Sulphur 415 Nov-Dec 2024

30 November 2024

Market Outlook

Market Outlook

SULPHUR

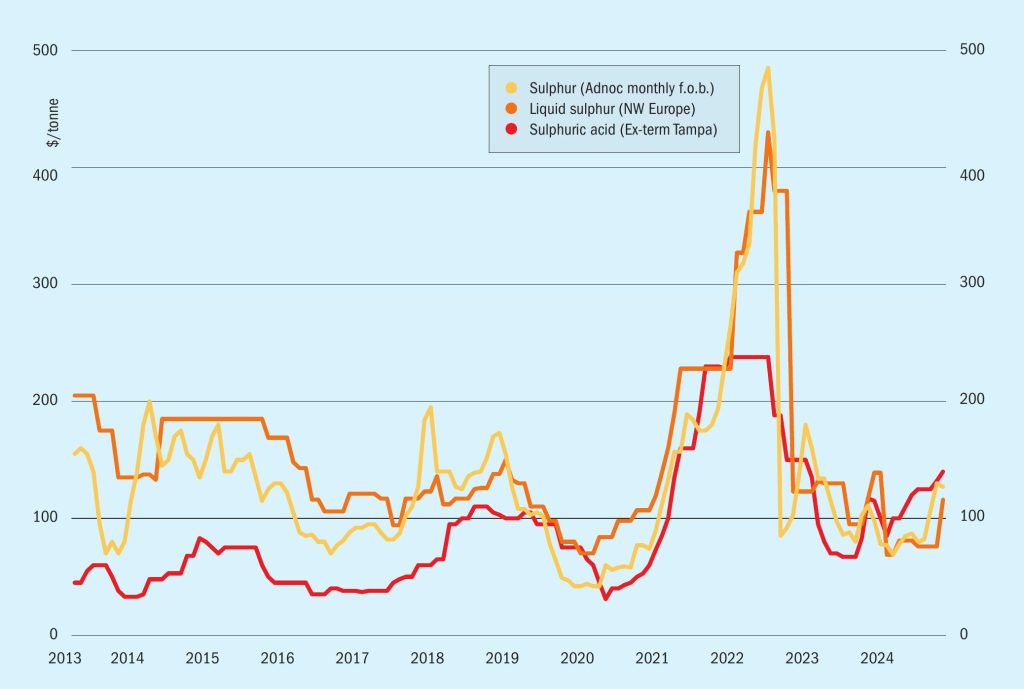

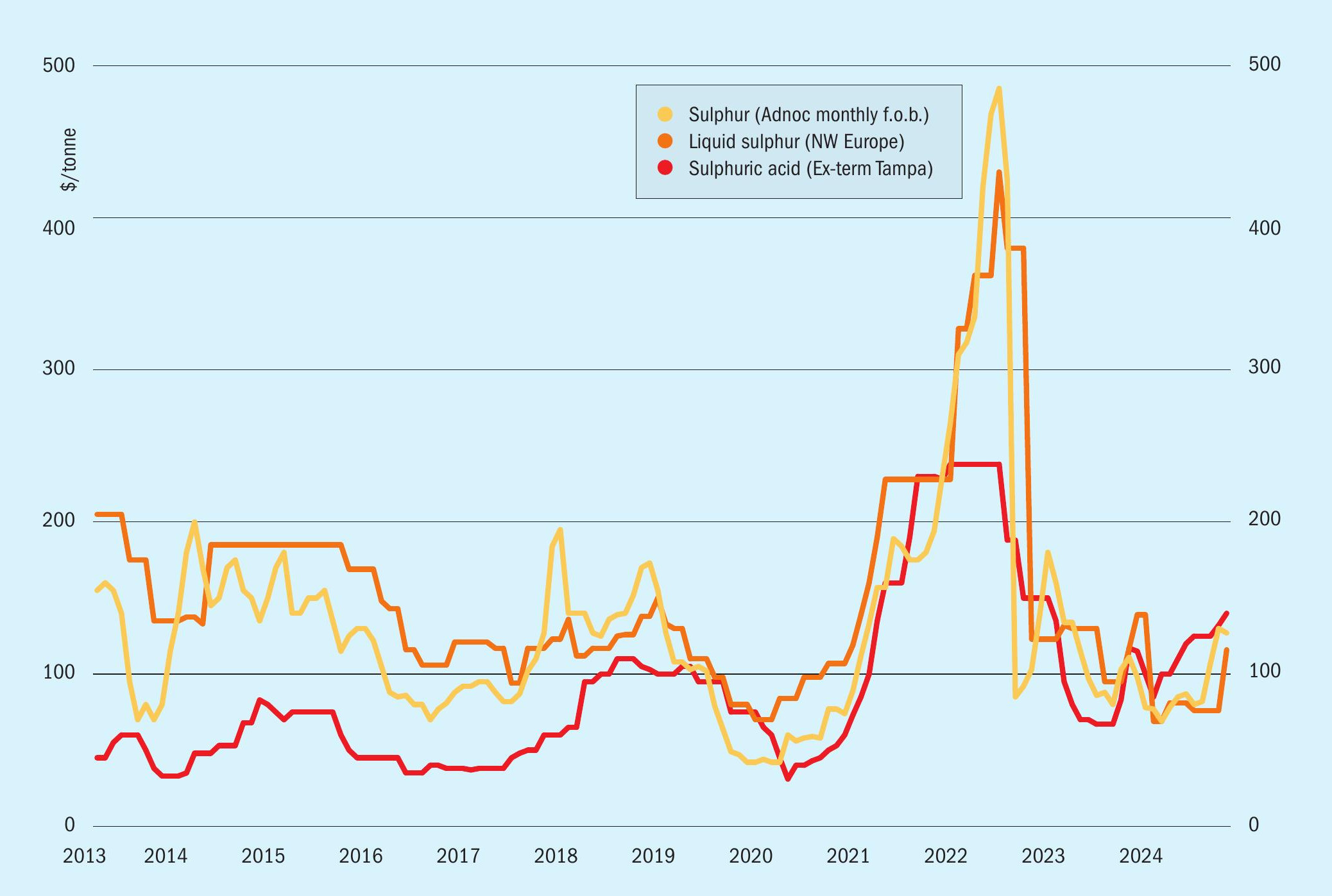

- Global sulphur prices are expected to continue rising in certain regions but at a reduced rate of increase. Recent higher spot prices in the Middle East are likely to carry over to other markets. Sulphur affordability in key markets such as China remains good, reinforced by recent increases in phosphate prices.

- This was visible at the start of November as CIL in Indian was understood to have secured a cargo in the mid-$150s/t c.fr via a trader, with tonnes from ADNOC, although Indonesian prices were not seen to have risen as yet.

- In spite of concerns that higher sulphur prices from the Middle East have made trade less viable for both China and Indonesia, it is believed that sulphur consumption in Indonesia will still increase further this year, though demand may be partly offset by increased domestic smelter acid production.

- Major stock drawdowns this year, particularly from Kazakhstan, appear to have masked underlying tightness in the market, and as Kazakh stockpiles become exhausted next year, longer term prices are likely to rise, with markets tight until the start up of major Middle Eastern new sulphur capacity in a couple of years time. China has been building inventory at ports this year, with stocks up to 2.5 million tonnes, giving buyers some flexibility in negotiating contracts going forward.

SULPHURIC ACID

- Global sulphuric acid spot prices are likely to remain steady in the coming weeks as supply is tight globally. A gradual decline is expected towards the end of the year. Shifts in supply/ demand dynamics will determine the pace and rate of this decrease.

- Lack of availability of copper concentrate continues to constrain Chinese smelter acid production, but this also means that outages such as at Daye will be offset by higher production from other smelters, keeping output relatively constant.

- Growing output from Indian smelter plants has tempered the need for imports, adding to price stability. Additional shifts in market supply are anticipated with PPL’s upcoming sulphuric acid facility expected to launch next year and potential capacity developments at Greenstar, which could further reduce import volumes.

- Key import markets such as Morocco, Indonesia and India are likely to reduce acid imports in 2024 H2 in favour of burning sulphur. Morocco is expected to commission two new sulphur-burners, which should lead to a reduction in imports by Q4 2024. In Indonesia, despite the recent fire at PT Freeport’s newly inaugurated Gresik smelter, other projects are scheduled to come online, adding volume in 2025.