Sulphur 409 Nov-Dec 2023

30 November 2023

Market Outlook

Market Outlook

MARKET INSIGHT

Maria Mosquera, Editor of the Argus Sulphur Report and Liliana Minton, Editor of the Argus Sulphuric Acid Report at Argus Media assess price trends and the market outlook for sulphur and sulphuric acid.

SULPHUR

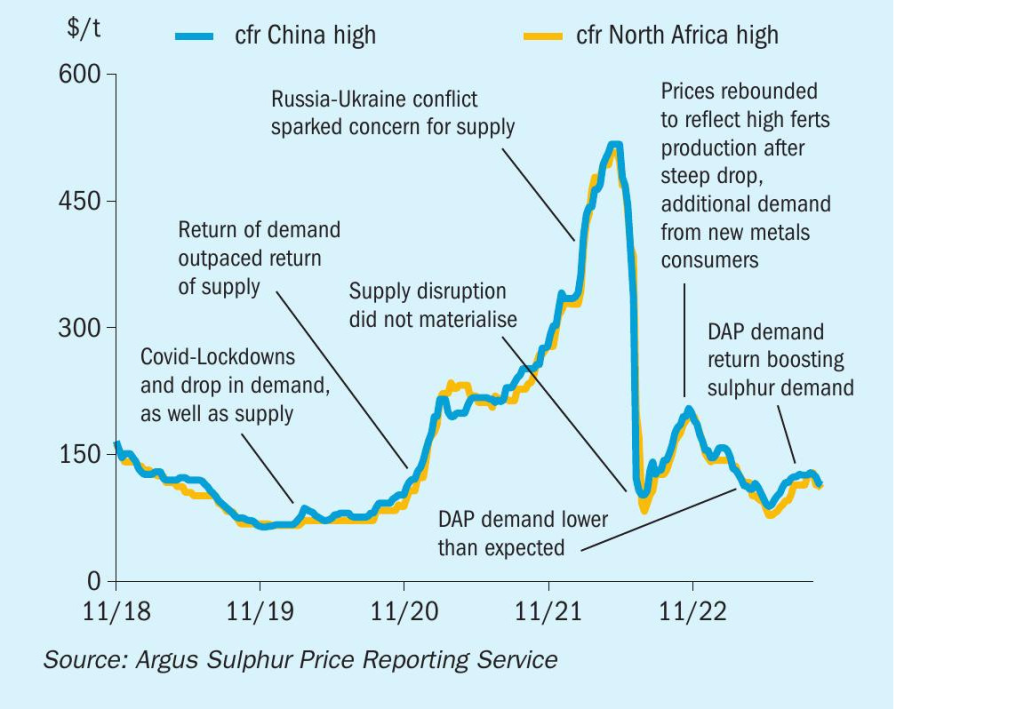

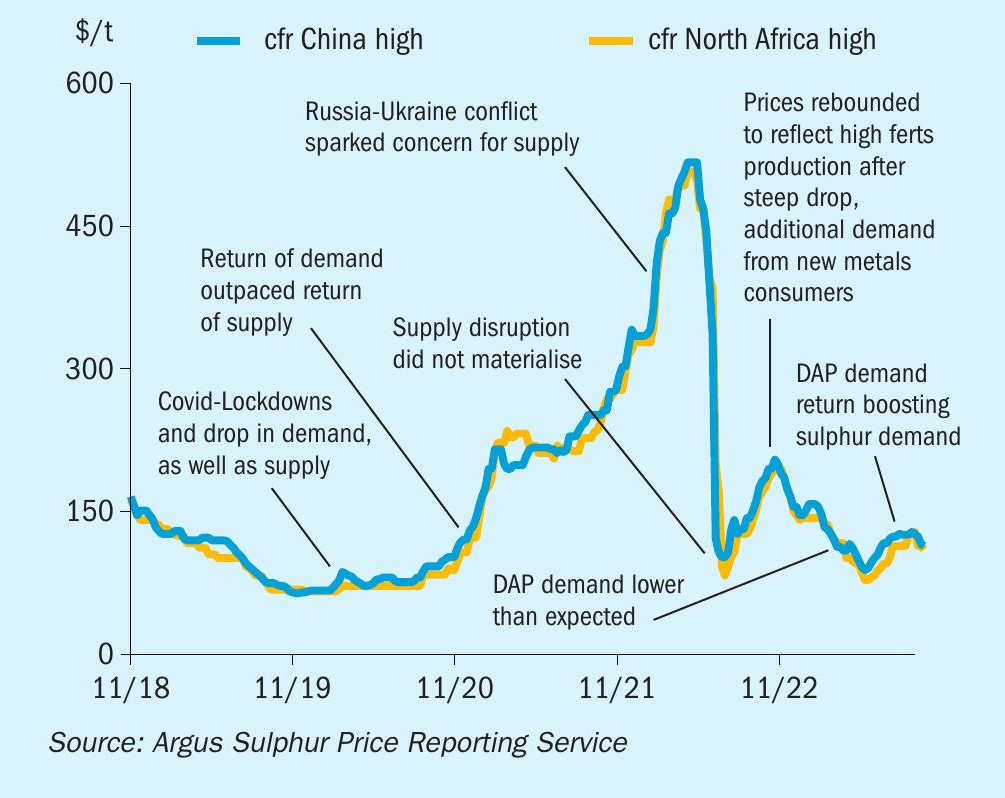

Volatility in sulphur prices has been reduced in the past year following the large price spike and subsequent drop in the summer of 2022. This price volatility has been due to various disrupted seasonal trends from the global pandemic, uneven recovery, geopolitical shifts and demand destruction for fertilizers. Changes to trade flows that have taken place during 2023 have been guided by geopolitical considerations. This again illustrates how the important conversations around sulphur today are not about how much sulphur is globally produced, but affordability and the cost of logistics from the site of production to the site of consumption.

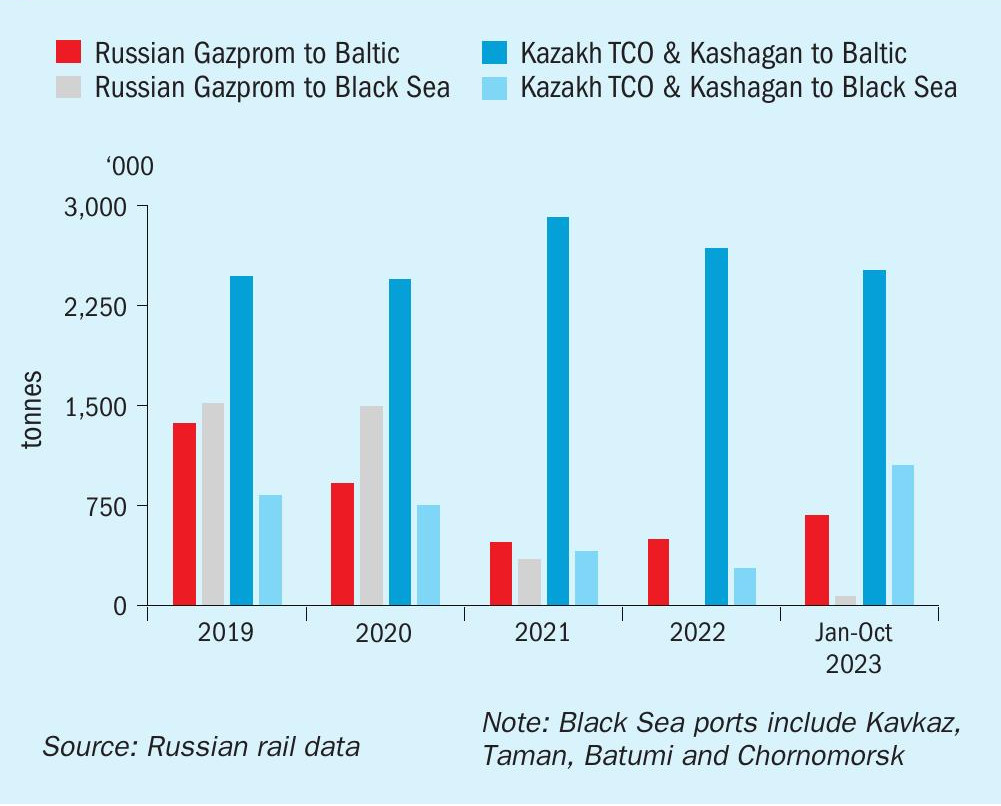

During 2023 US, EU and UK sanctions on Russia have had implications on prices and direction of export flows from Russian ports. Russian-origin product has become somewhat marginalised in terms of price and destination, as many sulphur consumers have self-sanctioned as a result of a greater business risk, banking difficulties and higher costs of transport. Kazakh product exported via Russian ports has also, to a lesser extent, been impacted. This has increased price spreads from the Baltic and Black Sea, as well as depressing f.o.b. netbacks against other suppliers. Some tonnes that load at Georgia’s Batumi port can bypass Russian port and vessel restrictions. However, product export flows have not halted.

The key market Chinese sulphur demand is constrained by two significant factors. One is the substantial level of port stocks, reaching around 2.7-2.8 million tonnes in November. This is a significant level of stocks; a two year high since October 2020, when China’s sulphur stocks averaged 2.9 million tonnes. The stocks were drawn down over a period of reduced import buying in favour of domestic business. This is also likely to occur at the end of 2023.

Additionally, China’s main economic planning body the NDRC suspended customs inspections for phosphate fertilizers for export on 9th November with immediate effect and until further notice because of a rise in domestic prices. This is expected to lead to a reduction in run rates, and sulphur consumption, among Chinese fertilizer producers. Without an export outlet and the domestic market often providing less of a financial incentive to keep producing at high rates, sulphur demand will likely be curbed while restrictions remain in place.

The lack of any significant flows of sulphur exports via the barge route to Black Sea ports has also disrupted the seasonal price trend, where the closure of the lock system from November to March would lead to a pick-up in prices at the end of the year. No Gazprom sulphur was sent along the Volga-Don river route to Kavkaz this year, as has been the case since 202021, when barge exports dropped from an annual 1.5 million t/a to 346,000 t/a and then to nothing in 2022.

However, substantial Middle East flows moving to North Africa during the fourth quarter are reducing available spot tonnes and as such supporting prices from any dramatic erosion. In addition to this, regular spot demand from Indonesian nickel producers has mitigated some of the missing Chinese demand. Chinese c.fr levels have at times trailed delivered prices to what is emerging as a premium market in southeast Asia for Indonesia’s growing nickel refining industry.

The year 2024 does not appear to be the year when geopolitics becomes less impactful on trade flows. While the likelihood for the kind of volatility that was seen in sulphur pricing last year is judged to be low, there is a risk for higher freight rates and a reconfiguration of trade flows leading to short term disruptions if geopolitical turmoil persists or escalates. Higher delivery costs would cap achievable netbacks for suppliers next year, with downstream demand from the phosphate industry likely to remain somewhat lacklustre moving to 2024, weighing on delivered prices.

SULPHURIC ACID

Global sulphuric acid prices have remined firm into the fourth quarter as demand from Moroccan fertilizer buyer OCP returned in mid-August, thus tightening sulphuric acid availability in Europe and Asia.

Northwest European prices peaked this year at $65/t f.o.b. at the end of October, a considerable recovery from the $5.50/t f.o.b. recorded in mid-July, as prices quickly reacted to heavy spot buying from OCP – which entered the spot market to secure approximately 500,000 tonnes of acid of European and Asian origin combined, for delivery in the last four months of the year.

Asian prices also saw sharp increases as Chinese f.o.b. prices peaked at $47.50/t f.o.b. on 21st September, but have since then fallen to $35.50/t f.o.b. on 9th November on a combination of higher domestic availability coupled with the lower demand from the domestic fertilizer sector.

Chinese f.o.b. prices may continue to experience some downward pressure as Chinese smelter-based acid availability is to increase following new capacity coming on line. The start-up of Guangxi’s Nanguo smelter – with a capacity of 1.6 million t/a – in September and capacity expansions at Shandong’s Dongying Fangyuan copper smelter, Baiyin Nonferrous and Houma north Copper are also expected to increase availability.

But it was not just OCP who returned to the market in August/September, demand from Chile – largest sulphuric acid offtaker – was also active in August-September, and resulted in delivered prices to rise as demand was met with tighter supply from key origins.

Chile experienced domestic supply disruptions following an unplanned outage at Noracid’s sulphur burner in August and output issues at Enami’s Paipote smelter following its return from heavy maintenance also that month, which tilted the domestic market into deficit, and forced buyers to enter the spot market to cover the domestic supply shortage.

Current delivered prices to Chile averaged $150/t c.fr in October, well above the $90/t c.fr when prices bottomed out in July, thus making Asian import tonnage viable considering current Asian fobs and freight rates.

Looking forward, demand from Chile next year is expected to be largely unchanged as the decommissioning of BHP’s Cerro Colorado at the end of the year is expected to be partly offset by lower domestic production following the decommissioning of Codelco’s Ventanas smelter at the end of May.

End users in Chile are expecting sulphuric acid prices to trend lower in 2024 and as such buyers are keeping a larger proportion of their annual volumes to be fixed on a variable basis – either on formula or on a quarterly pricing negotiation.

Base metal prices have been volatile in October and into November, and heavily influenced by economic sentiment coming out from China and a strong US dollar. Persisting high inflation levels have also weighed on metal prices.