Sulphur 413 Jul-Aug 2024

31 July 2024

Market Outlook

Market Outlook

SULPHUR

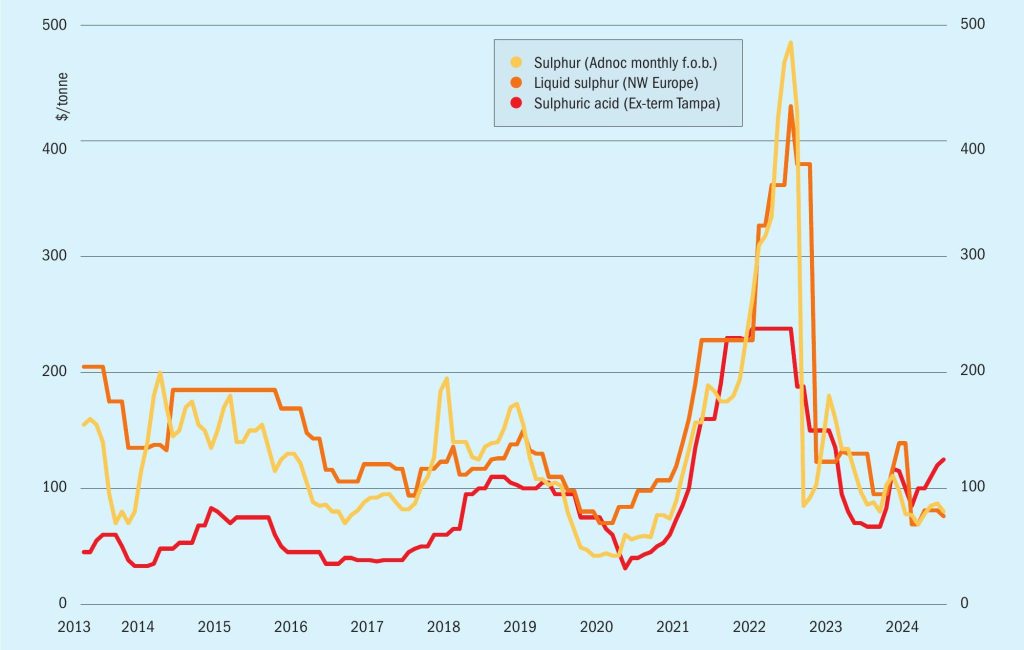

- Sulphur prices are expected to recover from declines in May and June and continue climbing over the coming months, though good availability will limit upside.

- Port inventories in China have declined to their lowest volume this year, but remain higher than the average for 2022-23. Recent firming in domestic phosphate markets should add some support. Affordability of sulphur relative to phosphates is good, especially with DAP and MAP prices climbing, though some downstream production is still relatively weak, limiting appetite for raw material sulphur.

- Sulphur demand in Indonesia for nickel is set to increase further following a big jump in imports since 2022, limiting possible downside to global spot prices. Still, some of this demand may be met with increased domestic smelter acid output.

- On the supply side, Kazakhstan’s Kashagan oilfield has faced government pressure to reduce its sulphur stocks, and crushed lump supply from the site adding to market length, though lower stock levels should ease this pressure later in the year and sales of additional volumes from stock are expected to slow.

- Overall, the recent growth in sulphur production, in addition to producer stock drawdown and high China inventories, is expected to limit upwards potential for prices in the short term and keep sulphur prices low relative to phosphates. Still, good affordability continues to support raw materials purchasing and leaves room for further price increases, especially if downstream production picks up further and sulphur stock drawdown slows as expected.

SULPHURIC ACID

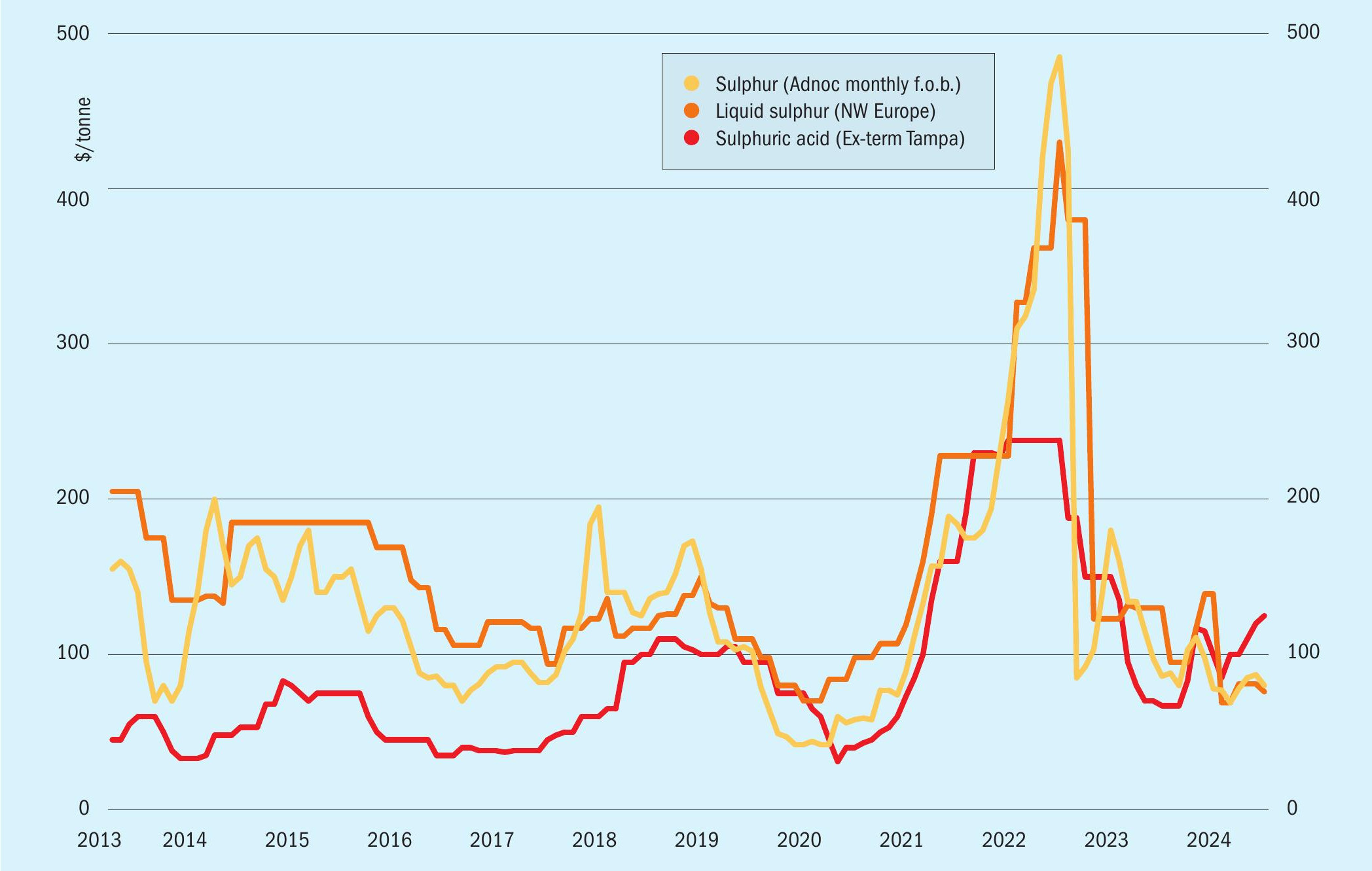

- Sulphuric acid prices are expected to remain relatively firm before undergoing slight declines in Q4, but prices may be pushed down further if demand is weaker than expected.

- Smelters in Japan and South Korea are facing reduced sales options this year. China, the key source of marginal seaborne acid supply, requires higher acid prices to draw out more volume, as domestic sales offer favourable pricing.

- India’s import demand is under pressure as sulphur offers a more affordable raw material option. In addition, buyers have recently added sulphur burner capacity, limiting merchant acid requirements, with additional domestic smelter acid production expected during the forecast from Adani’s recently commissioned large smelter likely to cut acid import demand further.

- Indonesia imports increased steeply in 2023, but import demand there is also likely to decline as domestic production increases from both integrated sulphur burners and new smelting capacity.

- Improving availability of smelter acid and sulphur in the US Gulf has been limiting merchant acid import requirements. Sulphur availability in the region is increasing at the moment, and prices there still suggest much lower levels on acid, though strong fertilizer markets are supporting acid prices.