Fertilizer International 519 Mar-Apr 2024

31 March 2024

Market Insight

Market Insight

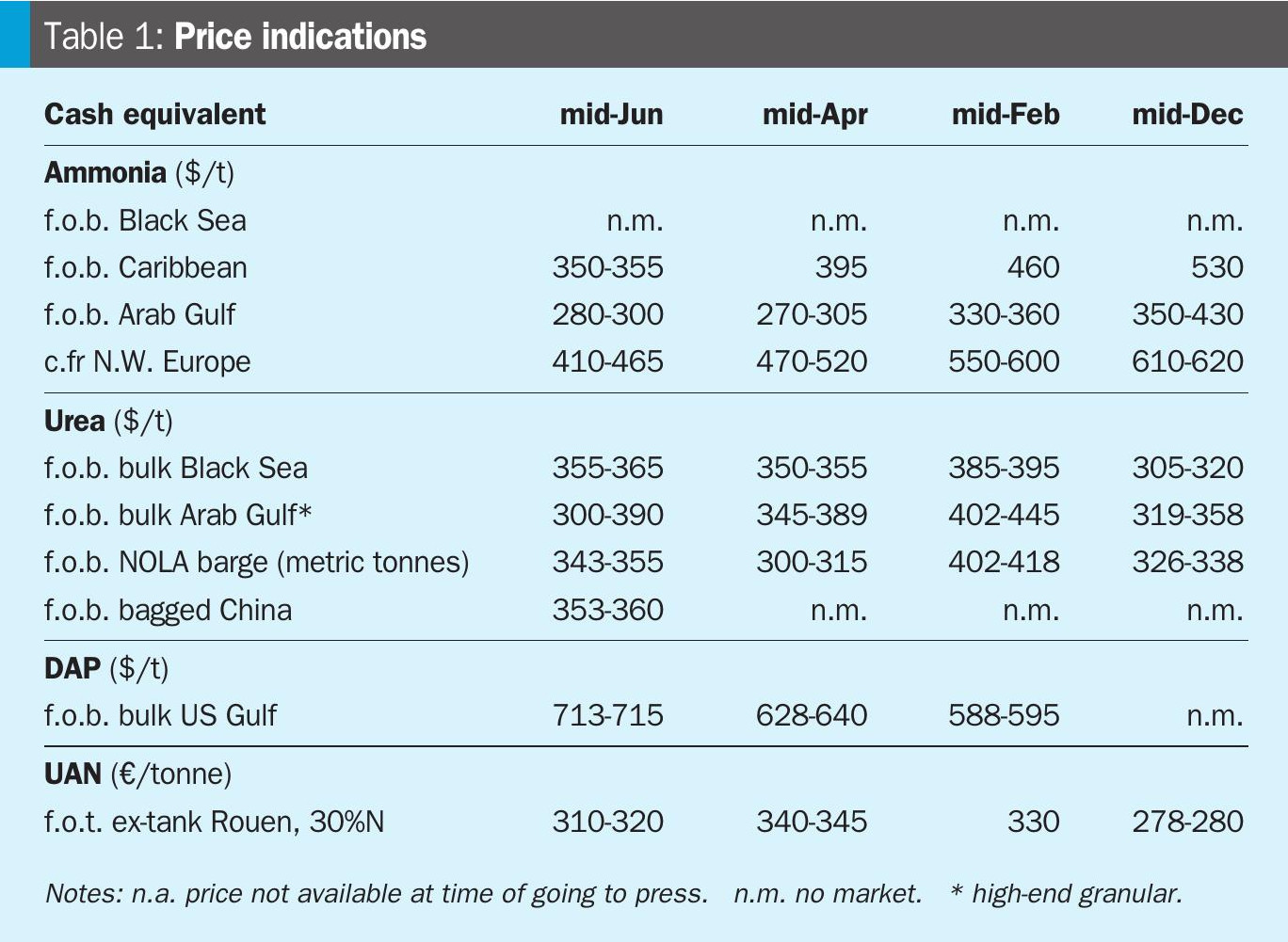

PRICE TRENDS

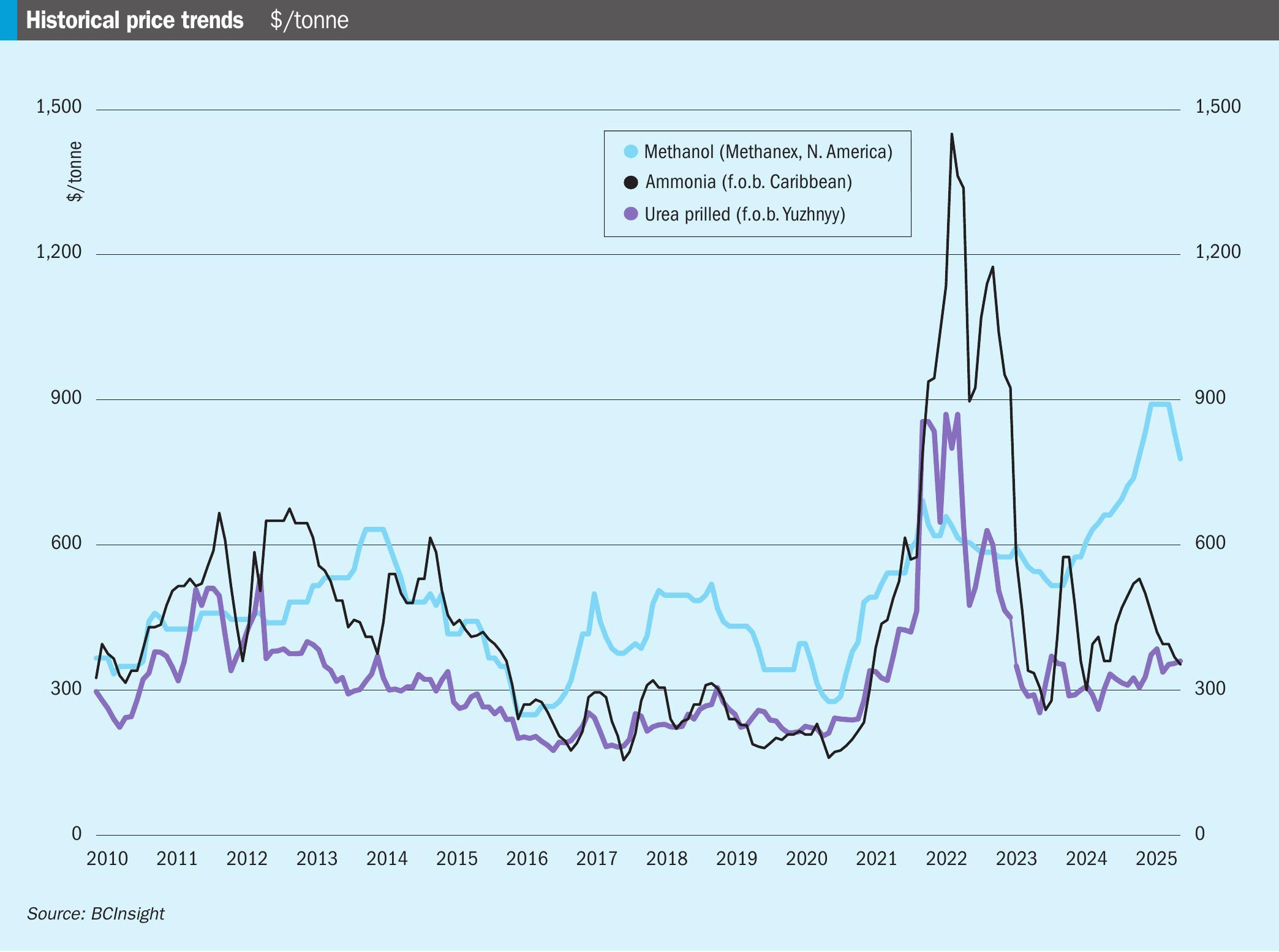

Urea. As February ended, urea prices found support in the US and Brazil while Europe remained subdued and Egypt struggled to find buyers. New Orleans was the one bright spot in the urea market – with NOLA prices benefitting from the meeting of suppliers and buyers at the TFI’s domestic conference. With positive sentiment all round, prices moved up $30/st, peaking at $390/st f.o.b. for March.

Participants gathering at the AFA conference in Cairo were not boosted by the same sentiment as their US counterparts. Egyptian producers remain optimistic, however, despite the lack of market interest and prices edging below $400/t f.o.b. Some buying interest is expected to re-emerge in Europe, although the wet weather continues to cause disruption. Egyptian and Black Sea suppliers are unlikely to find relief in Turkey either, as demand there is soft due to poor farm interest.

Unlike phosphates, there is currently no clear indication when Chinese urea exports will resume.

Ammonia: Price benchmarks in the east remained stable-to-soft at the end of February, while prices in North America experienced some support in an otherwise lengthy market. Regional ammonia sentiment is trending towards the downside currently despite the rollover in the Tampa contract price.

There was little to shout about in the Middle East either. The region’s producers continue to focus on contractual obligations, with Ma’aden reporting reduced netbacks on its latest term shipments around the $295/t f.o.b. mark. Import demand from India may be stimulated in the coming weeks following a 38 percent increase in the nutrient-based subsidy (NBS) rates for phosphate fertilizers. The news of fresh phosphate export quotas in China is also likely to boost ammonia producer sentiment.

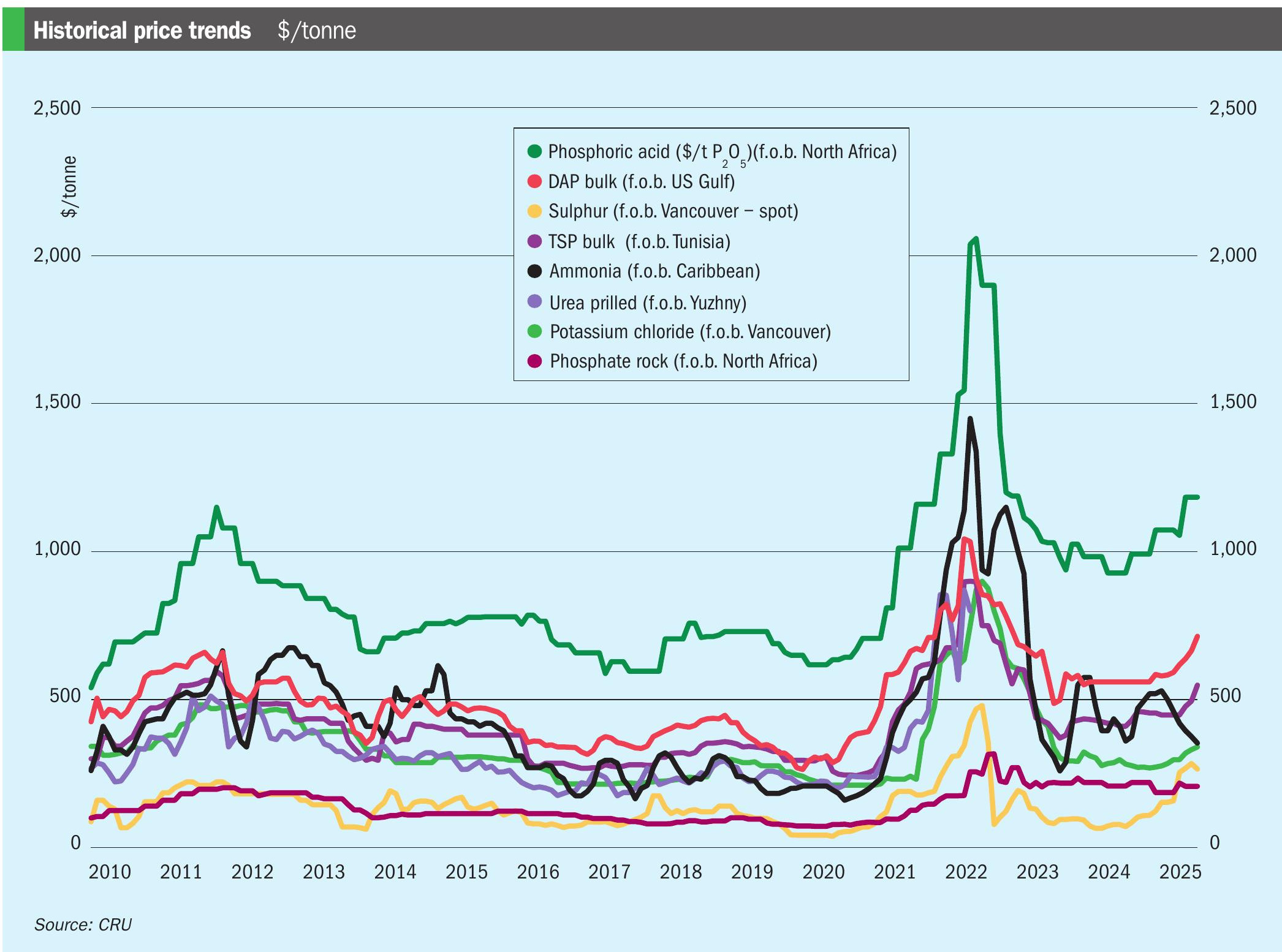

Phosphates: China’s publication of its 2024 DAP/MAP export quota and India raising its nutrient based subsidy (NBS) rates by 38 percent for phosphate fertilizers were the two main market developments at the end of February.

After weeks of market speculation, China announced a new phosphate export quota for 2024 of around five million tonnes for DAP and two million tonnes for MAP, with export inspections set to begin on 15th March 2024. These volumes are in line with CRU’s previous expectations.

Most prices remained largely unchanged, however, despite these announcements, with the exception of the US market. US DAP prices rose to $600610/st f.o.b. NOLA, with MAP barges holding stable at $610-625/st f.o.b. NOLA. Prolonged market tightness was reflected by a narrowing in the spread between DAP and MAP prices.

Potash: Potash price direction has been mixed. Prices in Brazil firmed for a second week in a row at the end of February while other spot prices outside the US declined. Brazilian potash prices recovered to an average price of $290/t cfr, their highest price level in four weeks, although still down $25/t on the start of the year.

Indian potash contract negotiations remain a mystery. Although some expect prices to fall to $280/t cfr, neither Indian importers nor suppliers have commented. India’s NBS announcement left the potash subsidy unchanged for the upcoming Kharif season. The maximum retail price for potash was also unchanged at INR 1,670 per bag.

Sulphur: Prices ended February relatively stable following previous gains. While the price trend is seemingly still upwards, bullish sentiment is being limited by a few concerns.

The Middle East spot sulphur price – while still down 59 percent on early December 2022 – was assessed at $73-78/t f.o.b., having climbed 12 percent in the past two weeks. The benchmark rallied by 47 percent last year, between the end of July and mid-October, to reach $110/t f.o.b. before declining once again.

Steep increases in Chinese port stock levels, meanwhile, are a market issue. Although concerns over this are being countered by expectations of better demand, good affordability and likely increases in phosphate production linked to resumed export allowances.

OUTLOOK

Urea: Buying in the northern hemisphere is offering price support. Following warnings of spring season urea shortages from US producers and importers, this has finally translated into a price rally in the NOLA barge market. US prices are expected to strengthen during March and April before declining post season.

While Egyptian prices plateaued in February, after a strong start to the year, another rally is expected in March. This might prove to be a price peak as Europe moves out of season subsequently.

Global DAP/MAP demand remains relatively poor currently. Yet, with inventories across many key global markets quite low, demand is expected to rebound as buyers seek to replenish stocks.

Ammonia: The outlook is looking less negative with slightly more support than previously envisaged. While good availability and limited spot interest continues to add length to the Asian market, suppliers are hopeful that a ramp-up in Chinese demand, in support of downstream urea and phosphate production, will add temporary support to prices through the spring.

Similarly, in the Middle East, expectations of renewed import appetite from the Far East – and potentially India – should limit the price declines envisaged previously. In the US, the Tampa benchmark should hold relatively stable in the short term, in CRU’s view, although it will most likely bottom out at some point during the third quarter.

“China’s publication of its 2024 DAP/ MAP export quota and India raising its nutrient based subsidy (NBS) rates by 38 percent for phosphate fertilizers were the two main market developments at the end of February.”

Phosphates: Global DAP/MAP prices are expected to drift gradually lower over the short term, although the downside is expected to be limited until around May-June, given the persistence of tight supply.

Following China’s announcement of a new 2024 phosphate export quota, some small DAP/MAP volumes may be exported in coming weeks. But CRU is not expecting bulk exports from China until well into second quarter. In the meantime, global prices look set to be supported by limited availability.

Potash: Market oversupply should apply downward pressure on prices over the next six months, with spot and contract prices expected to fall below $300/t by May. Prices could even fall lower than expected if supply continues to rise.

Globally, supply continues to outweigh demand, with many potash markets reporting record 2023 imports. In Brazil, MOP prices are expected to rise to a peak in April/May before falling back. Southeast Asian standard MOP prices are expected to decrease steadily throughout the forecast period.

Sulphur: Prices are forecast to increase out to August due to good affordability and slightly improved demand, though any upside is likely to be limited by good availability.

Overall, the recent growth in sulphur production, in addition to stock drawdown and high Chinese inventories, is expected to limit upwards potential for prices in the short term and keep sulphur prices low relative to phosphates. However, affordability continues to support raw materials purchasing and leaves room for price increases, especially if downstream production picks up as expected and sulphur stock drawdown slows.