Sulphur 412 May-Jun 2024

31 May 2024

Morocco’s new acid capacity

MOROCCO

Morocco’s new acid capacity

Morocco’s OCP is continuing to expand its phosphate fertilizer production capacity. This includes the construction of new sulphur-burning acid capacity to support phosphate production and provide carbon-free power.

Morocco continues to be the giant of the world’s phosphate industry, with around two thirds of the world’s proved phosphate reserves (some say as high as 80%) and a major share of its production. All of this is in the hands of state-owned Office Cherefien des Phosphates (OCP), 95% owned by the Moroccan government.

OCP produced just over 30 million t/a of phosphate rock in 2022 (9.3 million t/a P2 O5 ), or around 15% of global phosphate rock production, making it the second largest rock producer in the world after China. It also produced 6.3 million t/a (P2 O5 ) of phosphoric acid, again just under 15% of the world total. But rock exports were 3.2 million t/a P2 O5 , around 33% of global trade in phosphate rock, and Morocco’s share of finished phosphate trade was likewise around 31%.

Most phosphate mining happens in the north of the country, at Khourgiba and Gantour, where most of the country’s proved reserves lie (see Figure 1). There is also a smaller mine at Boucraa in Western Sahara. These in turn feed export facilities at Jorf Lasfar (for Khourgiba), Safi (for Gantour) and Laayoune (for Boucraa).

Since 2007, OCP has been in a continuous strategy of expansion, intended to double its phosphate rock production and triple its finished fertilizer production by 2025. The first two phases of this expansion are now complete, and the third phase, now scheduled to be completed in 2027, is under construction. As well as expansions at the mine areas, OCP has instituted beneficiation plants and built two gravity-driven slurry pipelines to take phosphate concentrate from the mines to the coastal processing plants, the largest cluster of which is at the massive Jorf Lasfar Phosphate Hub (JLPH) complex. Jorf Lasfar is the world’s largest chemical production site, with a fertilizer production capacity of 11 million t/a and 6 million t/a of phosphoric acid.

Strategy

Since 2023, OCP has altered its corporate strategy. While it continues to consolidate its position as a world leader in phosphate production, it has also earmarked $13 billion in investment for the period 20232027 to increase its environmental sustainability, with a long-term goal of achieving carbon neutrality by 2040 via investments in innovative green fertilisers and renewable energies. The Green Investment Plan also aims to increase OCP’s fertiliser production capacity from the current 12 million t/a to 20 million t/a by 2027. This will involve the expansion of mining capacity, including the opening of a new mine at Meskala, in the Essaouira region, as well as the establishment of a new fertiliser complex in Mzinda. This production unit will process rocks from the Benguérir and Youssoufia mines, as well as from the new Meskala mine.

The company is also increasing its fertiliser and phosphoric acid production capacities at its various sites. By 2027, OCP plans to increase its fertiliser production capacity by 8 million t/a thanks to the addition of three granulation units of 1 million t/a each in Jorf Lasfar and the development of a new chemical complex in Mzinda with a capacity of 4.2 million t/a. The construction of a new chemical complex in Laayoune with a capacity of 1 million t/a is also planned in 2025.

Innovation

OCP is also investing in research and innovation to diversify its products and services and explore new opportunities, particularly in the electric battery market, taking advantage of the high global demand. On the fertilizer side, it has established a strategic alliance with Fertinagro Biotech, SL, a Spanish company specialising in the commercialisation of innovative solutions in plant nutrition. It is also studying innovative options for the monetisation of phosphogypsum such as applications for agriculture and construction materials, offering the company the opportunity to diversify and sustainably manage its waste.

Sulphur fertilizers

As part of its innovation and diversification plan, OCP has also been developing a range of sulphur enhanced fertilizers. In 2016 it signed a deal with Shell to license the latter’s Thiogro technology, which was installed at production lines in Jorf Lasfar during 2017. This allows OCP to incorporate micron-sized particles of elemental sulphur into its existing ammonium phosphate, NPKs and current sulphur-enhanced products. These products are nitrophosphate and NPK fertilizers containing from 5-10% sulphur by weight (most are 5-7%). Some also contain other plant micronutrients such as zinc and boron at around 1% levels. Sold in the US under the brand name TerraTek, the fertilizers contain sulphur in both sulphate and elemental sulphur forms. This provides sulphate for immediate plant uptake, as well as micronised elemental sulphur which slowly breaks down and converts in sulphate as soil temperatures, rise, providing sulphur nutrient through a plant’s growing cycle.

Africa

OCP’s strategy also involves developing agriculture, particularly sustainable agriculture, across the continent of Africa, which has 60% of the world’s arable land and which is expected to be the fastest growing area for new fertilizer demand. In February 2016, the company created its OCP Africa division, which aims to provide African farmers with access to adapted and affordable products, services and support, as well as logistical and financial solutions. OCP is increasing its sales on the continent and has committed to invest in new capacities, mainly NPK blending plants, across the region, in Ethiopia, Nigeria, Ghana and Rwanda.

Sustainable production

In addition to committing to achieving carbon neutrality by 2040, OCP has an ambition of achieving 34% water self-sufficiency in 2024 and is also committed to ensuring that 87% of its electricity needs come from renewable or clean sources by 2027. In particular, the company aims to produce 5 GW of clean energy (wind and solar) by 2027 and 13 GW by 2032. This renewable energy capacity will also be used for the production of green ammonia. In this respect, the group aims to reach a production of 1 million t/a of green ammonia by 2027 and 3 million t/a by 2032 at a new site in the south at Tarfava, An electrolyser production plant will support this project, ensuring local industrial integration within the new value chain. A desalination plant with a capacity of 60 million m3 will supply these industrial facilities and contribute to meeting regional water needs.

As a start to this, under its Green Investment Programme, OCP has secured a 100 million euro loan from the IFC to finance the group’s solar projects and build four solar photovoltaic power plants to power the group’s facilities in Morocco. The facilities, with a total capacity of 202 megawatts, will be built near the mining towns of Benguérir and Khouribga.

Low carbon energy will also power new seawater desalination plants to meet the industrial production requirements as well as supply drinking water and irrigation to areas bordering OCP sites. Desalination capacity is aimed to reach 560 million m3 in 2026, with 110 million m3 up and running by the end of 2023.

Current operations

OCP had a bumper year in 2022, as it benefited from sanctions on Russia and Belarus affecting phosphate customers and high prices for phosphates. The company posted a 48% decline in net profit for the 12 months of 2023, down from $2.78 billion to $1.45 billion, as fertilizer prices declined. However, 4Q 2023 revenues were up 21% as prices rose again. Fertilizers contributed 66% to OCP’s total revenues in 2023, the producer said, with TSP volumes increasing substantially to 15% of fertilizer sales, up from 11% in 2022. Phosphoric acid was 8% of revenue by product with phosphate rock at 17% of revenue by product.

In 2024, CRU expects OCP to increase rock exports from levels seen in 2023. Still, these are expected to remain below historical averages as the company continues to negotiate rock sales at high prices. Prices dropped significantly in 2023 Q3, but these have remained largely stable since then. Morocco’s 68-72% BPL FOB benchmark price remains at a premium to similar-grade Jordanian rock, and while the gap between prices has started to close compared with that in most of 2022 and 2023, this differential is expected to remain wide when compared with pre-2022 levels.

New capacity

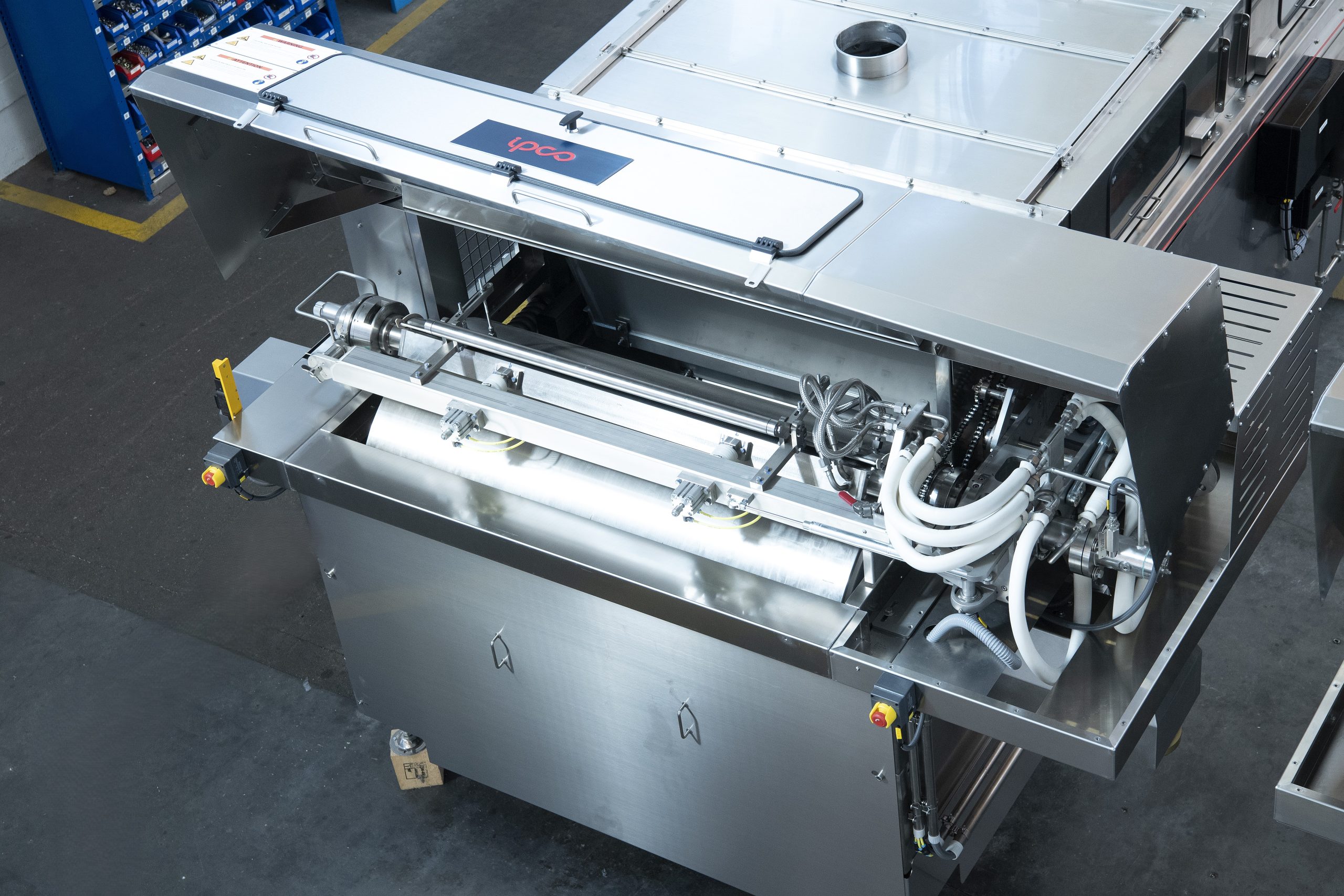

OCP has been building new phosphate capacity at Jorf Lasfar. Two new lines started in 2023, with a third expected to be up and running by the end of 1Q 2024. Each of OCP’s three new lines will have a production capacity of 1 million t/a of DAP. Previous expansions have had dedicated phosphoric and sulphuric acid plants integrated into the downstream phosphate production, but for this series of expansions, OCP has debottlenecked phosphoric acid capacity at its legacy phosphoric acid hub, clearing 350,000 t/a P2 O5 , and added two additional 450,000 t/a P2 O5 lines. There is also additional sulphuric acid production. A tender was awarded in 2019 with Metso for the engineering, procurement, and construction of a new e80 million acid plant based on advanced proprietary technologies such as the HEROS heat recovery system as well as a converter, absorption towers and an acid distribution system that are made of Edmeston SX stainless steel alloy, and the plant came onstream last year. In 2023 a 2,300 t/d acid plant was also started up at Safi to replace two existing acid plants at the site. Altogether OCP added 2.6 million t/a of new sulphur burning sulphuric acid capacity last year, and another 1.8 million t/a of capacity is expected to start up this year.

In addition to these, OCP also signed a joint venture with EMAPHOS partners Brudenheim and Prayon to build a second purified phosphoric acid plant, with 140,000 t/y P2 O5 capacity, which was commissioned in 2023. OCP has also announced ambitious plans for a megaproject in Mzinda, aiming for a capacity of up to 4 million t/a of TSP.

Acid supply

As if to illustrate some of the risks involved in relying on overseas acid production, the recent attacks by Houthi rebels on vessels in the Red Sea has led to OCP having to source most of its sulphuric acid requirements from European producers. In January and February 2024 OCP imported 420,000 tonnes of acid via Jorf Lasfar, around 90% of which came from Europe, up from around 50% in December, helping to support acid prices in Europe. At the same time, OCP postponed deliveries of sulphur to Jorf Lasfar in February due to a backlog of up to 40-45 vessels, sources state. OCP has stated that given the difficulties and reduced production levels, it is well covered for sulphur in March. Traders expect shipments to be postponed for up to a month to allow the congestion to ease.

SO2 reduction

OCP has also been working on reducing sulphur dioxide emissions from its sulphuric acid plant via a process which it calls Sulfacid. The Sulfacid process has been installed at first the Jorf Lasfar and then subsequently Safi sites as a total cost of $58 million, reducing SO2 emissions by 98%. The system recovers waste gases and converts them into sulphuric acid, which is then fed back into the production process. It incorporates a supplementary gas scrubbing process designed to remove SO2 . The system recovers the gas emitted by the contact unit and converts it into sulphuric acid using a wet catalysis process, and in so doing reduces SO2 emissions from roughly 600 ppm to less than 15 ppm (i.e. a 98% reduction). It was developed in coordination with a partner company which specialises in waste gas treatment.

OCP is also looking at treating other waste streams, including sulphur ash. Sulphur ash results from the sulphur smelting and filtering facilities at OCP’s processing sites. A solution has been found to turn ashes via a hydrometallurgical process into sulphuric acid that can be used at the Safi and Jorf Lasfar processing sites, and industrial tests are ongoing to implement this solution. It is envisaged that around 400 t/d of acid can be produced via this route.

Sulphur demand

At the end of 2017, OCP signed a long-term sulphur supply agreement with the UAE’s ADNOC, under which ADNOC will supply OCP with granular sulphur until 2025 on a quarterly contract basis. OCP imported 6.5 million tonnes of sulphur in 2023, and its sulphur consumption is forecast to increase out to 2028, as it expands finished fertilizer capacity at its Jorf Lasfar processing facility. Phosphoric acid production is expected to rise from 6.1 million t/a P2 O5 in 2023 to 8.8 million t/a P2 O5 in 2028. Sulphur imports will rise concomitantly as the new sulphuric acid production ramps up, from 6.5 million /a in 2023 to 9.9 million t/a in 2028. OCP has been expanding sulphur import capacity at Jorf Lasfar and installed new melting units to handle the extra volumes anticipated.