are also moves to expand mining and greatly expand downstream phosphate production, at Abu Tatour, where 900,000 t/a of phosphoric acid capacity is planned to come onstream by 2024. Jordan is a major phosphate producer, and now Saudi Arabia has also moved into phosphate expansion and processing via state-owned mining company Ma’aden. Two large phosphate complexes are already up and running, the most recent, the Wa’ad Al Shamal joint venture with Mosaic in 2017, and a third mega-complex is planned for 2026.

Sulphuric acid demand

CRU forecasts that total world phosphoric acid capacity will rise from 60.5 million t/a in 2021 to 64.3 million t/a in 2027. This represents annual growth of around 2.0%. Ma’aden III and OCP represent the largest slices of Over the same period, demand is forecast to increase by 3.68 million t/a P2 O5 , only just shy of the new capacity additions (3.8 million t/a). This represents additional demand for sulphuric acid to produce phosphoric acid of around 9 million t/a, with Morocco, Saudi Arabia, India and Russia the major recipients. This will equate to additional sulphur demand for India and Morocco and reduced exports from Saudi and Russia.