Sulphur 408 Sept-Oct 2023

30 September 2023

Demand for sulphur fertilizers

FERTILIZERS

Demand for sulphur fertilizers

While phosphate fertilizer production represents the main slice of demand for elemental sulphur and sulphuric acid, sulphur fertilizers continue to be a growing sector of demand due to changes in the way that we use sulphur.

Sulphur is a vital nutrient for plant and animal health, and is commonly regarded as the “fourth nutrient” for plants, after the big three of nitrogen, phosphorus and potassium. While sulphur is not needed in the same quantities as nitrogen, for some crops, such as oilseeds, it can be comparable in its requirement to P or K. It is essential for plants to form proteins, enzymes, vitamins and chlorophyll. In legumes it is crucial in nodule development and efficient nitrogen fixation. Protein synthesis requires large amounts of sulphur, especially for the formation of oils within the seed. As a constituent of several amino acids and vitamins in plants and animals, it is critical for determining the nutritional quality of foods. It is also essential for photosynthesis and contributes to crop winter hardiness. Crops with high sulphur requirements include legumes such as alfalfa and soybeans, as well as canola and rapeseed, but because of its effect on nitrogen uptake, it is important for crops with high nitrogen requirements such as maize and cotton. Persistent experiments show that sulphur application can increase crop yields by around 20%. Sulphur also helps the uptake of other micronutrients, such as zinc, and contributes towards helping with dealing with zinc and other deficiencies.

Elemental sulphur also has fungicidal properties, and, applied as a powder, can e.g. control growth of mildew. For high pH soils it can help acidify soils and lower soil pH, and when applied as gypsum it can be applied as a source of calcium and improve soil physical properties, for sodic soils which have high salt content. Calcium as a nutrient can be particularly beneficial for e.g. peanuts, which have a high calcium requirement.

Sulphur deficit

It is a well rehearsed argument, but one that bears repeating, that the industrialised world ‘benefited’ from ‘free’ sulphur application to soils for many decades, from two main sources. The first was that the fertilizers used often had an overlooked sulphur component. Ammonium sulphate, for example, was one of the most widely used nitrogen fertilizers in the first half of the 20th century, as it was a by-product from a number of industrial processes, such as manufacture of caprolactam for artificial fibres like nylon. It was also produced using sulphuric acid to scrub the by-product ammonia from coke oven gas – the main source of gas for lighting and heating in the late 19th and early 20th century. Likewise, the first commercial phosphate fertilizer was single superphosphate (SSP), produced by reacting phosphate rock with sulphuric acid. SSP is around 12% sulphur, and ammonium sulphate 24% by weight, and this sulphur was being applied as a matter of course with the fertilizer.

However, the latter half of the 20th century saw the development of more concentrated forms of nutrient, firstly ammonium nitrate, and then urea, which gained particular popularity in the fast developing agricultural economies of Asia and South America. Urea has double the nitrogen content of ammonium nitrate by weight, and hence is more efficient to ship and apply, but of course none of the sulphur. Likewise the development of triple superphosphate (TSP) and then mono- and di-ammonium phosphates (MAP/DAP), the latter with up to 60% phosphate content, as compared to 20% for SSP, soon eclipsed the SSP market. And in the potash market, potassium sulphate (also known by its old name sulphate of potash or SoP) became less popular than potassium chloride (so-called muriate of potash or MoP).

“The Sulphur Institute (TSI) has calculated that the total ideal crop sulphur requirement worldwide is around 24 million tonnes S per year”

At the same time, sulphur dioxide emissions to atmosphere from various industrial processes, but in particular power generation from burning coal and vehicle emissions from burning gasoline, went largely unchecked. Efforts to tackle this were the birth of the modern sulphur industry, as sour gas producers and oil refiners were pushed to remove ever-greater percentages of sulphur from their product. In parallel with this, a switch away from burning coal in Europe and North America towards natural gas and the installation of scrubbing systems at remaining coal-fired power stations and metal smelters has progressively reduced sulphur dioxide emissions across those continents.

The extent of this has been recently document in a paper published in Nature looking at changes in soil sulphur in the US Mid-West due to falling rates of atmospheric deposition, which calculated that atmospheric sulphur deposition in the region fell by around 80% from 1985-2017. In this region of the US, this was balanced by increased application of sulphur-containing fertilizers such that the total amount of soil sulphur remained roughly constant. However, this has not been the case everywhere. The Sulphur Institute has persistently warned of a growing sulphur deficit in soils, meaning that sulphur is less available to plants and growth rates and crop quality may be affected. The Sulphur Institute (TSI) has calculated that the total ideal crop sulphur requirement worldwide is around 24 million tonnes S per year, while total application of sulphur fertilizers is around 11.8 million tS/a, or only about half of the ideal requirement. In sub-Saharan Africa this shortage is even more acute, with a sulphur deficiency of around 90%, contributing to degraded soils and increased rates of poverty and malnutrition.

Sulphur vs sulphate

There are essentially two forms in which sulphur can be applied to soils; as elemental sulphur, or as sulphate. Sulphate is the form in which plants are able to take in the nutrient, as it is soluble and can be transported via water into the roots. Conversely, elemental sulphur must first be broken down by thiobacteria into soluble sulphates before it can become available to the plant. This process is comparable to the way that urea must be oxidized to a nitrate before plants can use the nitrogen, but the conversion process for sulphur is much slower and can take months. This process can be sped up by increasing the surface area of elemental sulphur by using it in a micronised form (particles <150 micrometres in diameter), or by breaking up sulphur granules into smaller particles. A common technique is to use 5% bentonite clay in the sulphur granule. The clay absorbs water and swells, leading to the brittle sulphur granule to fracture. Some of the major developments in the past decade in sulphur fertilization have involved greater control over sulphur particle size and dispersion in conventional fertilizers, leading to a growing range of ‘sulphur enhanced’ fertilizers.

However, as with nitrates, there are risks with the over-application of sulphate fertilizer. The main concerns are related to sulphates leaching into water courses, where the sulphate can be reduced to sulphide, which can have toxic effects on river and marine organisms.

As always the way forward is proper nutrient management, but it makes the application of sulphur fertilizers a more knowledge-intensive process than some other nutrients.

‘Traditional’ sulphur fertilizers

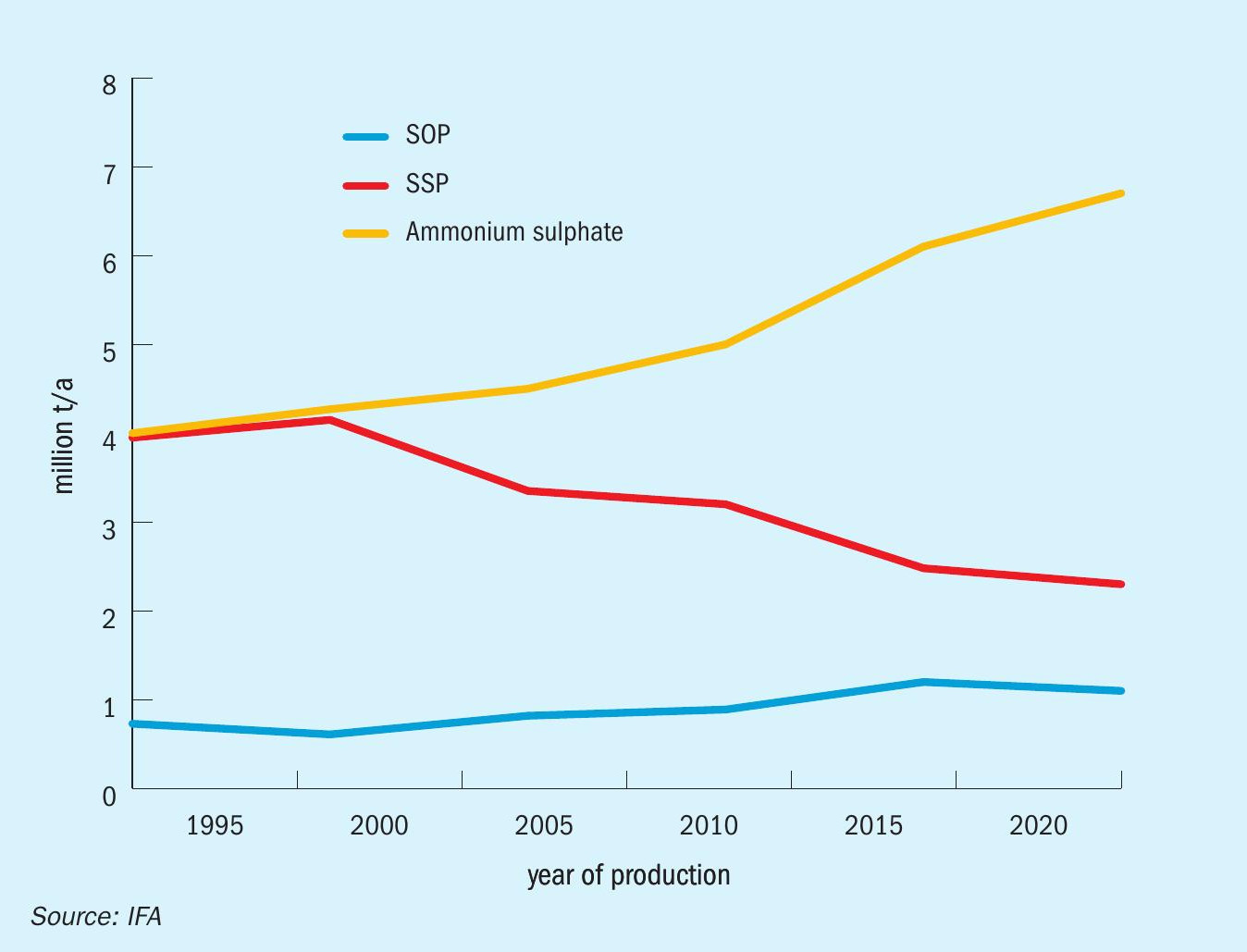

The three main traditional sulphur-containing fertilizer – ammonium sulphate, single superphosphate and potassium sulphate – still represent a significant majority (ca 70%) of sulphur fertilizer applications. Figure 1 shows how application rates of these fertilizers have changed over time.

Ammonium sulphate

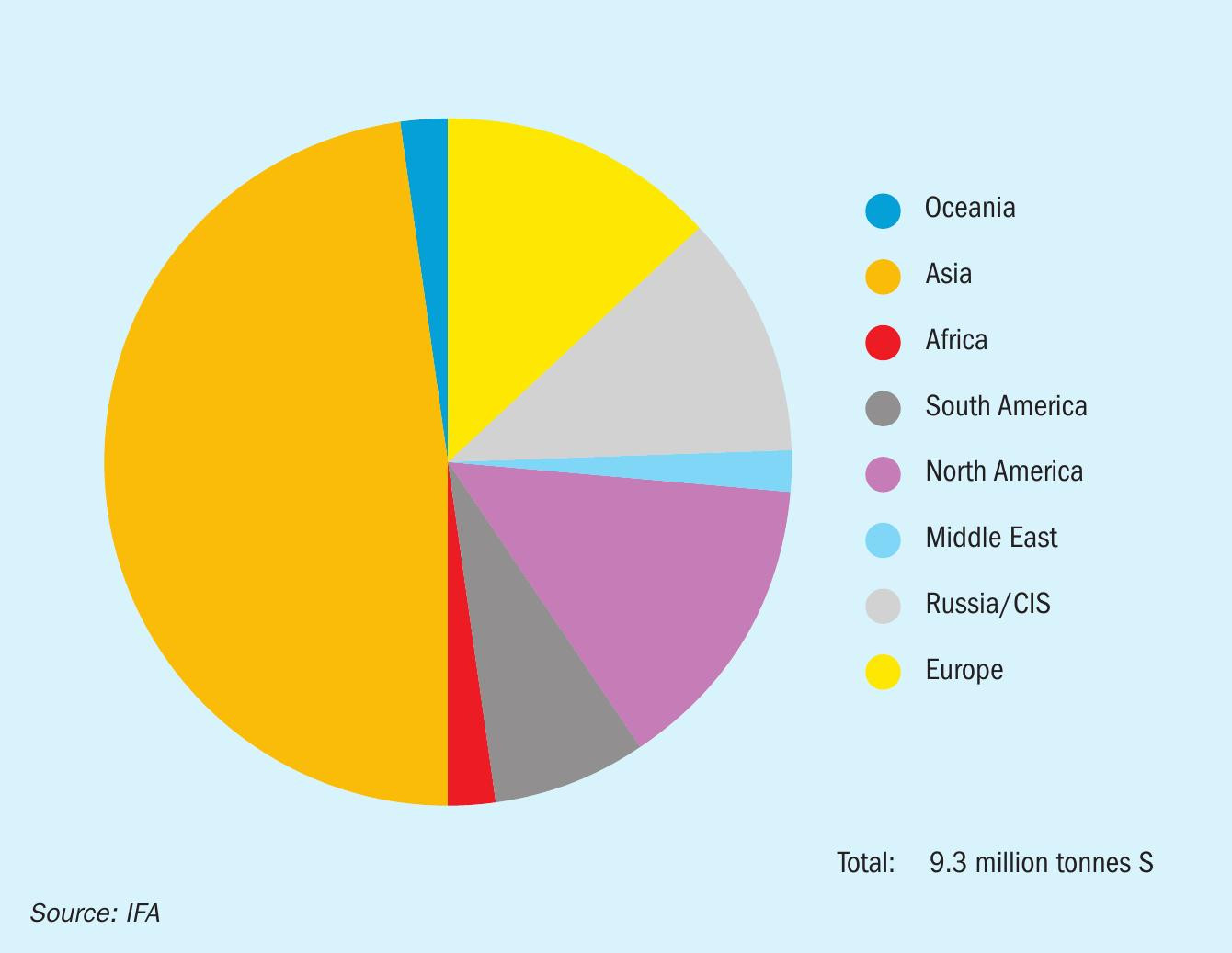

The most popular remains ammonium sulphate. Global ammonium sulphate capacity was 38.6 million t/a in 2021, or around 9.3 million tonnes S per annum. Figure 2 shows the geographical distribution of capacity. Most is in China, where there is a great deal of involuntary production as a by-product of caprolactam manufacture for nylon fibres, methylmethacrylate, acrylonitrile, methionine production etc, and this new capacity in China represents most of new AS supply over the past two decades. Around 65% of AS capacity added between 2017 and 2021 was in China. IFA estimates that 71% of AS capacity is based on by-products from other production, and in China this figure is 83%. It is also 90% in Europe and 73% in North America. However, in the Middle East, Africa and South America, the opposite is true, and on-purpose production predominates, between 75% of production (in South America) to 95% (in the Middle East). Ammonium sulphate capacity is predicted to continue to grow to 41.5 million t/a (10.0 million tS/a) by 2026, with China continuing to represent the bulk (70%) of new production, for various industrial processes. Most of the rest of new capacity will come from Russia and Turkmenistan.

As AS production is largely involuntary, it tends not to be determined by fertilizer prices but rather the markets for fibres and the other products that it is a by-product of. This ensures that AS will continue to represent the largest slice of sulphur fertilizer production for the foreseeable future. Consumption is concentrated in Asia, with the USA, Brazil, Turkey and Mexico also major consumers.

Single superphosphate

World capacity for single superphosphate (SSP) is 56.1 million t/a (6.7 million tonnes S per annum), making it the second best selling fertilizer worldwide for both P and S content. China represents 31% of capacity here, but there is also considerable capacity in India (23%) and Brazil (17%). Around 7% of capacity is in Australia, and these four markets also represent around 85% of demand for SSP; because of its relatively low phosphate nutrient content compared to diammonium phosphate, it tends to be consumed in the country of origin, and export volumes have declined due to increasing competition from more economic high-analysis phosphates. SSP capacity and production has fallen from 2015 to 2020, as Figure 1 shows, but out to 2025 is expected to remain roughly the same as 2020 figures. This masks some changes in geographical capacity, however; Chinese capacity is falling, as MAP/DAP becomes preferred, while India will have added around 700,000 t/a of SSP capacity from 2015-2024.

Potassium sulphate

Potassium sulphate/sulphate of potash (SoP) has always been a niche product compared to the much more widely used potassium chloride (muriate of potash/ MoP), but it is valued as a chloride-free source of potash for cash crops such as tobacco, tree nuts and citrus fruits. World capacity is around 11.3 million t/a (2.0 million tonnes S). China accounts for 70% of world capacity, and Germany another 10%. Other major producers are the US and Belgium. China also dominates consumption, with North America and Europe also major consumers.

Sulphur-enhanced fertilizers

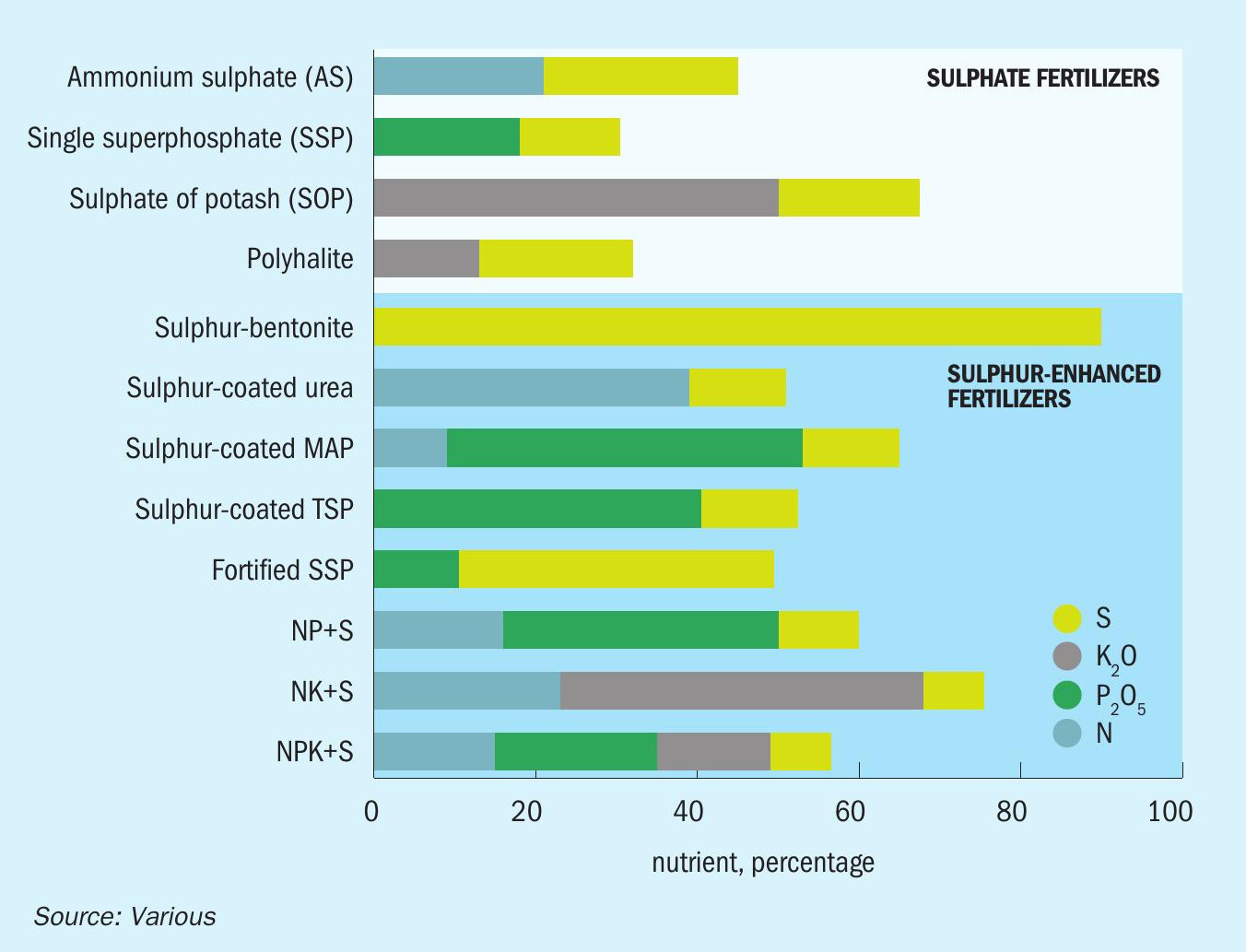

With a growing recognition of the issue of sulphur deficiencies in soils has come a wide range of sulphur containing or enhanced fertilizers (see Figure 3). These typically use innovative technologies to incorporate elemental sulphur into higher analysis fertilizers, either within granules or as an external coating. Introducing a liquid sulphur spray to Urea, TSP, MAP or DAP during drum or pan granulation, for example, results in N and P products with a 5-20% elemental sulphur content. Sulphur-enhanced fertilizers combine nutrient availability with high use-efficiency, and also have good storage and handling properties. The market for sulphur-enhanced NP+S products has developed over the past decade, with particular take-up in the US, Brazil, India and parts of Africa. In North America, Mosaic has been selling its MicroEssentials range of fertilizers since 2008, containing 10-15% sulphur in a 50-50 mixed form of both sulphate (for initial availability) and micronised elemental sulphur to keep plants growing throughout the season. Sales of MicroEssentials reached 2.8 million t/a in 2022, according to with Mosaic. PhosAgro and OCP also have NPS products. OCP exported 1.4 million t/a of NPS products in 2021 according to company figures.

Controlled release fertilizers (CRFs) can be produced by coating highly soluble nutrients such as urea with relatively insoluble coatings. While India uses the plant fibre neem, other polymers can be used, and elemental sulphur (usually with a polymer outer coating) is also used as a coating – the sulphur breaks down slowly, eventually allowing the encapsulated to become available over a longer time period. Sulphur-coated urea (SCU) combines 77-82% urea (36-38% N) with a 14-20% sulphur coating. SCU is used for multiple nitrogen applications on sandy soils under high rainfall or irrigation conditions. It is marketed as a controlled release fertilizer for grass forage, turf, sugarcane, pineapple, cranberries, strawberries and intermittently-flooded rice.

The popularity of liquid fertilizers in North America, especially liquid ammonia and urea ammonium nitrate solution (UAN) has led to the use of soluble thiosulphates to produce sulphur enhanced liquid fertilizers. Tessenderlo Kerley, a leader in speciality liquid fertilizers, has four main thiosulphate products, with ammonium, potassium, calcium or magnesium, with a sulphur content of 10-26% sulphur.

“The launch of new sulphur enhanced fertilizers continues. India has recently launched a new premium variety of urea coated with sulphur, which is known as ‘urea gold’.

Urea gold

The launch of new sulphur enhanced fertilizers continues. India has recently launched a new premium variety of urea coated with sulphur, which is known as ‘urea gold’. It was unveiled during a visit to Rajasthan by prime minister Narendhra Modi, and is being sold by one of India’s major state owned fertilizer companies, Rashtriya Chemicals and Fertilizers Ltd (RCF). The sulphur-coated urea has an analysis of 37% nitrogen (N) and 17% sulfur (S), and aims to serve two primary objectives: fulfilling sulphur requirements in Indian soils and enhancing nitrogen use efficiency (NUE), as the sulphur coating allows for a slower release of nitrogen, leading to prolonged nutrient availability during the plant’s growth cycle. India has low rates of NUE; only around 35% of nitrogen that is applied makes its way into crops. Urea gold is being marketed as a way of using less urea; 15kg of urea gold is equivalent to 20kg of conventional urea, according to the marketing literature. India has long struggled with overapplication of urea and lack of balanced nutrient management. As with the domestically produced neem-coated urea, the aim is also to try and make the country’s existing production of urea go further, reducing import demand. According to local press reports, manufacturers of urea gold will be allowed to sell the fertilizer at a maximum retail price (MRP); a major boost for areas where soil contains less sulphur.

Still room for growth

While reliable statistics are hard to come by, total fertilizer sulphur nutrient consumption is estimated to be 12.2 million tonnes S, against a potential global requirement of 24 million tonnes S. This ongoing sulphur deficiency in soils, especially in parts of the developing world, where attempts to tackle SO2 pollution have been more recent and the effects are only now starting to be felt, needs to be tackled in order to achieve the kind of crop yields that the world will need in order to sustain a growing population.

Indeed, sulphur fertilizers represent a potential bright spot amid general declining or plateauing use of fertilizer. Overall fertilizer demand is slowing in most markets as they mature, and efforts are taken to correct overapplication and fertilizer leaching into water courses. Indeed, consumption is falling in many major markets. The Chinese government aimed to stabilize fertilizer application rates at 2000 levels via its Zero Fertilizer Growth policy, but in fact a combination of environmental crackdowns and overcapacity led to a 15% fall in fertilizer use from 20152020. EU consumption fell by several percent over the same period due to a focus on nutrient use efficiency. Recent runs of high prices have also impacted on fertilizer demand as affordability has been low; IFA estimates that global fertilizer consumption dropped by 7.6% over 2021-22, recovering only around 4% this year. Looking forward, fertilizer use is expected to grow by 1-2% year on year out to 2027. However, for sulphur fertilizer the comparable increase is expected to be 3% per year, with Asia the largest source of new demand as sulphur deficiency is increasingly recognised and tackled.