Sulphur 411 Mar-Apr 2024

31 March 2024

Price Trends

Price Trends

SULPHUR

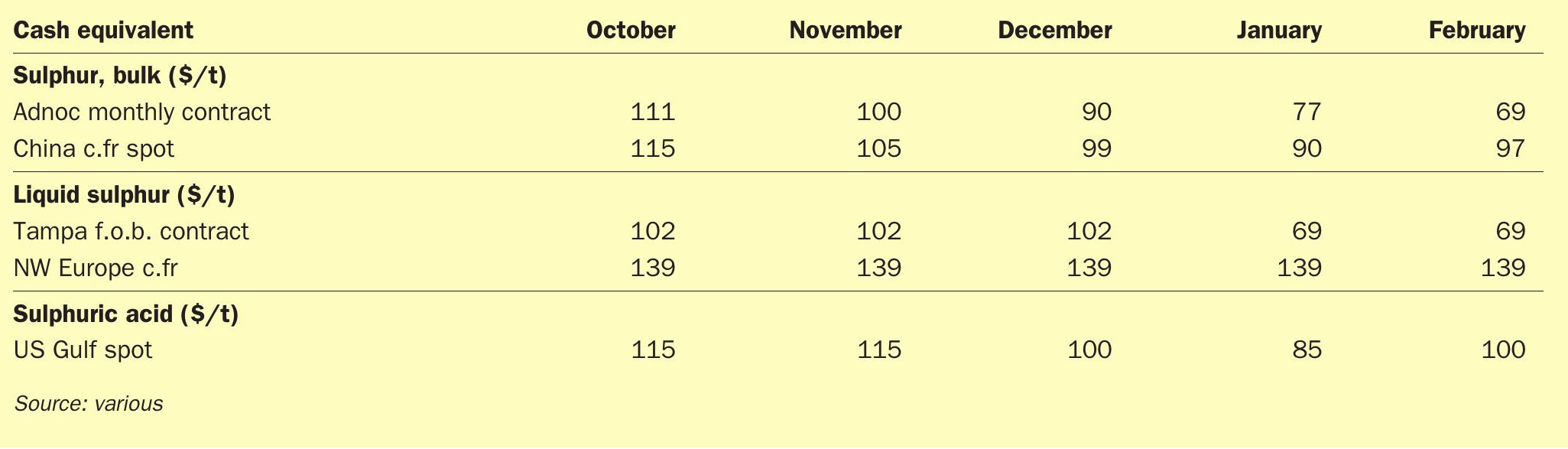

Sulphur prices reached a low point in mid-February, with buyers looking to the tender from Muntajat as well as the return of Chinese buyers following the Lunar New Year holiday for the direction that the market would turn. CMOC’s 5 February tender for 40,000 tonnes of sulphur for early-April arrival was indicated awarded in the upper $90s/t c.fr on supply from the FSU, though details were not confirmed.

Availability appeared to be tighter from the US Gulf, but demand was lacklustre and availability seemed ample from most origins worldwide, with buyer requirements limited. Downstream fertilizer production has yet to increase substantially in key markets outside China, where fertilizer production has been cut due to export restrictions. Meanwhile, sulphur availability from most origins is ample. Still, affordability is exceptionally good, and downstream production in some areas may grow over the coming months, with further price recovery likely within Q1 and beyond. Downstream fertilizer production remains weak, though affordability is attractive and some believe prices will increase further, particularly as many expect China’s phosphate exports to increase from March.

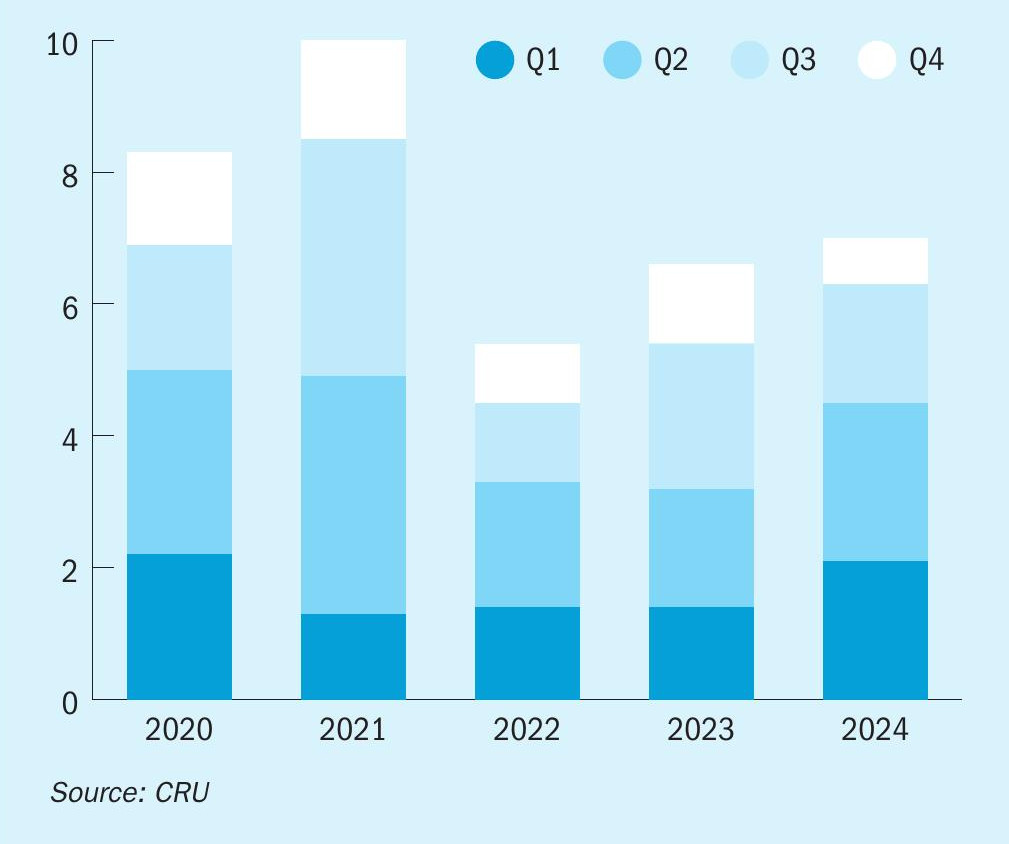

Indonesian buyers have recently purchased crushed lump sulphur from Saudi Arabia, with price indications around $80/t c.fr, well below the $95-100/t c.fr level of granular sulphur cargoes. This crushed lump supply is likely to reduce buyers’ requirements for new granular sulphur cargoes, limiting price support from Indonesia demand. Increased interest in the battery metals sector has prompted a new wave of nickel leaching projects, with Indonesia being the centre of attention for new additions. Indonesia’s sulphur imports for 2023 reached 2.7 million t/a, up 31% from the previous record high of 2.06 million t/a in 2022, when imports climbed 75% year on year. While some market participants are concerned the recent falls in nickel prices may reduce Indonesia’s sulphur demand, CRU believes that sulphur consumption there will still increase further this year, though demand may be partly offset by increased domestic smelter acid production.

There is considerable speculation in downstream phosphate markets surrounding the potential lifting of Chinese export restrictions and the possible imposition of sanctions by the US against Russian fertilizers. Clarity is still being sought in both cases, but DAP and MAP prices rebounded in the US in the meantime on the back of tight supply, which is also continuing to support prices elsewhere.

Availability of liquid sulphur is reported to be good in the US. The supply of liquid sulphur in the US tightened considerably following the onset of the Covid-19 pandemic as refineries cut output, and the Texas storms of February 2021 also led to large cuts in sulphur output. Since then, domestic production has picked up due to higher refinery run rates and more sour crude inputs. This, along with some demand destruction, has left the domestic molten sulphur market in a surplus. In January, US Gulf sales were concluded in the $60s/t f.o.b. as export availability was long, but the market has since tightened, partly due to refinery maintenance being conducted in the western Gulf, as well as some technical issues at export terminals. Meanwhile, US exports of sulphur climbed 10% year on year to 1.91 million t/a for 2023.

Following the low point in mid-February, global sulphur prices climbed as China returned from Lunar New Year holidays, with a range of benchmarks assessed higher this week. Chinese sulphur prices declined in 2023 Q4 following the climbs of Q3 amid ample availability and limited spot demand. Prices rebounded slightly in late January 2024 and increased further after Chinese New Year holidays. Sulphur prices are now assessed at RMB 910-920/t free carrier (FCA) ($126-128/t) and $97-107/t c.fr, up RMB20/t ($3/t) and $8/t on average respectively from their pre-holiday levels.

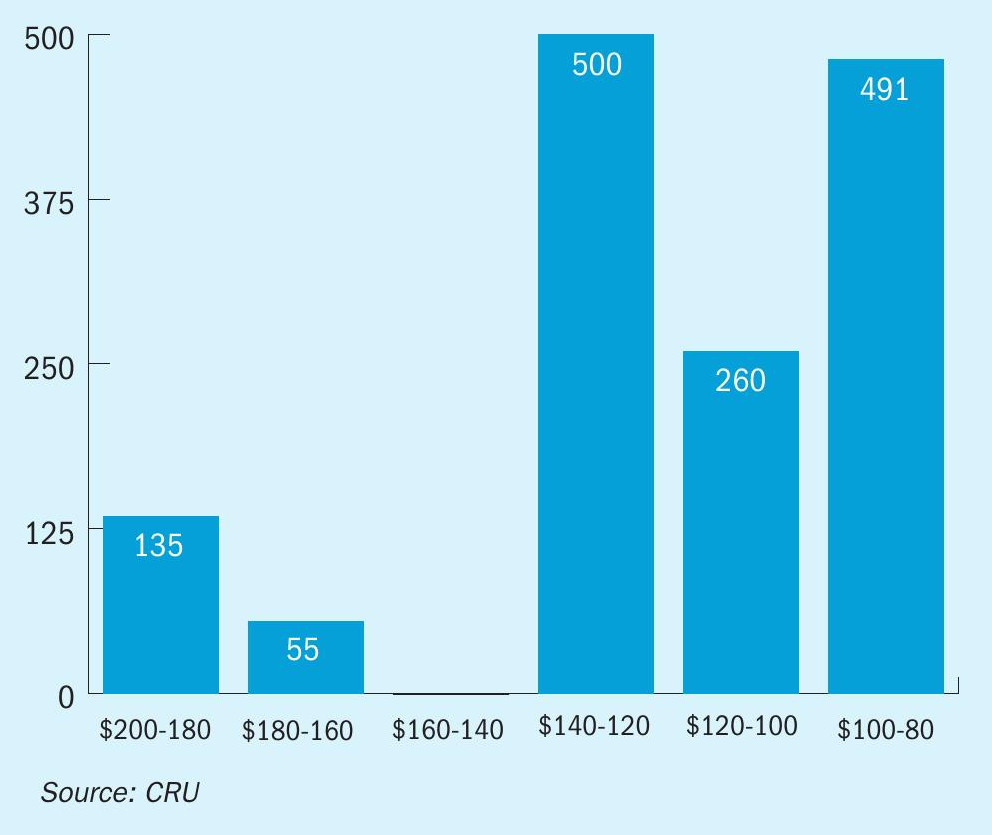

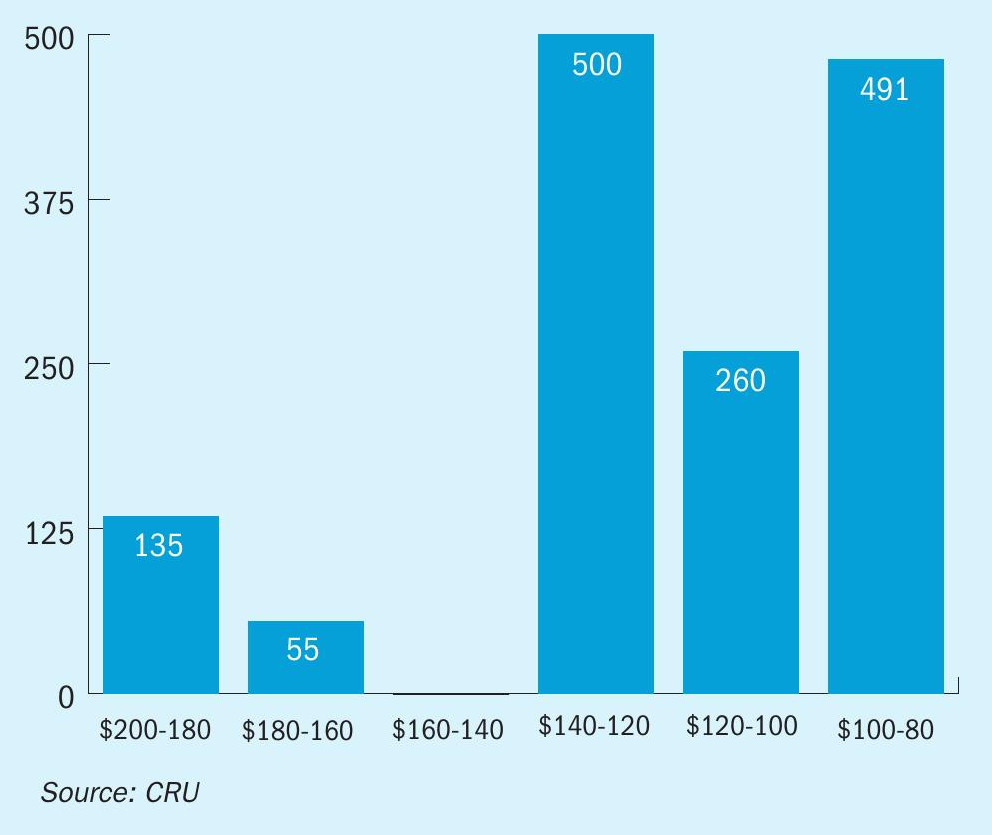

The price rises were in spite of rising inventories at Chinese ports. Sulphur port inventories in China jumped 92,000 tonnes in February to around 2.86 million tonnes, the highest level since October 2020. The total remains well above the 2022 average of 1.44 million tonnes and the 2023 average of 2.07 million tonnes, as stocks climbed by over 1 million tonnes between mid-June and the end of October in 2023. The volume at Yangtze River ports increased 61,000 tonnes to 1.05 million tonnes. Dafeng port inventory was steady around 430,000 tonnes. These stocks are understood to be mostly held by traders rather than end-users. The majority of stocks were built up at prices of $100-140/t c.fr, CRU estimates, while current inland port prices indicate a netback of around $104-105/t c.fr. Consumption of stocks remains slow, as traders are reluctant to take losses.

SULPHURIC ACID

Sulphuric acid prices were broadly stable across the globe in February, as market participants awaited China’s return to the market following the Lunar New Year holiday. Chilean demand was lacking and fresh Atlantic market deals were awaited. However, there was a rise in Atlantic markets towards the end of the month due to limited spot export availability from Europe. Most major European producers seem relatively well-committed and unwilling to accept prices below the $40s/t f.o.b. on new business. Tightening molten sulphur availability in Europe is adding some additional acid demand from European buyers, while demand from Morocco has been soaking up most available export volumes on offer. Spot prices for acid exports from northwest Europe were assessed at $35-45/t f.o.b. for several consecutive weeks as most market participants agreed with the range, though sentiment remained mixed.

Some sources pegged c.fr prices for the US Gulf and Brazil at higher levels as they argue that trans-Atlantic freights were higher, though recent freight broker indications do not support this. Spot prices for sulphur exports from the US Gulf were assessed up at $70-75/t f.o.b. from $65-70/t, based on latest indications. There were reports of sales possibly into the $80s/t f.o.b., though these were understood to be for smaller volumes. Recent Brazil prices into the upper $90s/t c.fr should enable netbacks within the published f.o.b. range. Firm spot sales on an f.o.b. basis have been limited in recent weeks.

Demand from key import market Chile was also lacking. Frequent closures at Mejillones port in recent weeks due to ocean swells have also slowed acid trade. In addition, recent arrivals of vessels that were previously delayed due to Panama Canal issues have left buyers well covered, with some indicating they would require no additional acid until April at least. Mexico’s Fertinal scrapped its sales tender due to a lack of appropriate bids, according to sources. This may also be a result of the lack of Chilean demand.

Saudi Arabia’s Ma’aden closed another purchase tender, this time for April arrival. The session was again indicated awarded in the $60s/t c.fr, roughly in line with current published prices for Asia/Pacific markets given current freight rates. Other Asia/Pacific markets were quiet. Prices in Asia/Pacific markets were stable as spot demand remained scarce Far East export prices have come under pressure from high freight rates and weakening import demand from some key import destinations, such as India and Indonesia.

The only change in published assessments was a further decline in the India c.fr to $55-60/t based on last reported business. Indian demand is decreasing due to new domestic supply, while sulphur is a much more attractive alternative at current prices. Buyers CIL and IFFCO have slower demand due to new sulphur-burner capacity starting or having already started. In addition, Adani group is planning to start new smelter production with 1.5 million t/a of sulphuric acid capacity. Latest reports suggest the smelter will be running by the end of March.

Indonesia’s acid imports are also likely to decrease this year due to increased domestic production expected from smelters and sulphur burners, after imports for 2023 increased 253% year on year to 1.09 million t/a. Indonesia’s Lygend was out with a tender for 30,000 t for March delivery. Given the cargo size requirement, this will likely need to draw supply out of China, which could require higher prices than previous Indonesia business.

Producers in China have been increasing their offers, although the China spot f.o.b. was assessed unchanged in late February at $5-15/t f.o.b. Buyers and traders show little appetite for double digit f.o.b. prices, with current freights and c.fr prices creating pressure for lower f.o.b. rates amid limited demand, particularly with sales from Japan and Korea concluded at negative f.o.b. prices in some cases. China producers have been resisting pressure to lower offers further, and sources suggested that recent offers have climbed to the $20s-30s/t f.o.b. Resistance to lower export prices is partly the result of relatively higher prices available on domestic sales.

PRICE INDICATIONS