Sulphur 408 Sept-Oct 2023

30 September 2023

Price Trends

Price Trends

MARKET INSIGHT

Maria Mosquera, Editor of the Argus Sulphur Report and Liliana Minton, Editor of the Argus Sulphuric Acid Report at Argus Media assess price trends and the market outlook for sulphur and sulphuric acid.

SULPHUR

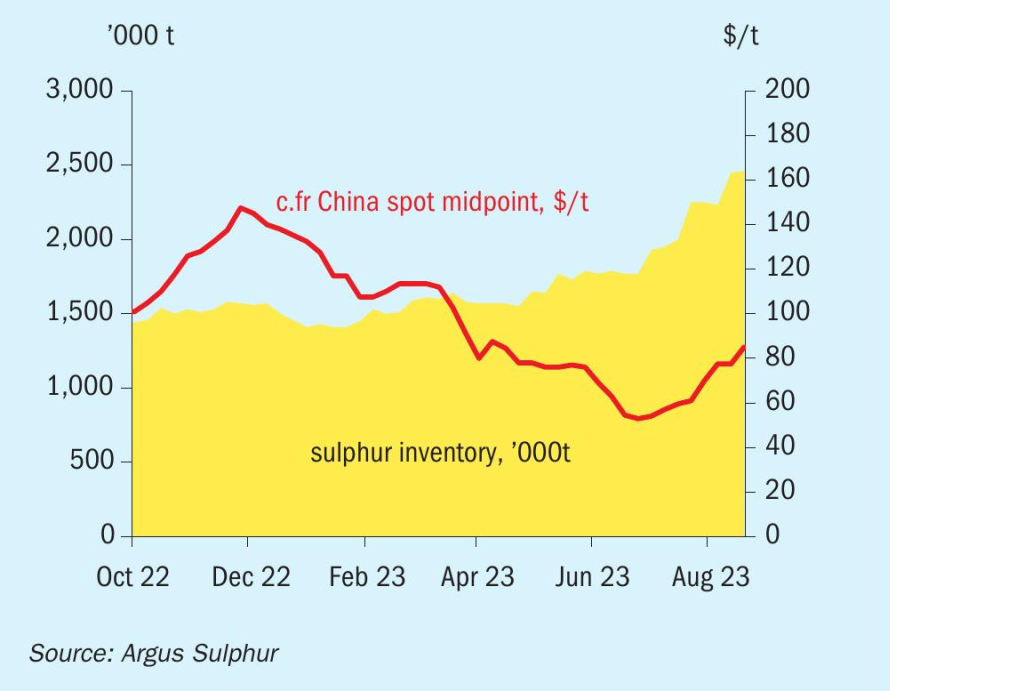

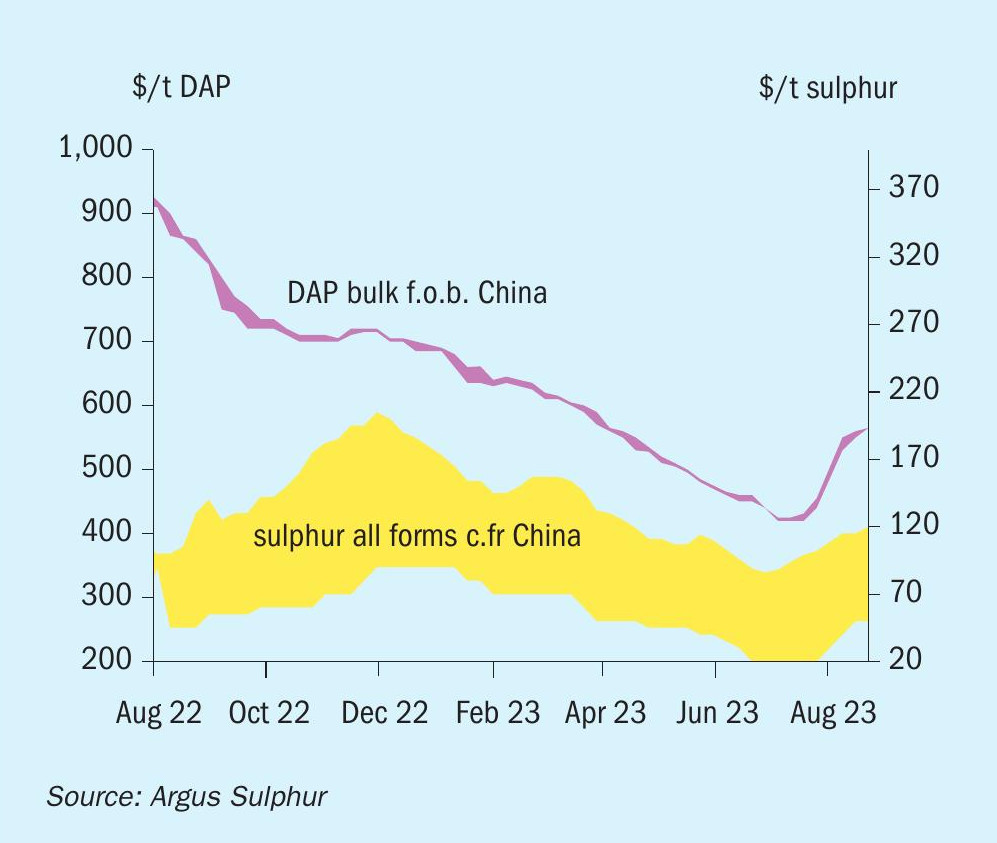

Sulphur prices have firmed during the third quarter following the soft trend of the second quarter. The c.fr China granular sulphur price lifted by $32/t in the six weeks from 6 July to 24 August- with further firming for September deliveries evident. The rising phosphate fertilizer market encouraged offers to move up, with September tonnes offered to buyers consistently at and above $130/t c.fr to several markets.

With phosphate fertilizer prices and demand lifting operating rates, sulphur demand and prices have lifted during the quarter. This has been led by Chinese demand, and while the bullish sentiment from returning demand and price increases in the DAP and MAP markets are lifting sulphur prices in September, high inventory levels provide a downward signal. The upcoming autumn fertilizer application season and strong fertilizer export sales supported producers in keeping production rates high in September; up to 70-80% in the river regions and 70% in the south during August. DAP export prices lifted by $53/t in the space of a month from 5th July to 3rd August, and continued to rise through August. DAP prices f.o.b. China rose by $153/t in August from early July.

However, some Chinese import demand was from traders already holding substantial port inventories, and looking to add to these in order to average out stock cost and dilute the high cost of tonnes bought when the market was firmer last year. This had the impact of lifting port inventory levels to a substantial 2.45 million tonnes, a level not reached since 2021, when stock levels briefly reached 2.6 million tonnes. That followed the high stock build up during the 2020 pandemic, when stocks reached an unprecedented 3.1 million tonnes in March and April, before beginning to fall off. In the early part of this year stocks have been consistently rising, and c.fr China import prices reducing, with stocks building until June.

This is despite increasing domestic sulphur production from new domestic refineries adding to readily available inventory. Chinese domestic sulphur production has risen by around 5% compared to 2022. Last year, when port stocks briefly rose to similar levels, the period of heavy import activity was followed by trading, mainly taking place in local currency from existing port stocks, leading to falling import demand. This, in turn, also eroded prices with a sudden lack of Chinese import demand weighing on global demand. This is likely to be repeated this year, particularly when the DAP market softens.

Indonesian buyers have moderated buying for the nickel leaching sector since the bulk-buying of 400,000 t in the space of a few weeks led to a price increase in the first quarter. Now buyers are either consuming existing stock amid a slow ramp of full operations in the case of PT Huayue, receiving contract shipments and sulphuric acid cargoes in the case of PT Halmahera Lygend or buying sulphur stock at a more moderate pace. With a large ramp up to Indonesia’s sulphur demand last year by as much as 1 million tonnes, this year the rise will be moderate with sulphur demand to ramp up further in the second half of the year, bringing import expectations for the year to around 2 million tonnes.

The gap between east of Suez and the softer markets west of Suez increased during the quarter. Since much of the demand in the west was covered under contract, length in the US Gulf secured lower prices for product and Morocco made use of ample Kazakh availability of both granular and crushed lump sulphur. Demand was also subdued due to fertilizer stock that needed to be placed. In July and August the difference between c.fr pricing in China and Southeast Asia for sales to Indonesia and key buyers in the west like North Africa and Brazil ranged between $10-20/t. With freight rates high, a gap of around $10-20/t is still below the freight differential to encourage a steady flow of shipments from west to east, though some Russian supply is finding its way to markets as far afield as China and India. However, the gap is expected to close once the latest round of Chinese demand has been covered.

In Western European molten sulphur market the Benelux quarterly contract price for third-quarter supply settled at a substantial reduction of $40/t on the second quarter, equating to a price of $87-103/t c.fr Benelux. This reflected the slow-down in consumption from much of European industry amid competition from lower-priced chemical imports and higher energy costs. Due to the lower consumption, the reduced sulphur production arising from the stoppage of Russian crude imports to European refineries was not felt by most consumers, leading to a logistical exercise of moving product within the region.

SULPHURIC ACID

Sulphuric acid prices started the third quarter of the year with an east/west of Suez divide, which was determined by demand – or the lack of it. This factor dominated market sentiment specially in July and into August and resulted in fob prices to fall to three-year lows. It was the continued absence of spot demand from the world’s largest acid buyers – Chile and Morocco’s OCP – which pressured acid prices globally and led to trade flows being determined by freight costs.

East of Suez, China and South Korea/ Japan prices fell to their lowest level in three years on 20 July, when China and South Korean/Japanese acid fell to -$12.50/t f.o.b., both on a midpoint basis, as ample availability was coupled with a lack of spot demand. Furthermore, persistently high freight rates across the Pacific have impeded some of the trade flows and limited the outlets for acid.

A factor that surprised nearly every market participant was the strong demand from Indonesia seen so far this year, which provided a much-needed outlet to supply to producers in the east of Suez, and it impeded a further erosion on fob netbacks. Indonesia imported 564,000 t of acid between January-June this year, of which China has supplied 284,000 t of acid, a jump of nearly double the 144,000 t of acid imported from China in 2022, according to trade data, thus becoming the largest offtaker of Chinese acid, displacing Chile as the number one home for acid from China. Looking forward to the remainer of the year, sulphuric acid demand from Indonesia is expected to remain robust owing to the development of new metals projects that commenced operations in Halmahera and Sulawesi in 2021.

“Sulphuric acid demand from Indonesia is expected to remain robust.

In contrast, sulphuric acid prices west of Suez remained in positive territory in the third quarter, despite the sluggish domestic demand from the downstream sector and weak spot demand from Chile – which has become the largest outlet for Northwest European acid producers – and Morocco’s fertilizer producer OCP.

And while Northwest EU fobs fell to a three year low at the start of the quarter, prices were above zero and averaged $5.50/t f.o.b. in the first three weeks of July. But spot buying from OCP and Chile finally arrived by mid-August, and supported a recovery in f.o.b. pricing owing to tight availability, as producers remained committed for the short term.

The much-awaited demand from Chile stemmed from an outage at a domestic supplier in the country, which resulted in the domestic balance to switch to negative and led to end users to enter the spot market to secure cargos for prompt arrival.

In North Africa, demand from finished phosphate producer OCP finally came back after several months of inactivity as a pick-up in phosphate prices globally awakened appetite for feedstocks to produce fertilizers.

Overall, the short term picture is more positive for the coming months, and it is expected that sulphuric acid prices will remain firm in the fourth quarter, as tight supply is met with robust demand from large offtakers.

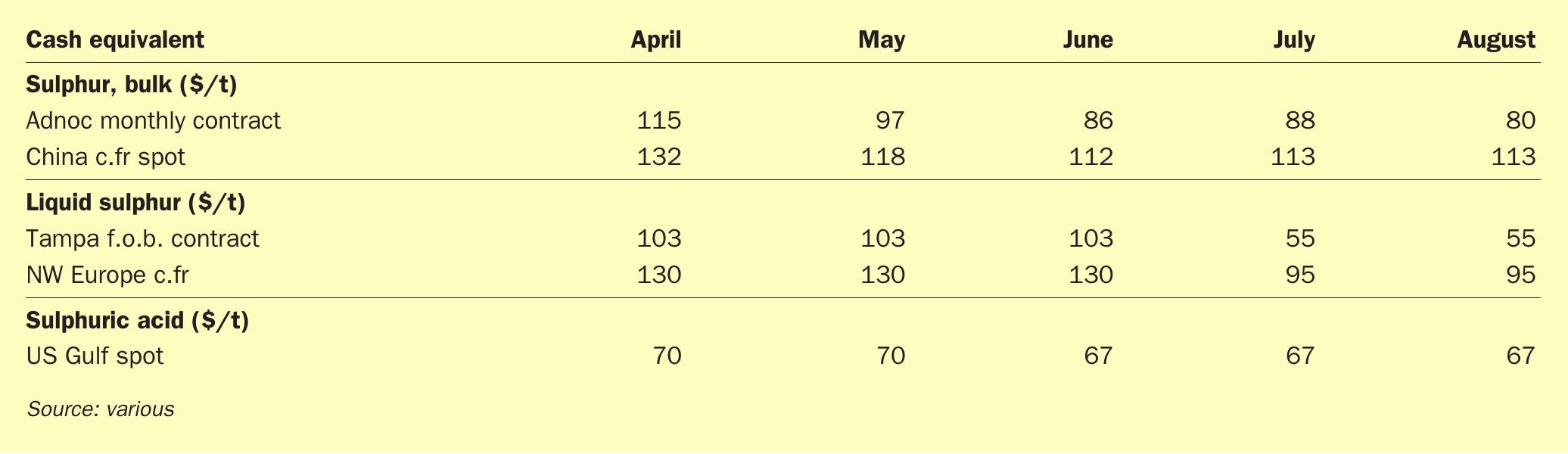

PRICE INDICATIONS