Sulphur 408 Sept-Oct 2023

30 September 2023

Market Outlook

Market Outlook

SULPHUR

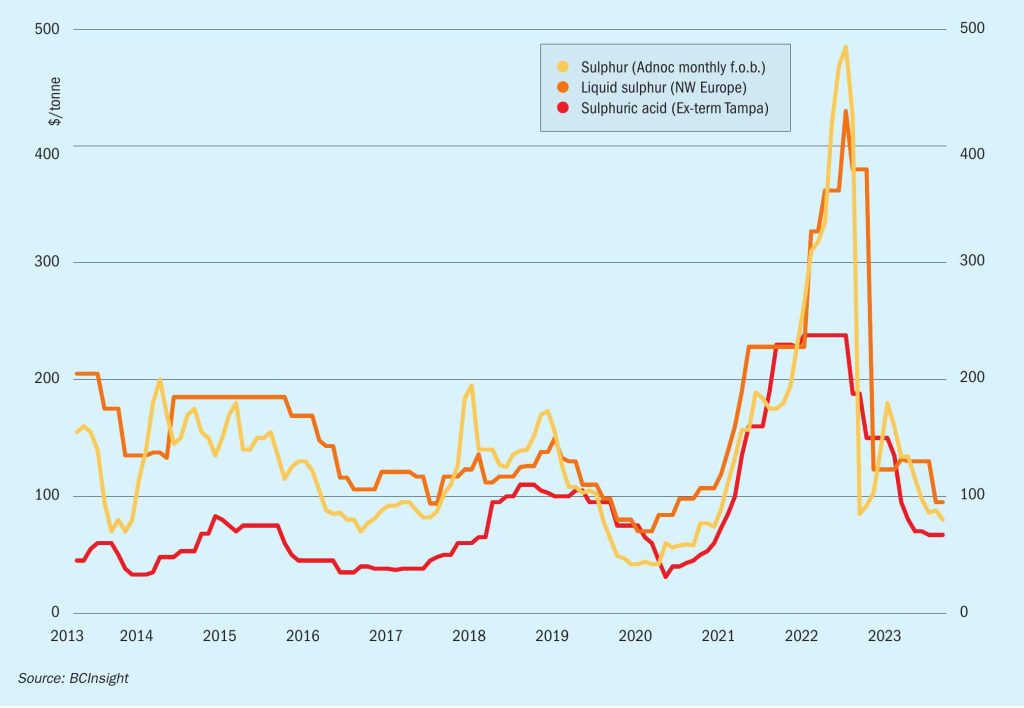

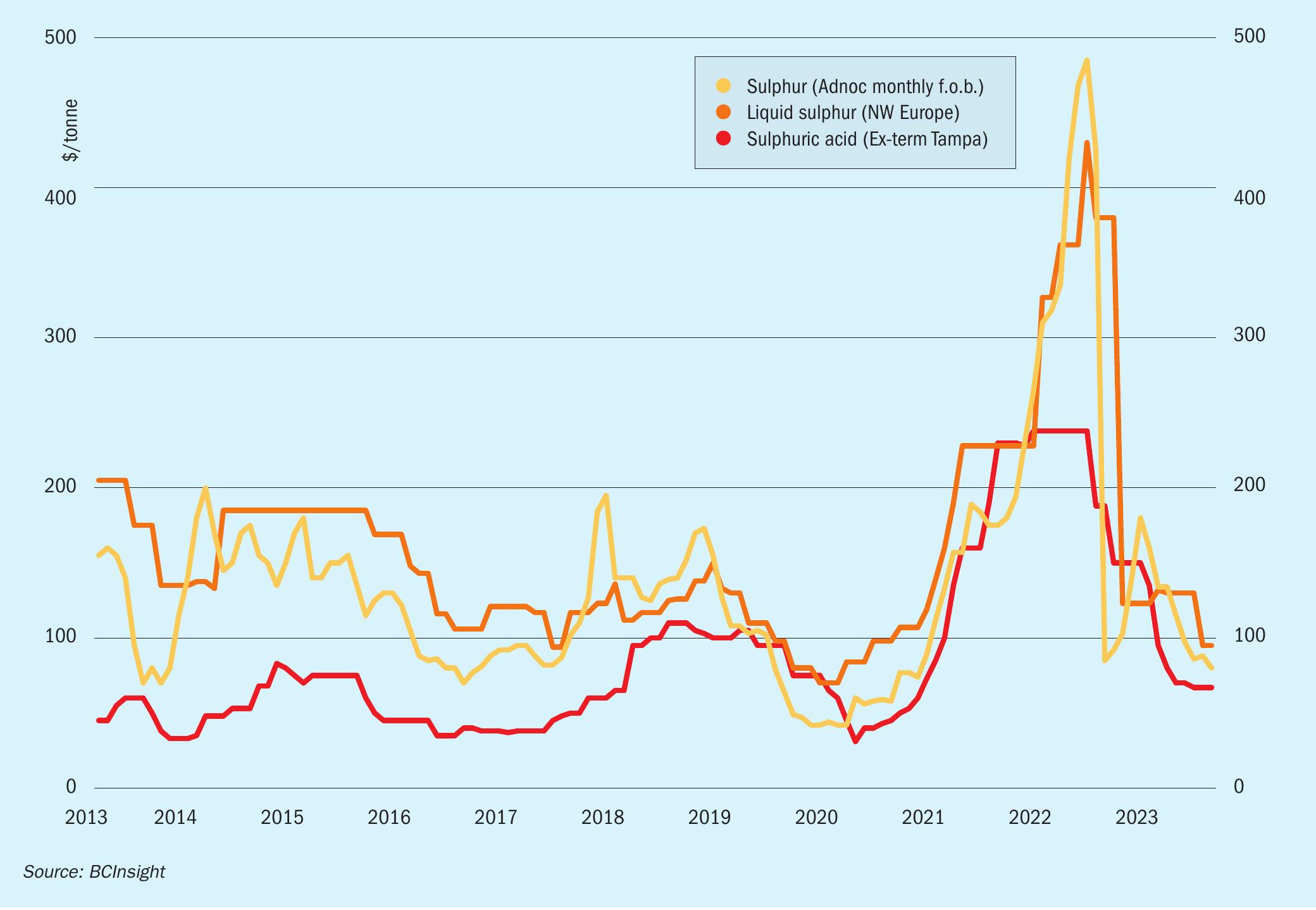

- New supply is weighing on the market. In addition to increased exports in the second half of the year from upgrades and new refining projects from the Middle East, crushed lump sulphur is also again entering the market in higher quantities from both the FSU and the Middle East, and displacing granular product in some markets, notably Morocco and China.

- Firming DAP market and higher operating rates have been key factors in pushing up sulphur prices. This is expected to give way to a seasonal slump from October for the rest of the year and into 2024.

- Chinese port stock build up will erode import demand and prices in the fourth quarter.

- Indonesian metals buyers are moving into a more predictable pattern of buying. This is removing some of the volatility from the market. The gap between east and west of Suez pricing is expected to close in the fourth quarter once prices come off in the east of Suez markets.

- Outlook: Prices are poised to continue to lift on the back of rising phosphate fertilizer demand and pricing in September. However, with sulphur in healthy supply and Chinese port stock levels rising to match levels reached briefly in April 2021, a correction is expected to follow by October once fertilizer demand has been largely covered and operating rates start to fall.

SULPHURIC ACID

- Indonesia’s sulphuric acid imports are set to rise in the second half of the year as a result of higher demand from new metals projects. Buying momentum is expected to remain strong in the second half of the year on the back of higher demand and firm supply, according to market participants.

- Chinese acid supply is expected to continue to increase owing to the expansion of smelter capacity in the Baiyin, Hubei and Shanxi regions, which is projected to add another 2 million t/a of production capacity this year, according to Argus estimates.

- Maintenance at three Japanese smelters will tighten merchant acid availability in the fourth quarter. This could remove over 280,000 tonnes/month of acid in the fourth quarter, depending on outage length.

- Chile’s demand will determined by how the domestic supply situation is progressing for the rest of the year, this as lower ore grades mined has resulted in less smelter acid produced thus tightening the domestic market and forcing end users to enter the spot market to buy sulphuric acid.

- Outlook: Sulphuric acid prices are expected to continue to recover in the short term on the back of robust demand from key offtakers. The continuation of spot demand from Morocco’s OCP and Chilean end users will influence price movements. In Asia, supply availability will tighten from September onwards as key smelters in Japan start a period of heavy maintenance, and this will impede a further erosion on prices, as availability will be restricted in the fourth quarter.