Sulphur 412 May-Jun 2024

31 May 2024

Market Outlook

Market Outlook

SULPHUR

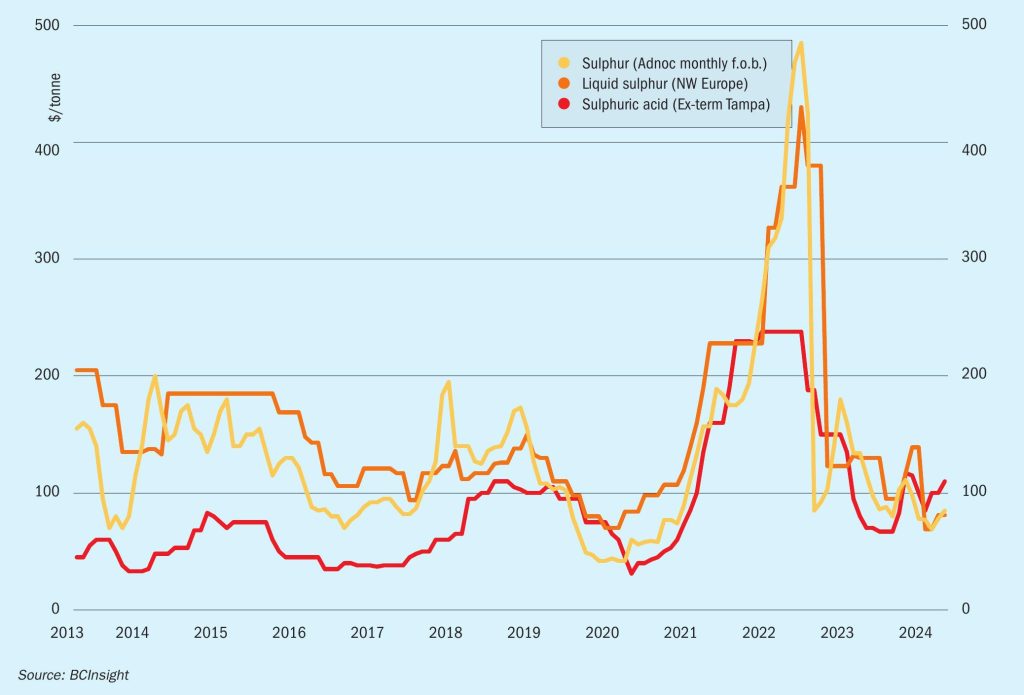

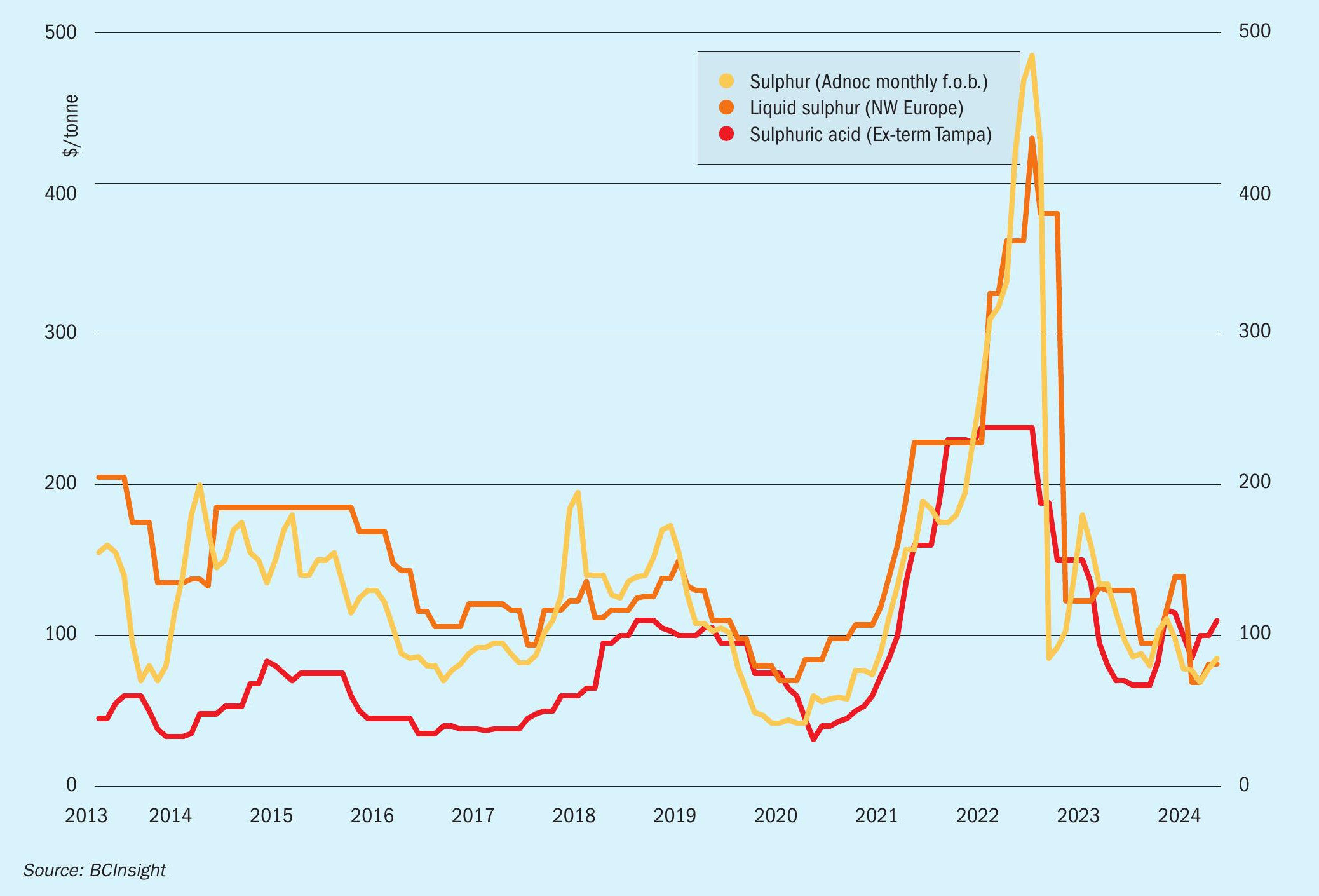

- Downstream phosphate production is expected to climb, with further sulphur price recovery expected. Overall, global demand remains lacklustre as downstream demand has yet to increase substantially in key markets and sulphur availability from most origins is ample.

- Molten sulphur availability in Europe is set to remain tight throughout the year due to decreased European production, despite weakness in the downstream caprolactam sector. Lower production is partly the result of increasingly sweeter crude feedstocks being used by refineries as Red Sea logistics issues and a ban on crude imports from Russia limit the availability of sour inputs. In addition, availability from the Grossenkneten gas fields in Germany is expected to continue decreasing year on year as reserves are depleted.

- Chinese DAP producers attempted to intervene to stem the flow of price declines this week by setting a price floor of $530/t f.o.b. Still, offers are already indicated at this level, and traders continue to offer short in Indian DAP tenders. Further declines across most markets seem likely in the weeks ahead.

- Outlook: the market tone appears to be turning less bullish, with many traders pegging high-end prices lower and most less certain of potential price rises. Some market participants are concerned that weakness in phosphate markets may lead to weaker production and therefore lower demand for sulphur. Phosphate production rates in China have already been cut over the past week.

SULPHURIC ACID

- Global spot sulphuric acid prices are likely to remain relatively firm over the coming weeks. European smelter maintenance, along with strong Moroccan demand, will add support to some benchmarks. Morocco’s imports of sulphuric acid for January-February 2024 jumped to 385,260 t from only 63,439 t a year earlier, according to data via Global Trade Tracker (GTT). China was the lead supplier over the two months with 92,549 t, followed by Bulgaria with 75,606 t and Turkey with 58,173 t.

- Downstream production rates remain relatively weak overall and domestic production is increasing in some key import markets. Affordability relative to downstream markets is broadly acceptable, but is the worst it has been for some time and looks particularly bad when compared with upstream sulphur.

- Given current c.fr prices in key import destinations along with current freight rates, netbacks above the $10s/t f.o.b. on Far East supply appear challenging to most destinations aside from North Africa. Latest business to key import markets such as Indonesia and India net back well below this, while spot demand from Chile is non-existent. There is also little potential for upside in c.fr prices in these markets, as domestic availability in India and Indonesia is growing, while acid affordability is an issue.