Sulphur 415 Nov-Dec 2024

30 November 2024

India’s sulphur and sulphuric acid industries

INDIA

India’s sulphur and sulphuric acid industries

India’s phosphate production is using increasing volumes of sulphuric acid, but new domestic smelter and sulphur burning acid capacity may mean reduced imports in future.

India is now the world’s fifth largest economy and the second largest country in the world by size of population, and both of these indicators continue to grow. GDP grew by 6.7% year on year for 2Q 2024, and is projected to be 7.0-7.2% for the 2024-25 fiscal year, making it one of the stars of the global economy now that China’s economic growth has stalled. As these growth rates continue, by 2030, India is projected to be the world’s third largest economy after the US and China. However, rising population – India is projected to overtake China some time in the next decade – mean that there is also rising demand for food and fertilizer.

Phosphates

Phosphate availability is a key factor for India’s agriculture. India has a significant domestic finished phosphate industry but little domestic phosphate rock mining. Consequently the country is one of the most important importers of phosphate rock and phosphoric acid, and the largest importer of processed phosphates like DAP.

India’s phosphate consumption was 7.9 million t/a P2 O5 for the fertilizer year 2022-23, according to the Fertilizer Association of India, part of a steady increase over the past few years. This included 4.9 million t/a P2 O5 of MAP and DAP, 0.8 million t/a P2 O5 of single superphosphate (SSP), 1.7 million t/a P2 O5 of triple superphosphate (TSP) and 2.6 million t/a of nitrophosphates and NPK fertilizer. Domestic phosphate fertilizer production was 5.0 million t/a P2 O5 , including 2.2 million t/a (P2 O5 ) DAP and 1.1 million t/a P2 O5 of SSP. Imports of DAP ran at 6.6 million t/a (tonnes product).

However, more recently high phosphate prices, especially for DAP, have dramatically impacted upon domestic demand, with a lack of availability from Russia and China. India runs a nutrient-based fertilizer subsidy (NBS) scheme and mandates maximum retail prices (MRP) for key fertilizers, and the government has tried to boost NPS rates for phosphates to make imports more affordable, but even with drawdowns of domestic stocks, DAP remains expensive for farmers. Between January and July, DAP imports plummeted 51% year on year, while domestic production declined 19%, leading to a steep 48% decrease in stocks. Negative margins have kept major buyers away, pushing farmers and importers to seek alternatives.

The ongoing supply crunch has prompted India to seek alternatives to DAP, bringing into the spotlight NP/NPKs, SSP and TSP. There has been renewed interest in TSP, particularly from Moroccan producer OCP. In the first half of this year, OCP sold around 30,000 tonnes of TSP to India, marking a tentative re-entry into the market, and OCP later agreed to supply 200,000 tonnes of TSP at $455-460/t c.fr for September loading. However, a large scale shift to TSP would require significant effort in terms of education, distribution, and adjustments to the NBS scheme to make TSP more attractive and viable for both importers and farmers. Also, the existing infrastructure, distribution networks, and farmer familiarity are all geared towards DAP and other established fertilizers.

Sulphur supply

India’s domestic sulphur supply comes almost exclusively from oil refining. India’s refining capacity is currently 5.1 million bbl/d, but this is expanding, and is expected to reach 6.4 million bbl/d by 2030 and 7.7 million bbl/d by 2040, from its present 5 million bbl/d. The rapidly growing economy and rising population are contributing to increased demand for liquid fuels. The Indian government has authorised several brownfield projects which are expected to add 1 million bbl/d of additional capacity at existing refineries by 2025, and there are also two major new greenfield refineries under development to add a further 1.2 million bbl/d of capacity. Indian fuel sulphur standards have also moved to a Euro-VI level of 10 ppm permitted sulphur, meaning that more sulphur is being recovered from that throughput. The combination of new capacity and tighter fuel standards mean that Indian refinery sulphur output has virtually doubled over the past decade, increasing from 2.1 million t/a in 2014 to an estimated 3.9 million t/a in 2024.

Indian sulphur consumption runs at just over this, and is expected to reach an estimated 4.1-4.3 million t/a in 2024, an increase of 400,000 t/a compared to 2023. But while this makes India a slight net importer of acid, the country is in fact both a large exporter and importer of elemental sulphur, with exports mainly from west coast refineries and imports arriving on the east coast to feed phosphate production. Exports have been on a declining trend, dropping 7% in 2023 to 1.4 million t/a, and are expected to be lower still this year at around 1.2 million t/a. Imports meanwhile have been on an increasing trend, rising to 1.63 million t/a in 2023, but they have been relatively subdued in the early part of this year, with figures for Jan-April showing only a 1% increase year on year to 400,000 tonnes, and overall Indian sulphur imports for 2024 are expected to be lower at around 1.34 million t/a. Most of these arrive via the port of Paradip, near to phosphate manufacturer Paradip Phosphates Ltd (PPL). Paradip accounted for 66% of imports in 2023, up 23%. Domestic supply is expected to increase by 140,000 t/a this year, as production ramps up at the Indian Oil Company’s (IOC) Panipat refinery project. Most Indian acid producers import sulphur from the Arabian Gulf region. The major exporters of sulphur into India are Abu Dhabi, Qatar, Oman, Japan, Singapore, Saudi Arabia, Kuwait and Bahrain.

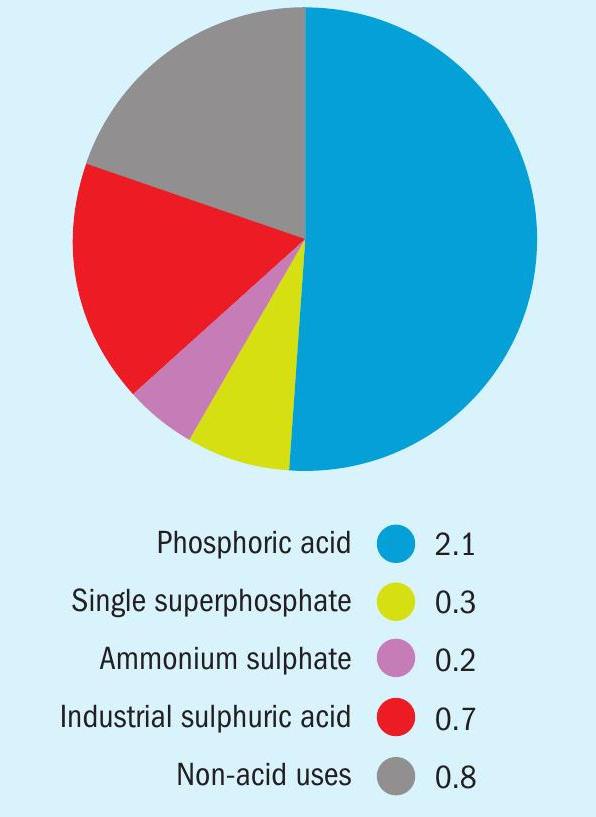

As Figure 1 shows, India’s consumption is mostly for phosphate fertilizer production – the phosphoric acid section which is the largest slice of consumption is mostly for domestic mono- and diammonium phosphate (MAP/DAP) and triple superphosphate (TSP) production, with single superphosphate (SSP) adding another 330,000 t/a of sulphur demand. New sulphur burning acid plants for phosphate producers will see demand increase. Coromandel International Ltd (CIL) started its new sulphur burner capacity in late August 2023, adding 200,000 t/a, and a new burner capacity at IFFCO was inaugurated in May 2024, also with a capacity of 200,000 t/a. Over the medium term, supply is not expected to be able to meet the sustained growth in demand, leading to a continuing increase in import requirements, forecast to reach 2.1 million t/a by 2028.

Sulphuric acid

India has over 70 sulphuric acid plants, although many of them are extremely small and associated with small scale chemical production. India’s sulphuric acid production is split between sulphur burning acid plants which run on the domestically generated and imported sulphur, and several metallurgical acid plants associated with base metal smelting; copper, zinc and lead. On the metallurgical acid side, Hindustan Zinc Ltd (HZL) is the largest producer, with production from its lead smelter at Chanderiya, and zinc smelters at Debari and Dariba. Hindustan Copper operates two more acid plants at Khetri and Ghatsila, and Hindalco has three sulphuric acid plants at its Dahej copper smelter at Birla.

On the sulphur-burning acid side, most of the plants are associated with downstream phosphate fertilizer production. The Indian Farmers Fertilizer Cooperative (IFFCO) at Paradeep in Orissa is the largest. Other major producers include Paradeep Phosphates Ltd (PPL), Gujarat State Fertilizers & Chemicals Ltd (GSFC), Fertilizers and Chemicals Travancore (FACT) and Coromandel Fertilizers. There is also acid capacity at Mangalore Chemicals and Fertilizers (MCFL) and Khaitan Chemicals and Fertilizers. Outside of fertilizer production, there are some smaller sulphuric acid plants associated with the chemical industry.

Indian acid production was 11.4 million t/a in 2023, a level which has been relatively stable since the closure of the Sterlite copper smelter in 2018 (see below). Consumption runs slightly higher than this at 13.3 million t/a in 2023, leading to a deficit of 1.9 million t/a which is made up by imports of sulphuric acid. Hence as well as producing their own acid from sulphur burning, many major phosphate producers also import sulphuric acid directly. Major acid importers include Coromandel, IFFCO, Greenstar, PPL, FACT and MCFL.

New acid capacity

As noted above, there are new sulphur burning acid plants which are continuing to expand Indian acid production. CIL started its new 500,000 t/a sulphur burner plant in late August 2023, and the company also announced in April 2024 an investment on a new phosphate plant at Kakinada, with an acid capacity of 600,000 t/a, which is expected to be commissioned in 2026. IFFCO reportedly commenced operations at its sulphuric acid plant in Paradeep in May with a total acid capacity of 600,000 t/a, while Gujarat State Fertilizers and Chemicals (GSFC) is expected to commission its sulphuric acid plant at Sikka unit in 2025 and reach a full capacity of 600,000 t/a by 2026. PPL will commission its sulphuric acid plant of 500,000 t/a between 2024-25.

Adani

As well as sulphur burning acid capacity, there is a new major copper smelter in India which will add another 1.5 million t/a of acid capacity. The Kutch Copper smelter, owned by Adani Enterprises Ltd, started operations in March 2024 at Mundra, with the capacity to produce 500,000 t/a of copper in its first phase at a cost of $1.2 billion. A second phase which will double capacity to 1.0 million t/a of copper and 3.0 million t/a of acid is under development, according to the company, and is expected to be completed in 2029. India’s increasing demand for copper is being driven by investment in renewable energy, electric vehicles, charging infrastructure, and the development of power transmission and distribution networks.

Sterlite

Finally, mention must be made of the ongoing saga of the Sterlite Copper smelter in Tuticorin. Sterlite, a wholly owned subsidiary of the Vedanta group, operated what was then the largest smelter in India, and which produced around 1.2 million t/a of sulphuric acid, most of which went to the domestic fertilizer industry. Sterlite also had plans to double the smelter’s capacity to 800,000 t/a. However, the smelter was closed in May 2018 after the plant’s operating license was not renewed by the pollution control board of Tamil Nadu province due to environmental concerns which had driven a huge local protest movement, leading to riots in which there were a number of fatalities. That ruling was overturned by the Indian environmental court, the National Green Tribunal (NGT), which would have allowed the smelter to recommence operation, but this decision was itself appealed by the Tamil Nadu regional government, and the case ultimate ended up in India’s Supreme Court. After several years of legal arguments, in February 2024 the Supreme Court ruled that the smelter should remain closed, citing “serious environmental violations and repeated breaches”. The removal of the smelter not only turned India from a net copper exporter into an importer, but also created havoc with the domestic sulphuric acid market. Sterlite has presented a petition for review, but it took a $90 million writedown to its Q2 accounts over the court decision, and the smelter looks to be closed permanently now.

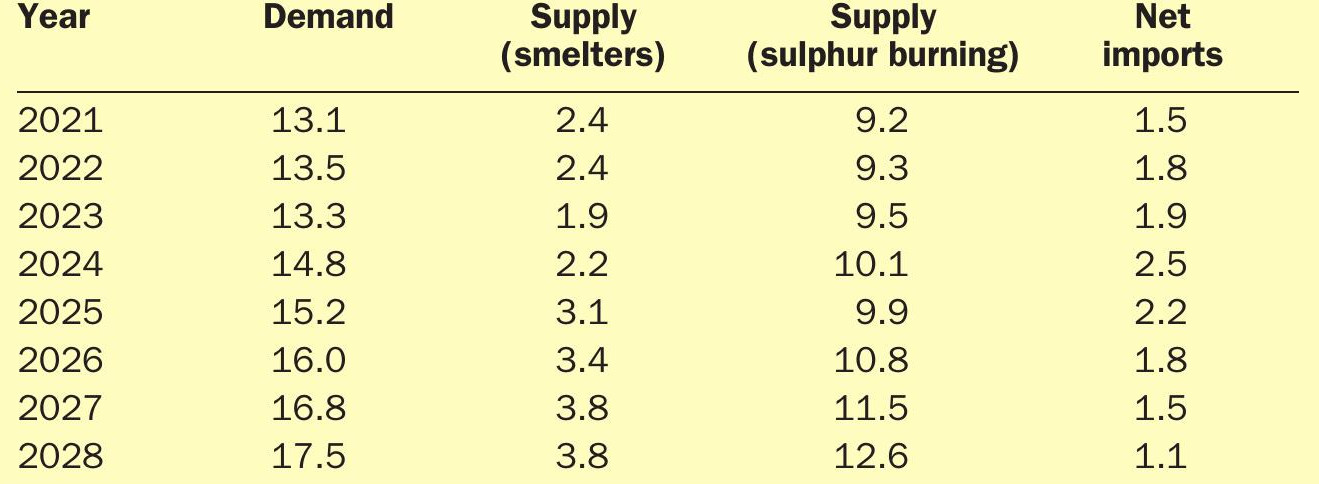

As Table 1 shows, acid supply from both smelters and sulphur burning capacity is increasing rapidly, and while demand, mostly from the phosphate sector, is also increasing, by about 4.2 million t/a over the period 2023-2028, additional domestic availability of acid in India is expected to increase production by about 5 million t/a over the same period, reducing acid import requirements over the coming years, with net imports for 2028 projected to be down to 1.1 million t/a. However, actual import volumes are expected to be maintained above 1.7 million t/a, as the new smelter capacity will likely export additional volumes.