Sulphur 409 Nov-Dec 2023

30 November 2023

Sulphuric acid markets

SULPHURIC ACID

Sulphuric acid markets

The merchant market for sulphuric acid is only a small slice of overall global acid demand, dominated by smelter acid producers. Increasing replacement of acid imports by dedicated sulphur burning acid plants by end use consumers is reducing the scope for merchant sales and could lead to overcapacity in the near term.

Sulphuric acid prices have been through a turbulent couple of years, with prices rising steadily through 2021 and remaining at high levels for much of 2022, before beginning a price collapse that has only turned around in the past couple of months.

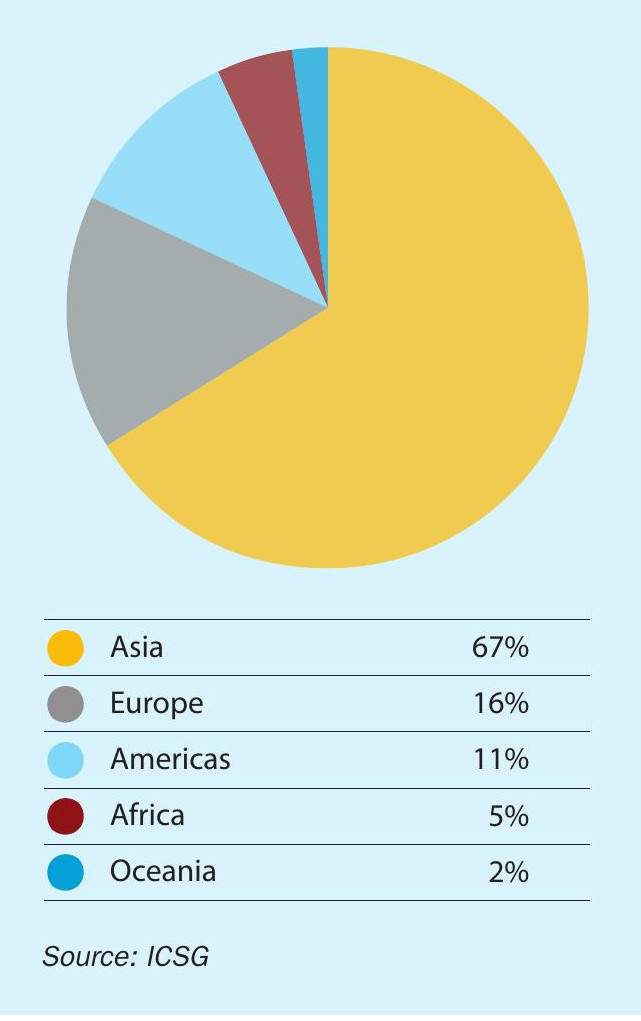

Global sulphuric acid production of around 270 million t/a is dominated by sulphur burning acid capacity, with around 30% coming from the off-gases from smelting of base metals; mainly copper, but also lead, zinc and to a lesser extent nickel. Because it is involuntary production to avoid emissions of harmful sulphur dioxide, production of smelter acid is driven primarily by the economics of metal markets rather than sulphuric acid prices, and hence it is often produced regardless of prevailing acid market conditions. As Figure 1 shows, smelter acid capacity is concentrated in Asia, particularly China. In 2022, China accounted for almost 50% of world copper smelter production, followed by Japan (7.4%), Chile (5.2%) and Russia (4.6%).

The difficulty and hence high cost of shipping sulphuric acid means that sulphur-burning acid capacity is usually integrated into local downstream uses, especially phosphate fertilizer production, but also copper and nickel leaching etc. Domestically and internationally traded acid thus tends to come mainly from smelter acid production, with sulphur burning acid capacity adding to this when prices permit. In 2022, seaborne sulphuric acid trade was only 16 million t/a, a fraction of the huge market for sulphuric acid, and CRU estimates that 12.8 million t/a of this (80%) was accounted for by smelter acid, with sulphur burnt acid making up the remaining 20%.

This creates a dynamic between sulphur and sulphuric acid prices. Where sulphuric acid prices are higher than the equivalent volume of sulphur, there is an incentive for consumers to import acid rather than sulphur. Conversely, low sulphur prices are often a signal for those who have the capability to burn sulphur instead of importing acid to start up their sulphur burning acid plants, which can also often generate electricity credits. Much of the fall in acid prices during 2022 and 2023 was due to falling sulphur prices, which had peaked at around $500/t in mid-2022, only to drop quickly to below $100/t within months. This fed through into, for example, a significant reduction in Moroccan imports of acid, especially from Europe. At the same time, significant volumes of acid were available from China, helping to push prices down.

The past couple of months, however, have seen something of a turnaround in acid prices, as Morocco has returned to the market, taking available volumes and leading to something of a supply squeeze as spot cargoes became unavailable.

This has been driven by a buoyant phosphate market, with phosphate prices rising around 20% during 3Q 2023. Demand has been rising from Chile, helping to bring acid prices upwards again.

Demand – major importers

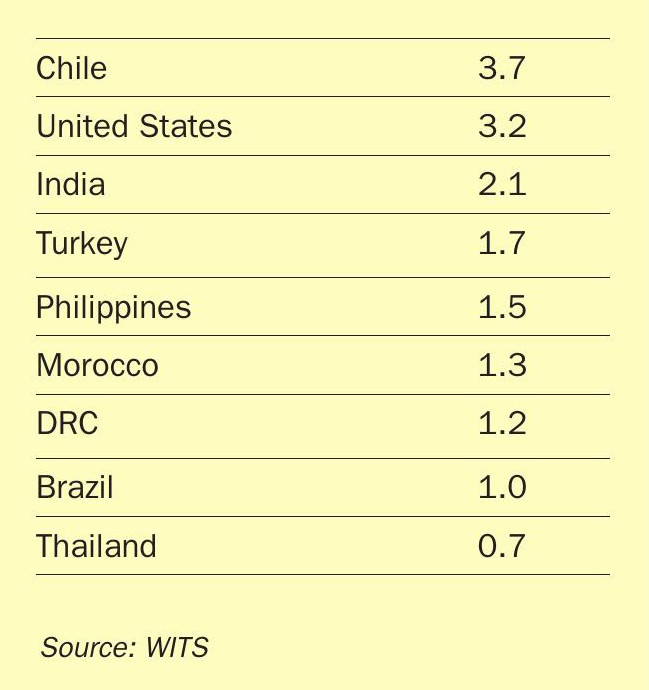

As Table 1 shows, the major importers of sulphuric acid in 2022 were Chile at 3.7 million t/a, followed by the United States and India. As noted, Morocco’s imports were significantly down on 2021.

Chile

Chile’s acid demand is almost all destined for copper leaching projects. Chile has the largest copper leaching operations in the world. However, demand has been falling due to the exhaustion of some projects and falling ore grades, while there has been a renewed increase in copper smelter projects. Chilean demand for sulphuric acid for copper production was 8.4 million t/a in 2022, and this is expected to fall to 8.2 million t/a this year. However, some mine life extension programmes and new leaching projects are expected to more than make up for the decline of existing projects and boost Chilean acid demand over the next few years, up to 8.3 million t/a in 2024 and back to 8.4 million t/a in 2027.

On the other hand, interruptions in domestic smelter production mean that Chilean acid imports were 3.7 million t/a in 2022; a record figure, and up significantly from 3.3 million t/a in 2021. Of this, around 1.1-1.2 million t/a of imports comes from copper smelters in neighbouring Peru, and this figure has been fairly constant for at least a decade and there is at present no real prospect of this changing in spite of some controversial copper smelter projects in Peru like the now shelved Tia Maria project. The upshot is that additional Chilean acid demand of around 1.7 million t/a must be supplied from outside the region. Mostly this comes from East Asia, but when prices are right European acid can also make its way to Chile. There are complications with this related to freight prices however, and recent congestion in the Panama Canal has forced European acid shipments to travel around Cape Horn, adding 10 days onto shipping times and increasing freight costs accordingly.

The ageing Ventanas smelter was decommissioned in May 2023, removing 450,000 t/a of domestic acid production. However, Chile also continues to build domestic sulphur burning acid capacity, which will reduce the scope for long-distance shipments to Chile over the medium term, from around 2.6 million t/a at present to 2.0 million t/a by 2027.

United States

The US exports some sulphuric acid, mainly to Canada and Mexico, however it is mainly a net importer, to the tune of around 2.6 million t/a per year. Most of this goes to feed phosphate production in Florida. A downturn in US phosphate production reduced US acid demand in 2022 to about 31 million t/a, though domestic acid production also reach a low point of 28.2 million t/a. US domestic acid production is now on a rising trend, however, with both some incremental smelter capacity and new sulphur burning acid plants to feed copper and lithium mining operations. At the same time, these mining operations are also boosting overall demand, and the volume of US imports is expected to remain relatively even over the coming years at just under 3 million t/a.

India

Indian acid demand was 13.4 million t/a in 2022, mainly for phosphate production. Of this, domestic sulphur burning acid plants supplied 9.1 million t/a and domestic smelters 2.4 million t/a. The acid situation in India continues to be significantly impacted by the forced shutdown of the Sterlite Copper smelter at Tuticorin. Tuticorin had 1.2 million t/a of acid capacity, and its absence has led to increased Indian imports of acid to make up for the shortfall.

Indian acid capacity is increasing. Coromandel started a new 0.6 million t/a sulphur burning acid plant in August this year, and Iffco are due to start a new sulphur burning plant of similar size in Q1 2024. Paradeep Phosphates is also building a 0.5 million t/a acid plant which is due to be completed at the end of 2024 or start of 2025. In addition to this 1.7 million t/a of capacity, Adani has a new smelter due to start production next year which will add another 1.5 million t/a of sulphuric acid capacity. By 2027, Indian acid production is forecast to be 15.8 million t/a, up 3.9 million t/a on 2022. As with the US, additional demand is expected to keep pace with capacity additions, however, and imports are not likely to fall much on their current levels.

Morocco

Morocco imports acid to feed its rapidly growing phosphate industry. Moroccan phosphate capacity is rising from around 20 million t/a in 2018 to about 32 million t/a in 2025-6. But at the same time, the country is building sulphur burning acid capacity to cover the additional requirement for acid, and in fact Moroccan imports are likely to fall from around 2 million t/a in 2021 to closer to 1.2 million t/a over the medium term.

Supply – major exporters

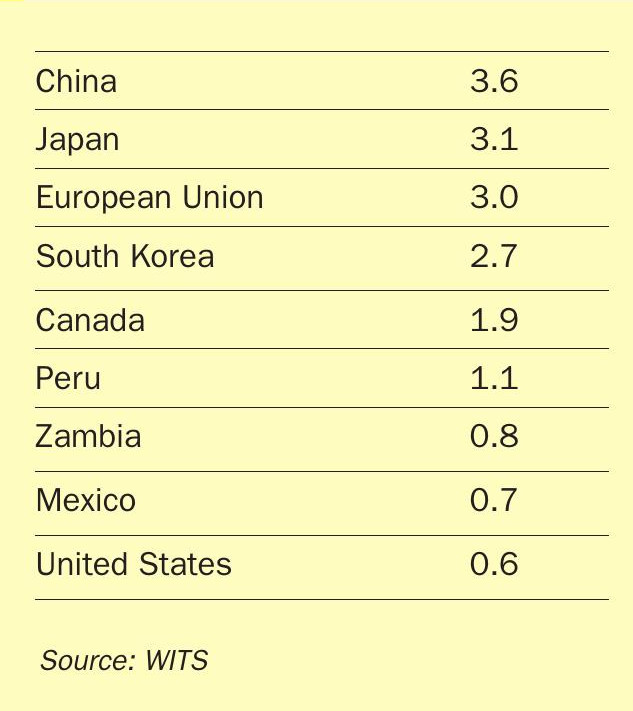

As Table 2 shows, the largest exporters of acid in 2022 were China, followed by Japan, the European Union, South Korea, Canada and Peru.

China

China exported a major volume of acid in 2022; 3.6 million t/a, making the largest global exporter that year. However, Chinese acid exports in 2023 have been down significantly, with lower prices deterring sulphur-based acid producers from entering the export market, and smelters finding opportunities for acid sales on the domestic market. Chinese f.o.b. acid prices have dropped to only just above zero, with domestic prices around $50/t. The third quarter of 2023 did see an uptick in Chinese exports of acid nevertheless, with Indonesian demand high in Q2 and Q3. Overall, Chinese exports are expected to be 2.3 million t/a of acid for full year 2023.

Copper smelting in China expanded dramatically over the period 2005-2015, and Chinese acid production doubled over that period. While there has been a period of rationalisation since then, with a crackdown on energy-intensive industries as part of the country’s aim to reduce its carbon emissions, and a focus on greater reuse of copper scrap and reduced condensate imports, new smelter capacity continues to increase. Daye Nonferrous and Nungua Copper will add 2.0 million t/a of acid capacity this year and Jinchuan Copper 1.2 million t/a next year.

Japan and Korea

Japan and South Korea continue to be major exporters of sulphuric acid from their smelting industries.

Korean exports are expected to remain at around 2.6-2.7 million t/a of acid over the next few years, and Japan around 3.13.2 million t/a. Output is expected to be down slightly overall for 2023 due to 4Q maintenance turnarounds at Japanese smelters, removing up to 280,000 tonnes of acid from the market.

Europe

The other major acid exporting region is Europe. Acid exports used to be typically around 4.0 million t/a, with Bulgaria, Germany and Spain among the largest producers, but 2022 saw a wave of maintenance shutdowns at smelters and also high power prices which led to some smelters working at reduced capacity for economic reasons, so exports fell to 3.0 million t/a. The figure for 2023 is expected to be slightly higher, with for example the Ecobat smelter in Germany resuming operations in March 2023.

Others

Acid demand is rising rapidly in Indonesia for HPAL nickel production. Demand will more than triple to 17.0 million t/a to 2027. Most of this will be supplied by domestic sulphur burning acid capacity, however, which is set to rise from 3.9 million t/a in 2022 to 12.8 million t/a in 2027. New copper smelting capacity will take Indonesian smelter acid production to 3.2 million t/a in 2027, and another 1.1 million t/a may come from pyrite roasting. All of this could actually turn Indonesia into a net acid exporter, though only a marginal one. In the short term however, it has led to increased acid imports, up to 564,000 tonnes in 1H 2023, mostly supplied from China.

Africa’s Democratic Republic of Congo is seeing a new copper smelter being constructed at Ivanhoe Mines’ Kamoa-Kakula copper mining complex. The smelter will produce 500,000 t/a of copper at capacity, and is scheduled to open in 2025. Vedanta is also looking to build a new zinc smelter at its Gamsberg zinc mine, near Aggeneys, in South Africa. The project would produce 300 000 t/a of high-grade zinc by processing 680 000 t/a of zinc concentrate, generating 450,000 t/a of sulphuric acid for both export and consumption within South Africa.

Oversupply looming?

Smelter acid is continuing to increase its share of global sulphuric acid trade. As smelter operators see sulphuric acid almost purely as a waste product, this could help to keep acid prices subdued. At the same time, there is new sulphur burning acid capacity coming onstream in traditional import markets such as India, Chile and Morocco which are reducing the need for long distance acid shipments. Merchant trade in acid is forecast to fall from 16 million t/a this year to 14.4 million t/a in 2024, and may not begin to rise again until 2028. There is therefore the potential for oversupply in the market over the next few years. On the other hand, phosphate markets appear to me moving into deficit, which could help boost sulphur and acid prices going forward.