Sulphur 412 May-Jun 2024

31 May 2024

Price Trends

SULPHUR

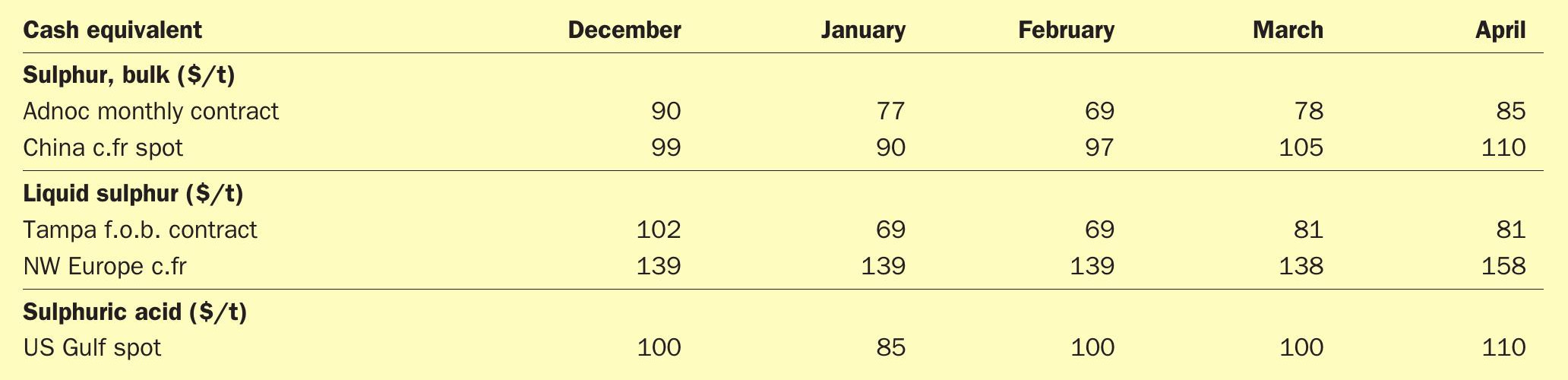

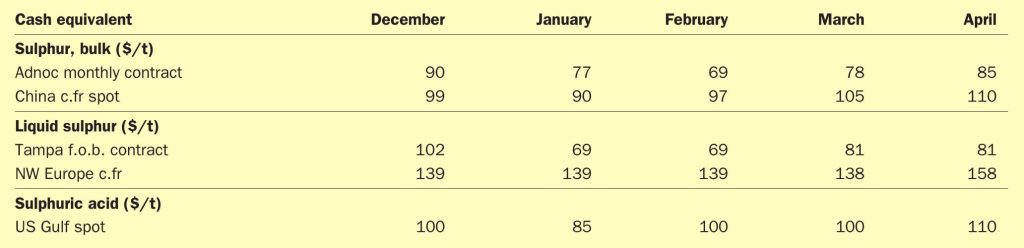

Sulphur benchmarks firmed around the globe in April. Although availability remains ample, downstream production is expected to rise in the weeks ahead and further upside for prices is expected, at least in the short term. Prices increased the Middle East, Indonesia, India, Brazil, and the Mediterranean. The Middle East spot price was assessed up an average $3/t at $83-88/t f.o.b. The previous low end of the range was no longer considered achievable. The price has climbed 27% since mid-February this year. The benchmark is down 53% from early December 2022, but had climbed 47% from the end of July 2023 to its mid-October average of $110/t f.o.b. before declines set in once again. Chinese buyers returned to the international spot market in late April following weeks of inactivity, lifting c.fr prices.

High stocks in China continued to allowed buyers there to avoid higher offers, with the spot c.fr unchanged at $102-107/t for several weeks before moving up to $107112/t c.fr for crushed lump and granular cargoes, the highest level since mid-November. The price is 79% lower than in mid-June 2022, but is up 29% from mid-July 2023. It had fallen 29% between mid-October 2023 and the end of January 2024. Chinese sulphur production growth has been the underlying driver of declining import dependence, with supply increasing from 5.6 million t/a in 2016 to 7.5 million t/a in 2020. Chinese sulphur production climbed to 9.44 million t/a in 2022, according to CRU data, up 5.6% year on year from 2021’s 8.9 million t/a and up 23% on 2020. Further growth in production is likely to keep Chinese imports below previous highs. China’s bans on fertilizer exports have also limited demand for sulphur.

Sulphur port inventories in China decreased to around 2.93 million tonnes in total. The total remains well above the 2022 average of 1.44 million tonnes and the 2023 average of 2.07 million tonnes, as stocks climbed by over 1 million tonnes between mid-June and the end of October in 2023 and have further increased by around 400,000 tonnes since the end of 2023. Chinese buyers are comfortable at a price around $108/t f.o.b., according to local importers. The price remains assessed at $102-107/t c.fr. Domestic phosphate prices, international prices and operating rates all decreased, with the declines having a negative impact on sulphur market sentiment.

Spot prices for sulphur cargoes to Brazil were assessed higher at $115-118/t c.fr. Mosaic reported two 35,000 tonne April cargoes at $115/t c.fr. The origin of the material was not confirmed but supply is building in the US Gulf with refineries coming off turnarounds there. Another purchase by Mosaic at $118/t c.fr was later confirmed. Previous Mosaic buying in March was at $111/t c.fr. Brazil’s imports of sulphur for March 2024 decreased 30% year on year to 178,658 tonnes, according to data via Global Trade Tracker (GTT). March imports from the US were down 7% to 80,046 t. Total imports in the first three months of the year were down 18% to 556,772 t, with the US, Saudi Arabia and Russia dominating supply. Imported material from the US in the first quarter reached 320,000 t. Imports from Saudi Arabia in March were up 13% at 43,197 t, with Russian imports in March up nearly sevenfold year on year at 27,500 t. The UAE supplied just 150 tonnes to Brazil in March, down from 73,895 t in the same month a year earlier. The volume from Kazakhstan increased 58% to 26,840 t from 16,948 t. Kuwait was down to nothing from 31,509 t and no tonnes arrived from Qatar in March.

Contract prices for supply of liquid sulphur in northwest Europe in the second quarter of 2024 have been published at wide ranges following a chaotic round of settlements. The price range for Q1 was published at $103.50-123.50/t c.fr Benelux for barge/railcar, with the truckload range at $123.50-153.50/t NW Europe, after settlements were reported at rollovers from 2023 Q4. Some prices were agreed at increases of $10/t from Q1 by one major supplier, sources reported, though the majority were finalised at increases of $30/t by two other major suppliers. Quarterly settlements are usually agreed at consistent deltas across buyers and sellers. The price range for Q2 is published at $113.50-153.50/t c.fr Benelux for barge/railcar, with the truckload range at $133.50-183.50/t CPT NW Europe. Global prices weakened during Q4 and remained soft in early 2024, but tight availability in Europe meant that buyers were unable to achieve a decrease on Q1 contract prices despite price decreases elsewhere for Q1.

The Middle East spot sulphur price was assessed higher at 85-90/t f.o.b., with the previous low end of $78/t no longer deemed achievable. The price has climbed 30% since mid-February this year. With the Middle East celebrating Eid, confirmation of new business was lacking. A sales tender from Muntajat was indicated awarded around $88/t f.o.b. Recent sales of Middle East sulphur to Brazil around $110-111/t c.fr would likely net back in the upper $70s/t f.o.b. Qatar’s Muntajat, the UAE’s ADNOC, and Kuwait’s KPC all posted official monthly contract prices for April at $83-85/t f.o.b., up from $78/t f.o.b. for March and $69/t f.o.b. for February. Indian sulphur prices were assessed higher at $105-108/t c.fr, Based on higher values from the Middle East. An importer on the east coast recently bought 38,000-39,000 t sulphur ex-Qatar at $105-108/t c.fr, local sources report. Demand remains relatively lacklustre due to temporary phosphate shutdowns, with restarts anticipated in the coming month.

Morocco’s OCP imported 1.08 million tonnes of sulphur in the first two months of 2024, up 13% year on year, according to data via Global Trade Tracker (GTT). Kazakhstan was the number one source of sulphur for the period with 568,240 t, up 272%. This was followed by the UAE with 255,669 t, down 43%. OCP and Adnoc have a long-term sulphur supply agreement. Supply from Saudi Arabia was down 21% at 139,269 t. Imports from Qatar and Kuwait climbed from nothing to 50,492 t and 42,000 t, respectively. Morocco’s imports for 2023 climbed 3% year on year to 6.45 million t/a after imports for 2022 decreased 7% year on year to 6.27 million t/a, representing the lowest annual imports since 2018. Morocco’s annual imports for 2021 were down 7% year on year to 6.72 million t/a after imports for 2020 increased 8% year on year to a new record of 7.24 million t/a. Imports are expected to increase further over the coming years as sulphur burner capacity increases and downstream fertilizer production ramps up.

SULPHURIC ACID

Sulphuric acid spot market activity was scarce in late April, while some market participants voiced more bearish sentiment on Asia/Pacific markets, though Europe/ Atlantic markets remained well-supported. Spot prices for sulphuric acid exports from China were assessed steady at $20-35/t f.o.b., though some traders expected prices to decrease amid limited opportunities for higher FOBs. The average price of $27.50/t f.o.b. is up from -$5/t f.o.b. in early August 2023 but is well below its 2022 peak of $150/t f.o.b. in mid-June. It has fallen from $42.50/t f.o.b. in October 2023. One deal was reported in mid-January for February loading around $15/t f.o.b., while another source said two sales were subsequently concluded around $10/t f.o.b. More recently, a sale had been concluded last month in the mid-$20s/t f.o.b., followed by another deal early this month in the low $30s/t f.o.b., according to sources.

Some sources said pressure was building on China producers as phosphate markets were weakening and downstream production was being cut, while some smelter maintenances were coming to an end. Given current c.fr prices in key import destinations along with current freight rates, netbacks above the $10s/t f.o.b. appear challenging to most destinations aside from North Africa and possibly Saudi Arabia. Traders suggested a lack of available vessels for 30,000 t lots was also limiting any potential for fresh business.

Resistance from producers to lower export prices emerged partly as a result of relatively higher prices available on domestic sales. Domestic acid prices climbed further after Chinese New Year holidays, partly due to expectations of seasonal peak demand for fertilizer in Q2 and the easing of fertilizer export restriction, and partly due to copper smelter maintenance brought forward to March and April due to tighter concentrate supply and lower TC/RCs.

Spot prices for exports from northwest Europe were also assessed steady at $60-75/t f.o.b., leaving the mid-point at its highest level since October. Sentiment was uniformly bullish for these prices, at least for Q2, as tight availability keeps prices supported. Prices are still 76% lower than they were in June 2022, but are up 575% from early August 2023 and have climbed 69% since February this year. Demand from Morocco has been soaking up most available spot export volumes on offer, leaving the market firmer than expected both for European supply and exports from the Far East. Still, export markets such as Brazil and the US Gulf could still provide netbacks to Europe within the published f.o.b. range.

Spot prices for sulphuric acid cargoes to the US Gulf were assessed up at $105115/t c.fr, up from $100-110/t based on latest indications, though some argued for lower levels. At least one recent deal was concluded around the upper end of the range, though one source argued that this was not representative and said recent deals elsewhere remained below $100/t c.fr. One supplier also indicated the previous range was still representative. Still, current Europe spot f.o.b. prices suggest that anything below the low end of the new range would be unlikely on new spot business. Acid import prices are unattractive compared with sulphur. The Tampa contract for 2024 Q2 was settled up $12/lt, though this still equates to acid prices well below the published v.fr. Domestic acid prices vary greatly by region, but contracts tend to be more linked to sulphur prices. The US Gulf import market for acid in recent years has seen limited spot activity, with volumes mostly on contracts.

Spot prices for full cargoes of acid to India were assessed steady at $6575/t c.fr, up from $55-60/t, though buyers mostly continued to resist the higher prices. Major end users said they had limited demand for now and were resisting high offers. Traders said offers were mostly from the mid-$70s/t c.fr upwards. There were reports that IFFCO had purchased around $70/t c.fr, but the buyer said it had not bought international spot acid recently. Indian acid demand is decreasing this year due to new domestic supply, while sulphur is a more attractive alternative as last spot deals were concluded below $100/t c.fr India and one tonne of sulphur yields three tonnes of acid as well as energy credits. Sulphur prices have increased, but India buyers could still likely source spot cargoes around $110/t c.fr. Demand from CIL has slowed as it already started new sulphur-burner capacity as of late August 2023. The plant, which was announced in November 2021, is set to increase the company’s acid production by around 500,000 t/a and is reportedly running at full capacity. IFFCO in Paradip inaugurated its new acid plant, with capacity around 2,000 t/day, on 20 February. In addition, Adani Group in late March commenced operations at its new smelter with 1.5 million t/a sulphuric acid capacity.

PRICE INDICATIONS