Nitrogen+Syngas 389 May-Jun 2024

31 May 2024

The shipping race

“By 2027, 270 methanol powered vessels should be in service…”

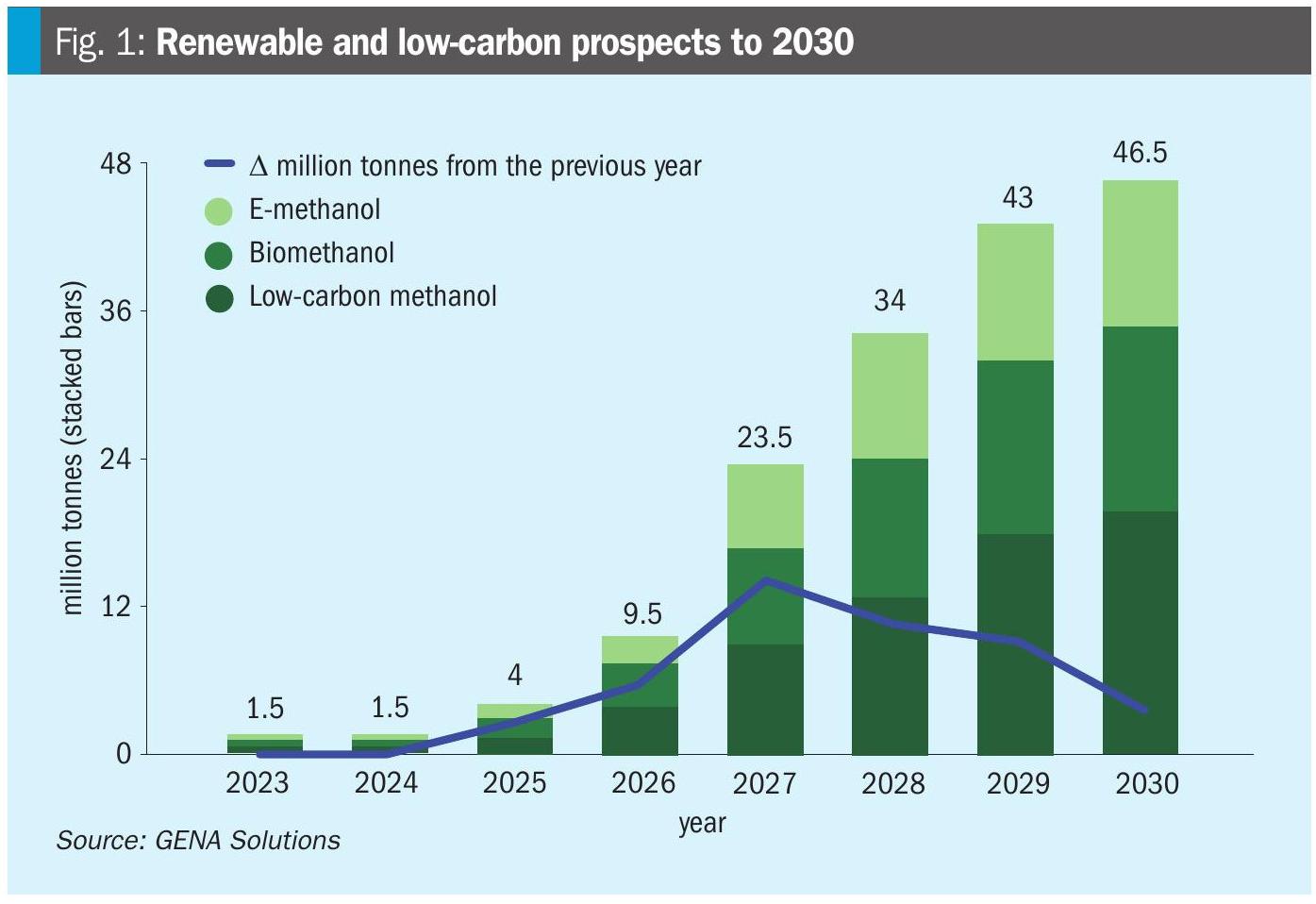

While there has been a lot of talk about decarbonising ammonia and methanol production, for as long as blue and green production is more expensive than conventional production, uptake will be dependent upon markets which are prepared to pay a premium for such chemicals, perhaps because they have no other reasonable choice, given environmental mandates. One sector above all has dominated the prospects for medium term demand for low carbon ammonia and methanol alike, and that is shipping.

The International Maritime Organisation’s revised greenhouse gas strategy, adopted at the Marine Environment Protection Committee meeting last year, includes an enhanced common ambition to reach net-zero emissions from international shipping by 2050, a commitment to ensure an uptake of alternative zero and near-zero GHG fuels by 2030, as well as indicative check-points for international shipping to reach net-zero emissions for 2030 (by at least 20%, striving for 30%) and 2040 (by at least 70%, striving for 80%). Several propulsion sources are in the running to be the low carbon shipping fuels of the future, including biofuels, electric power, fuel cells, hydrogen, and even a return to wind power, but ammonia and methanol have been among the most prominent, as they are liquid fuels which have a supporting infrastructure already available at many major ports.

Up until now, methanol has appeared to be winning that race, with ammonia lagging on issues like engine design and safety concerns, but there are signs that this may be slowly changing. Norwegian classification society Det Norske Veritas (DNV) maintains a count of orders for new alternative fuelled vessels, and its most recent publication shows interest in ammonia-powered ships picking up. DNV says that there were 23 orders for alternative fuelled vessels in April, of which 12 were methanol powered, seven LNG, and four were ammonia powered. According to DNV, this brings the total orders for the year to date to 93, a 48% increase on that for the first four months of 2023. DNV notes that this also brings ammonia’s total for the year up to 9 vessels, showing a growing enthusiasm for ammonia as a fuel.

Methanol however continues to be the most popular alternative fuel overall, with 47 orders in the first four months of 2024, 42% up on last year, and now representing almost exactly half of all orders, outpacing LNG, which was previously popular. There are now 33 methanol fuelled vessels in operation, most of them tankers, particularly the fleet operated by Methanex subsidiary Waterfront Shipping, but there are 248 methanol ships now on order, the majority of them container ships. Danish shipping giant Maersk has been a pioneer in this regard, with 18 very large container ships on order, the first of which, the Ana Maersk, was launched last year and which recently completed a container run from Hamburg, through the Mediterranean and docking in early May at Dubai. This means that by 2027, 270 methanol powered vessels should be in service, representing several million t/a of potential demand. But just as the shipping industry appears to have pivoted from LNG powered vessels to methanol in the past couple of years, it remains possible that similar could happen for ammonia over the next few years. Nine orders this year are only straws in the wind, but could be the start of something bigger.