Sulphur 409 Nov-Dec 2023

30 November 2023

Market Outlook

MARKET OUTLOOK

SULPHUR

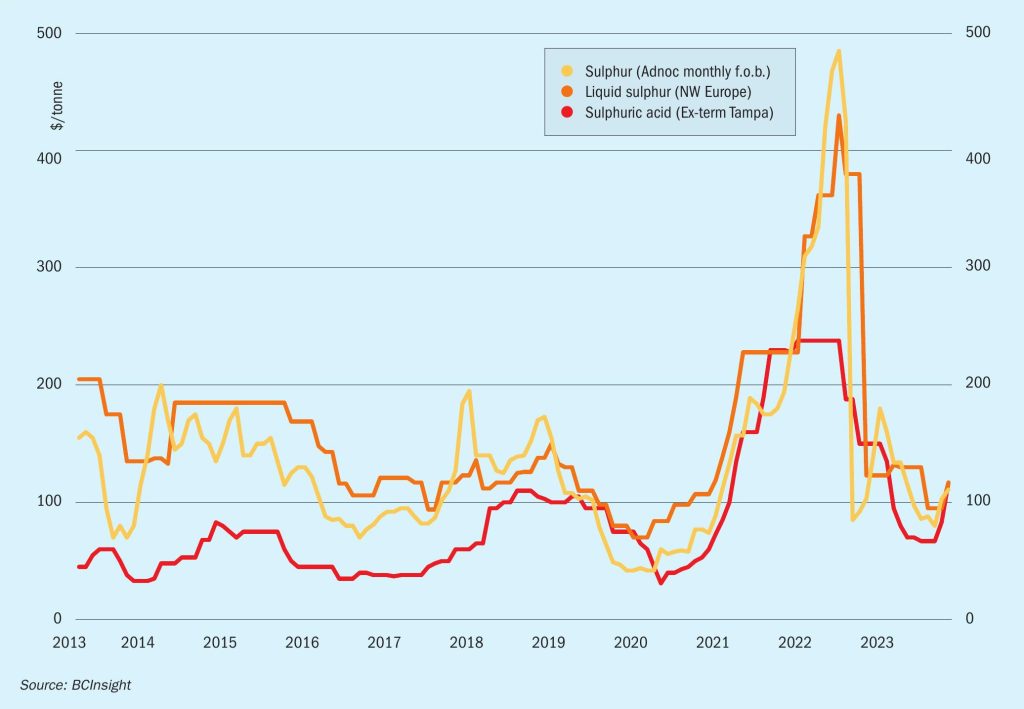

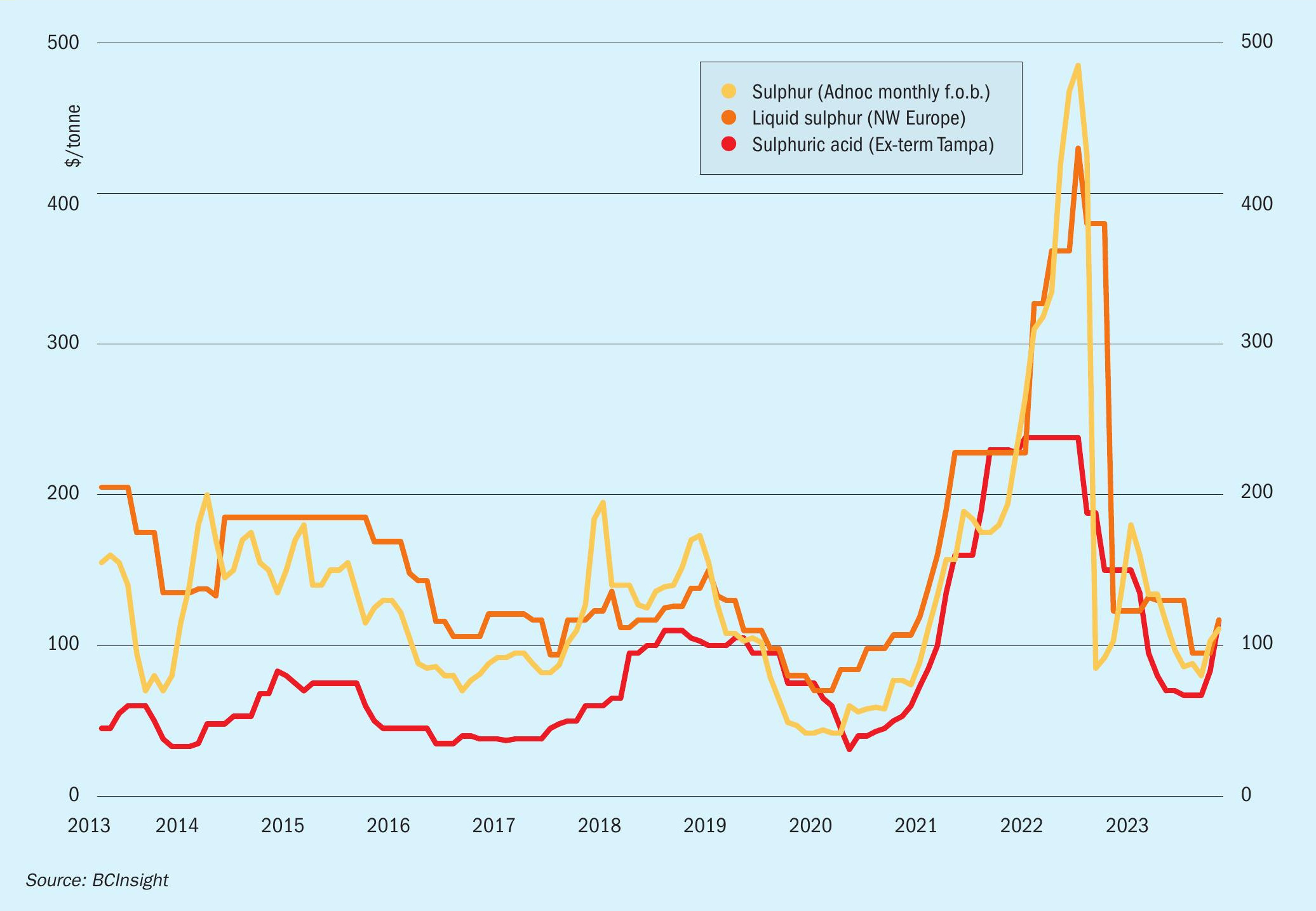

- A softer trend in DAP prices, linked to lower operating rates in China and declining demand, is contributing to falling sulphur prices.

- However, west of Suez, healthy November bookings for Moroccan and Brazilian markets are expected to provide market support and limit any downside. A softening in freights assessments should also support supplier f.o.b. prices.

- Chinese sulphur import demand is likely to be weighed down in the short term by high port stocks and reduced fertilizer exports as a result of ongoing export controls.

- However, at present sulphur demand for Indonesian high pressure acid leaching nickel production is mitigating some of the shortfall from Chinese imports in Pacific markets. l North African demand for sulphur is continuing to increase due to OCP’s new phosphate production in Morocco.

- Geopolitical considerations such as the conflict in Ukraine have altered global trade flows of sulphur and limited netback prices, and this situation is expected to persist into 2024.

- High freight costs and geopolitical turmoil remain significant risks to trade flows, and hence there may well be short term price volatility were it to be the case that there any bottlenecks in supply arise next year.

SULPHURIC ACID

- Morocco remains in the market for sulphuric acid tonnages for early 2024 arrival. The sulphuric acid line up at Jorf Lasfar was estimated at a total of 330,000 tonnes scheduled for arrival during 4Q23.

- Chilean sulphuric acid demand is expected to remain firm next year, with more end users keeping some of the volumes to be supplied by the spot market in anticipation of lower f.o.b. prices in Asia. The rise in northwest European prices and the ongoing logistics issues in vessels crossing the Panama Canal will likely affect vessel arrivals into Chile and result in more acid remaining in nearby destination markets.

- European suppliers are sold out for October-November loading. Some additional European supply could become available for December loading considering the current high export prices, but it remains to be seen if European producers can manage to free up some tonnes for loading towards the end of the year.

- European acid pricing is expected to remain firm next year as heavy maintenance at key smelters – such as Aurubis’ Hamburg smelter – is scheduled in the second quarter of 2024, which will tighten acid availability from Europe.

- Chinese acid pricing is expected to soften as 2024 progresses on the back of new smelter acid capacity coming online, as well as output ramp-ups from already completed projects. However, a risk to the forecast could be a strong domestic market, which may limit acid availability for the export market.