Sulphur 411 Mar-Apr 2024

31 March 2024

Market Outlook

Market Outlook

SULPHUR

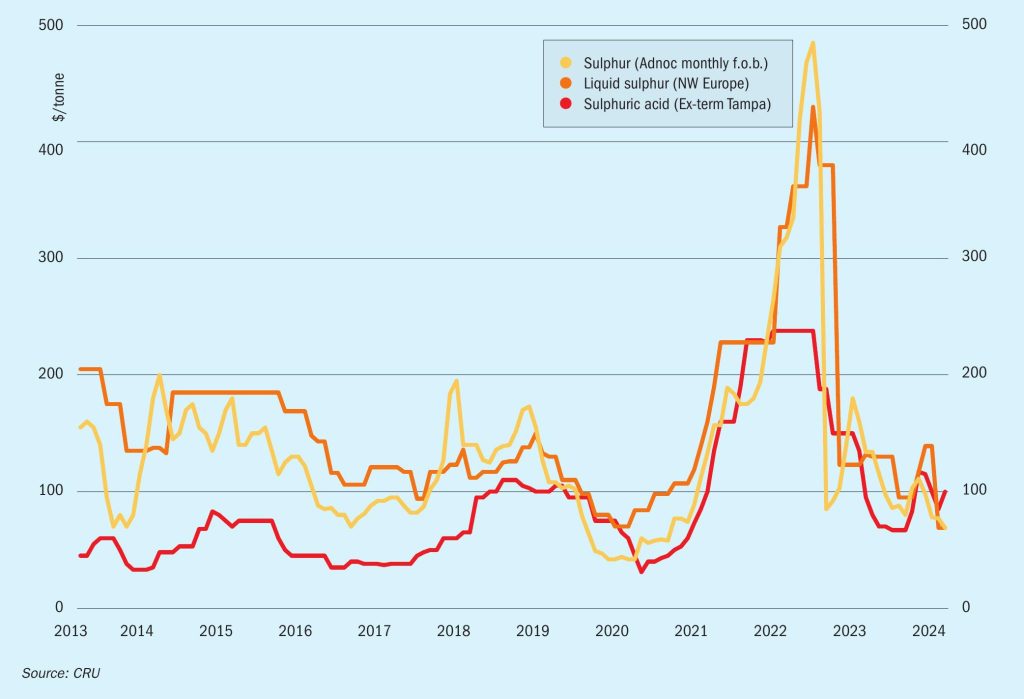

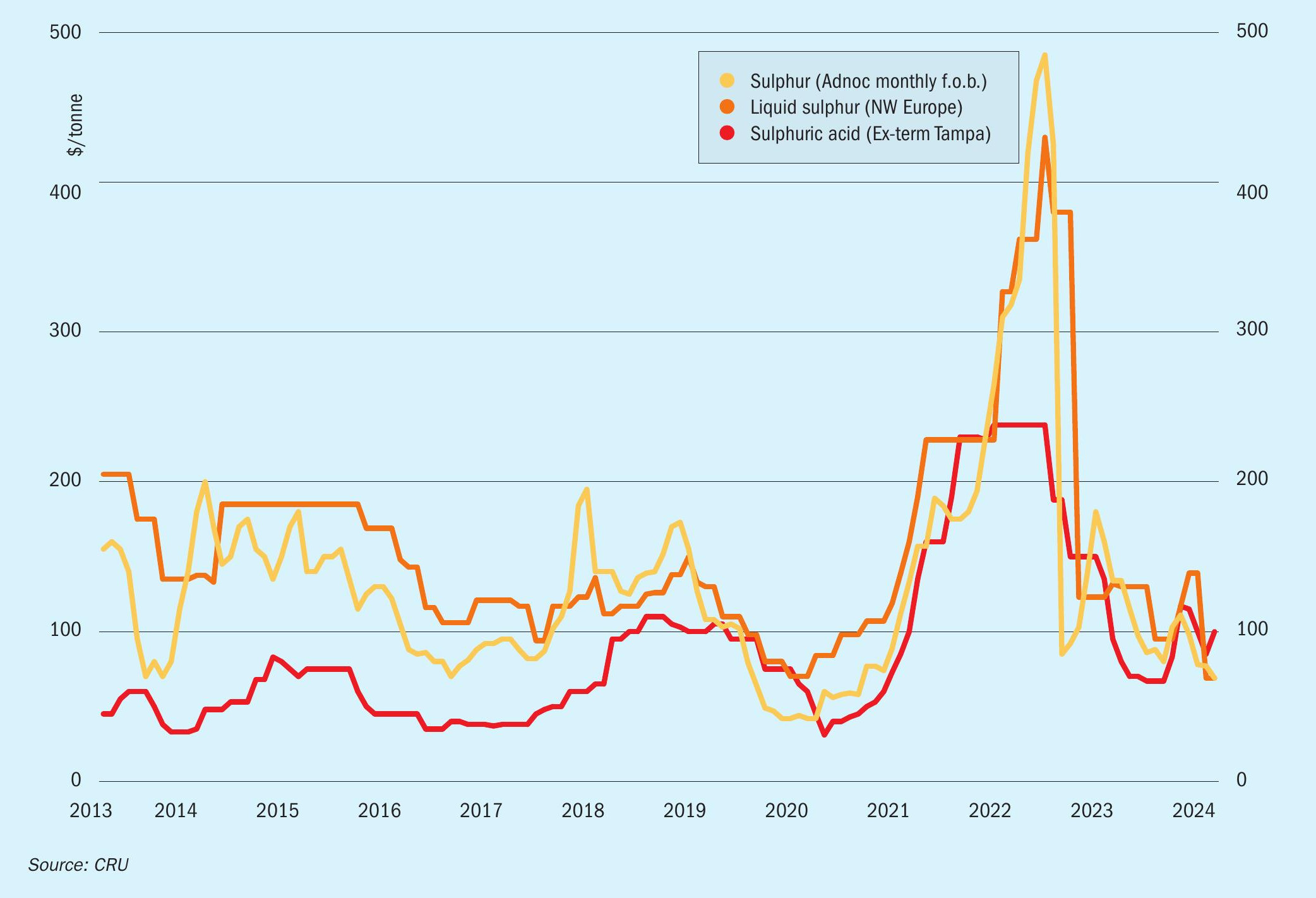

- CRU expects sulphur prices to be supressed in early 2024 by high port inventory and limited phosphate export business. However, affordability continues to support raw materials purchases and leaves room for price increases, especially if downstream production picks up as expected and sulphur stock drawdown slows.

- Two key factors are expected to influence China sulphur prices in 2024: port inventory and phosphate export restrictions. High inventories in Chinese ports will continue to limit the upwards potential for prices in the short term, and keep sulphur prices low relative to phosphates.

- In the meantime, phosphate fertilizer producers in China, the largest importer of sulphur, have suffered from escalated export barriers since November 2023. They have cut downstream production as a consequence and hold limited sulphur inventory However, export restrictions are expected to be eased after China’s spring application season.

- Furthermore, the affordability of sulphur relative to phosphates remains good even at lower forecast DAP prices. As such, sulphur demand should increase when phosphate export activity picks up, as phosphate producers can purchase the raw material without price pressure.

SULPHURIC ACID

- Global spot prices are likely to decline further over the coming weeks and months, but severe decreases are not expected. Downstream production rates remain relatively weak overall and domestic production is increasing in some key import markets. Still, affordability (relative to downstream markets) is broadly acceptable, even though it is the worst it has been for some time and looks particularly bad when compared with upstream sulphur.

- Pressure from increasing acid availability across the globe will continue to weigh on European f.o.b. prices for acid, as will low-sulphur prices outside Europe.

- News that Enami’s Paipote smelter would close in April may add some support to acid demand for Chile in the coming months. The company announced in late January that the smelter, which produces around 290,000 t/a acid in the Atacama region, would close in late April. Company officials previously announced that the smelter was scheduled to close temporarily in January 2025, although it was expected to be brought forward to 2024.

- Production at Chinese copper smelters has remained high, but some sources expect smelter maintenances in April-June may tighten availability. The ramp-up of several new smelter projects, such as Houma II, Nanguo II, Baiyin II, and Guorun Copper II, as well as resumption at the old Daye smelter could significantly drive smelter output growth in 2024.

- In India, the Adani group is planning to start production at a new smelter with 1.5 million t/a sulphuric acid capacity. Latest reports suggest the smelter will be running by the end of March.