Sulphur 413 Jul-Aug 2024

31 July 2024

Price Trends

Price Trends

SULPHUR

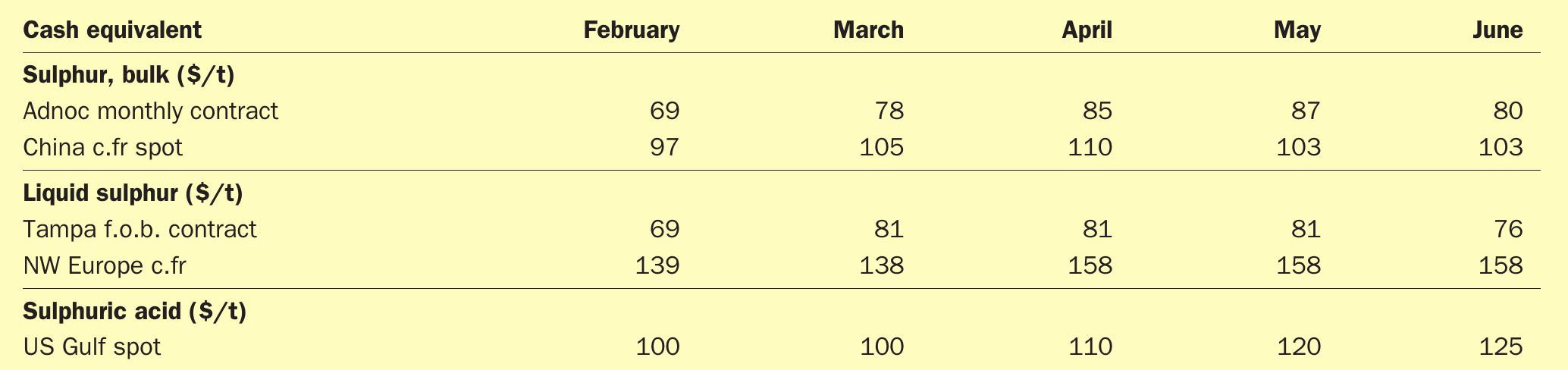

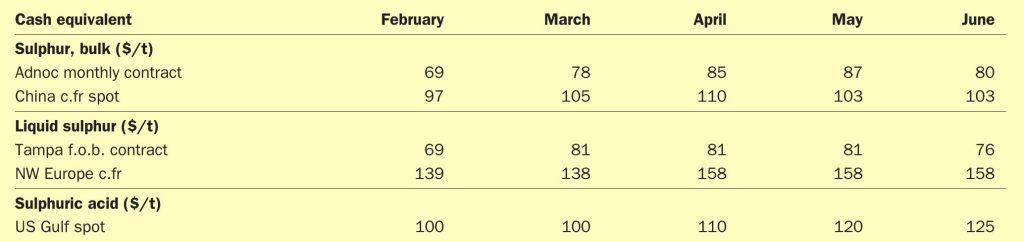

Sulphur prices in China are expected to recover with downstream demand anticipated to surge in the second half of the year and good affordability to support raw materials purchasing. Chinese nitrogen, phosphate, and potash prices have surged, driven by heightened demand for the summer corn application season. In particular, average 11-44 MAP prices jumped 16% from $390/t ex-works to $463/t in Hubei province. However, sulphur prices have taken a while to follow the trend on phosphate prices. Port prices have fluctuated in the range of $126-130/t c.fr since late March, and import prices fell from a high of $112/t c.fr to $100/t c.fr, capped by high port inventory and sufficient supply. Port inventories in China remain around 2.8 million tonnes, well above the 2022 average of 1.4 million tonnes and the 2023 average of 2.07 million tonnes. These elevated stock levels limited the upside for prices in China and provided buyers with options. At the start of July, Sinopec’s Puguang, the largest sulphur producer in China, increased its sulphur sales prices at Wanzhou port up $4/t RMB980/t, while its factory price at Dazhou was up RMB20/t at RMB950/t ex-works. These prices are considerably down from RMB1,600/t in December 2022 and RMB 2,945/t from mid-June 2022 and are the lowest since July 2023, but are still up from a low of RMB605-655/t at the end of August 2020.

Kazakhstan’s Kashagan oilfield has faced government pressure to reduce its sulphur stocks, and crushed lump supply from the site is adding to market length, though lower stock levels should ease this pressure later in the year and sales of additional volumes from stock are expected to slow.

In the Middle East, new project commissions and expansions accelerated last year, with producers adding considerable volume. Much of the new capacity can access the market with low logistics costs, adding to the market surplus. There are fewer capacity additions to come in 2024 and demand is expected to catch up with supply by next year. Kuwait Petroleum Corporation (KPC) posted its official monthly price for sulphur exports, the KSP (Kuwait Sulphur Price), at $80/t f.o.b. for July, up $2/t from June. Total sulphur capacity in Kuwait is estimated by CRU to have climbed to 2.9 million t/a in 2023; up from 1.4 million t/a in 2020.

Elsewhere, in Qatar, Muntajat’s latest sales tender was believed to have sold at close to $85/t f.o.b. in the UAE, ADNOC is understood to have completed negotiations with OCP in Morocco and GCT in Tunisia over Q3 sulphur. ADNOC has settled contracts with traders for sulphur supply from the Middle East in the third quarter of 2024 around $79/t f.o.b. Saudi Arabia has been selling crushed lump from stockpiles alongside its new production. Overall the Middle East spot price was assessed at $80-83/t f.o.b., up from $75-80/t f.o.b. earlier in June.

On the demand side, sulphur demand in Indonesia for nickel is set to increase further following a big jump in imports since 2022, limiting possible downside to global spot prices. Still, some of this demand may be met with increased domestic smelter acid output. The spot price assessment for sulphur cargoes to Indonesia was up modestly at the end of June to $102-105/t c.fr. PT Lygend’s tender on the 19th June for 100,000 tonnes of sulphur was reported to have been awarded at $102/t c.fr. The importer is understood to have purchased two cargoes, with one potentially from Shell in Vancouver. Petro Jordan Abadi, a joint venture between JPMC and Petrokimia Gresik, closed a tender for 30,000 tonnes earlier in the month, with an award indicated around $103/t c.fr. Lygend had previously closed a tender on May 8th for 50,000 tonnes of sulphur, with the request reportedly covered around $107/t c.fr with supply from the Middle East.

Morocco’s OCP has increased its fertilizer production in recent months and may ramp up further, though it has a range of options for sulphur supply.

In Europe, prices were relatively unchanged with a lack of buying and selling activity. Export prices were assessed steady at $75-80/t f.o.b. at the end of June, while the import range was at $95-105/t c.fr. Key markets in Egypt, Tunisia and Turkey were quiet apart from a domestic sales tender from Tupras in Turkey. Demand in Egypt from NCIC may also have taken a hit amid the country’s ongoing natural-gas crisis.

Spot prices for sulphur cargoes to Brazil were assessed modestly higher at $103-105/t c.fr following two purchases by Galvani and Mosaic. Galvani’s tender was understood to be for 30,000-35,000 t with Mosaic seeking as much as 40,000 t for August arrival at Tiplam in Brazil, which has been undergoing maintenance. Mosaic’s tonnes are expected to load in the US Gulf. Mosaic’s previous deal was a cargo of Middle East origin purchased in early May around $111/t c.fr. The buyer is reportedly covered until August now due to upcoming maintenance at the Tiplam terminal of Santos.

In North America, availability from Vancouver has been strong due to relatively high production at sites in Canada as well as re-melting of solid sulphur stocks. Supply from Canada is expected to remain strong, though current prices leave little incentive for sales from northern Canada, and stock drawdown will likely slow further. US availability is strong as refinery output is strong as the summer months approach, offering additional supply options for buyers west of Suez.

SULPHURIC ACID

Global spot prices are likely to remain relatively firm over the coming weeks. Strong Moroccan demand continues to add support to some benchmarks, with further support coming from Chile’s return. Downstream production rates remain relatively weak overall and domestic acid production is set to increase in some key import markets, though this is more weighted to latter 2024. Affordability relative to downstream markets is broadly acceptable but looks particularly bad when compared with upstream sulphur.

Spot prices for sulphuric acid exports from China were assessed unchanged at $30–35 /t f.o.b. at the end of June, stabilising at this range. Sentiment in the Chinese phosphate market has improved over the past few weeks, with prices rising on the back of tight availability, while some increases in downstream production added support to domestic acid markets. Resistance from producers to lower export prices emerged partly as a result of higher prices available on domestic sales. Domestic prices continue to offer a premium over achievable f.o.b. prices for most producers, having increased sharply in recent weeks due to strong demand from MAP producers. Quarterly contract prices for supply to China were indicated settled around the low-to-mid-$20s/t c.fr for Q2, which could net back well below the published range, depending on freight rates. Settlements were indicated at a rollover for 2024 Q1, though indications on actual c.fr prices ranged from the mid-$10s/t to around $30/t. Export volumes for China have been lower in recent years and have further declined this year.

Prices for sulphuric acid exports from Japan and South Korea were assessed between -$15/t to $25/t f.o.b. for spot sales, with contracts from -$15/t to $20/t. Market sentiment remained firm despite limited spot business for cargoes of 20,000 tonnes or less given the current high freight rates. Tightness in the market persists amid strengthening markets in key import regions like India, China and Indonesia. Export prices had been under pressure from high freight rates and weakening import demand from some key import destinations, partly due to increasing domestic output in these markets, which is likely to intensify in H2 . The price range is higher than the March 2023 low of -$15/t to $0/t, which represented the lowest average since October 2020, but prices are down from a mid-point of $98/t f.o.b. in June 2022, with the upper end of the range down from the $45/t f.o.b. of October 2023. Some traders have doubted whether prices in the $20s/t f.o.b. were achievable on spot business amid scarce supply in the prompt market. Sellers are well committed for prompt availability, while regional import prices have firmed slightly. Delivered prices in key import markets, such as India and Southeast Asia, indicate netbacks no higher than the upper $10s/t f.o.b. despite some increases in those markets’ c.fr levels.

Spot prices for sulphuric acid sales into Chile moved higher to $150–155 /t c.fr, as rising freight rates continued to boost prices. Given the export prices from China are around $30-35 /t f.o.b., coupled with transportation and other costs, prices in Chile are likely above the $150/t c.fr mark. Ocean swells delayed deliveries to Chile earlier this year, limiting spot demand and activity. The large line-up of deliveries for Mejillones recently eased, with tank capacity also starting to clear. Most sources expect relatively firm spot demand in the second half of the year, though some buyers argued they were comfortable for now after forward-buying volumes in the $120s/t c.fr. Chile’s sulphuric acid imports from January through May 2024 were down 8% year on year at 1.46 million tonnes, according to data via Global Trade Tracker (GTT). China once again overtook Peru as the lead source of acid, with the former supplying 490,707 tonnes over the five months (up 163% year on year) while the latter supplied 451,620 tonnes (down 24%). Imports from South Korea increased 8% to 206,809 tonnes, while the volume from Japan was up 65% at 183,482 tonnes. Imports from European origins declined amid reduced arbitrage opportunities and the return of Moroccan demand for European acid supply. Chile’s annual acid imports for 2023 were up 2% year on year at 3.78 million t/a, representing the highest annual acid imports to Chile on record.

Contracts for supply of sulphuric acid in Europe in the third quarter of 2024 are expected to settle at price increases from Q2. It is suggested that smelters were achieving increases of around e20, with sulphur burners arguing for climbs of e50 or more. Spot prices for sulphuric acid exports from northwest Europe were unchanged at $70–80 /t f.o.b. in May and June, with limited buying interest. Low availability of supply in the spot market has supported prices and most industry participants see little chance of price declines in the short term, but this has resulted in a lack of fresh f.o.b. spot sales. Most major European producers are well-committed, and a strong maintenance schedule is limiting availability, especially in the current quarter. There are further smelter maintenances planned for Q3, though the acid output loss is lighter than for Q2. The price range for contracts for Q2 was published at e120-140/t c.fr NW Europe, up from Q1’s e110-130/t c.fr NW Europe, which was unchanged from 2023 Q4, though there were some falls on earlier Q1 settlements.

Firm sentiment is partly the result of tight molten sulphur availability in Europe. Some consumers in Europe have had to seek additional acid cargoes to compensate for a lack of sulphur, while sulphur-based acid producers are facing higher raw materials costs and limited supply. Strong international demand, particularly from North Africa, has increased spot f.o.b. prices from Europe in recent months. In addition, a strong maintenance slate in Europe tightened availability for Q2 in particular. Notably, Aurubis had a two-month maintenance planned at its Hamburg smelter through May and June. The smelter has acid capacity of around 1.3 million t/a.

PRICE INDICATIONS